As a seasoned investor with a knack for spotting trends and understanding market dynamics, I find myself both exhilarated and cautiously optimistic about the recent surge in Bitcoin spot ETF inflows. With over two decades of experience under my belt, I’ve witnessed countless market cycles, bull runs, and bear markets. However, the pace at which Bitcoin ETFs are gaining traction is unprecedented, even for my seasoned eyes.

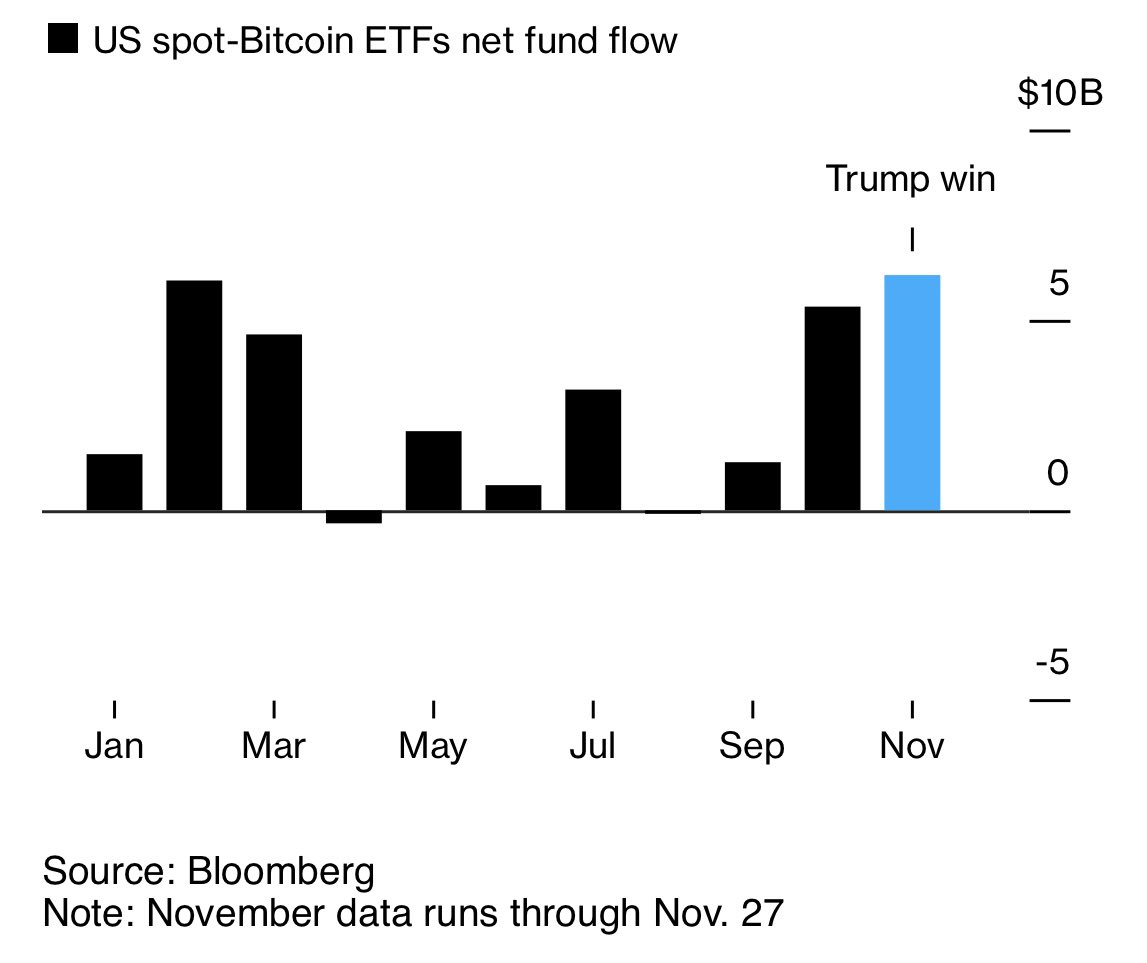

As a crypto investor, I can’t help but feel excited about the remarkable month that Bitcoin spot ETFs had in November. These investment vehicles, providing institutional investors with an indirect route to Bitcoin (BTC), saw an extraordinary influx of $6.2 billion. This surpassed the previous record set earlier this year, making it a truly historic month for these financial instruments.

The surge in optimism aligns with President-elect Donald Trump’s supportive stance towards cryptocurrencies, boosting investor trust in digital currencies and associated financial services.

Political Winds Boost Bitcoin ETFs Past Key Milestones In November

After the significant approval of Bitcoin Spot Exchange-Traded Funds (ETFs) in January, these financial products have seen a collective inflow of $6.2 billion in November, as reported by Bloomberg. This surpasses their previous record from February, which was also $6 Billion.

As a crypto investor, I’m thrilled to share some exciting news: Spot Bitcoin ETFs are on track to shatter their monthly inflow record! So far in November, an impressive $6.2 billion has flowed into these ETFs. Previously, the highest monthly inflow was $6 billion back in February, but this year’s momentum seems to be unstoppable. This update comes from Nate Geraci, president of The ETF Store.

As an analyst, I’ve noticed that Donald Trump’s presidential win served as a significant turning point, triggering unprecedented influxes in certain sectors. His administration’s pledge to establish a welcoming regulatory landscape for cryptocurrencies, including revisions of restrictive measures implemented during the Biden era, has undeniably contributed to this surge of interest.

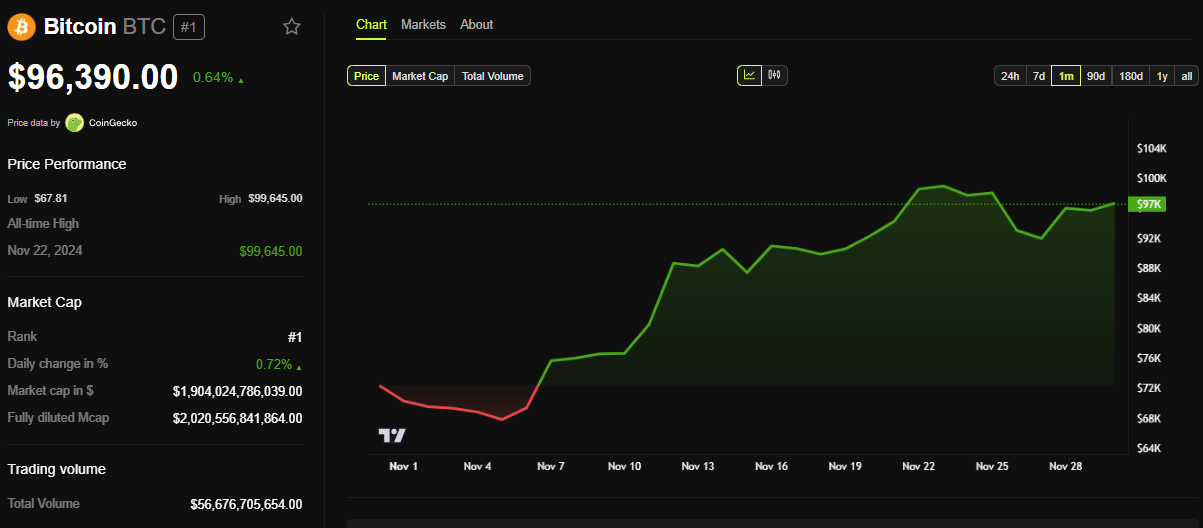

The news about setting up a strategic Bitcoin reserve and choosing regulatory figures who are friendly towards cryptocurrencies has significantly boosted investor confidence. This optimism pushed Bitcoin’s value near the $100,000 mark.

The optimism is also evident when it comes to Bitcoin ETFs, particularly spot ones. After the election, they experienced their largest one-day inflow worth approximately $1.38 billion. BlackRock, a key player in this field, reported over $1 billion in a single day, indicating strong institutional interest in investing in Bitcoin through legitimate channels.

Aside from seeing unprecedented inflows, Bitcoin Exchange Traded Funds (ETFs) have also experienced swift increases in their Bitcoin holdings, nearing 1 million BTC in total. Experts forecast that by the end of the year, these ETFs could exceed the estimated Bitcoin holdings attributed to Bitcoin’s creator, Satoshi Nakamoto. If this occurs, it would further strengthen their market presence and influence.

In a remarkable development, the BlackRock iShares Bitcoin Trust (IBIT) has seen unprecedented activity, overtaking gold-focused ETFs in terms of popularity. This trend suggests that conventional investors are increasingly leaning towards digital assets. Additionally, ETFs from Fidelity and Bitwise have also witnessed substantial investments, broadening Bitcoin’s influence within traditional finance.

Trump’s Policies Pave Way for ETF Expansion

The Trump administration is anticipated to open up more possibilities for financial products based on cryptocurrencies. Currently, the crypto market offers options trading for Bitcoin Exchange-Traded Funds (ETFs). Lately, approvals by the Options Clearing Corporation (OCC) have facilitated the introduction of options trading for Bitcoin ETFs. This allows investors to use an extra instrument to protect and speculate on price fluctuations in Bitcoin.

Matt Hougan, serving as the Chief Investment Officer at Bitwise, highlighted these advancements in the crypto sector as significant potential disruptors. Essentially, they would empower institutional investors to venture into the digital currency realm with increased assurance. This growing trend coincides with the broader institutional embrace of Bitcoin as a tactical asset, spurred on by encouraging regulatory indications.

A supportive regulatory framework for cryptocurrencies could offer protection to institutional investors who’ve been eager to invest in this sector for some time now. This change could be significant.” [Hougan posted on X]

Exchange-traded funds (ETFs) are significantly contributing to Bitcoin’s growing acceptance, and their ongoing expansion might maintain Bitcoin’s rising trend. Forecasts indicate that Bitcoin could hit unprecedented peaks, with some projections pointing towards $117,000 if its current surge continues. Currently, Bitcoin is being traded at around $96,390, representing a slight 0.64% increase from the start of Friday’s trading session.

During November, U.S. Bitcoin spot ETF investments saw record highs, indicating a fusion of political and regulatory occurrences with investor attitudes. The positive standpoint on cryptocurrency by President Trump has rekindled investor excitement, leading to both price increases and significant adoption achievements.

Over time, these Exchange-Traded Funds (ETFs) are becoming more influential, transforming the landscape of Bitcoin investment, and making it more likely that Bitcoin will gain wider recognition within the financial world.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DODO PREDICTION. DODO cryptocurrency

- The Elder Scrolls: Oblivion Remastered Review – Rebirth of a Masterpiece

- 30 Best Couple/Wife Swap Movies You Need to See

2024-11-29 11:09