As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of market events that can cause a stir, and today’s expiration of over $10 billion worth of Bitcoin (BTC) and Ethereum (ETH) options is no exception.

Today, over $10 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are due to expire.

This specific event is getting a lot of focus from market analysts because it could significantly impact short-term patterns by affecting contract volume and the worth of those contracts. Analyzing put-call ratios and identifying potential ‘pain points’ can offer valuable insights into traders’ predictions and potential market movements.

Bitcoin and Ethereum Options Expiring Today

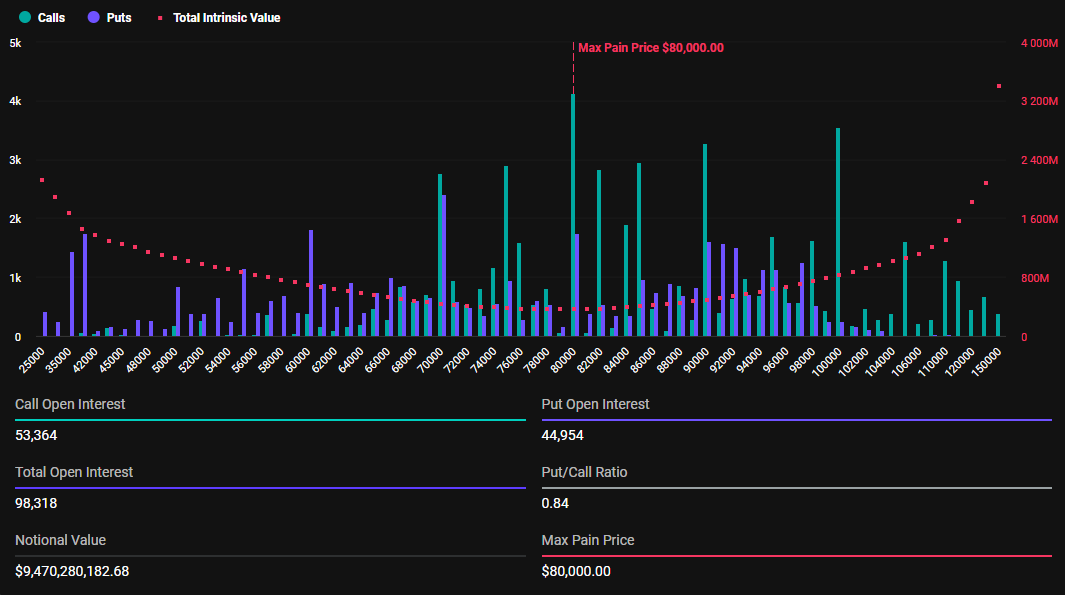

Today’s total worth of the Bitcoin options set to expire stands at approximately $9.47 billion, as per Deribit’s data. In this group of 98,309 options, there are more calls (purchase options) than puts (sales options), with a put-to-call ratio of 0.84. This indicates a higher preference for buying Bitcoin over selling it among option holders.

The data shows that the price level where most of these crypto options will end up being worthless upon expiration is $80,000. This is referred to as the maximum pain point in options trading, meaning it’s the price at which a majority of traders are likely to suffer financial losses due to their positions.

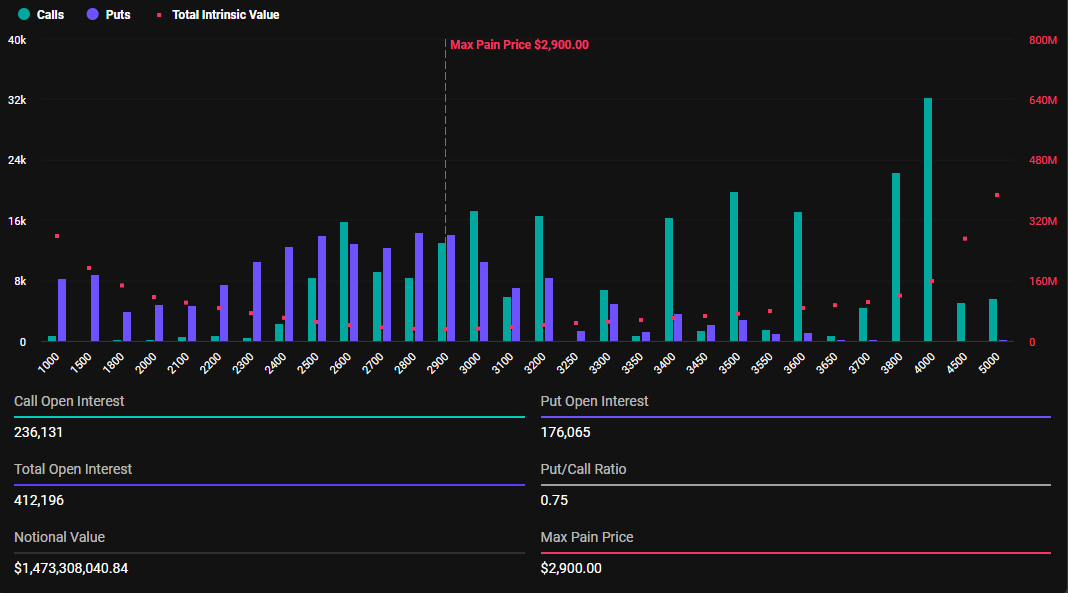

412,116 Ethereum option agreements will reach their maturity today, with a total worth estimated at approximately $1.47 billion. This ratio of puts to calls stands at 0.75, and the “maximum pain point” for these options is set at around $2,900.

At present, the prices of Bitcoin and Ethereum are higher than their most predicted points of resistance. Bitcoin is being traded at approximately $96,353, while Ethereum stands at around $3,573. This implies that if these prices persist when options expire, it would typically result in losses for option holders.

The outcome for options traders can vary significantly depending on the specific strike prices and positions they hold. To assess potential gains or losses at expiration accurately, traders must consider their entire options position, along with current market conditions.

Insights on Today’s Expiring BTC and ETH Options

Specialists from the options trading tool provider Greeks.live disclose a fascinating perspective about investors, suggesting that thorough assessment is crucial prior to making any definitive judgments.

There’s been a 11% decrease in BTC, and some folks are predicting that the end is near. Just over a week ago, those very same individuals were expressing their desire for a dip in price so they could make purchases.

According to Jeff Liang, the CEO and co-founder of Greeks.live, he’s ready to wait it out till the options expire at 8:00 UTC on Friday, showing his optimistic stance.

Liang stated that even though the difference in value is substantial, the suggested volatility for this deal matches the average volatility of the past month, which means it’s not overpriced. A 5% rise in the current price could balance out this gap. He also mentioned that he plans to hold onto these options until they expire. Liang added that he purchased a number of call options last night, and the market has shown some activity this morning.

Currently, there’s a quiet sense of optimism permeating the cryptocurrency markets. According to Bybit, this may stem from the anticipation that a replacement for outgoing SEC Chair Gary Gensler might be friendlier towards crypto investments.

Amidst these circumstances, Bybit has shared its thoughts on the present market trends. They pointed towards a potential decrease in Bitcoin’s price and mentioned that expiring Ethereum options indicate reduced bullish enthusiasm.

The decrease in Bitcoin’s price near the $100,000 level has caused the Automatic Tellers Machine (ATM) volatility curve to flatten, with short-term options now below 60%. This trend is similar to one seen since the US election. A lower actual volatility seems to be causing this decline. Despite no change in open interest for calls and puts, demand for short-term options has slowed this week. Ethereum options exhibit a slightly more optimistic outlook compared to Bitcoin options. The markets have adjusted after the post-election peak, but call options still lead in both trading volume and open interests, according to Bybit.

In simpler terms, ATM IV, or Implied Volatility of an Option at the Money (ATM), refers to the predicted volatility of a financial asset based on the price of an option whose strike price matches the current market price of that asset. This type of implied volatility is commonly used by analysts and traders to assess market sentiment and anticipate volatility predictions for the underlying security.

Investors should exercise caution since historically, option expiration periods can cause temporary market turbulence. Additionally, the upcoming weekend may prove significant because it typically exhibits increased volatility given the reduced trading activity.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ‘I’m So Honored’: Zooey Deschanel Talks About ‘Amazing’ Bridgerton Kiss Inspired By Passionate Scene From New Girl

2024-11-29 09:38