As a seasoned crypto investor with battle-hardened nerves, I find myself standing at the precipice of another potential milestone for Bitcoin – the $100,000 mark. With a decade of investing under my belt, I’ve seen more than a few rollercoaster rides in this space, but the current momentum is something truly captivating.

The value of Bitcoin (BTC) is quickly approaching a staggering market capitalization of two trillion dollars, currently standing at 1.89 trillion dollars, following a significant surge of 38% over the past month and setting new record highs in November. The anticipation remains high as the Bitcoin price inches closer to the $100,000 mark, a level it is only 5% shy of reaching.

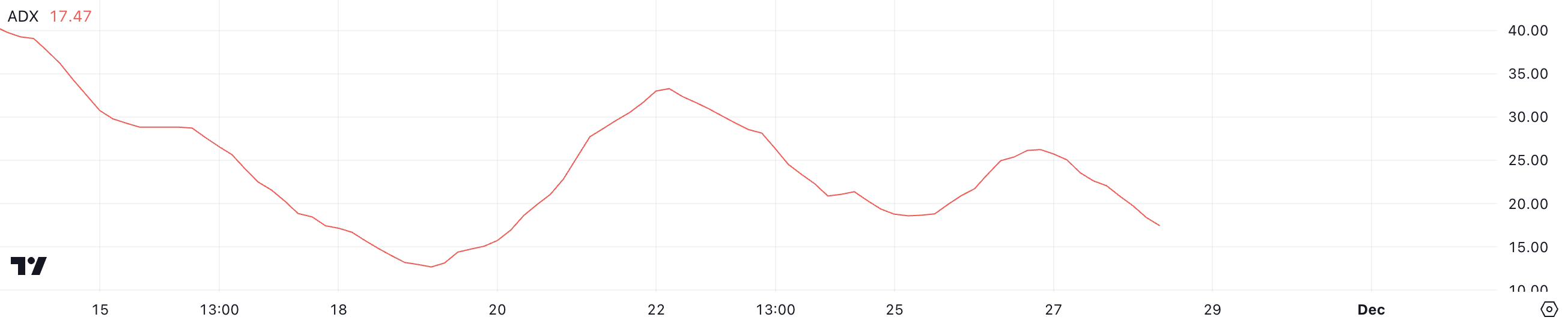

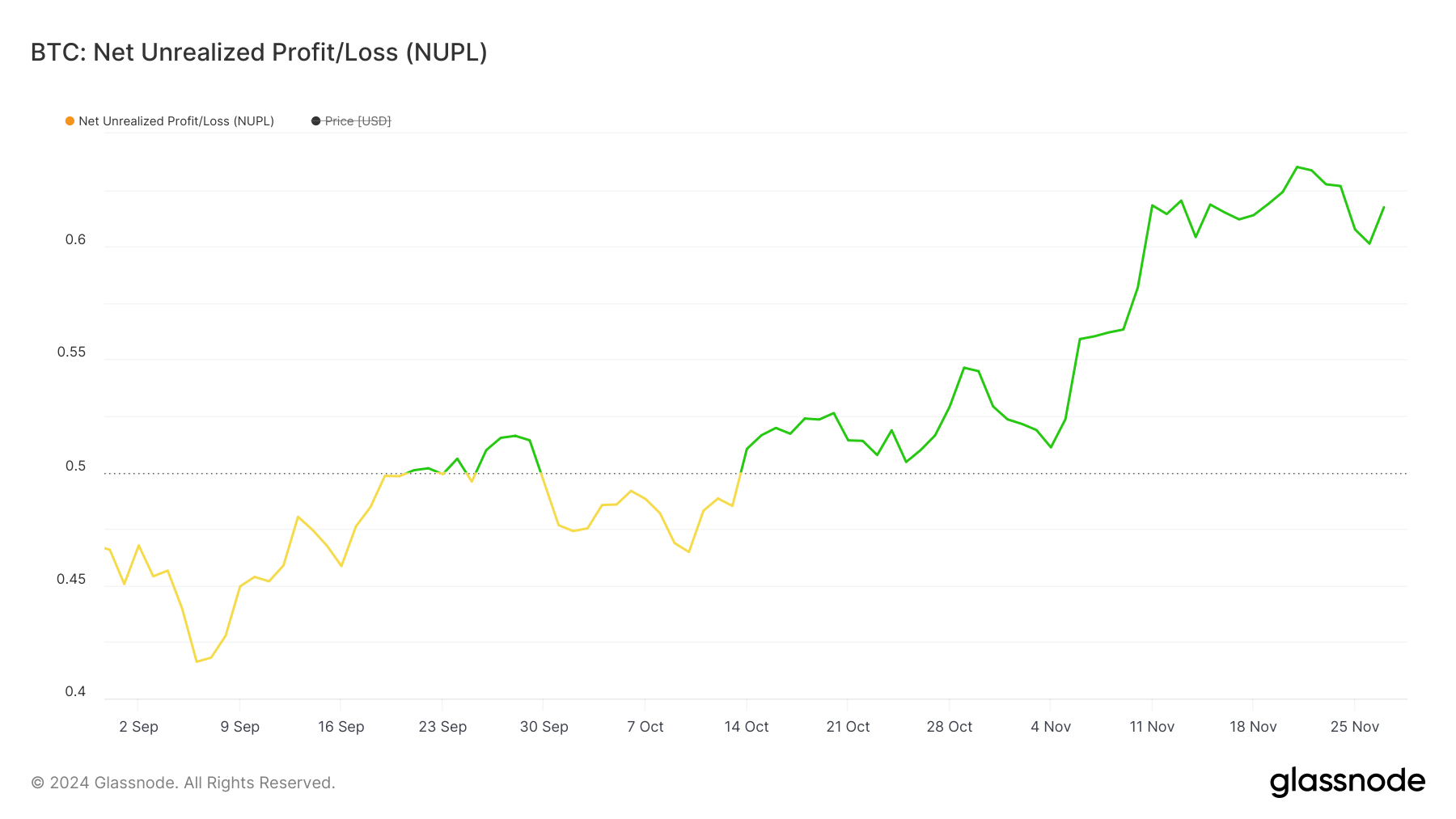

Although the Average Directional Index (ADX) hints at a weakening trend, the Negative Upside Price Oscillator (NUPL) implies that Bitcoin remains relatively distant from the “Euphoria” threshold. This decreases the probability of significant price corrections occurring.

BTC’s Trend Is Losing Steam

Right now, the Bitcoin ADX stands at 17.4, suggesting a less dominant trend compared to two days ago when it was at 26. The Average Directional Index (ADX) gauges the strength of a trend, ranging from 0 to 100, regardless of its direction. A value exceeding 25 indicates a strong trend, whereas values below 20 signify a weak or non-existent trend.

The current Average Directional Movement Index (ADX) of Bitcoin indicates that while it continues to rise, the power propelling this increase has noticeably decreased. This could mean that Bitcoin might experience a period of stabilization or a possible reduction in its upward trajectory.

Bitcoin NUPL Is Still Far From Euphoria

Currently, the Net Unrealized Profit/Loss (NUPL) for Bitcoin stands at 0.61, positioning it within the “Belief – Denial” zone as per October 14th. NUPL measures the ratio of unrealized profits to losses, offering insights into investor sentiment about the market.

At this stage, the rising optimism among investors is evident since they continue to benefit from their investments, hinting at a belief that the prices will keep climbing higher.

When Bitcoin’s NUPL (Network Value to Transactions Ratio) is at 0.61 and remains below the 0.7 benchmark, it indicates we are entering the “Euphoria” zone. Typically, this transition has been followed by significant price corrections due to increased profit-taking.

In simpler terms, this present situation offers potential for Bitcoin’s price increase without pushing it into dangerously high levels, indicating that the upward trend could persist without an imminent stretch beyond its limits.

BTC Price Prediction: Is $100,000 Possible In November?

After some minor adjustments in the past few days, the Bitcoin price is now just under 5% shy of hitting a significant record of $100,000. However, the ADX indicates that the current momentum may be weakening, which might cause a slight delay in Bitcoin reaching this crucial threshold.

Yet, the NUPL shows that the market hasn’t reached the “Euphoria” level yet, implying that significant corrections might not occur at this point in time.

As an analyst, I’m expressing my viewpoint based on current market trends: If the bullish trend gains traction, Bitcoin’s price might surge beyond $100,000 and even reach a temporary peak at around $105,000 in the short term. Conversely, should a bearish trend manifest, the price could dip to approximately $88,000 before trying to regain its upward momentum again.

Read More

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Solo Leveling Season 2: Check Out The Release Date, Streaming Details, Expected Plot And More

- Who is Owen Cooper? All About Netflix’s Adolescence Star Taking Hollywood by Storm

- The First Berserker Khazan: Best Greatsword Build

- Solo Leveling Season 2 Release Schedule: How Many Episodes Are Left? Find Here as Ep 10 Eyes More Battles

- COMP PREDICTION. COMP cryptocurrency

- The Roots Unveil Roots Picnic 2025 Lineup

- Selena Gomez and Benny Blanco Shares Loved-Up Mirror Selfie and Snap of Adorable FaceTime Call; See HERE

2024-11-28 23:53