As a seasoned crypto investor with a penchant for Cardano and its ADA coin, I find myself both exhilarated and cautious about the recent surge of 27%. The spike has propelled an impressive 88.40% of its circulating supply into profit – a significant milestone indeed. However, as history has taught me, such developments can sometimes be double-edged swords.

As a researcher, I’ve noticed an impressive 27% surge in the value of Cardano‘s native cryptocurrency, ADA, over the past week. This rise has translated into a substantial chunk of its current supply moving into profitable territory.

Yet, such a situation might prompt ADA holders to consider selling to lock in their profits, potentially disrupting the coin’s upward trajectory.

Cardano’s Supply in Profit Spikes

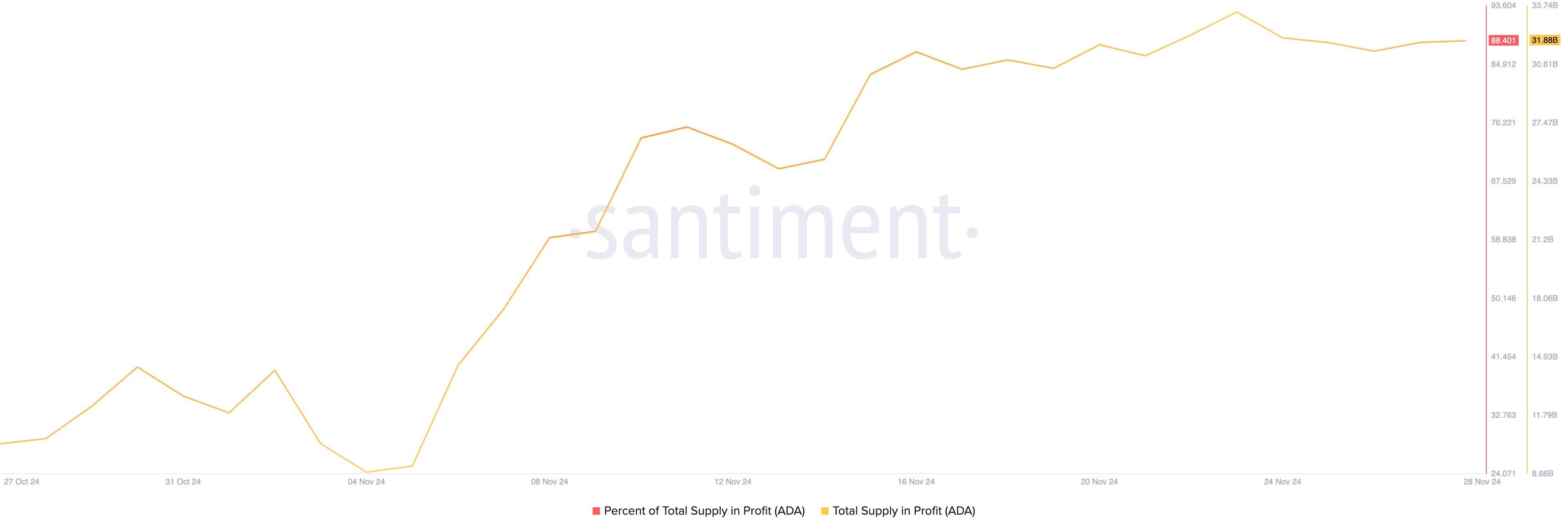

Cardano’s double-digit rally over the past week has pushed a substantial portion of the coin’s circulating supply into the profit area. At current market prices, investors hold 32 billion ADA coins worth $31 billion in profit, accounting for 88.40% of ADA’s circulating supply.

Initially, towards the start of the month, about 40% of all ADA coins were being held with a profit. This points to a positive trend in the coin’s market, but it also carries risks. When a large amount of an asset’s stockpile shifts into profitable positions, it can lead to sell-offs as investors cash out their profits.

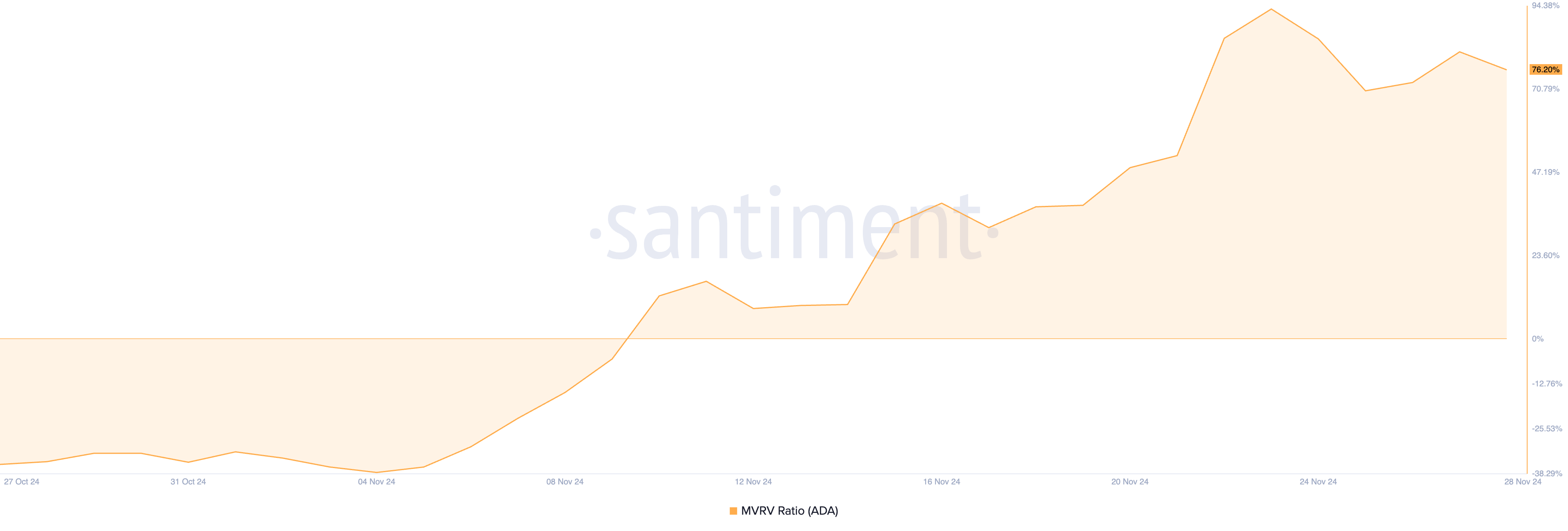

An assessment of ADA’s market value to realized value (MVRV) ratio confirms this risk. According to Santiment’s data, ADA’s current MVRV ratio is 76.20%.

Based on the MVRM (Market Value to Realized Value Ratio), it appears that Cardano’s current value may be inflated compared to its actual worth. This is because its market value exceeds its realized value considerably. If all coin owners were to cash out, they would, on average, pocket a gain of approximately 76.20%.

ADA Price Prediction: A Decline to $0.79 or Rally Above $1?

Currently, one ADA is valued at approximately $0.98, with a key support level established at $0.93. Should profit-taking ensue, the price may challenge this support level. If the support fails to sustain, it would confirm the ongoing downtrend and possibly lead to a drop in ADA’s value to around $0.79.

If traders decide not to sell their ADA holdings for profits, the price could potentially rise beyond $1, reaching as high as $1.15 – a level last seen in April 2022.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-11-28 17:22