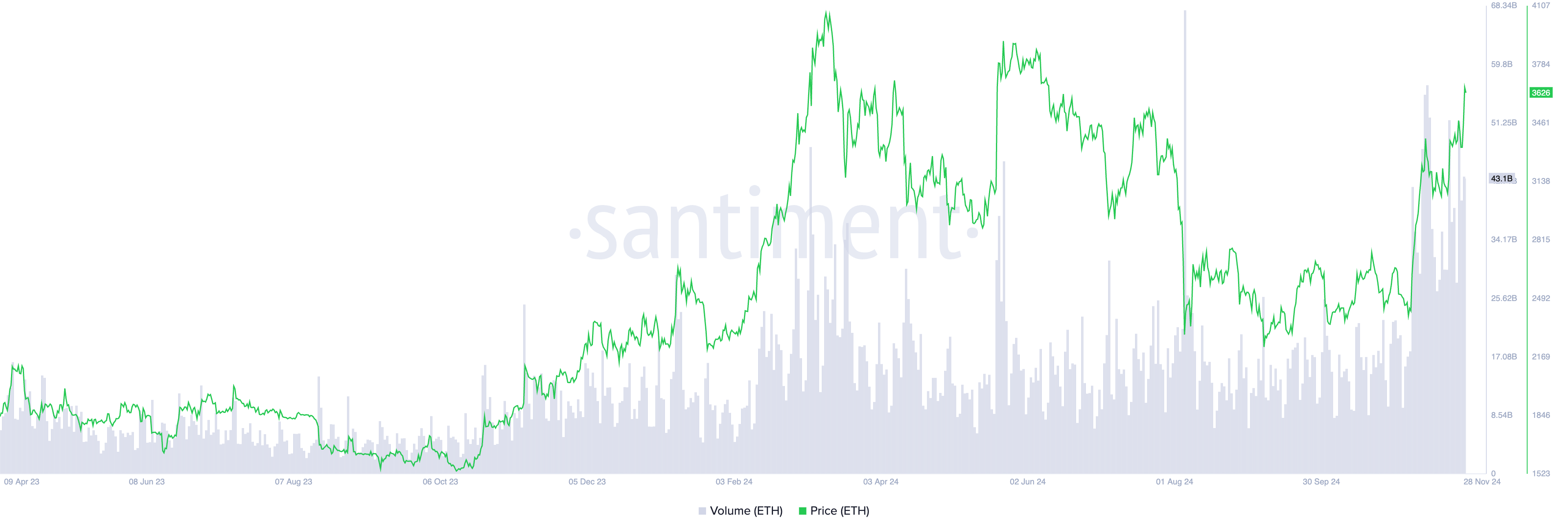

As a seasoned analyst with over two decades of market experience under my belt, I must say that the recent surge in Ethereum (ETH) is nothing short of impressive. The trading volume exceeding $43 billion in just 24 hours is a clear indication of strong market interest and confidence, which, in my opinion, makes this rally more sustainable than previous ones.

In my role as a researcher, I’m observing a significant price jump in Ethereum (ETH) over the past 24 hours. This altcoin has breached the $3,600 barrier and is currently trading at $3,613. Interestingly, this is a level it hasn’t traded at since June.

Over the last day, this recovery has been driven significantly by a colossal trading activity that surpassed $43 billion. This suggests a persistent upward trend aiming towards the psychologically significant level of $4,000.

Ethereum Price Surge Hints at Altcoin Season

In the last 24 hours, the total trading volume of ETH has reached an impressive $43 billion. This significant spike in trading activity has caused the coin’s value to soar back to a level not seen since it was last observed approximately five months ago.

When a security’s trading activity increases together with its value, it shows a high level of market enthusiasm and belief in its continued rise. This correlation implies that the price surge is fueled by substantial buying actions, which makes it more durable.

Consequently, ETH’s heavy trading activity indicates an increase in market interest and widespread involvement. This makes it less likely for a sudden price drop to occur.

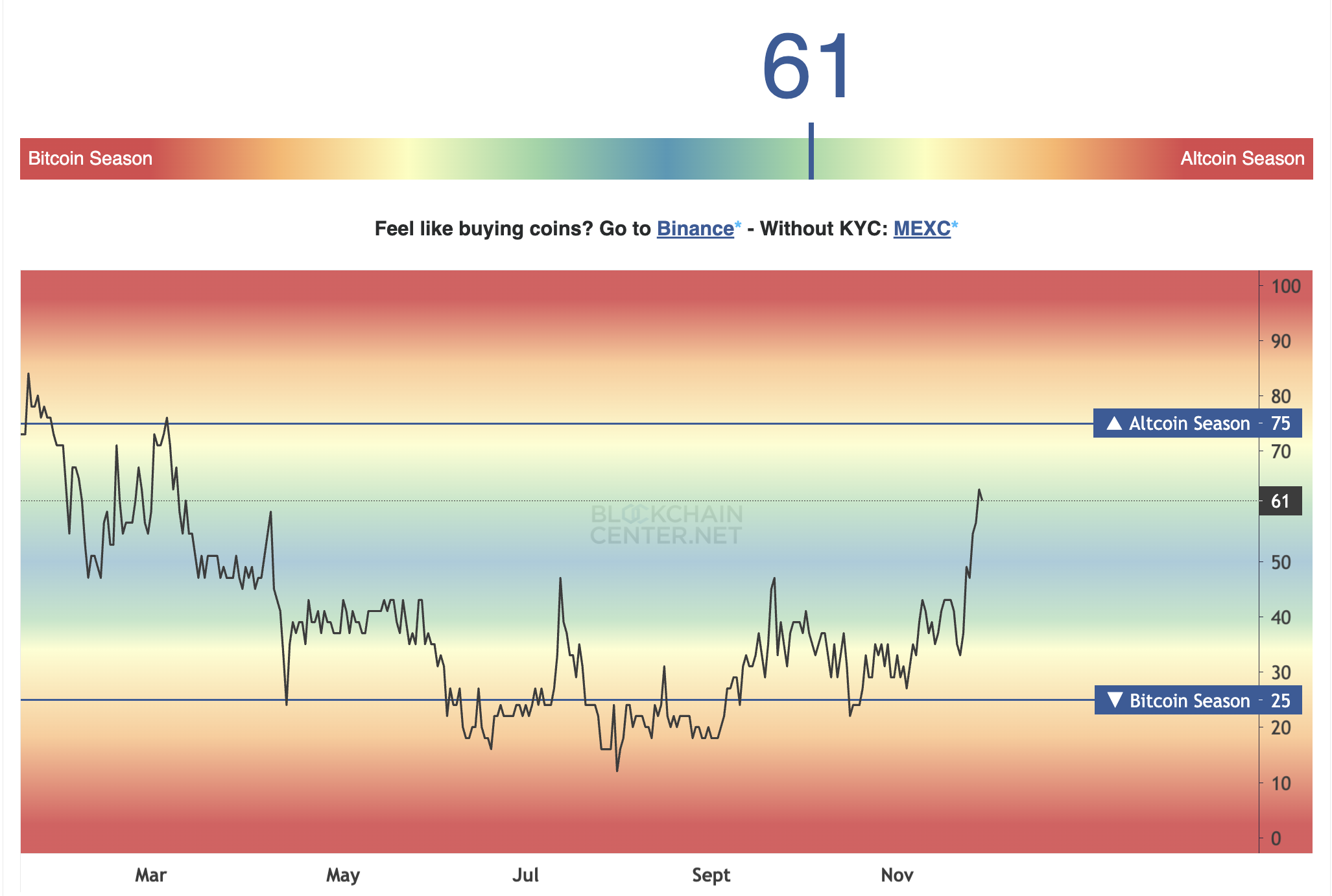

Additionally, Ethereum’s recent growth might indicate a move towards what is known as an altcoin rally period. As per the Altcoin Season Index (ASI) by Blockchain Center, the current score is 61 out of 100, which is approaching the 75-point mark that typically signals the start of this much-awaited phase.

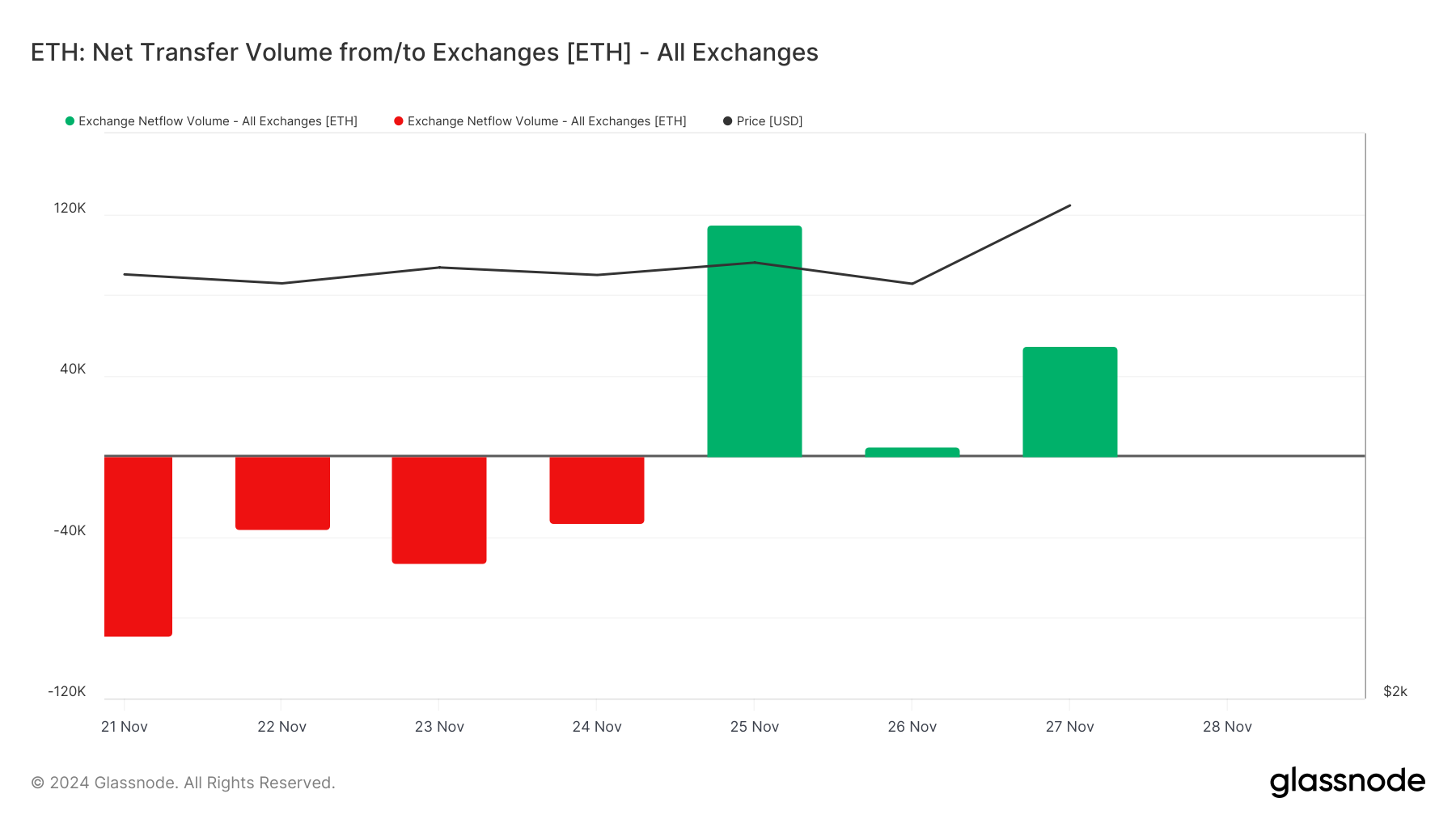

It’s worth mentioning that some individuals are starting to sell their Ethereum (ETH) due to the recent price increase, as indicated by the coin’s increased exchange netflow volume. On Wednesday alone, approximately 54,974 ETH valued at over $199 million were transferred to exchanges.

In simpler terms, the Netflow Volume measure in exchange monitoring tracks the contrast between the amount of assets entering and leaving exchanges within a defined timeframe. If an asset’s netflow is greater than zero, it means more coins are being deposited into exchanges than withdrawn, which could suggest increased selling pressure as traders may be preparing to offload their holdings.

An enhanced supply on trading platforms could potentially put downward pressure on prices, especially when demand fails to keep pace with the increased accessibility.

ETH Price Prediction: Rally Toward Year-To-Date High

Regardless, the general optimism towards Ethereum continues to be robust, implying that its upward trend could continue. The arrangement of Ethereum’s Parabolic Stop and Reverse (SAR) indicator, as observed on a daily graph, supports this positive perspective.

This tool helps spot possible shifts in market trends and generates shifting lines of support and resistance. The lines are represented by dots placed either beneath or above the price graph: dots below the price line hint at a rising market (bullish), whereas dots above suggest a falling market (bearish).

In terms of Ethereum (ETH), when the Simple Average Rate (SAR) stays below the current price, it indicates a rising trend and implies a bullish market. If this upward movement continues, the ETH’s price might break through the resistance level at $3,669 and advance towards its highest point for the year so far, which is $4,093.

Conversely, a decrease in buying pressure might lead the Ethereum coin’s price to drop towards the $3,336 level of support.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-11-28 16:18