As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset landscape, I find myself increasingly optimistic about Ethereum’s future price trajectory. The recent stabilization above $3,000, despite brief moments of uncertainty, is a testament to the resilience of this leading smart contract platform.

In recent times, Ethereum (ETH) appeared to be dropping below $3,000, but it managed to maintain its position thanks to buyers who stepped in to prevent a decline.

Now trading at $3,480, here’s what could be next for ETH.

Ethereum Still Has More Room to Grow

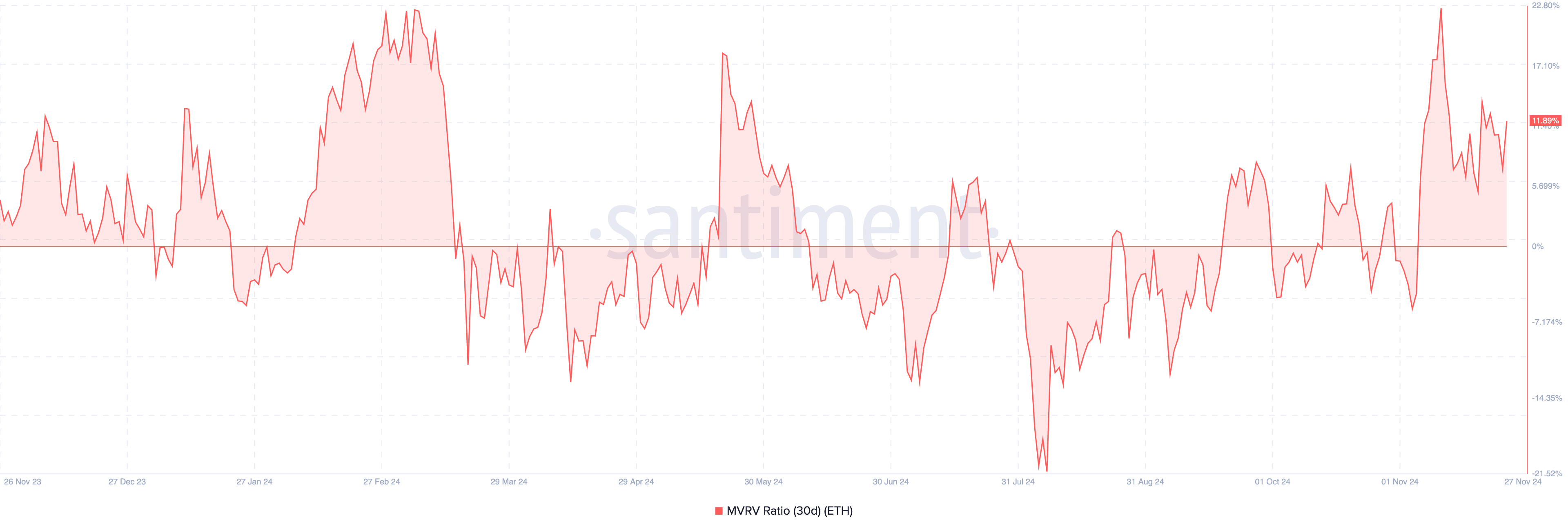

A valuable method for evaluating Ethereum’s market trends has been the Market Value to Realized Value (MVRV) ratio. This tool helps determine the profitability of holders and predict possible market peaks or troughs. Essentially, the MVRV ratio measures a cryptocurrency’s market value against its true worth, giving us clues about whether it might be overpriced or underpriced.

When the MVRH (Miner’s Realized Value Ratio) increases, it generally means more investors are earning a profit. But if it spikes too much, this could signal that the asset might be overpriced, potentially leading to a price adjustment or correction. On the flip side, when the MVRH decreases, it usually indicates lower profit margins for investors.

If the Multivariate Ratio of Value (MVRV) for ETH reaches 11.89%, it indicates a potential undervaluation, offering a promising chance for investors to accumulate. Nevertheless, this ratio is not yet near the local peak, typically around 18% and 22%. Consequently, this trend hints at Ethereum’s price possibly continuing its current trajectory rather than experiencing a significant increase.

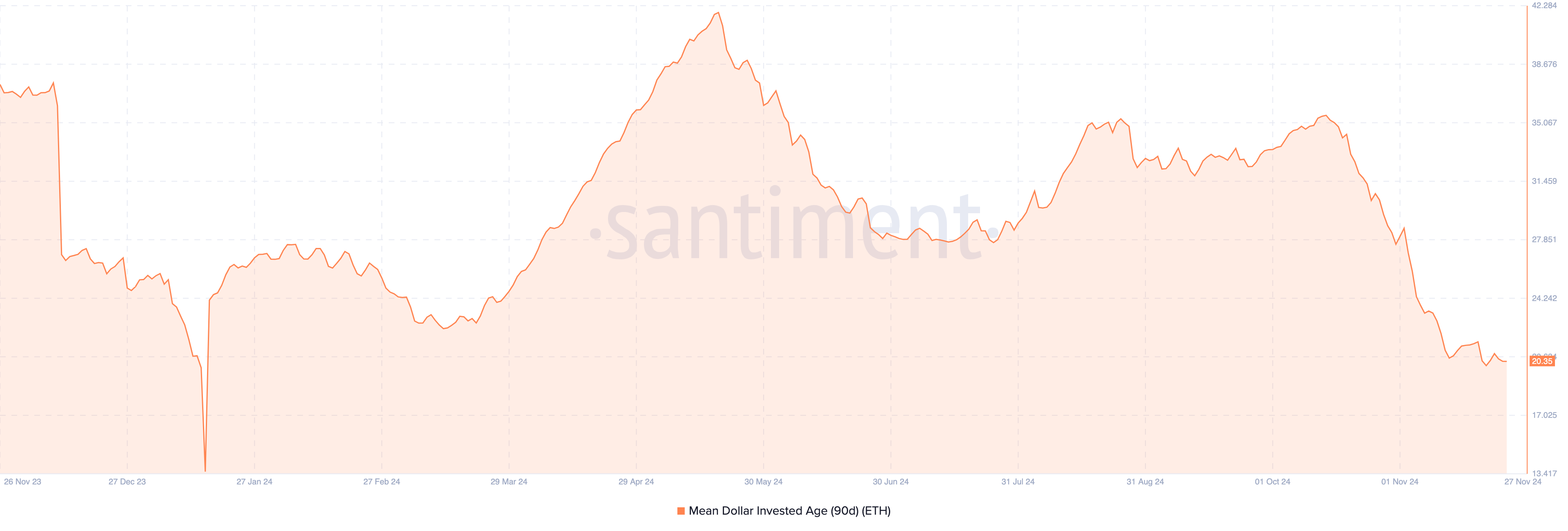

Additionally, the Average Dollar Age of Investment (ADAI) indicates that Ethereum could sidestep additional price decreases. This metric calculates the typical age of all coins on the blockchain, taking into account their original purchase prices.

An increasing Media Dominance Index (MDI) suggests that the coins may be experiencing less volatility, thereby decreasing the chances of a substantial price spike.

In other words, when the Moving Average Decrease Indicator (MDIA) decreases, it indicates that coins that were previously inactive are now being traded more frequently, as seen with ETH. If this pattern continues, it might increase Ethereum’s potential for a price surge.

ETH Price Prediction: $4,000 Could Be Coming

On the day-to-day graph, Ethereum’s price appears to have created an upside-down head-and-shoulders configuration. This setup usually follows a lengthy decline, suggesting that the sellers might be running out of steam, potentially indicating a reversal in trend.

The pattern comprises three key parts: the left shoulder, which marks the first uptrend; the head, signaling the end of the downtrend; and the right shoulder, indicating the rebound.

As Ethereum continues to climb, it’s expected to reach around $4,000 in the near future. However, if there’s increased selling activity, this prediction could flip, and Ethereum might drop down to approximately $3,206 instead.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-11-28 01:46