As a seasoned analyst with over two decades of experience in the financial markets, I find it intriguing to witness the dynamic evolution of the crypto industry. BitWise’s latest move to expand its crypto ETF offerings is a strategic step that aligns with the growing institutional appeal towards cryptocurrencies.

BitWise has submitted an application to the Securities and Exchange Commission (SEC) to establish a new Exchange-Traded Fund (ETF) that mirrors their 10 Crypto Index Fund. If accepted, this ETF would represent one of the most diverse and expansive crypto offerings in the U.S. market.

This week, BitWise joined other companies such as Canary Capital, VanEck, and 21Shares in filing an application for a Solana Exchange-Traded Fund (ETF) with the Securities and Exchange Commission (SEC).

BitWise is Looking to Expand its Crypto ETF Offerings

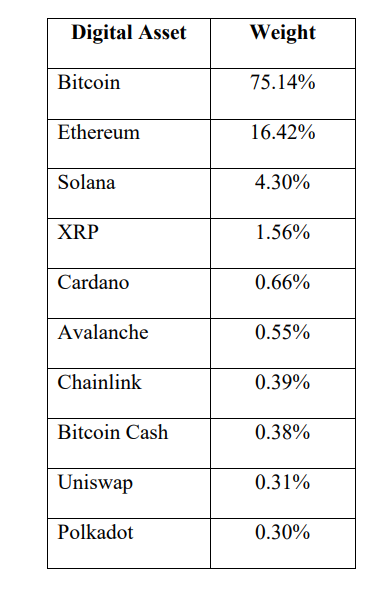

As stated in the documentation, this investment fund encompasses a variety of digital currencies such as Bitcoin, Ethereum, Solana, Ripple (XRP), Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap. Since its establishment in 2018, BitWise has consistently held this fund, aligning its worth with the top ten most valuable cryptocurrencies available.

Big Pey recently mentioned that ADA‘s significant price surge might be due to someone acquiring ADA for an ETF. Now, NYSE Arca has filed a proposal with the SEC to create a Bitwise 10 Crypto Index Fund, with Cardano as the fifth largest asset. Given this development, it seems likely that Coinbase will also introduce a similar fund, perhaps marking the start of many such offerings.

Earlier this year, BitWise entered the market for cryptocurrency exchange-traded funds (ETFs) by introducing their Bitcoin ETF (BITB). Notably, BitWise was one of the initial ten entities to submit an application for an ETF to the Securities and Exchange Commission (SEC).

It appears that with the submission of their recent application, BitWise aims to capitalize on the increasing institutional interest in the wider cryptocurrency sector. Additionally, they’ve made a move by filing for an XRP-based exchange-traded product (ETP) within European markets.

The Securities and Exchange Commission (SEC) has validated the submission, initiating a timer during which they will either decline or endorse it. Nonetheless, no specific date for making a decision on this request has been set as of now.

The U.S. financial regulatory landscape appears to be warming up towards cryptocurrencies, with a growing acceptance under the Trump administration and a newly appointed SEC head. This shift could potentially lead to an increase in the approval of various types of crypto-based Exchange Traded Funds (ETFs).

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-11-28 01:20