As a seasoned analyst with over two decades of experience navigating the tumultuous waters of financial markets, I have learned to never underestimate the power of profit-taking and market sentiment in shaping price movements. The recent surge in Bitcoin’s long-term profit output ratio, coupled with the decline in active addresses on the network, paints a picture that could be troubling for short-term investors.

Bitcoin (BTC) investors who have held onto their coins for a long time have begun cashing out as the cryptocurrency approached $100,000. This selling pressure has caused Bitcoin’s price to dip slightly to around $93,000, which in turn affected the overall value of the entire crypto market.

Is Bitcoin’s price showing signs of recovery? This analysis, focusing on the short term, could be useful for those who trade frequently.

Activity Around Bitcoin Drops, Holders Book Gains

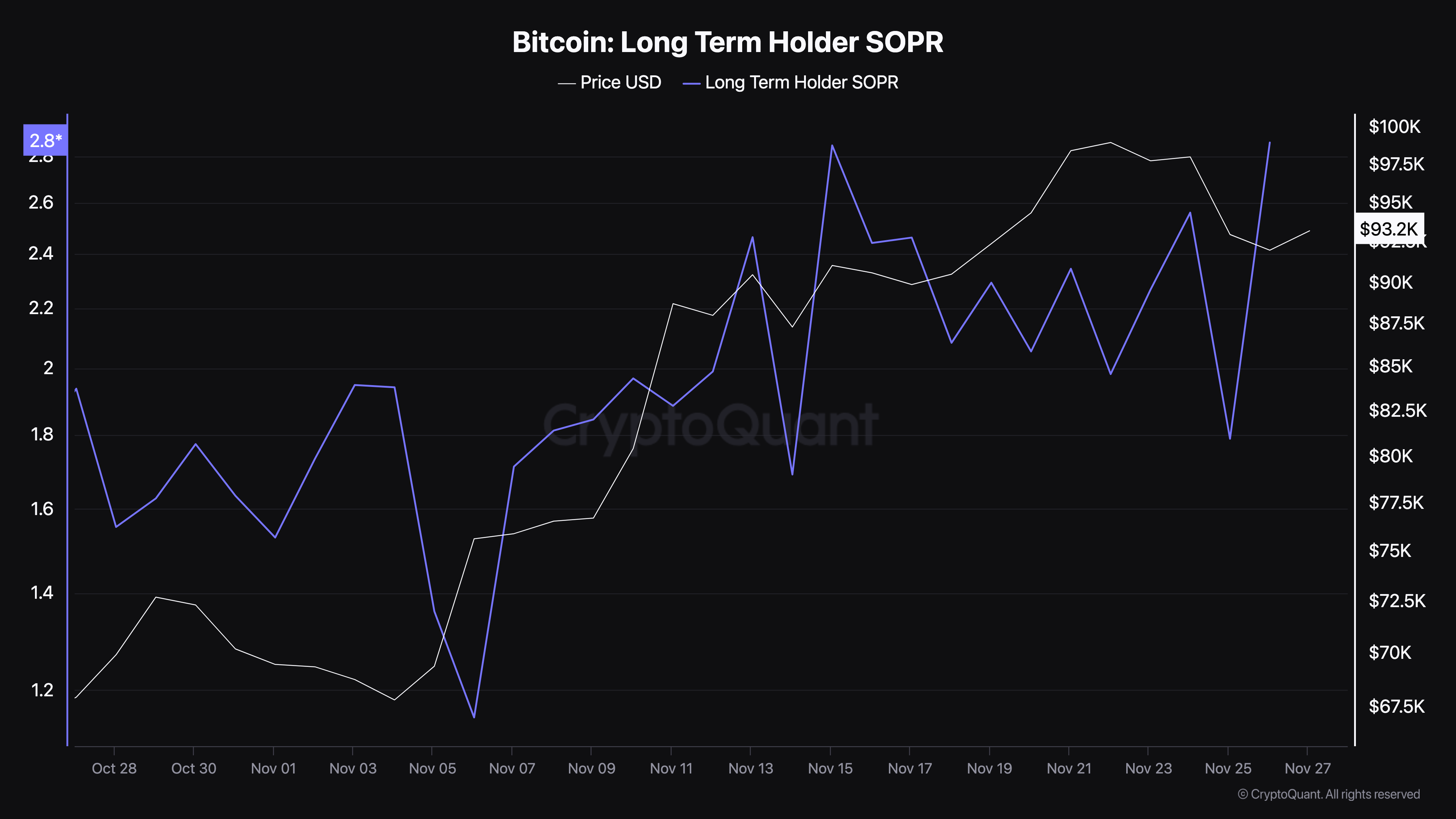

Based on data from CryptoQuant, the long-term profitability rate of Bitcoin, which represents the actions of investors holding the cryptocurrency for over 155 days, has significantly increased to approximately 2.86.

If the selling ratio of long-term Bitcoin holders exceeds 1, it suggests they’re selling for a profit. Conversely, when the selling ratio is below 1, it hints that they’re selling at a loss. Given the current reading, it suggests these holders are cashing in on the recent price surge by realizing their profits.

Additionally, it’s worth noting that this recent profit-taking marks the highest level since August 30. If this trend persists, there’s a risk that the Bitcoin price might dip below the $93,000 mark.

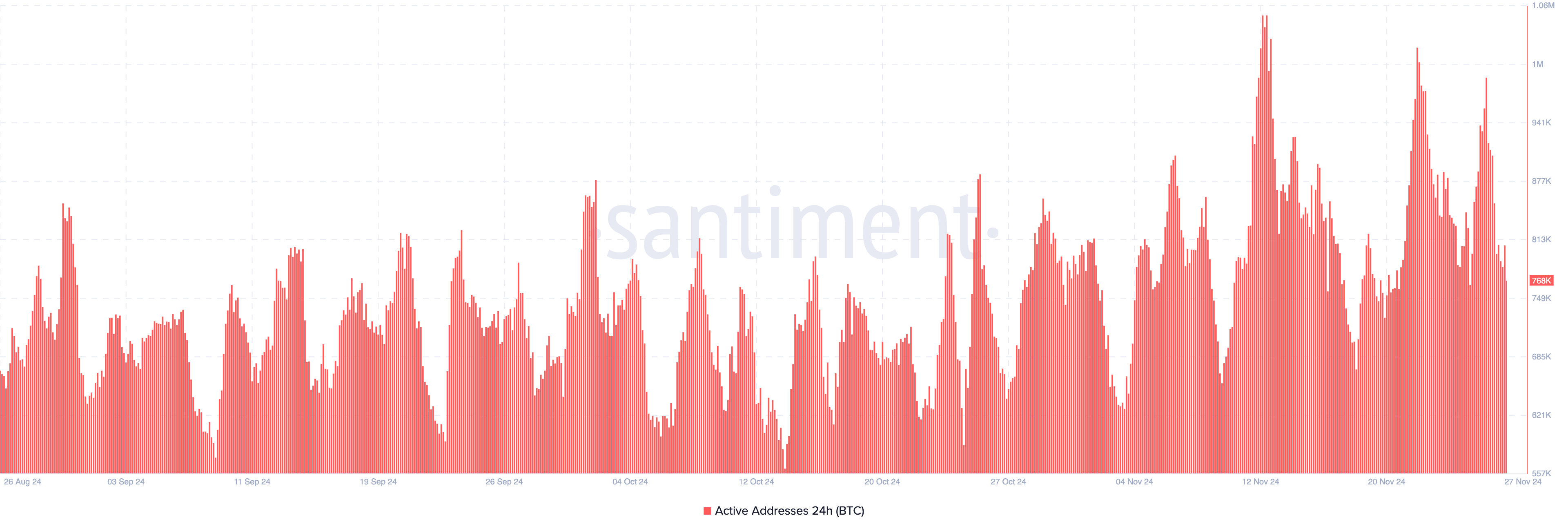

Furthermore, it’s worth noting that the number of active addresses on the Bitcoin network has noticeably dropped this week. If this decline continues, it could potentially impact Bitcoin’s price negatively. Active addresses represent the count of distinct addresses participating in transactions, indicating the level of user interaction with the blockchain.

As the number of active addresses rises, this typically means an uptick in network activity and wider user acceptance. On the other hand, a decrease usually signifies less involvement or fewer participants.

On November 26, Bitcoin saw approximately one million active addresses, indicating strong popularity. As of now, that number has dropped to 768,000, representing a significant decrease. If the activity on these active addresses continues to decrease, it could suggest a weakening market sentiment and potentially lead to additional price drops, as previously discussed.

BTC Price Prediction: Time to Go Below $90,000?

According to the Parabolic Stop and Reverse (SAR) indicator on the daily chart, Bitcoin’s price has dropped beneath its lines. This technical device helps in pinpointing potential support and resistance zones.

The thin lines beneath the Bitcoin price indicate potential strong support levels, while the lines floating above it represent possible resistance points that might cause a drop. At present, Bitcoin seems to be encountering resistance and potential decline.

Should the resistance continue, the price of Bitcoin might decrease to around $84,640. Conversely, if long-term investors choose not to sell for profits, the value of Bitcoin could increase, possibly reaching as high as $99,811.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-27 23:49