As an analyst with over two decades of experience in the financial markets, I’ve witnessed countless bull runs and bear markets, but none quite like the 2024 crypto surge. Having closely followed the rise of Layer-1 tokens this year, I must admit I was taken aback by their meteoric growth – a testament to the power of innovation and the unpredictable nature of the market.

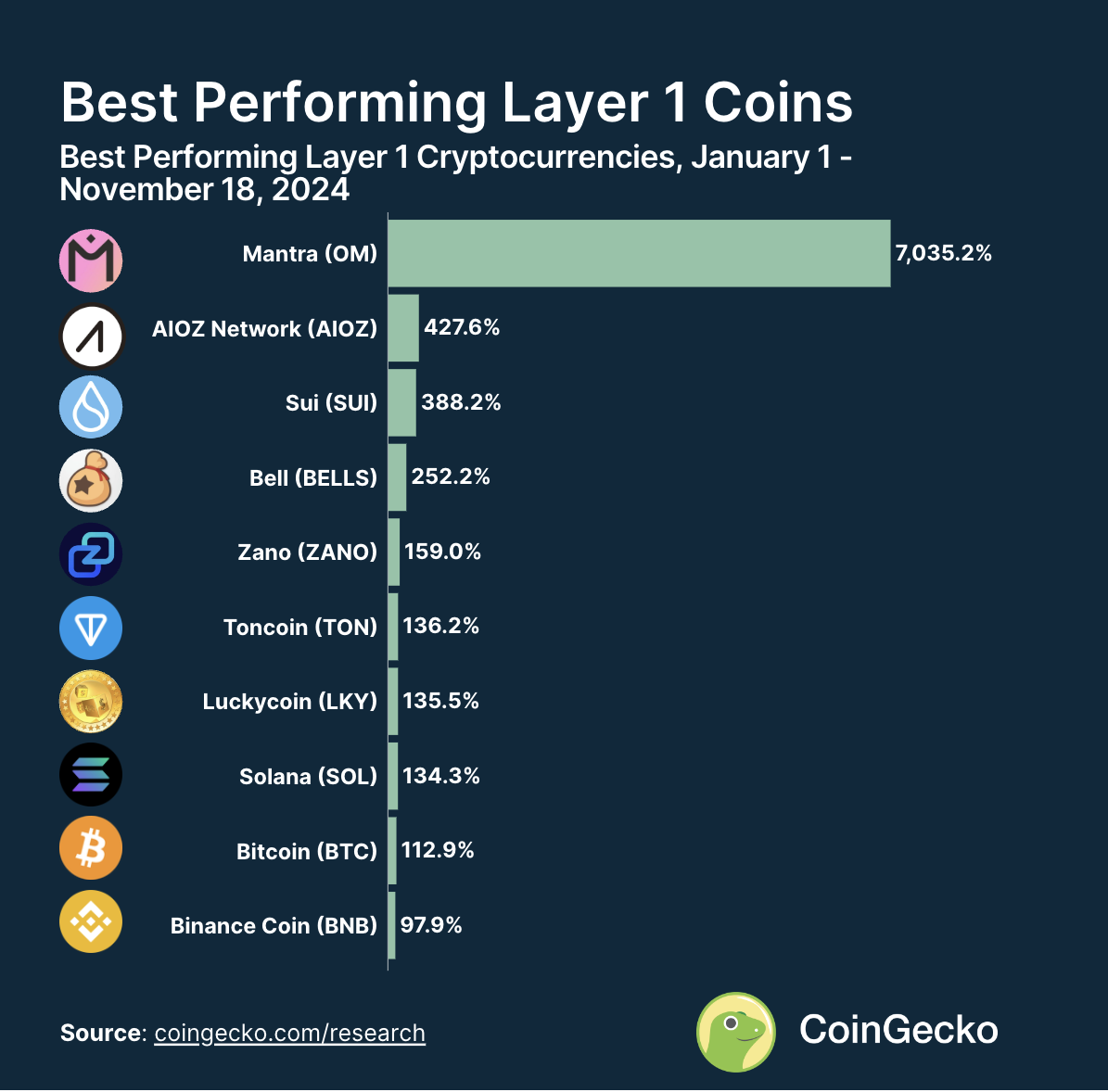

Data from analytics firm CoinGecko shows that Layer-1 native tokens grew by 7,000% in 2024. While major projects like Bitcoin and Ethereum recorded significant gains, other tokens saw notable growth in niche markets.

Conversely, as Layer-2 initiatives gain traction, new Level-1 platforms find themselves contending in a highly competitive and challenging landscape.

Layer-1 Tokens Surge in 2024

CoinGecko, a leading blockchain analytics firm, just posted a dramatic update on the 2024 crypto market. Layer-1 blockchain tokens have surged by over 7000% since January 2024, with several unexpected candidates growing fastest. The firm pointed to several trends, but Trump’s election victory further fueled the rally, sparking a broader bull market.

2024 saw an upward surge in the cryptocurrency market, boosted by Trump’s election win. There has been increased interest in L1 solutions as demand escalates… with numerous L1 blockchains vying for the leading position. Yet, they are confronted by intense competition from Layer-2 solutions, which focus on enhancing transaction speeds at significantly reduced costs, according to CoinGecko.

According to data from CoinGecko, well-known cryptocurrencies like Bitcoin, Ethereum, Solana, and others dominated in terms of market capitalization. However, some underdogs managed to surpass them significantly in terms of percentage growth. It’s important to note that the top Layer-1 blockchain projects have a substantial advantage in various critical aspects. For instance, the CEO of CryptoQuant predicted that Bitcoin could potentially become a global currency by 2030.

Even though these benefits aren’t impossible to overcome, they pose a challenge. Despite Bitcoin almost reaching $100,000 last week, it failed to hit that mark. Data from CryptoQuant suggests that this halt in momentum could significantly postpone this price level, due to excessive market greed. However, other assets are capitalizing on distinct advantages.

In recent times, the mantra (OM) has soared to a new peak, outperforming many others in the market. CoinGecko credits OM’s achievement to a strategic partnership that linked it with the burgeoning RWA tokenization market. Meanwhile, AIOZ has experienced consistent growth, bolstered by its content delivery network. Interestingly, CoinGecko also highlighted the swift expansion of Layer-2 networks within this specific sector.

Even though this is the case, CryptoQuant pointed out the fierce competition in the market of Layer-1 blockchains. Their research demonstrated that a majority of Layer-1 projects launched this year have suffered significant financial setbacks. Established Layer-1 protocols are benefiting from their previous standing, but as the Layer-2 market grows, it becomes progressively tougher for new protocols to thrive.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-27 22:18