As a seasoned analyst with over two decades of experience in the global financial market, I have witnessed numerous transformative events that have reshaped the economic landscape. The recent decision by SOS Limited to invest $50 million in Bitcoin is undeniably one such event.

The board of directors at the Chinese data mining company, SOS Limited, have given the green light for an investment of $50 million in Bitcoin. This announcement was made public on November 27 via a press release issued by the company.

SOS intends to employ multiple approaches for this investment, such as quantitative trading, direct investments, and strategies that take advantage of price discrepancies (arbitrage).

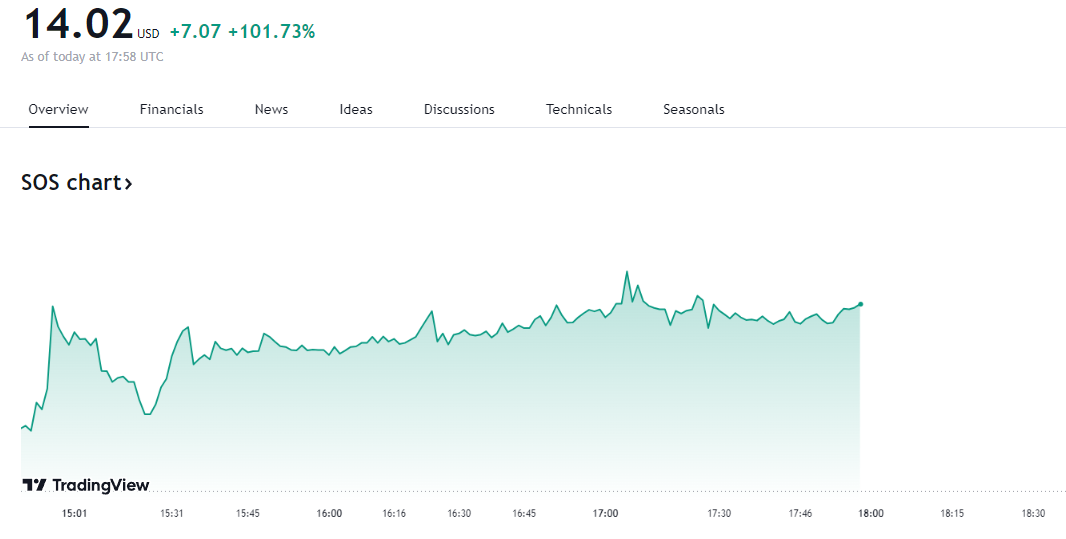

SOS Stock Surges 100% Following its Bitcoin Purchase

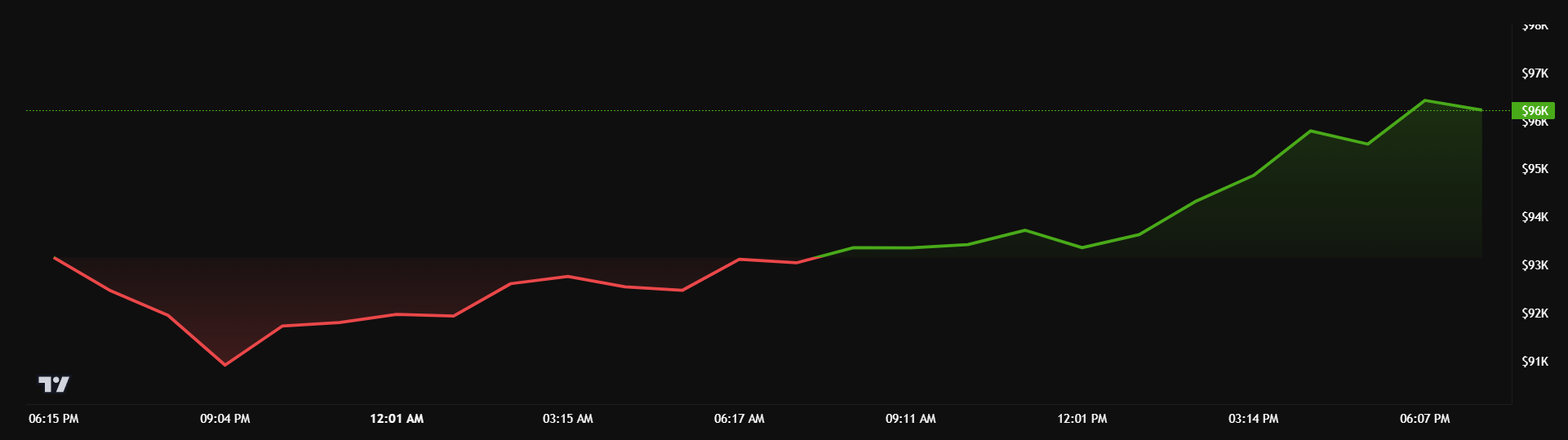

Today, Bitcoin is rebounding strongly following a significant drop that occurred yesterday, pushing its price down to around $91,000 – the lowest it’s been in a week. But the bullish trend has picked up speed once more, propelling Bitcoin back up to approximately $96,000 today.

On Wednesday, November 27, SOS Limited’s share prices skyrocketed approximately 100% after a significant news update. The recent growth in the cryptocurrency market is attracting more investors worldwide. This surge aligns with SOS Limited’s Bitcoin investment, which reflects the growing excitement surrounding digital assets.

The firm considers Bitcoin an essential digital currency with significant global significance, strategically speaking. SOS Limited endorses the idea that Bitcoin might hold a vital position in international reserve tactics.

Yandai Wang, as Chairman and CEO of SOS, stated that they are confident this investment strategy will significantly boost the company’s competitive edge and financial success within the digital asset investment industry.

Public Companies Are Extremely Bullish on BTC

Over the past few months, I’ve noticed a significant increase in Bitcoin acquisitions among publicly traded companies. Just this week, MicroStrategy, led by Michael Saylor, made another $5.4 billion worth of Bitcoin purchases. Remarkably, this was their third consecutive Bitcoin buy in the month of November.

This year, the company has amassed more than $16 billion in Bitcoin, solidifying its position as the industry’s foremost Bitcoin owner with the most substantial holdings.

The surge in Bitcoin’s value has significantly influenced MicroStrategy’s (MSTR) share prices as well. Remarkably, MSTR has seen a nearly 450% increase year-to-date, placing it among the top 100 publicly traded companies in the United States.

Moreover, cryptocurrency miner Marathon Digital has just secured a $1 billion investment via the sale of convertible senior notes. According to BeInCrypto’s previous report, the primary purpose of this capital injection is to purchase additional Bitcoins.

Regardless of Bitcoin currently being valued at $99,000 in its ongoing cycle, several prominent companies remain optimistic about Bitcoin’s future value. For instance, Pantera Capital foresees that the digital currency could surge to an astounding $740,000 by 2028.

Previously, the company predicted that the price of Bitcoin would reach approximately $117,000 by August 2025. At present, we’re getting quite close to that estimation.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-27 21:53