As a seasoned researcher with a knack for deciphering market patterns and trends, I find myself intrigued by PEPE‘s recent performance. Having closely followed the meme coin landscape, I must admit that the rollercoaster ride of PEPE is nothing short of exhilarating.

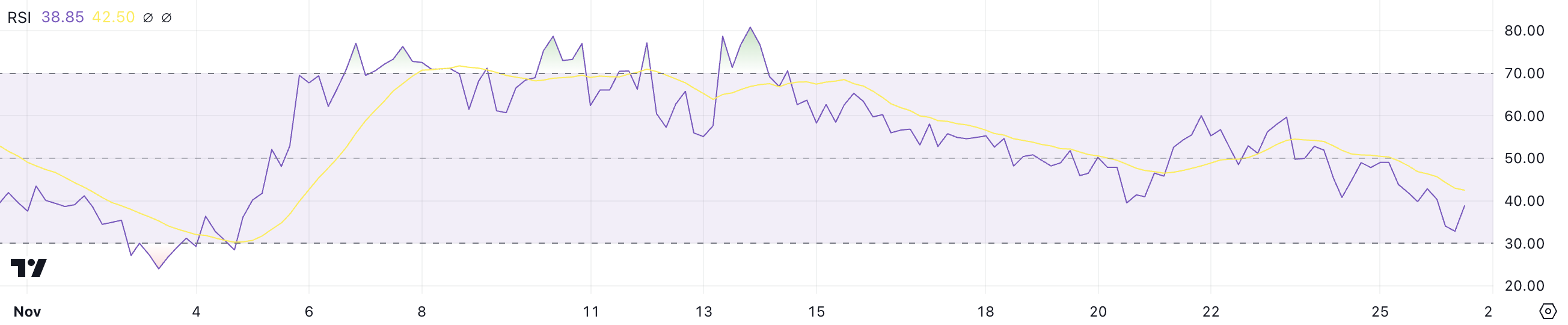

On November 13th, PEPE’s price reached an unprecedented peak following its listing on Coinbase, marking a 105% increase over the past month. However, it has dipped approximately 10% over the last week. Technical indicators like RSI and MVRV hint that more corrections might follow as the bullish trend seems to be waning.

If a death cross occurs in the Exponential Moving Averages (EMAs) for PEPE, it might cause PEPE to approach critical support levels around 0.0000139 or even lower. But if there’s a change in trend, PEPE could challenge resistance levels at 0.0000228 and potentially reach a new peak at 0.000030.

PEPE Isn’t Oversold Yet

Over the past three days, I’ve observed a significant drop in the PEPE RSI from 60 down to 38.8. This suggests a weakening of bullish momentum. The RSI, or Relative Strength Index, is a metric that ranges from 0 to 100, gauging price momentum. Values above 70 signal overbought conditions, while values below 30 indicate oversold levels. Currently, the PEPE RSI is in the oversold region, which could potentially signal a buying opportunity for some investors.

The drop reflects growing selling pressure, but the current RSI suggests PEPE is not yet oversold.

At a RSI of 38.8, PEPE’s relative strength index is approaching a significant threshold, as it hasn’t dipped below 30 since November 3rd. This implies that the price could potentially level off soon if past trends continue. The recent downturn doesn’t alter the fact that PEPE remains the third largest meme coin on the market, sitting beneath DOGE and SHIB in terms of size.

In other words, should the Relative Strength Index fall more significantly below 30, it might provoke a surge of downward pressure and potentially cause additional price decreases.

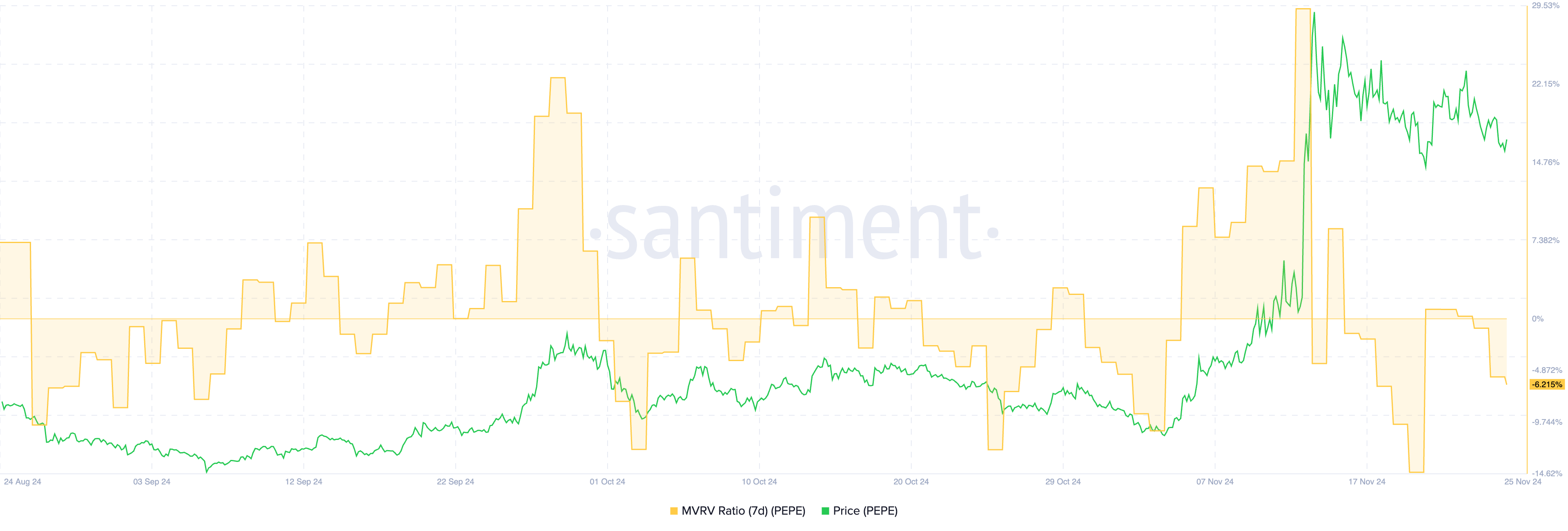

PEPE MVRV Ratio Shows The Correction Could Continue

Presently, PEPE’s 7-day MVRV (Market Value to Realized Value) stands at -6.2%. This suggests that the average recent investor is experiencing a modest unrealized loss, as the current market value of their tokens is less than what they initially paid. The MVRV ratio calculates profits or losses by comparing an asset’s market value with the price its holders originally paid for it.

When MVRV (Maker Value Ratio V) levels are negative, as in the case you mentioned, it often implies decreased selling pressure because holders may be reluctant to sell at a loss.

In historical patterns, a dip below -9.7% in PEPE’s 7-day Market Value to Realized Value (MVRV) ratio has often preceded significant price increases, suggesting that a period of correction might follow before another price rise.

Based on this pattern, it seems like the present MVRV ratio indicates potential consolidation. However, if there’s a more significant drop, it could pave the way for a bullish resurgence. If the MVRV trend continues to decline, it might signal a new phase of buying and a subsequent price increase.

PEPE Price Prediction: New All-Time Highs May Be Postponed For Now

PEPE’s Exponential Moving Average (EMA) lines are indicating a bearish trend, as there is a possibility of a “death cross” forming. This occurs when the shorter-term EMAs dip below the longer-term ones.

If the current trend continues, it might lead to additional adjustments. The price of PEPE may approach its support levels at $0.0000139 and $0.0000108. If selling activity increases significantly, PEPE could drop down to $0.0000077.

Should market faith rebound and the trend shift, I anticipate that the price of PEPE may attempt to surpass resistances located at $0.0000228 and $0.000026.

Breaking above these levels could push PEPE price toward $0.000030, setting a new all-time high.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2024-11-27 01:05