As an experienced analyst with a knack for deciphering market trends and a long-standing fascination with Bitcoin, I find myself cautiously bearish about the current state of affairs. The recent decline in Bitcoin’s price and the subsequent reduction in trading activity among US-based investors is a trend that has caught my attention.

The drop in Bitcoin‘s price recently has caused a significant decrease in trading by American investors. At present, one Bitcoin is being traded for approximately $92,540, representing a 6% loss in value over the last four days.

As substantial opposition has arisen around the $99,000 mark, U.S. investors have been progressively lightening their cryptocurrency positions.

Bitcoin Holders in the US Shy Away

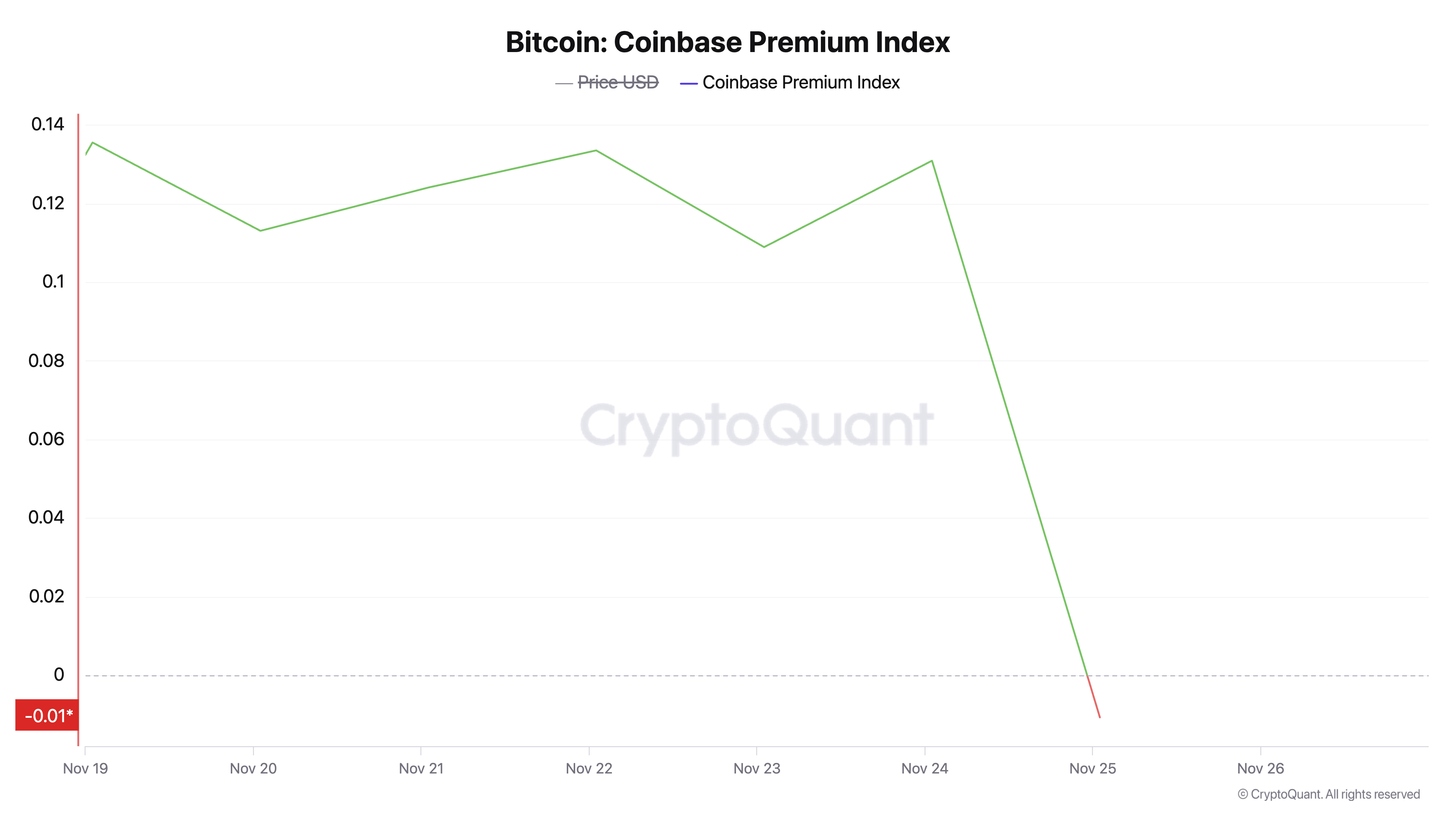

According to CryptoQuant’s findings, the Coinbase Premium Index for Bitcoin has decreased significantly over the last week. Currently, it’s positioned below the zero mark, reaching a seven-day low of -0.01.

As an analyst, I examine a metric that compares the Bitcoin price on Coinbase with that on Binance. This measurement focuses on the trading behavior of institutional and American investors, as Coinbase caters to these segments more prominently. When this value is negative, it signals that the Bitcoin price on Coinbase is lower than on Binance, implying reduced demand or selling pressure from US-based Bitcoin investors.

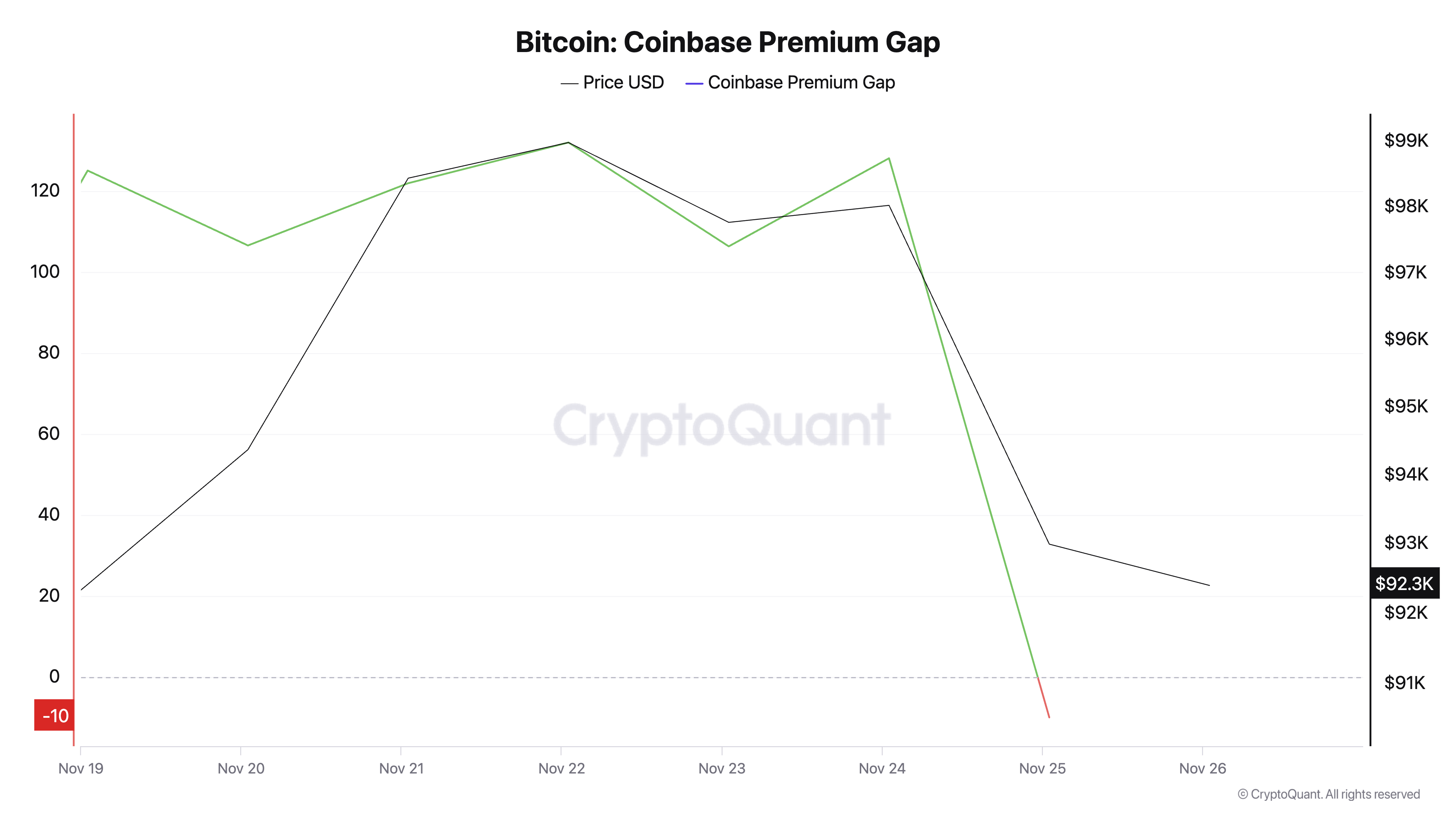

Additionally, the pattern of reduced purchasing from U.S. investors can be observed in the Bitcoin market on Coinbase, as indicated by the Coinbase Premium Gap reaching a seven-day low of -10, according to CryptoQuant. This suggests that the price of Bitcoin on Coinbase is lower than the global average, indicating reduced demand from U.S. investors.

As a researcher, I examine the disparity in Bitcoin prices between Coinbase Pro (traded in USD) and Binance (traded in USDT). When this difference is positive, it signifies stronger purchasing interest among U.S. Bitcoin investors on Coinbase, indicating an upward trend in demand. On the flip side, a negative gap suggests decreased demand from U.S. investors, potentially pointing towards reduced interest.

BTC Price Prediction: Downward Trend May Persist

On Bitcoin’s daily price graph, the Parabolic Stop and Reverse (SAR) indicator has started to display points above the current price, signifying a downward trend. This is the first occasion since November 6 that these points have been positioned in this manner.

In simpler terms, the SAR (Signal Average Rate) tool follows the direction of an asset’s price movement by marking points either above or below the price line. When points are positioned below the price, it indicates a rising trend, whereas points appearing above the price indicate a falling trend.

presently, Bitcoin is being traded around $92,540, which is almost 4% away from its previously established support level at $88,630. If the current downtrend persists, there’s a possibility that the coin could drop below this support level and potentially reach $80,159.

Should the market’s mood change and purchasing activity pick up again, it’s possible that Bitcoin could regain its previous peak price of $99,419.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-11-26 17:55