As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by Ethereum’s recent performance. While it may be lagging behind its peers in terms of growth, the 46% surge it has witnessed is certainly noteworthy.

The price of Ethereum (ETH) has experienced a significant jump of 46.11%, showcasing strong development, but it remains the second-poorest performer among the top 10 largest digital currencies. This recent surge can be attributed to an increase in ‘whale’ purchases and a 7-day MVRV trend indicating a neutral to slightly optimistic outlook for investors.

Nevertheless, the level of resistance around $3,600 may decide whether Ethereum (ETH) will keep its bullish trend towards $4,000 for the first time since late 2021. Conversely, a reversal might trigger a substantial decrease, with robust support at $3,000 and the possibility of a fall to $2,359 if the bearish sentiment grows more intense.

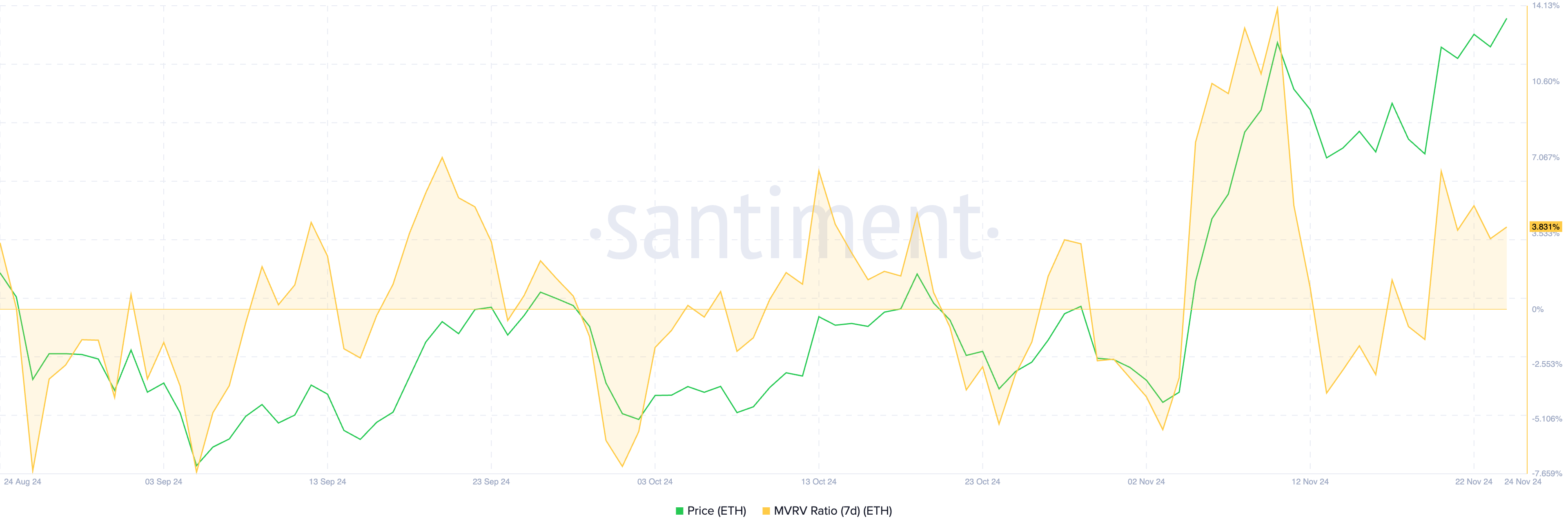

ETH 7D MVRV Shows An Important Threshold To Be Surpassed

In simpler terms, the Ethereum MVRV 7-day ratio stands at 3.8%. This suggests a relatively neutral to optimistic stance regarding immediate profit-taking actions among traders who have recently moved their coins. The MVRV 7-day figure calculates the market value versus the realized value of coins transacted over the last week, offering insights into the profitability experienced by recent traders.

When the MVRM 7 Day (Moving Average of Realized Value) is low, it suggests that traders are currently holding assets with losses or very small profits. This situation decreases the urge to sell, as many traders might be hoping for a price recovery. Conversely, higher MVRM 7 Day values indicate that traders have realized significant profits, which may lead to increased selling as they seek to lock in those gains, potentially increasing market pressure.

Historically, when the 7-day MVRV (Mayer Multiple Value) of ETH reaches between 5-7%, it has typically faced difficulties in sustaining an upward trend and often leads to corrections. However, its recent surge to 13% before a 10% correction suggests that exceeding this range might ignite prolonged bullish movement.

As a researcher studying Ethereum’s market trends, if the MVRV 7D (Moving Average Value of Realized Price) surpasses the 7% threshold once more, I believe we might witness substantial price growth for ETH, perhaps even exceeding a 10% increase. This positive momentum could stem from growing optimism among investors and traders who are hesitant to realize their profits, instead choosing to hold onto their positions in anticipation of further price appreciation.

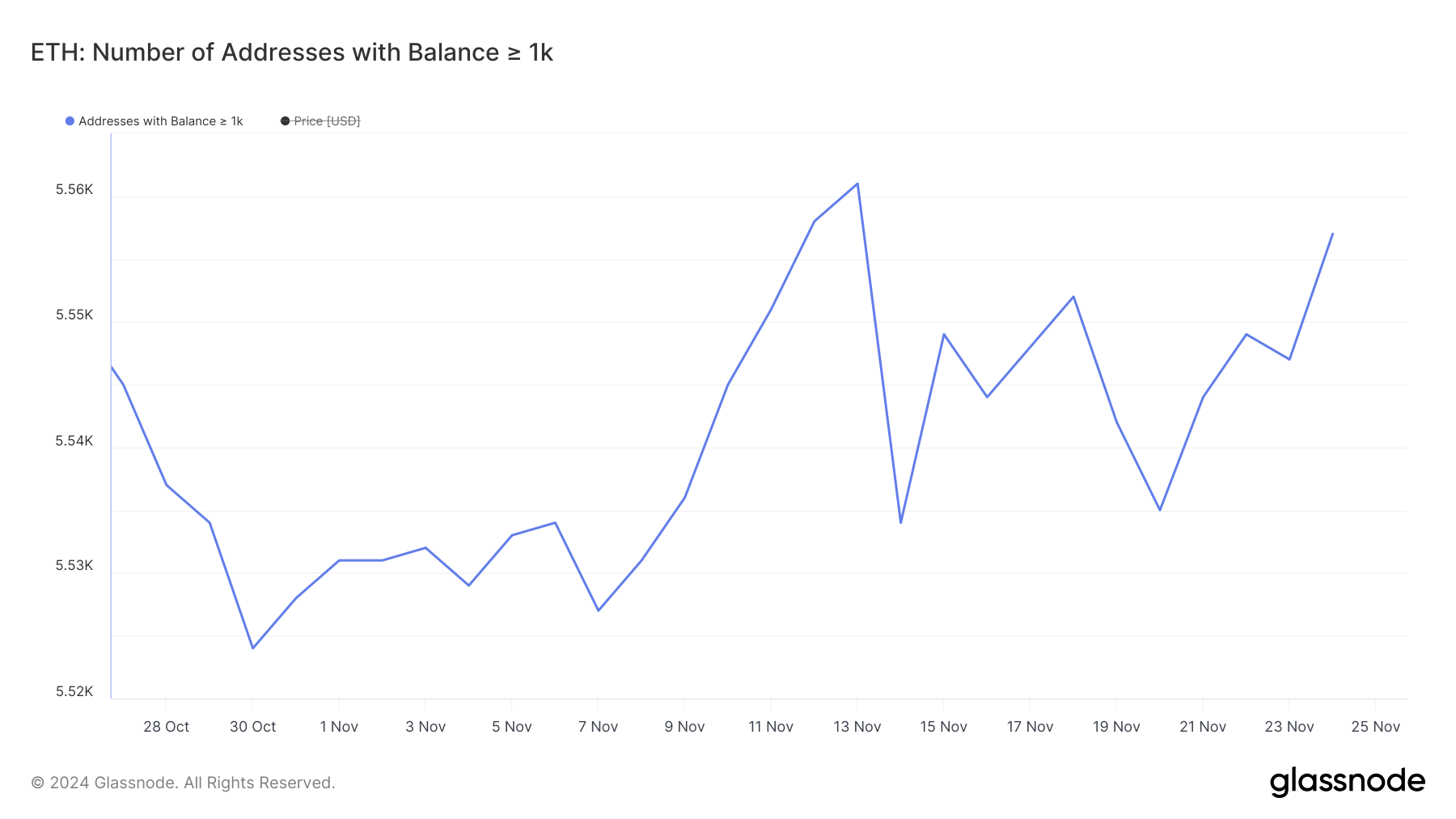

Ethereum Whales Are Back

Approaching the monthly peak of 5,561, the number of Ethereum investors holding over 1,000 ETH currently stands at 5,557. Keeping an eye on whale activity is crucial since these substantial holders can substantially impact market patterns by their trading actions due to their large quantities.

An increase in whale population (large investors) tends to reflect growing assurance about the value of an asset, fostering price stability or growth. Conversely, a decrease might suggest waning investor interest and possible selling pressure.

Over a six-day span, I observed the number of whales rising from 5,527 to 5,561. However, on November 20, this figure dipped slightly to 5,535, indicating a possible short-term selling or decreased buying activity among large investors. Yet, within a week’s time, the number has rebounded to 5,557, hinting at renewed interest and accumulation among these significant stakeholders.

The bounce back indicates increasing confidence in the market, potentially strengthening Ethereum’s price consistency, and setting a path for potential additional growth if the positive trend persists.

ETH Price Prediction: Can It Get Back To $4,000?

If Ethereum continues its upward trajectory, it may soon encounter a significant resistance point around $3,600. This level is crucial for the continued growth of bullish energy.

As an analyst, I find myself observing that surpassing the current resistance level would position Ethereum’s price merely 11% short of re-entering the $4,000 territory, a figure we last saw back in December 2021. Should this occur, it could spark increased optimism and stimulate additional buying activity, further strengthening the current bullish trend.

If the upward trend weakens and begins to reverse, Ethereum’s price should find solid backing at around $3,000 – an essential level that could help prevent substantial drops.

Should the backing not hold up, there’s a possibility that the price might plummet down to around $2,359, representing a possible 31% decrease from its current position.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-11-26 01:42