As a seasoned researcher with over two decades of experience navigating various financial markets, I must admit that the recent surge in Bitcoin inflows has piqued my interest like never before. The sheer volume of capital flowing into this once-niche asset class is nothing short of astonishing and serves as a testament to its growing dominance.

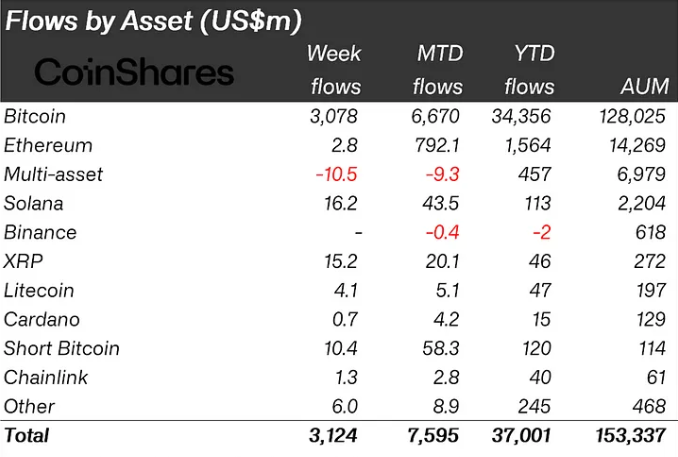

Last week saw a historic surge in crypto investments with a weekly inflow of approximately $3.12 billion. This significant increase has brought the total year-to-date inflows to an astonishing $37 billion, underscoring Bitcoin‘s expanding influence and increased appetite for digital asset investment opportunities.

As Bitcoin (BTC) persists in demonstrating the possibility of reaching fresh all-time highs, its current maximum price has soared to an impressive $99,588 on the Binance exchange.

Bitcoin Dominates Amid Crypto Inflows’ Record Highs

Last week saw Bitcoin lead the way with a record-breaking $3.078 billion influx, marking its best performance ever. Even as the price hit new all-time highs, there was also a significant increase in interest for short-Bitcoin investment products, which took in $10 million over the week. Interestingly, these short-Bitcoin investments recorded a monthly high of $58 million last month – the highest since August 2022.

As an analyst, I’ve noticed a significant surge in our recent inflow, amounting to $3.12 billion – a marked uptick compared to the previous weeks. This trend appears to be robustly upward, with the preceding week registering inflows of $2.2 billion. The boost in this week’s inflow can be attributed to the growing momentum of the Republican elections and the accommodative stance of the Federal Reserve.

During the preceding week, there was an influx of approximately $1.98 billion fueled by post-election optimism. This continuous inflow underscores the market’s robustness and increasing investor confidence, even amidst wider economic doubts.

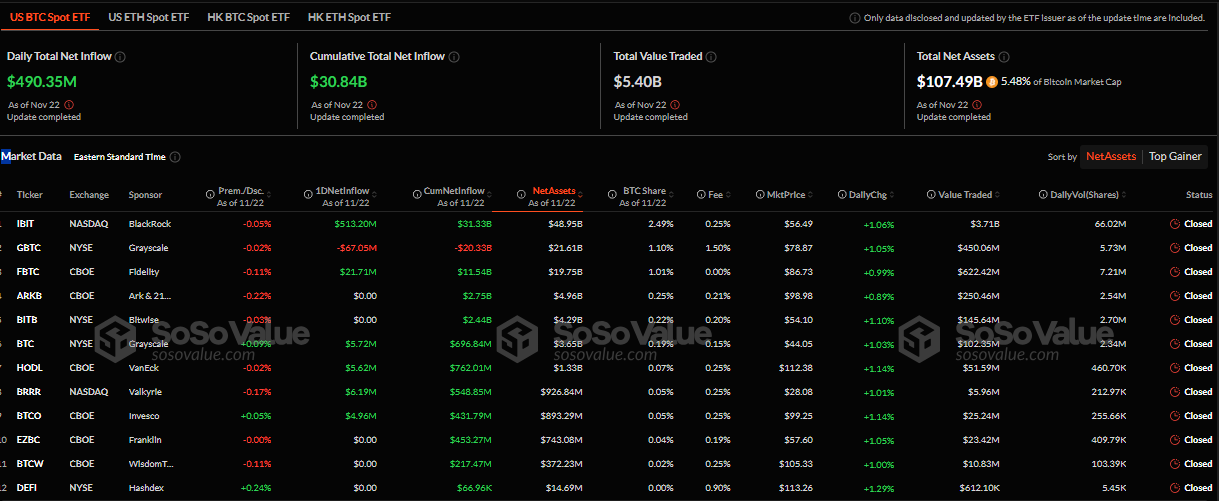

As a crypto investor, I’ve noticed an exciting trend: The surge in popularity and adoption of Bitcoin ETFs is playing a significant role in driving the price of Bitcoin upwards. According to SoSoValue’s data, the cumulative total net inflow for these Bitcoin ETFs had reached an impressive $30.84 billion by November 22, when markets closed on Friday. This institutional interest is undeniably pushing Bitcoin towards new heights.

As an analyst, I’ve noticed an intriguing trend: While many were focusing on MSTR, Exchange Traded Funds (ETFs) have been subtly accumulating over ten times the amount of Bitcoin mined last week. In other words, ETFs are acting like Pac-Man, consuming a significant portion of the newly minted Bitcoin. Eric Balchunas, an analyst with Bloomberg Intelligence, humorously pointed this out.

As an analyst, I’m observing a surge of optimism, with Balchunas’ observation that US spot ETFs are approaching Satoshi’s position as the world’s largest Bitcoin holder being a notable point. Analyst predictions suggest that Bitcoin could escalate to $115,000 during this holiday season, fueled by the activity of ‘whales’ and long-term investors capitalizing on the current rally, which adds to the overall enthusiasm.

Michael Saylor, who is known for advocating for Bitcoin from MicroStrategy, suggested that the company might increase its Bitcoin investments, thus adding more credibility to the digital asset among institutional investors.

Contrasting Fortunes Between Solana and Ethereum

As a crypto investor, I’ve noticed an impressive surge in Solana (SOL) over the past week, with a staggering $16 million flowing into it. This is quite a leap compared to Ethereum’s $2.8 million inflow. Yet, on a year-to-date basis, Solana seems to be playing catch-up, with Ethereum leading the pack as the dominant altcoin, having garnered substantially more total inflows.

The recent prosperity of Solana may be linked to the rising enthusiasm about Exchange Traded Funds (ETFs) based on Solana. With applications from VanEck, 21Shares, Bitwise, and other firms, the belief among investors in the Solana network has significantly grown.

These exchange-traded funds (ETFs) may expand the availability of Solana’s technology to both retail and institutional investors, subject to the approval of the Securities and Exchange Commission (SEC).

While Bitcoin and the overall crypto market are on an upward trajectory, there’s a sense of cautious optimism rather than unbridled enthusiasm. Analysts such as CryptoQuant urge restraint against excessive excitement, predicting a potential price drop following Bitcoin’s recent surge. Furthermore, critics like Justin Bons from Cyber Capital voice concerns about Bitcoin’s susceptibility to liquidity issues.

On the one hand, analysts predict sustained growth driven by ETFs, institutional adoption, and strong market sentiment. On the other hand, warnings of over-leveraged positions and liquidity risks suggest that a pullback could follow this bullish phase. How long this momentum will persist depends on regulatory developments, market sentiment, and macroeconomic factors.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-11-25 18:32