As a seasoned crypto investor with scars from numerous market rollercoasters, I’ve learned to decipher the dance of charts and the pulse of the market. The latest surge in SAND was indeed enticing, but my Spidey-sense is tingling.

During the early hours of the Asian trading session on Monday, The Sandbox (SAND) experienced a surge and reached a new annual peak of $0.86. Yet, since then, it has retreated by about 14%, currently trading at $0.76 as we speak.

Although the current spike might indicate otherwise, it seems that achieving the anticipated $1 price point is currently unattainable, based on both on-chain and technical analysis. Here’s the reasoning behind this.

The Sandbox’s Long-Term Holders Book Profit

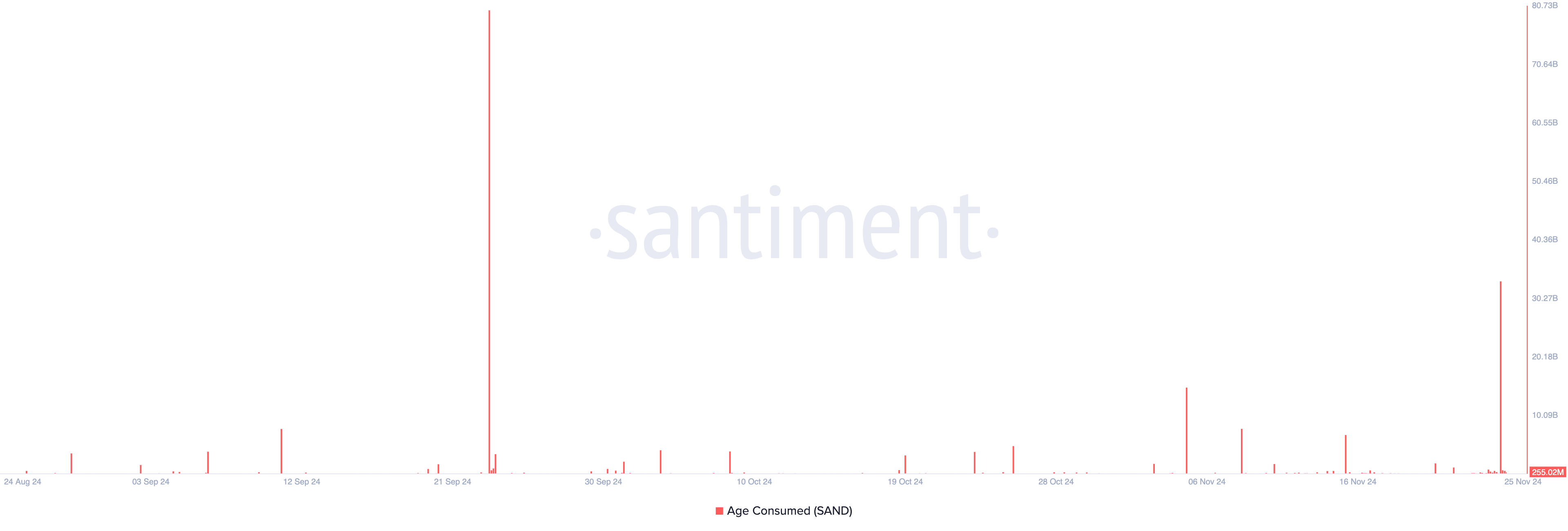

SAND’s price hike over the past week has prompted its long-term holders to move their previously dormant tokens around. This is reflected in the surge in the token’s age-consumed metric, which measures the movement of long-held coins. According to Santiment, this skyrocketed to a two-month high of 33.19 billion on Sunday.

The surge in this specific metric is remarkable because regular long-term investors tend not to frequently trade their assets. So, when they do, particularly during times of rising prices, it suggests a change in market dynamics. Large increases in the rate at which coins are sold during a rally could mean that long-term holders are cashing out, potentially causing increased selling pressure.

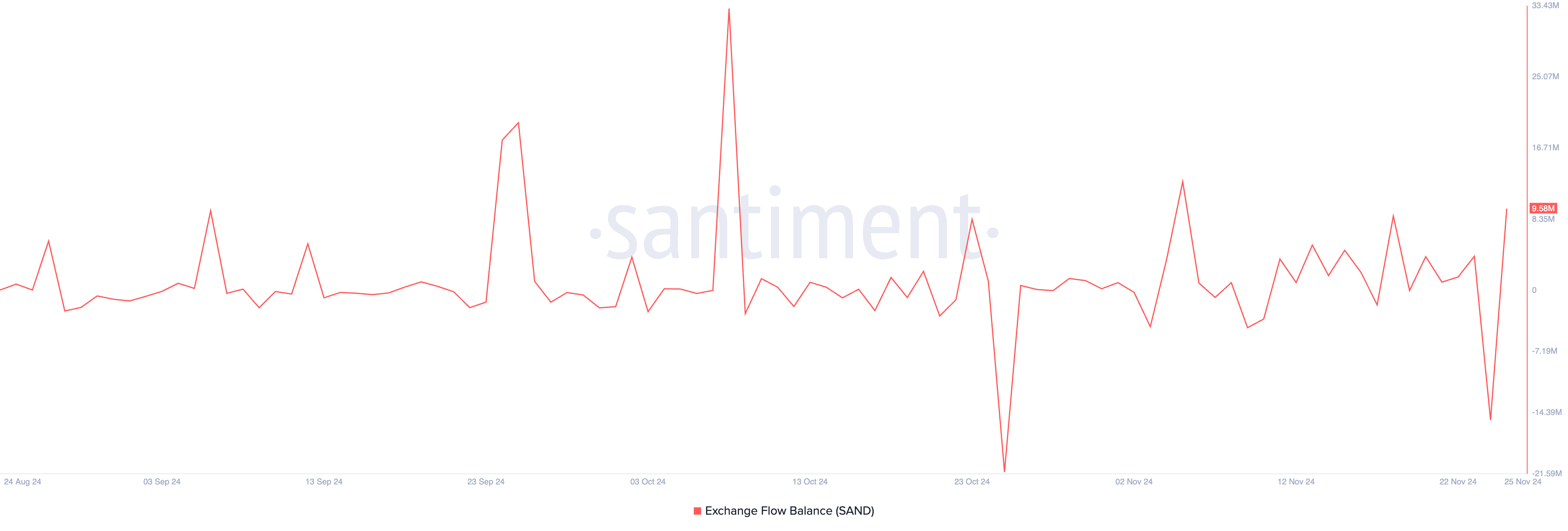

Significantly, the increase in SAND’s Exchange Flow Balance by 162% during the last 24 hours suggests a surge in selling activity. As Santiment explains, this metric, which gauges the net difference between assets going into and coming out of exchanges over a certain timeframe, indicates such an uptick.

As a long-time cryptocurrency investor with a keen eye for market trends, I’ve noticed that an increase in the number of SAND tokens being deposited to exchanges can be a telling sign. It’s like seeing the footprints of a herd moving towards the exit in a crowded stock market. This could mean that holders are readying themselves to sell their tokens, potentially causing downward pressure on the price. I’ve seen this pattern before, and history tends to repeat itself in the cryptosphere. So, it’s always prudent to keep a watchful eye on such trends.

SAND Price Prediction: Metaverse Token Is Overbought

On its daily chart, SAND’s Relative Strength Index (RSI) currently reads 87.18, signaling potential overbought conditions. This RSI scale goes from 0 to 100, with readings above 70 indicating the asset may be overbought and potentially due for a drop, while values below 30 might indicate it’s oversold and could recover.

87.18 RSI for SAND indicates it’s showing signs of being overbought, increasing the possibility of a short-term price drop. If a downturn happens, the price might fall to approximately $0.72. Intensified selling could then drive SAND lower still, potentially taking it down to $0.61 and moving it even further from the desired $1 mark.

Conversely, should the selling pressure decrease, there’s a chance that the SAND token could return to its highest point this year ($0.86), which would contradict the pessimistic perspective presented earlier.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- Defeat Trokka Easily in The First Berserker: Khazan!

- Gold Rate Forecast

2024-11-25 16:21