As a seasoned analyst with over two decades of market analysis under my belt, I’ve learned to read between the lines and decipher patterns that often go unnoticed by the average investor. In this case, Solana’s current long/short ratio and transaction rate are pointing towards an optimistic outlook.

On November 23rd, the value of Solana (SOL) reached an unprecedented peak, fueling anticipation that this cryptocurrency might surge up to $300. Although it didn’t reach that level, current information indicates that traders who deal with Solana are optimistic about a price recovery.

This on-chain assessment examines whether the traders’ optimism is justified, as their positions may lead to profits or potentially force them into losses due to liquidation.

Solana Longs Keep Shorts Out of the Way

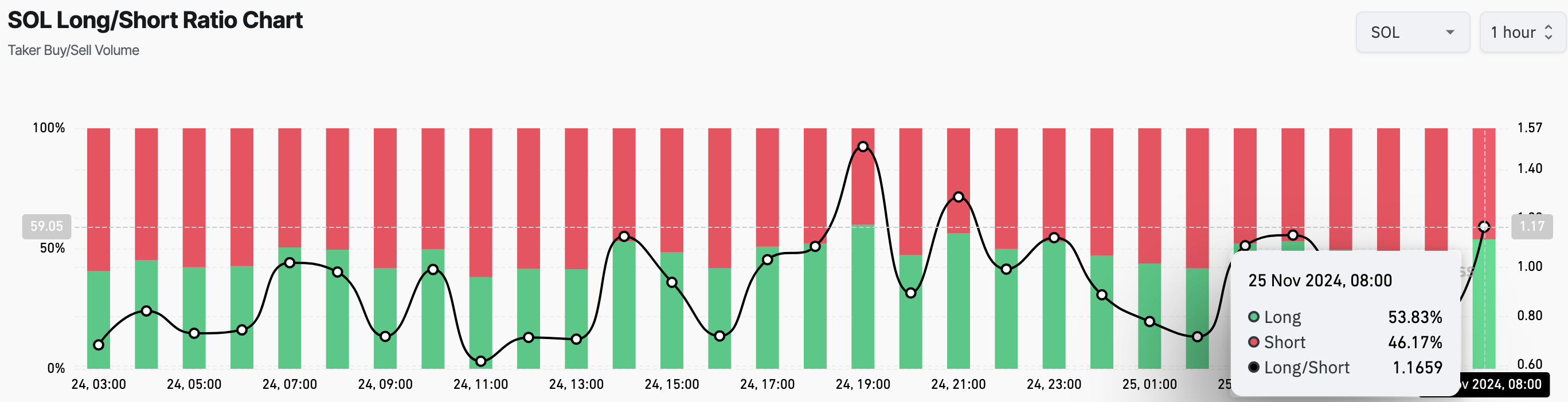

According to data from Coinglass, the Long/Short ratio for Solana, viewed over a 1-hour period, has reached 1.17. This ratio serves as a gauge of market sentiment, suggesting that more traders currently have bullish rather than bearish positions.

When the short-to-long ratio drops below 1, it signifies that there are more sellers (shorts) than buyers (longs), meaning more traders expect the price to decrease. On the other hand, when this ratio is greater than 1, it means more traders are betting on a price increase compared to those who anticipate a decline.

At present, approximately 54% of Solana’s traders are holding long positions, indicating that they anticipate the price to increase. On the other hand, around 46.17% of these traders predict a decline below $255. This suggests that there is more optimism about the token’s price increasing than decreasing, implying a predominantly bullish sentiment among traders.

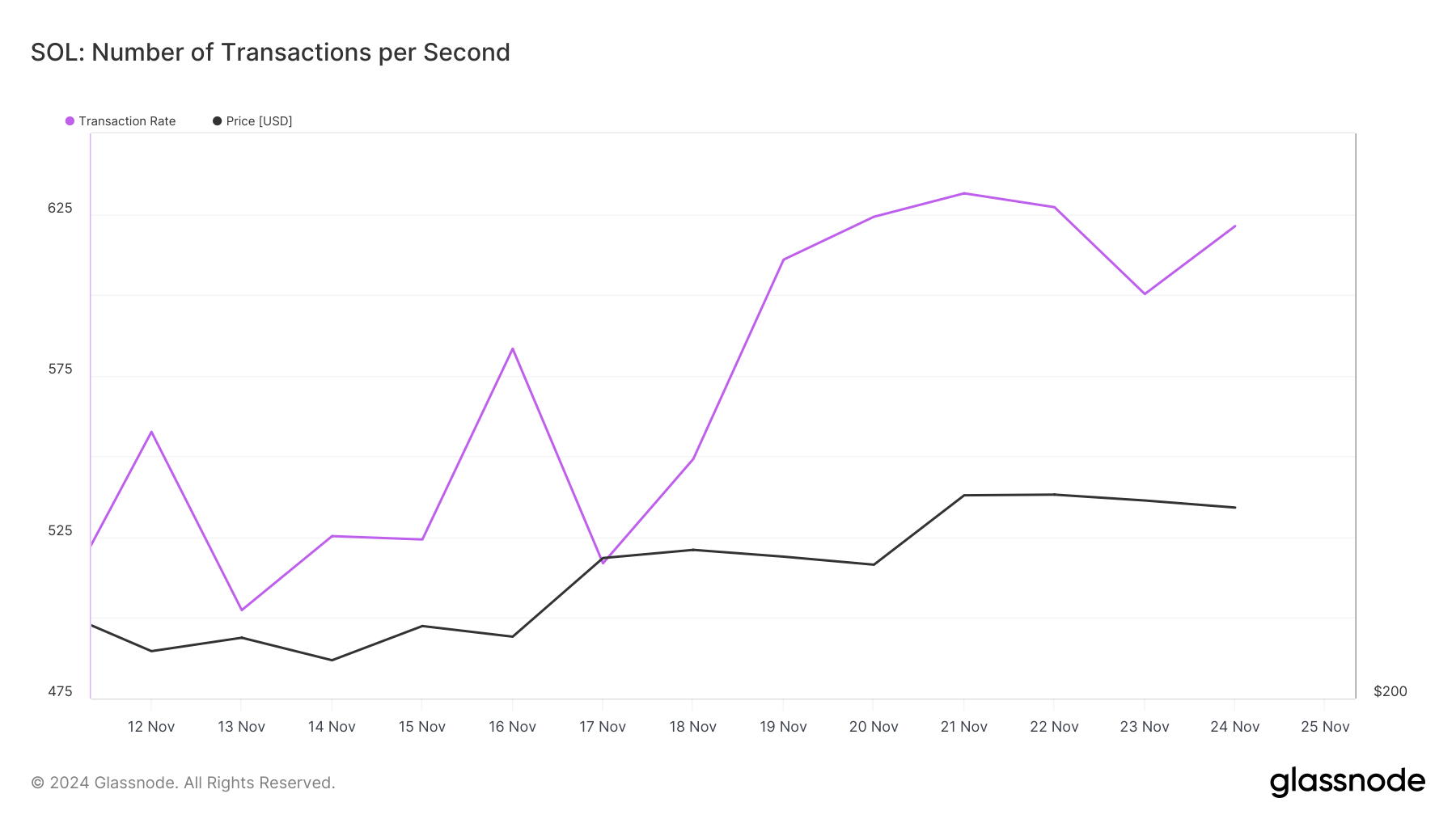

Furthermore, it seems that the earnings for these traders might increase as a result of a rise in Solana’s Transactions Per Second (TPS) rate, referring to the number of transactions successfully completed every second on its blockchain network.

A rising Transaction Rate suggests that users are becoming more active and engaged with the cryptocurrency, which may imply growing interest. Conversely, a decrease in Transaction Rate might indicate waning user interest. As per Glassnode, the Transaction Rate for Solana has been on an upward trajectory. If this trend persists, it could potentially drive SOL’s price beyond its previous record high.

SOL Price Prediction: Upside Potential Remains

On a weekly basis, Solana’s price has climbed over its 20 and 50 Exponential Moving Averages (EMAs), important markers that track market trends. When the price stays above these EMAs, it suggests an upward trend or bullish sentiment, while falling below them usually indicates a downward trend or bearish movement.

Currently, SOL is trading at around $255, which is higher than both its Exponential Moving Averages (EMAs), suggesting it might keep moving upwards. Additionally, the bull flag pattern that has formed gives credence to a bullish forecast for this cryptocurrency.

In simpler terms, a “bull flag” is a type of chart pattern that suggests an ongoing bullish (upward) trend following a brief period of sideways movement or consolidation. Once this pattern breaks out to the upside, it’s usually followed by continued price increases as seen in the case of SOL, which has already broken out and is moving higher.

So far, as long as the price continues to stay above the upper boundary of its current holding pattern, there’s a potential for it to climb up to around $325. But if selling pressure starts increasing significantly, this optimistic outlook could flip. In such a case, Solana (SOL) might drop below the $200 mark.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-11-25 14:38