As an analyst with extensive experience in the crypto market and a knack for deciphering blockchain data, I find myself intrigued by Decentraland’s MANA token’s recent 70% price surge. While it may have caught some off guard, a closer look reveals a series of catalysts driving this movement.

The digital currency known as MANA, which is unique to Decentraland, has experienced a significant 70% rise in value over the past week. This notable increase in the price of MANA cryptocurrency aligns with a broader upward trend among tokens associated with the Metaverse, a development that has piqued the interest of investors in the market.

Despite catching others off guard, a detailed examination by BeInCrypto reveals potential triggers propelling this trend. Through on-chain evaluation, we’re exploring possible future developments for the token.

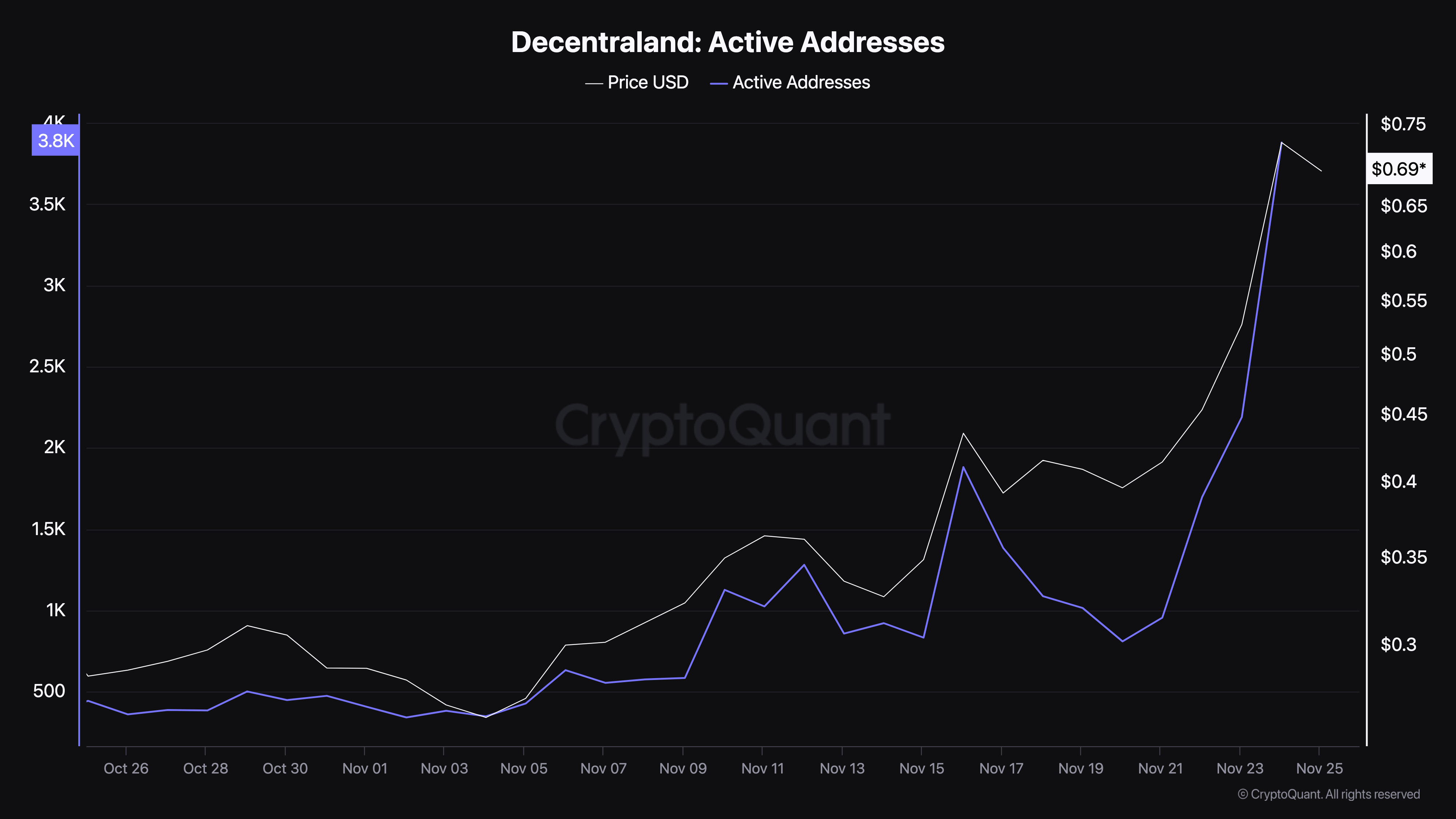

Decentraland Active Addresses, Volume Reach New Heights

The surge in MANA crypto prices may be linked to a substantial rise in the number of active addresses for the token, suggesting increased user engagement on the blockchain. Notably, this trend aligns with the resurgence of The Sandbox (SAND), another leading contender in the Metaverse comeback.

Measuring active addresses counts the distinct individuals who successfully conduct transactions within the network. An increase in this figure generally suggests heightened user interaction, a sign that’s often interpreted as positive or bullish for cryptocurrencies. On the contrary, a decrease may indicate less interest or reduced traction, which is typically viewed as negative or bearish.

By November 20th, the number of active MANA addresses was approximately 810. A short while later, this number saw a dramatic increase, nearly quintupling. This surge suggests an increasing fascination with the token. It’s plausible that this heightened activity fueled the price rise from $0.40 to $0.70 – the highest point since March.

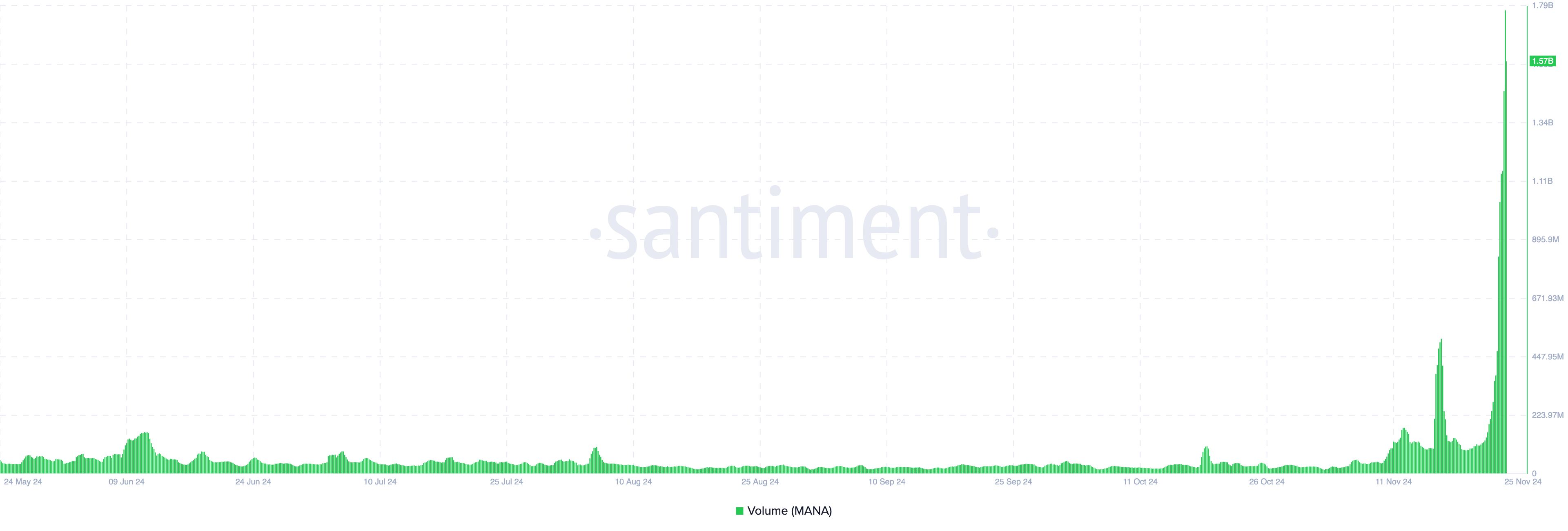

According to the progression, Santiment’s data indicated that the trading volume for MANA reached a staggering $1.57 billion. This volume signifies the overall worth of MANA exchanged during a particular timeframe.

This metric reflects a coin’s level of activity and liquidity. A high trading volume indicates notable buying and selling, which often suggests strong market participation. On the other hand, low volume may signify reduced activity, leading to weaker market interest.

Consequently, the increase in the token’s transaction activity supports the indications given by the active wallets. Yet, considering that MANA’s value has fallen from its latest high, maintaining the upward trend might prove difficult, and there’s a possibility of another dip approaching based on this assessment.

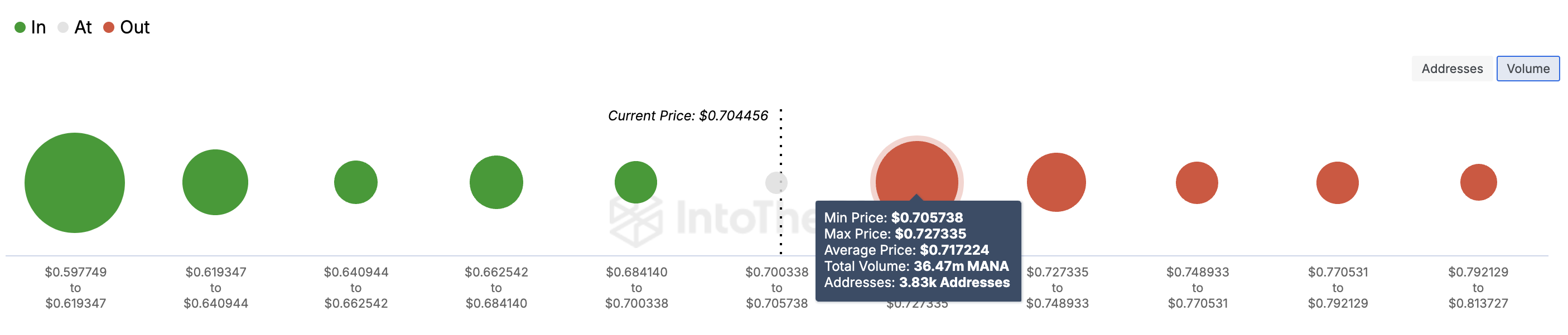

MANA Price Prediction: Pullback Imminent

Viewing it from a blockchain standpoint, there are indications that the rise in the MANA cryptocurrency’s value could be approaching a temporary peak, as suggested by the trends observed in the In/Out of Money Around Price (IOMAP) data.

One way to rephrase the given text in a more natural and easy-to-read manner is: “The IOMAP (Input/Output Map) is an essential tool that examines the distribution of cryptocurrency owners according to whether their investments are earning profits, showing losses, or just breaking even. Additionally, it sheds light on possible support and resistance points within the market.

When many groups of addresses have prices higher than the current market value (out-of-money), these regions tend to function as resistance, making it difficult for prices to increase further. On the flip side, when large numbers of addresses have prices lower than the current market value (in-the-money), they usually provide support because holders may choose to buy more or refrain from selling, anticipating a price rise.

36.47 million MANA tokens kept in accounts that were purchased around $0.70 now have a lower market value, making them “out of the money.” This quantity exceeds the amount of tokens held between $0.61 and $0.68. Consequently, this price range stands out as a significant barrier or resistance area.

Given these circumstances, it’s possible we may see a dip in the MANA crypto price. If this happens, the immediate future could see the cryptocurrency’s value falling to around $0.61.

If the demand for purchasing continues to rise and the trading volume surpasses that at $0.70, it’s possible that the predicted event won’t occur. Instead, MANA may ascend towards $0.80.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-11-25 12:28