Ethereum’s $3K Tango: Whales, Wails, and Wallet Woes 😱💸

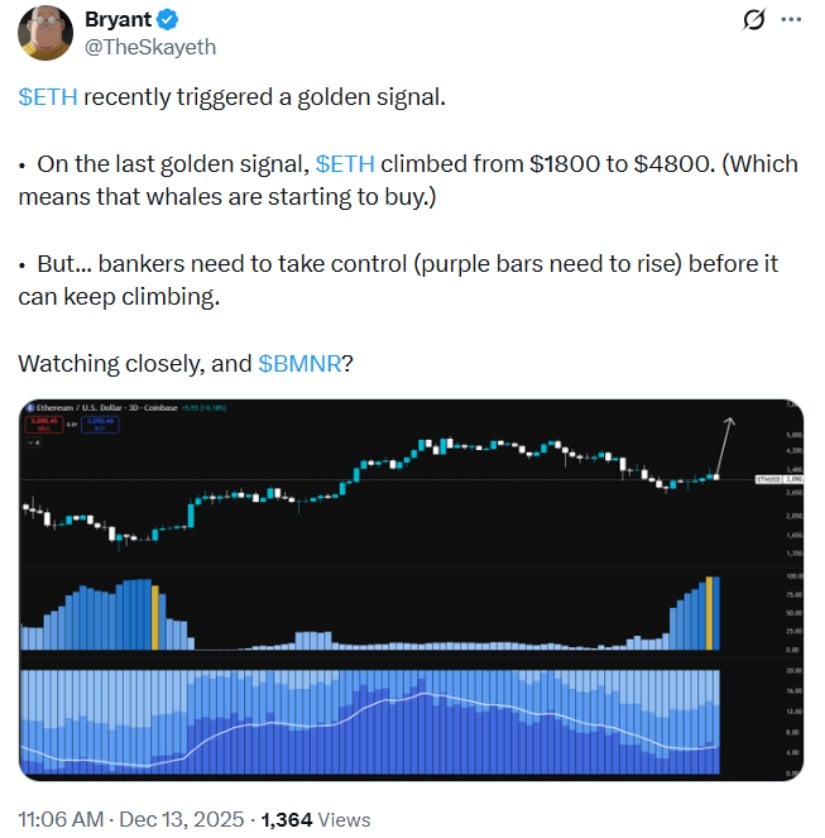

Speaking of which, Arkham Intelligence dropped a bombshell: some ETH whale decided to go all-in with a $537 million long position at $3,175. Bold move, Cotton. But then ETH took a 4.7% nosedive on December 12th, and suddenly that whale’s position is underwater to the tune of $20.5 million. Ouch. 🦈💦