As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bullish and bearish trends. However, Bitcoin’s current trajectory is unlike anything I’ve ever witnessed before. The relentless rally we’re seeing now reminds me of the dot-com boom, but with the potential to outpace it.

As a researcher, I’m projecting that the median forecast points towards a price point of around $125,000 by New Year’s Eve. There’s a 9% likelihood it could surge beyond $150,000, and there’s even a remote possibility it might reach as high as $250,000.

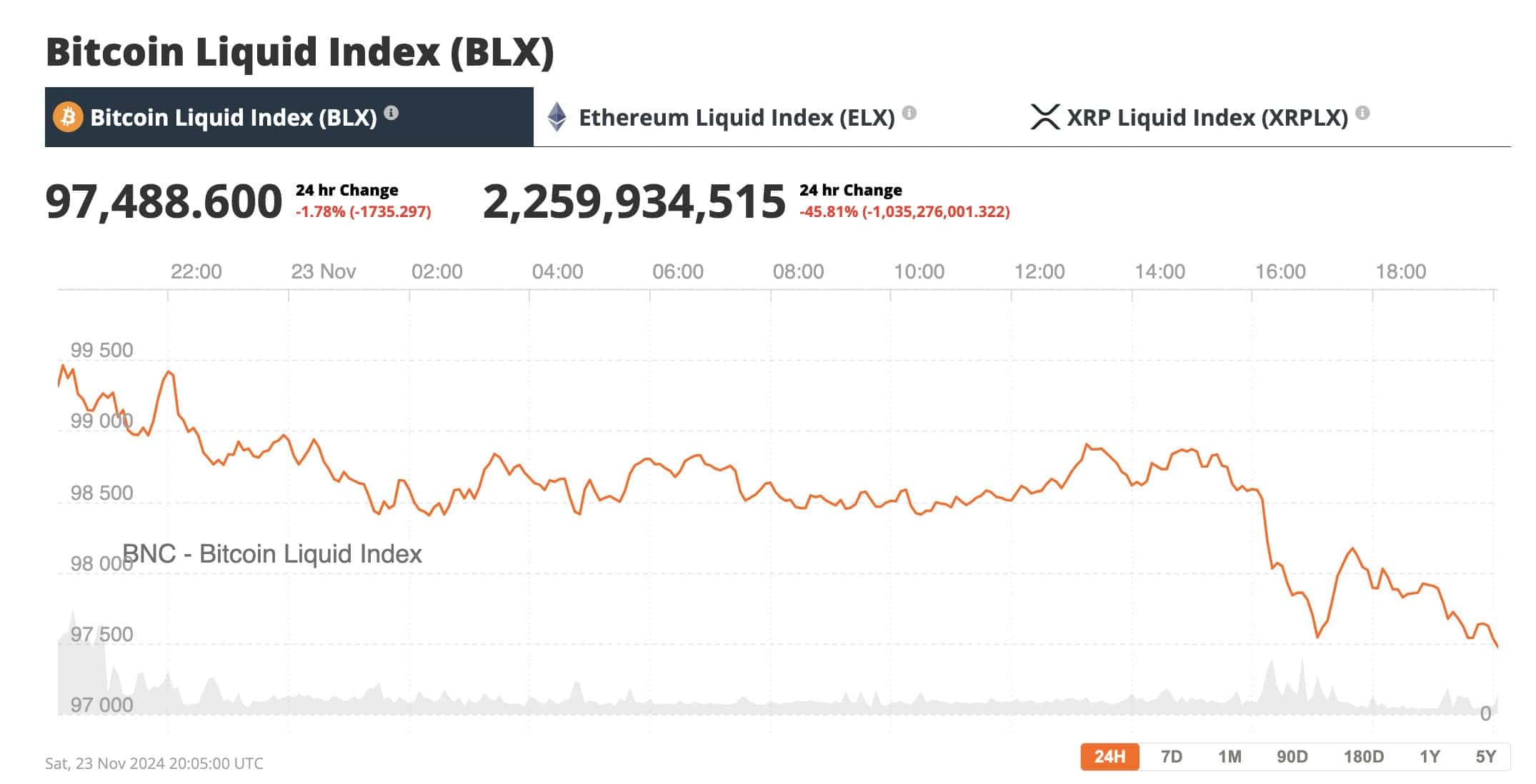

The current trend of Bitcoin indicates that reaching $100,000 is not a matter of “if” but “when,” according to data from Kalshi. Traders and analysts are optimistic about a powerful surge, predicting an explosive rally.

Bitcoin’s Meteoric Rise in Q4

Bitcoin’s November rally is already turning heads. The cryptocurrency is up nearly 40% for the month and 55% for Q4 overall, putting 2024 on track to mirror the late-2023 surge, according to CoinGlass. The rally has been relentless, with minimal pullbacks or support retests since Bitcoin reclaimed its all-time highs from March.

Even though certain market experts are advocating for a pullback to restore balance, Bitcoin refuses to conform to these predictions. The significant psychological level of $100K still stands as the next notable hurdle, yet the positive sentiment among investors is growing rapidly.

Institutional Inflows and ETF Frenzy

The increasing enthusiasm towards Bitcoin is fueled partly by institutional interest. As per Glassnode’s “The Week Onchain” report, Bitcoin exchange-traded funds (ETFs) have taken up around 90% of the selling pressure from long-term investors (LTHs). This pattern suggests that ETFs are playing a crucial role in market stability, as even long-term investors start to cash out their profits.

In recent times, investments into Exchange-Traded Funds (ETFs) have significantly increased, marking a record high for U.S.-based Bitcoin ETFs. These funds collectively manage over $100 billion in assets, indicating growing faith among institutions about Bitcoin’s potential future growth.

As the end of 2024 approaches, there’s much anticipation about Bitcoin’s next step. Could it surpass $100,000, as suggested by many prediction markets? Given the surge in institutional investments and overwhelmingly positive market sentiments, Bitcoin could be poised to establish new record highs.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-11-24 12:56