As a seasoned crypto investor with a knack for spotting trends and navigating regulatory challenges, I find Kraken’s plans to list 19 tokens and integrate three blockchains an intriguing development. The inclusion of popular meme coins adds a dash of fun and unpredictability to the market, while the integration of established networks like Binance Smart Chain, dYdX, and Arweave could open up new avenues for growth.

As an analyst, I’m excited to share that I’ve learned about Kraken’s latest announcement. This prominent cryptocurrency exchange intends to add 19 fresh tokens to its platform, including several well-known meme coins. Additionally, they aim to incorporate three extra blockchains into their system.

This advancement has ignited optimism throughout the cryptocurrency sector, as many believe that the incoming Trump administration may foster a more welcoming atmosphere for token listings.

Kraken Plans to List 19 Tokens and Integrate 3 Blockchains

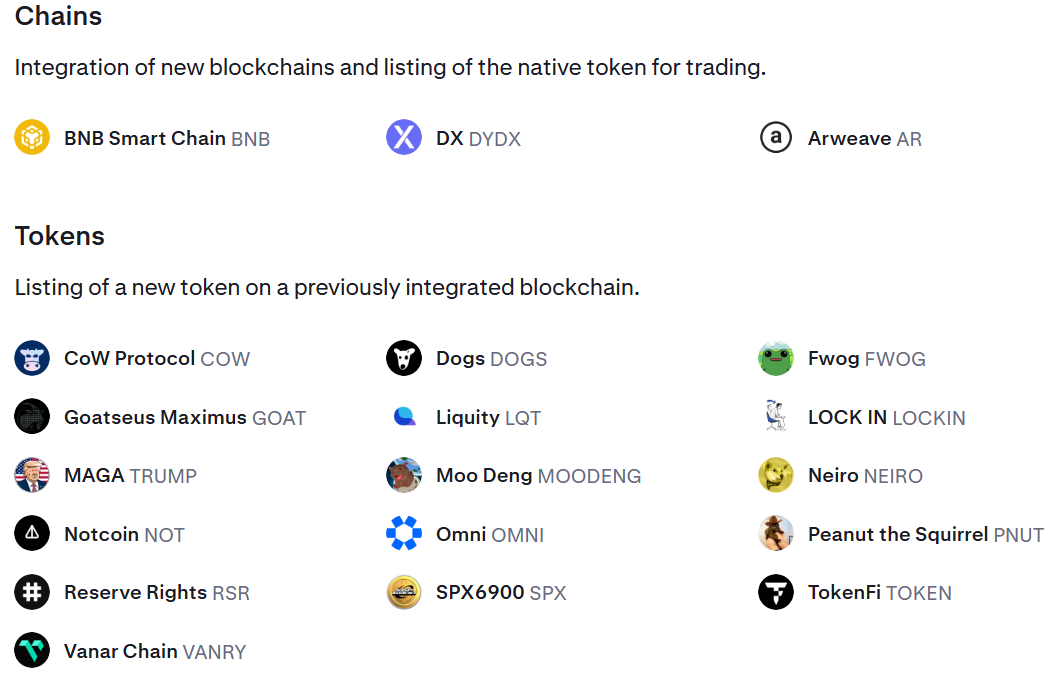

Based on their newly released plan for tradable assets, Kraken intends to incorporate the Binance Smart Chain, dYdX, and Arweave blockchains onto their platform. Each integration will encompass the native tokens of these respective systems.

“Kraken lists BNB,” Binance founder Changpeng Zhao stated.

Apart from the initial three, Kraken intends to include 16 more tokens, predominantly meme coins, in their listing. Notable inclusions among these are FWOG, TRUMP, NEIRO, DOGS, GOAT, PNUT, MOODENG, and COW, along with eight other tokens. These tokens come from blockchains that are already part of Kraken’s infrastructure.

Nevertheless, it was made clear that the token listings aren’t automatic. Trading and funding for these tokens will commence post the official declaration via Kraken Pro’s official account on platform X. It is important to note that depositing tokens ahead of schedule might lead to potential losses.

Kraken’s proposed growth of their token offerings coincides with the platform facing legal hurdles. The United States Securities and Exchange Commission (SEC) has leveled charges against Kraken, claiming they are running an unregistered securities exchange and providing staking services in contravention of federal regulations. Nevertheless, Kraken has been vigorously countering these accusations.

Although facing regulatory challenges, crypto enthusiasts are hopeful that the incoming government will ease restrictions on token listings. Many anticipate President-elect Trump’s positive stance towards cryptocurrency could foster a more welcoming regulatory atmosphere. Predictions suggest a clear regulatory structure, the possibility of a Bitcoin reserve, and a shift away from the SEC’s enforcement-based regulation approach.

Currently, significant American stock exchanges are taking advantage of increasing market enthusiasm to broaden their offerings of cryptocurrency tokens. Notably, Coinbase has added PEPE and FLOKI to its platform, capitalizing on the prevailing meme coin craze.

In a similar fashion, Robinhood broadened its services by incorporating assets such as XRP, Cardano, and Solana, which were previously classified as securities by the SEC. This strategy indicates a widespread initiative among trading platforms to seize market trends and address a variety of investor preferences.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-11-24 00:04