As a seasoned market analyst with over two decades of trading experience under my belt, I’ve seen more than a few market cycles come and go. The current situation with Bitcoin miners selling their holdings is not entirely unexpected given the market conditions. However, it’s important to remember that every bearish trend in a bull market is just an opportunity for smart investors to buy at lower prices.

In recent weeks, Bitcoin miners have been selling off their holdings, as the value of the coin remains below the crucial $100,000 threshold. At the moment of writing, the primary cryptocurrency is being traded at $98,535, representing a 1% drop from its recent peak of $99,860 reached during the Friday trading session.

In the world of cryptocurrency, as Bitcoin’s market starts moving laterally, I find myself contemplating the potential move by miners to disperse their BTC holdings. This could be a strategic decision aimed at capitalizing on profits or mitigating the increasing expenses associated with mining.

Bitcoin Miners Sell Their Holdings

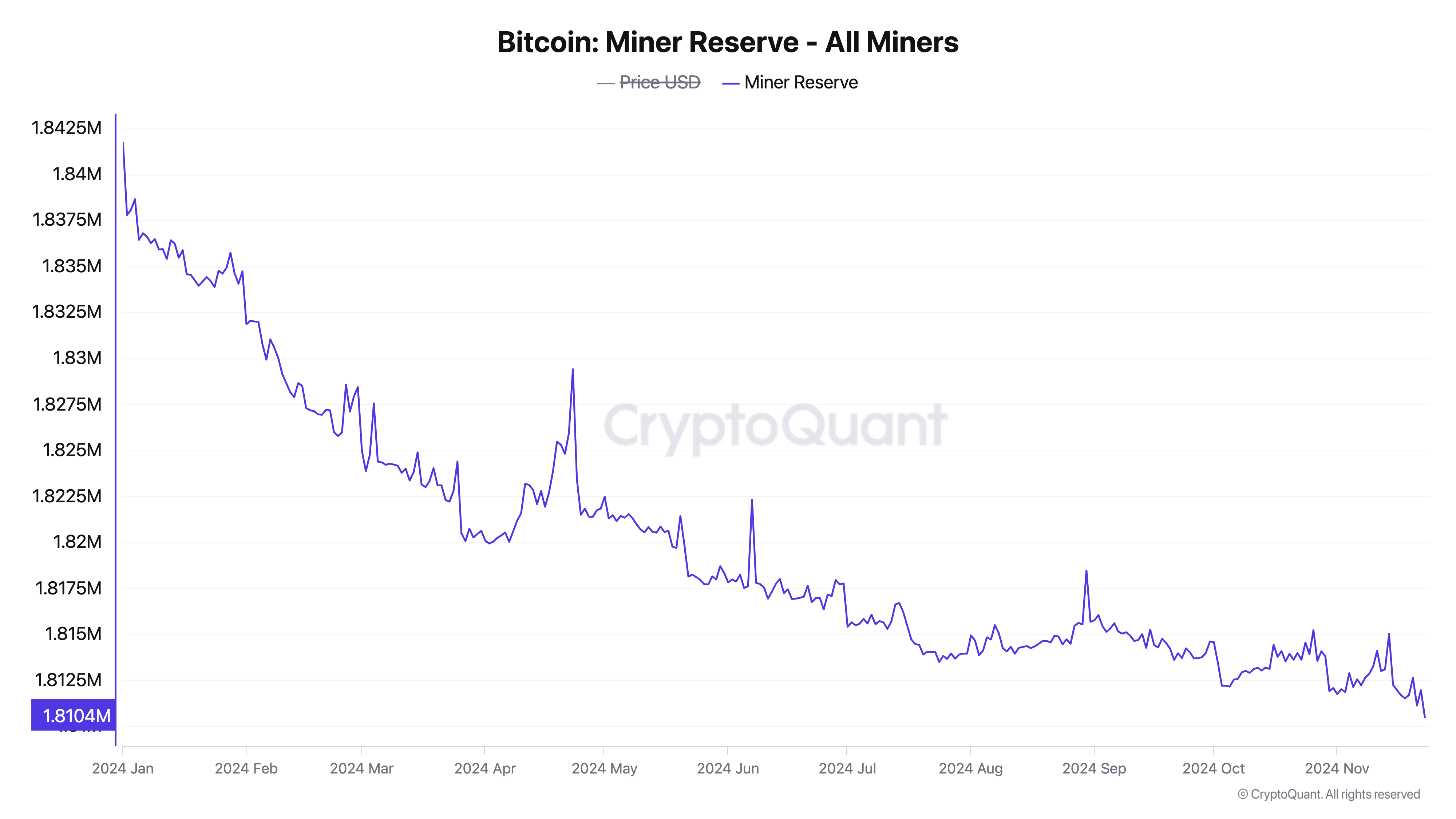

Based on information from CryptoQuant, the amount of Bitcoin held by miners has dropped to a minimum this year and is currently approximately 1.81 million Bitcoins.

This measure keeps tabs on the count of Bitcoins stored in miners’ digital wallets, which signifies the amount they have not yet decided to sell. A decrease in the BTC miner reserve suggests that Bitcoin miners are transferring their coins either for realizing profits or to cover mining expenses.

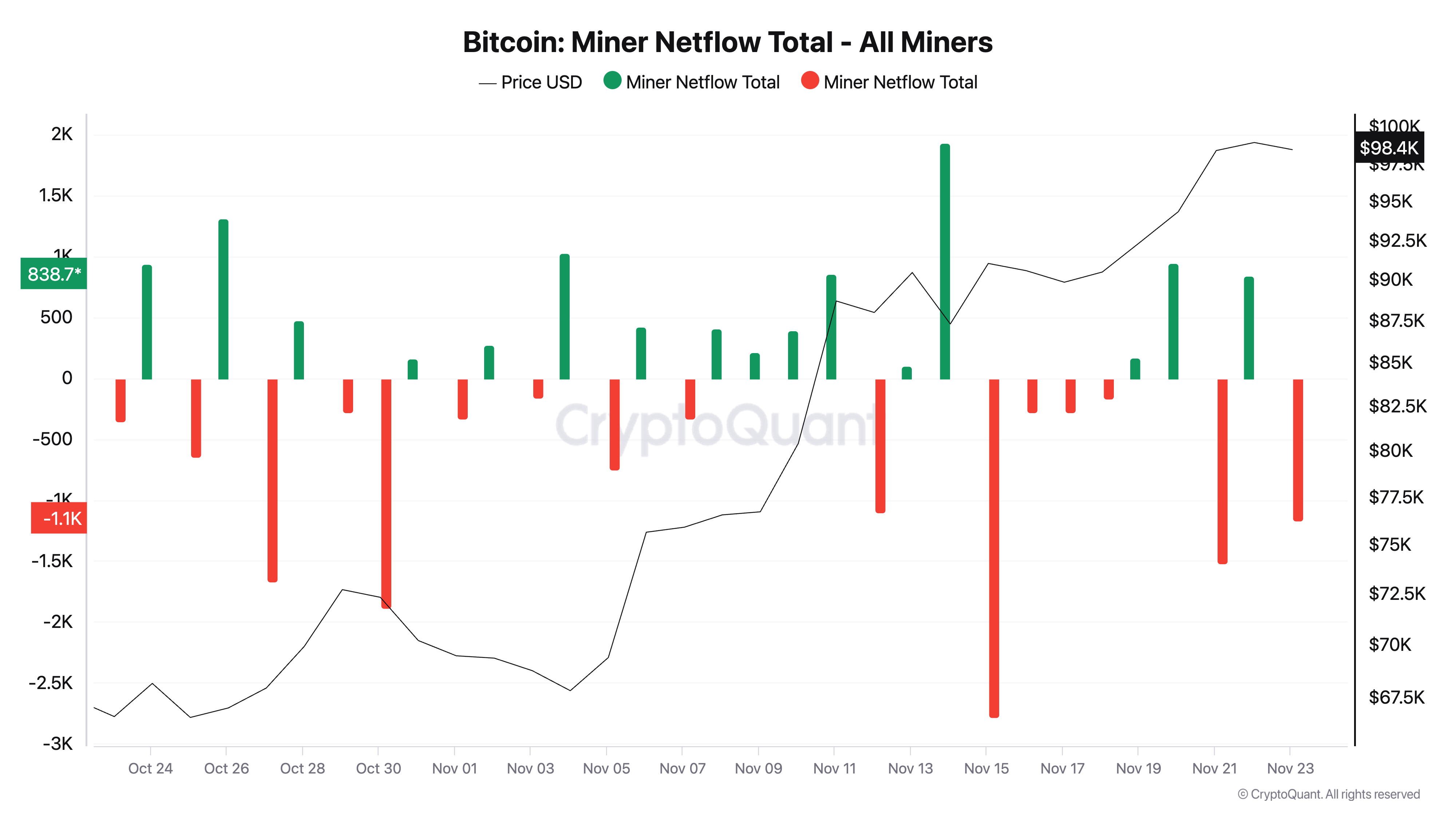

Furthermore, data from Bitcoin mining networks indicates a pattern of daily coin sales by these miners. At present, the metric stands at approximately -1,172 BTC, indicating net sell-offs.

The term “Miner Netflow” refers to the difference between Bitcoin that miners are acquiring versus Bitcoin they’re selling. It’s calculated by deducting the quantity of Bitcoin they sell from the amount they buy. When this figure is negative, it signifies that miners are offloading more coins than they’re buying. This situation is typically a bearish signal and can foreshadow a brief period of declining prices for the coin.

BTC Price Prediction: The Bulls Remain in Control

As a crypto investor, I’ve noticed that miners have been contributing to the selling pressure of Bitcoin over the past few weeks. However, the overall bullish sentiment towards Bitcoin, often referred to as the king coin, remains strong. This optimism is evident in the arrangement of the dots on its Parabolic Stop and Reverse (SAR) indicator. At this moment, these dots are positioned below the current price of Bitcoin, suggesting that the trend may continue upward.

The Parabolic SAR (Stop and Reverse) strategy helps determine an investment’s upward or downward trajectory and possible turning points. When the dots fall below the asset’s price, it indicates a rising trend, which traders often interpret as a buy signal or exiting their short positions.

As I observe the current trend unfolding, it seems that Bitcoin’s price could potentially surge back towards its all-time high of $99,860 and possibly break through the psychologically significant barrier of $100,000. However, a sudden increase in profit-taking activities might change this optimistic forecast. If selling pressure intensifies, Bitcoin’s price might dip to around $88,986.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-23 22:35