As a seasoned researcher with years of experience navigating the complexities of financial markets, I find myself both intrigued and cautious when it comes to the meteoric rise of MicroStrategy-linked leveraged ETFs. The story of Matt Tuttle’s MSTU ETF is a testament to the allure of quick profits and the risks that come with it.

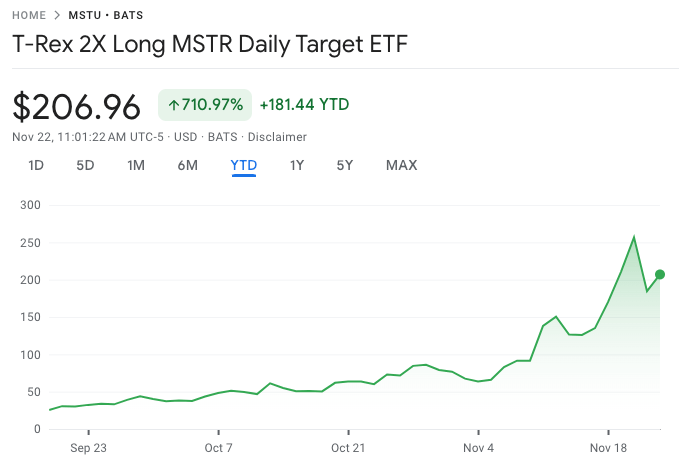

As a crypto investor, I’ve been closely watching the remarkable surge of MicroStrategy Inc. lately, which has shone a bright light on their leveraged ETFs. This attention has stirred excitement among investors and operational hurdles for fund managers, as detailed in a report by Vildana Hajric for Bloomberg News. The T-Rex 2X Long MSTR Daily Target ETF (MSTU), introduced by Matt Tuttle, has run into capacity limitations from its prime brokers because of the volatile nature of MicroStrategy’s stock, tightly linked to Bitcoin. At launch, MSTU swiftly gained popularity, becoming one of the most volatile ETFs ever launched on Wall Street.

The ETF, designed to deliver double the daily returns of MicroStrategy shares, saw surging demand as the stock skyrocketed. However, prime brokers—specialized bank units facilitating securities lending and other activities—soon reached their risk thresholds, limiting the amount of swap exposure they were willing to extend to the fund. At one point, Tuttle needed $100 million in exposure to meet investor demand but was only able to secure $20 million through swaps. To maintain the ETF’s leverage mandate, Tuttle turned to call options as an alternative strategy.

In a parallel development, Defiance ETFs introduced their Defiance Daily Target 2X Long MSTR ETF (MSTX) in August. Not long after its introduction, the company started employing options as part of their leveraged strategy, initially offering 1.75 times leverage. After Tuttle’s MSTU entered the market, they amplified this to a 2x leverage.

On November 22nd, 2024, MicroStrategy’s stock recovered, a day after Citron Research declared a short position that triggered a significant 22% fall the previous day. This recovery might be due to several factors, such as investors feeling the price drop was excessive and Bitcoin’s subsequent surge, which significantly impacts MicroStrategy’s worth. Traders may have also seen this dip as an opportunity to buy, anticipating a resurgence given the increased market interest in cryptocurrencies following Donald Trump’s pro-crypto statements and Bitcoin reaching new record highs.

As an analyst, I’ve observed that the volatility in MicroStrategy shares has been pushing the boundaries of Wall Street’s ability to handle these high-energy ETFs. Principal brokers involved in swaps for these ETFs, such as Cantor Fitzgerald, Marex, and Clear Street, have found themselves confronted with escalating margin requirements due to the risks tied to the underlying stock. Market-makers have expressed concerns that the swift expansion of these funds is challenging the risk threshold of broker desks, particularly considering the funds’ substantial margin demands.

Since 2022, single-stock leveraged ETFs, which have sparked interest among U.S. investors, have drawn attention from regulators due to their underlying risks. These financial instruments, frequently sought by retail investors aiming for rapid returns, present considerable difficulties for issuers. The management of these funds necessitates constant vigilance over derivatives like options, in order to preserve the desired leverage amidst changing stock prices. For Tuttle, this task now takes up a substantial chunk of his daily work.

Boasting a combined value of approximately $4 billion, MSTU and MSTX have generated remarkable returns since their debut – MSTU has soared by more than 710%, and MSTX has risen by 543%. Yet, the rapid expansion of these funds prompts concerns about their longevity and potential impact on financial markets. Some finance professionals suggest that the prosperity of these ETFs could indicate the market’s capacity limits, as they intensify a stock’s fluctuations beyond its inherent fundamental values.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-22 19:42