As a seasoned analyst with over two decades of experience navigating the dynamic world of finance, I find Schwab’s move into the spot crypto ETF market both intriguing and strategic. Having witnessed the rise and fall of numerous financial trends, I can confidently say that this is not just another fad but a shift in the tides of the financial landscape.

The large-scale financial institution, Charles Schwab, which manages more than $9.9 trillion, is planning to explore the exchange-traded fund (ETF) market that focuses on cryptocurrencies.

The planned move depends on gaining clarity from U.S. regulators, as stated by the incoming CEO Rick Wurster in a recent interview with Bloomberg Radio. He indicated that he anticipates possible regulatory shifts under President-elect Donald Trump’s administration could be beneficial for their business.

Charles Schwab Eyes Spot Crypto ETF Market

Schwab is actively delving into the world of cryptocurrencies via ETFs and futures. Their Crypto Thematic ETF (STCE) specifically targets companies involved in cryptocurrency mining, trading, and the development of blockchain technology.

Despite not holding digital assets directly, STCE is ready to provide direct trading signals, which signifies a notable change in direction. This move underscores the increasing need for traditional financial institutions like Wall Street to cater to the rising demand for cryptocurrency products among both retail and institutional investors.

“We will get into spot crypto when the regulatory environment changes,” Wurster said.

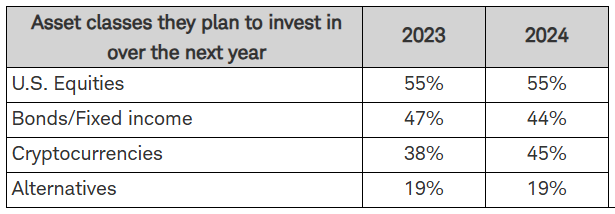

1) The statement echoes Schwab’s cautiously optimistic stance. Their October internal polling showed a robust client curiosity towards crypto-based ETFs. Interestingly, about 45% of respondents expressed their intention to invest in such products within the next year. This survey piqued the interest of industry veterans Eric Balchunas and Nate Geraci, who specialize in the ETF sector.

Trump Administration’s Pro-Crypto Agenda

The eager anticipation for regulatory clarity is rooted in the campaign promises made by Trump, particularly those concerning the creation of a Bitcoin reserve, protection of cryptocurrency mining, and favorable policies within the industry. A notable aspect of Trump’s cryptocurrency-centric platform was his intention to dismiss SEC Chair Gary Gensler.

On Thursday, Gensler unexpectedly declared that he would step down from his position by January 20th, 2025. In his final address, he articulated his accomplishments during his tenure and admitted that the regulation of cryptocurrency is still evolving. He emphasized that altering the SEC’s stance on digital assets will be essential to preserve investor confidence.

With Donald Trump at the helm, it’s anticipated that there will be a substantial change in the regulatory landscape within the United States. Trump’s strategies are geared towards aligning the nation with prominent cryptocurrency hubs globally, encouraging innovation, and tackling issues of security and compliance. The experts believe these adjustments could draw in institutional players such as Schwab, thereby positioning the US as a pioneer in the cryptocurrency market.

Wurster showed enthusiasm towards these advancements, pointing out that clear regulations would allow Schwab to introduce a wider variety of cryptocurrency services. Despite not personally investing in crypto, he acknowledged its attractiveness as a market.

The world of cryptocurrency has undeniably garnered much interest, with many people making significant profits from it. However, I myself have not invested in crypto, and now I find myself feeling a bit foolish about it.

As an analyst, I’ve noticed the growing momentum towards launching spot cryptocurrency offerings, and it seems this trend is catching the eye of external parties as well. In fact, VanEck’s head of digital assets research, Matthew Sigel, recently disclosed that a crypto asset manager has expressed interest in partnering with Charles Schwab – a clear indication of the industry’s desire to join forces with established financial titans like Schwab.

“Hearing a certain crypto asset manager went into Schwab today pitching a partnership,” Sigel said.

This interest aligns with the broader trend of traditional finance (TradFi) embracing crypto. Schwab’s entry into the spot market would represent a milestone for the firm and for the mainstream adoption of digital assets.

Although Schwab is experiencing progress, it encounters difficulties, one of which is navigating a highly competitive cryptocurrency marketplace. For instance, platforms such as Robinhood have garnered substantial popularity among individual investors due to their user-friendly crypto trading services. For Schwab to stand out, its unique offerings and the trust it has earned over many years will be crucial.

As a researcher delving into the world of cryptocurrencies, I must acknowledge the persistent uncertainty regarding regulations. Despite President Trump’s administration’s assurance of a more favorable climate, the complexities of cryptocurrency regulation in the United States remain shrouded, potentially requiring time to clarify. Schwab’s prudent strategy underscores an awareness of these challenges, positioning its entry into the crypto market in such a way that it aligns with the long-term interests of its clients.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-11-22 15:08