As a seasoned researcher with over two decades of experience in the financial sector, I have witnessed countless transformative moments that have shaped the global economy. The ongoing debate surrounding Microsoft’s potential investment in Bitcoin is one such moment that has piqued my interest.

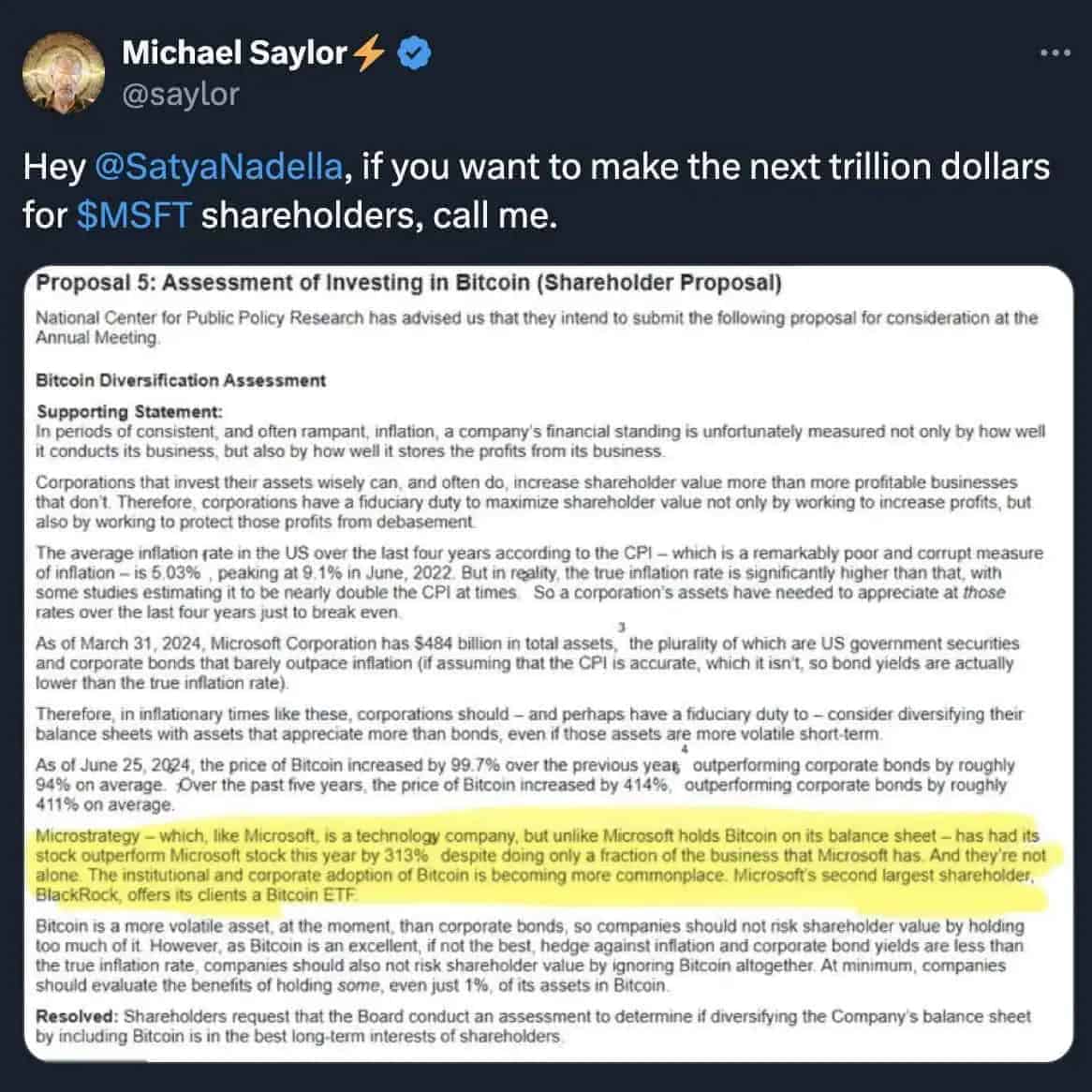

In a recent X Spaces discussion hosted by VanEck, Saylor revealed he would have just three minutes to make his case for why the tech giant should add Bitcoin to its balance sheet.

The Pitch

In a forthcoming discussion, Saylor plans to emphasize how integrating Bitcoin could potentially transform Microsoft into a “more secure and less volatile investment.” Despite an initial effort to privately consult with Microsoft CEO Satya Nadella regarding this idea, Saylor’s proposition will now be directly presented to the board.

In response to the activist who handed over the proposal, Saylor mentioned they requested him to speak on its behalf, which he consented to. He will deliver a three-minute speech – the maximum allowed – to the board of directors as stated.

The plan mirrors a resolution put forth by the National Center for Public Policy Research (NCPPR) that shareholders will vote on in December. This resolution asks Microsoft to evaluate the possible advantages of purchasing Bitcoin, using MicroStrategy’s Bitcoin approach as a point of reference.

Of course, Microsoft’s board has already recommended shareholders vote against the proposal, playing the card that they already keep a close eye on “a wide range of investable assets.” But does that stance hold water? Sure, Microsoft may track assets, but what’s the point if they remain perpetually on the sidelines while other companies dive in and reap the rewards? Just look at MicroStrategy. With an aggressive Bitcoin investment strategy, the business intelligence firm has outperformed Microsoft by over 300% this year. And remember, this is a company operating with a fraction of Microsoft’s resources, workforce, and market power.

Outperforming Microsoft

The NCPPR’s proposition emphasizes the exceptional achievement of MicroStrategy in 2023. Surprisingly, even though it is a much smaller company compared to Microsoft, MicroStrategy’s stock has surpassed Microsoft’s by more than 300% this year mainly because of its bold Bitcoin investment strategy.

Saylor, in his advocacy, consistently champions Bitcoin as an effective method for corporations to maintain shareholder value, particularly those with substantial cash holdings. He proposes that tech giants such as Apple, Google, Facebook (Meta), and even Berkshire Hathaway might want to explore similar strategies.

Microsoft’s enterprise value is highly dependent on its quarterly earnings (98.5%), with only a small fraction (1.5%) based on its tangible assets, according to Saylor. He suggests that incorporating Bitcoin could potentially make the stock more secure and less risky by linking a portion of its value to real, tangible property.

Challenges Ahead

Despite the suggestion made, the Microsoft board advises against this particular proposal. They believe that they are already considering a wide range of investment possibilities, and Bitcoin is one of them.

Ethan Peck, deputy director at the NCPPR’s Free Enterprise Project, shared with Cointelegraph that a thorough examination of Bitcoin might put Microsoft in a delicate situation. If Microsoft conducts an assessment and chooses not to invest, they could face criticism from their shareholders.

High-Stakes Vote

The shareholder vote has been set for December 10th, and its results could impact Microsoft’s financial planning. At present, the board consists of 12 members, including CEO and chairman Satya Nadella, as well as executives from prominent companies such as Disney, Citigroup, Wells Fargo, and GSK.

For Saylor, it’s not merely about Microsoft, but rather establishing a precedent that could influence other corporations boasting significant financial reserves. He suggested that considering such a move should be on the agenda for every prominent company.

Although Microsoft’s board is expressing opposition towards the proposal, its inclusion in the December vote indicates an expanding conversation about Bitcoin’s potential impact on corporate finance. It remains to be seen whether Microsoft will adopt Bitcoin or opt to stay out, but their decision could have significant ramifications for broader institutional acceptance of digital assets.

Read More

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Solo Leveling Season 2 Release Schedule: How Many Episodes Are Left? Find Here as Ep 10 Eyes More Battles

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- COMP/USD

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Solo Leveling Season 2: Check Out The Release Date, Streaming Details, Expected Plot And More

- Will Netflix’s Building The Band Happen After Liam Payne’s Tragic Death? All We Know About Current Status Of Show

- How To Get Doctor Garrow’s Notes In Atomfall

- Gokurakugai Chapter 26: The Kidnapping Confrontation

2024-11-21 13:10