As an analyst with years of experience navigating the complex and ever-evolving digital asset landscape, I find the recent development by 21Shares highly intriguing. The introduction of Ethereum Core Staking ETP (ETHC) not only demonstrates their commitment to innovation but also underscores Europe’s progressive approach towards crypto investments.

21Shares AG has made a major improvement to their Ethereum Core Exchange-Traded Product (ETP), now including staking capabilities. As part of this update, the product has been renamed to the Ethereum Core Staking ETP to more accurately represent its enhanced functionality.

The improved product, now operating under the symbol ETHC, can be traded on major European stock exchanges such as the SIX Swiss Exchange, Deutsche Borse Xetra, and Euronext Amsterdam.

21Shares Introduces Ethereum Core Staking ETP

This action intends to simplify Ethereum staking for both large investment firms (institutions) and individual investors, spread throughout Europe. It presents an innovative method to collect returns via Ethereum’s staking system, all while keeping costs minimal.

21Shares has introduced staking for increased earning opportunities! Now, you can stake with our 21Shares Ethereum Core Staking ETP (ETHC). This product comes with a low management fee and the extra perk of staking rewards, making ETHC an even more attractive investment choice.

The Core Staking ETP tied to Ethereum (ETH) is backed physically and offers an extremely competitive management fee of only 0.21%, making it one of the lowest fees in the market. This fee structure aims to entice a wide range of investors, even those who might have shied away due to higher costs in similar investment products before.

21Shares’ CEO, Hany Rashwan, stated that incorporating staking into ETHC is our recent initiative aimed at offering the European market advanced digital asset solutions that are both innovative and current. Our objective is to make staking easier and less expensive for investors.

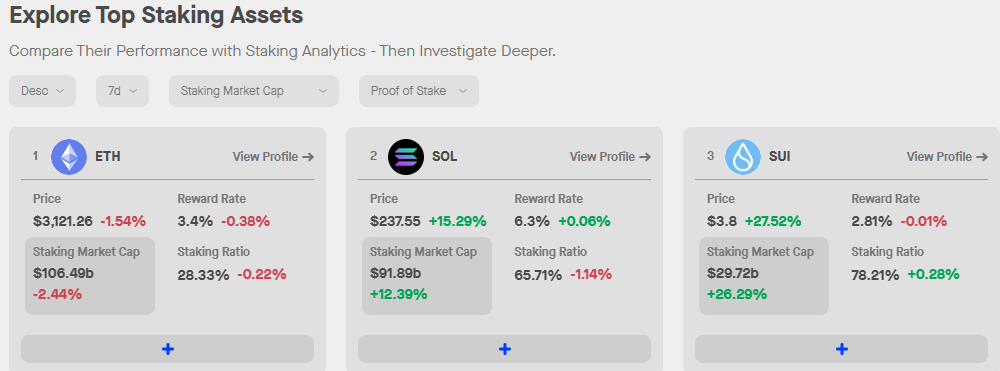

Currently, Ethereum staking returns an average of 3.4%, as indicated by data from Staking Rewards. By incorporating staking into ETHC, investors now have the opportunity to receive a continuous income while actively contributing to the Ethereum network’s Proof-of-Stake (PoS) consensus mechanism.

This evolution showcases a stark difference between Europe and the U.S., as Europe appears to be embracing yield farming or staking-based investments such as ETHC, whereas the U.S. Securities and Exchange Commission (SEC) seems to be adopting a more cautious approach.

The Securities and Exchange Commission (SEC) has repeatedly declined proposals for Ethereum ETFs that include staking rewards, expressing worries about market manipulation, inadequate regulatory supervision, and potential hazards to individual investors. This difference in regulatory stance towards cryptocurrency investments underscores the varying strategies among different geographical areas.

Europe’s Growing Presence in the Staking ETP Market

21Shares’ decision to incorporate staking capabilities into ETHC is part of their larger plan to broaden their product range and establish themselves as a dominant force in digital asset investment. This year alone, they have introduced three new Exchange Traded Products (ETPs) on both Euronext Paris and Amsterdam, increasing their European ETP portfolio to 43 products, managing over $3.3 billion in assets under management.

21Shares’ collection encompasses innovative products like the Solana Staking Exchange Traded Product (ASOL) and Injective Staking Exchange Traded Product (AINJ), demonstrating their dedication to catering to various investor preferences. Simultaneously, while this Switzerland-based company is perfecting its Ethereum staking offerings, other competitors are also gaining traction in the market.

Lately, a US fund manager named Bitwise introduced globally the first Exchange Traded Product (ETP) for Aptos staking, denoted as APTB on the SIX Swiss Exchange. Offering around 4.7% staking returns, this product streamlines the staking procedure by automatically accruing rewards within the ETP itself, ensuring a smooth and hassle-free investment journey.

Bitwise’s endeavors fall under their comprehensive Total Return portfolio, a collection that encompasses an Ethereum Staking Exchange Traded Product (ETP) launched recently. Additionally, the company has broadened its horizons by purchasing both the ETC Group and a non-custodial Ether staking provider known as Attestant.

The rapid development of staking-based financial products highlights the growing demand for accessible, secure, and efficient ways to participate in blockchain networks. With both 21Shares and Bitwise scaling their presence in Europe, the competition to dominate the staking ETP market is intensifying.

According to Tom Wan, a researcher in the field of blockchain data, it seems that when it comes to Ethereum (ETH) stakers looking for ways to keep their assets liquid while still earning rewards, the initial providers for these services may well be institutional staking pools and centralized exchanges (CEXs).

For investors, this presents an opportunity to benefit from the income potential of staking and gain exposure to novel blockchain technology. By making Ethereum staking easier and more cost-effective, the Ethereum Core Staking ETP and similar products are likely to appeal to a growing segment of the investment community.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-20 15:28