As a seasoned researcher with a penchant for deciphering market trends, I find myself intrigued by this recent Bitcoin surge. Having navigated through the tumultuous waters of the crypto market since its inception, I’ve seen the ebb and flow of its fortunes, much like the tide that shapes the coastline of my hometown.

This spike was primarily fueled by Bitcoin‘s price rise exceeding the expansion in mining difficulty, along with a rise in transaction fees relative to block rewards.

Between October 31st and November 15th, the market value of mining stocks monitored by JPMorgan surged approximately $8 billion, or 33%. This significant increase can be attributed to Bitcoin’s rising worth and a general optimism in the cryptocurrency sector following the U.S. presidential election.

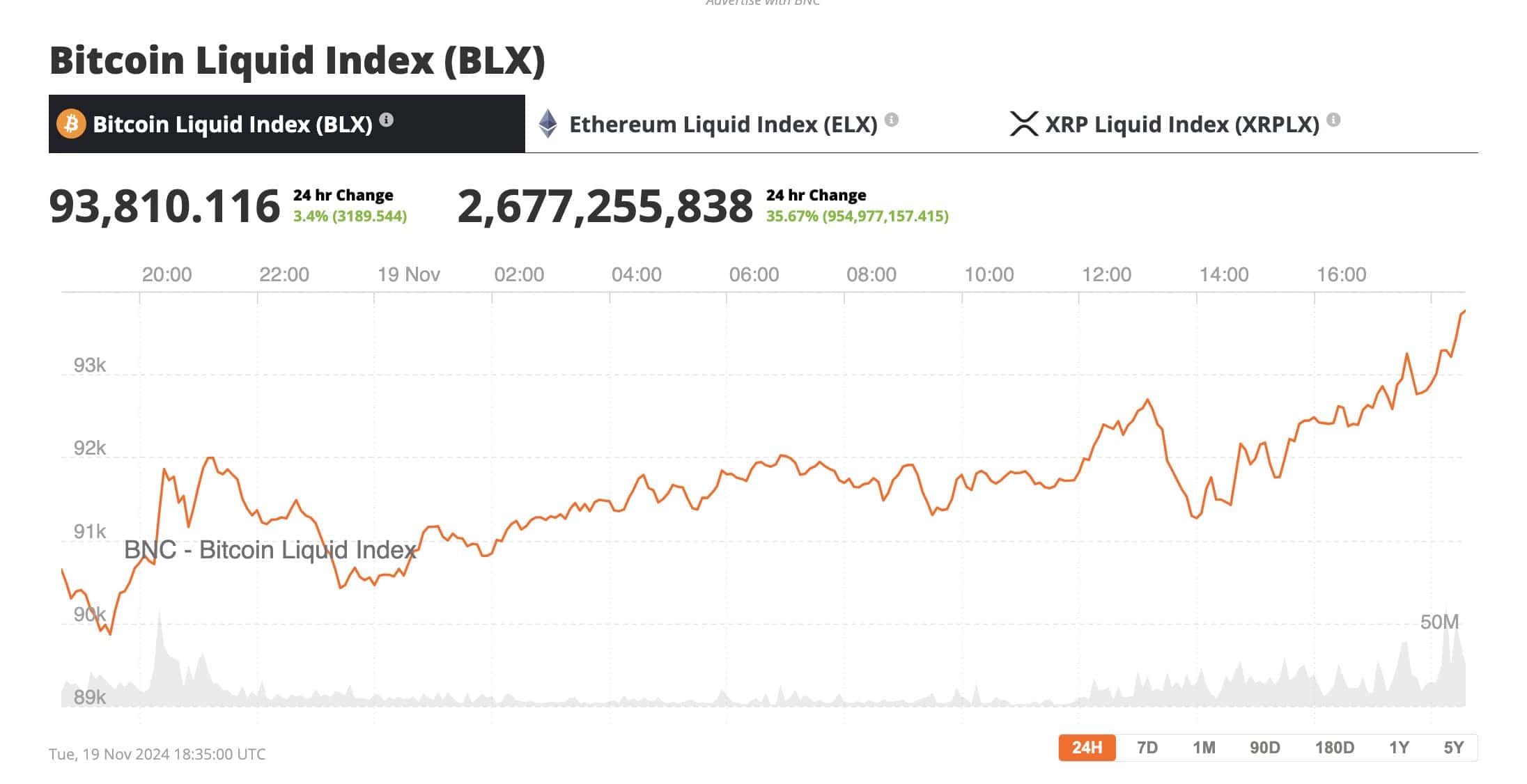

New Bitcoin All-time High

Bitcoin’s price soared approximately 30% to hit record highs following Donald Trump’s victory in the U.S. presidential election this month. At the same time, the network hash rate, which represents the total computational power employed for mining and transaction processing, increased by 2% over the past month, averaging 718 exahashes per second (EH/s). This figure functions as a stand-in for competition and mining difficulty within the Bitcoin industry.

Significantly, the fourteen U.S.-based miners analyzed in JPMorgan’s report currently account for around 28% of the total worldwide mining network’s computational power, keeping their dominance at peak levels.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-11-20 14:20