As a seasoned analyst with over two decades of experience in the financial markets under my belt, I’ve seen many a bull and bear run their course. The recent surge of Ripple (XRP) to $1 after three long years is indeed an exciting development. However, the subsequent drop in volume and social dominance has me raising an eyebrow or two.

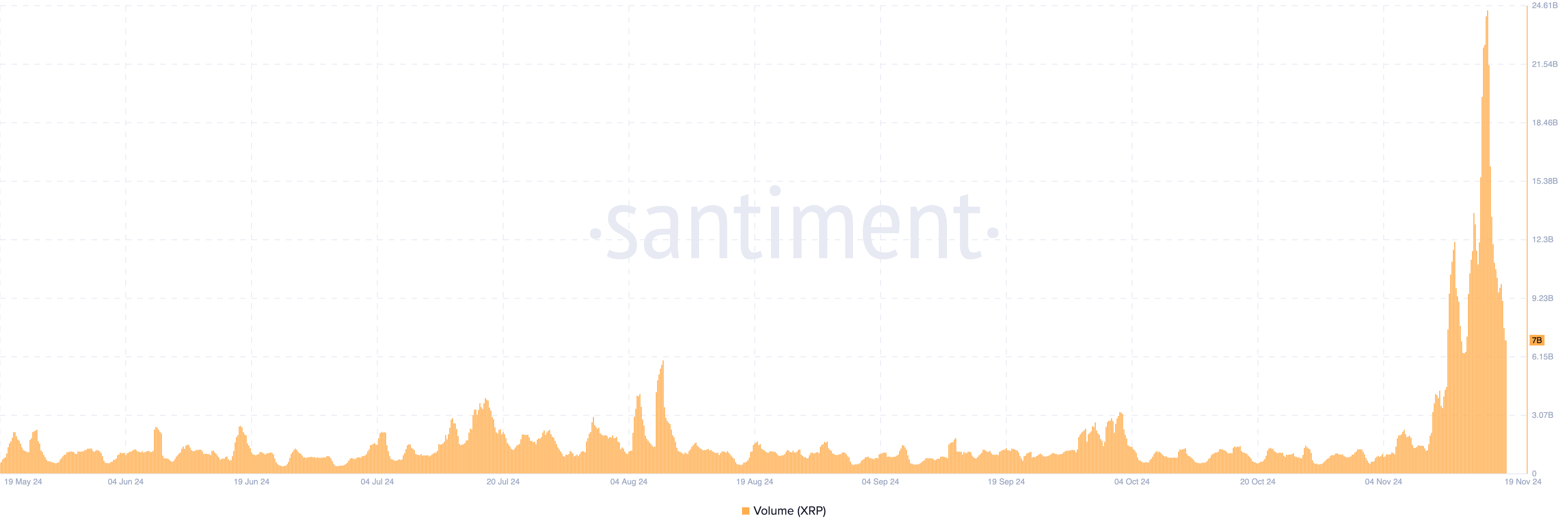

On November 17th Sunday, the value of Ripple‘s token (XRP) reached a price point of one dollar for the first time in three years. This significant milestone was accompanied by an increase in XRP trading volume up to $24 billion. However, at this moment, that value has subsequently decreased.

This drop suggests that enthusiasm for the altcoin has waned compared to its previous levels. However, it’s worth considering what impact this might have on XRP’s pricing.

Market Attention to Ripple Drops

As reported by Santiment, the trading volume of XRP reached an impressive high of $24.40 billion, however, it has seen a substantial drop since then, now standing at around $7 billion. This represents a decline of approximately $17 billion in overall buying and selling activity.

Technically speaking, a situation where the price goes up alongside an increase in trading volume often indicates a robust and enduring upward trend. Conversely, if the price increases but the trading volume decreases, this points to weakening momentum and possibly a forthcoming shift in direction.

It seems that the decrease in trading activity for XRP mirrors a reduced interest from the market. If this pattern continues, it might be challenging for XRP’s price to sustain its rising trend and could potentially dip below the $1 level in the near future.

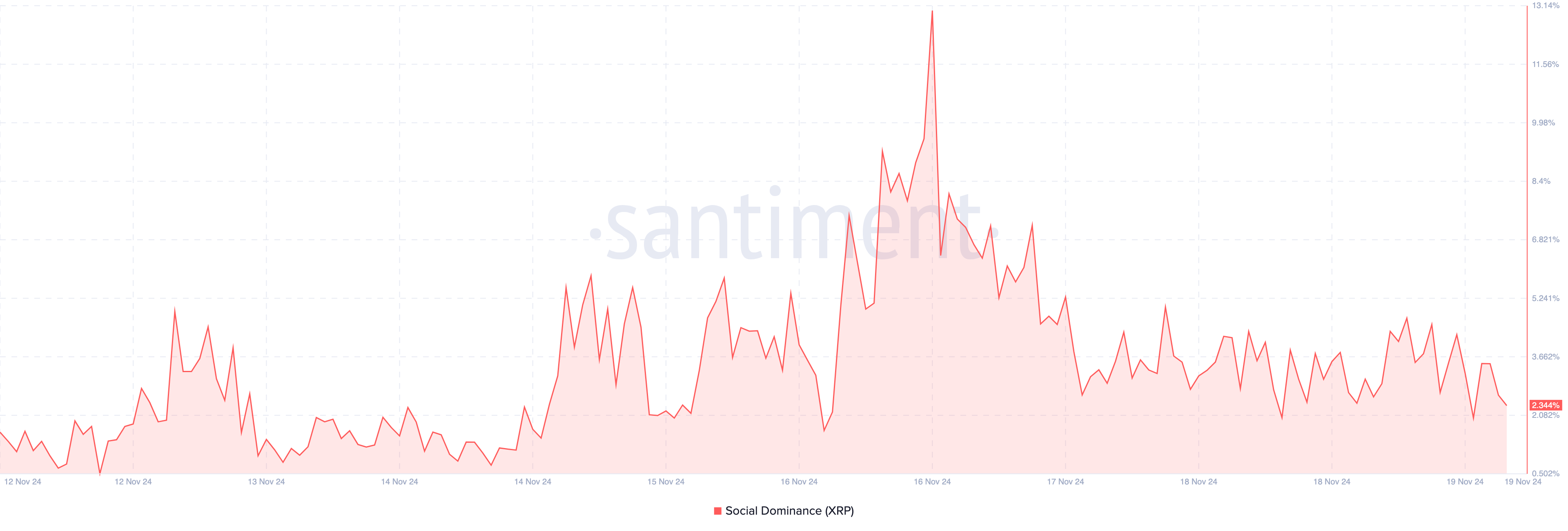

To provide additional insight, examining social dominance reveals a decrease in reading (or engagement) levels. Social dominance is determined by assessing the proportion of conversations revolving around a particular cryptocurrency relative to all discussions on various cryptocurrency-related forums. This measurement indicates the level of interest an asset is generating within the wider crypto community.

As social dominance rises, it frequently reflects growing excitement or buzz about the asset. On the other hand, a drop in social dominance might be a sign that the asset is becoming less popular or significant within the market.

Recently, the influence of XRP in social media conversations was nearly 13%, but now it’s down to 2.34%. This suggests a decrease in enthusiasm for the token. If this trend continues along with a decline in XRP trading activity, its price could potentially fall.

XRP Price Prediction: Sub-$1 Possible

According to the day’s graph, there was a noticeable increase in demand for XRP earlier on. This rise was signaled by the Money Flow Index (MFI), a tool that quantifies the amount of money flowing into the cryptocurrency.

Currently, the MFI value (Money Flow Index) has fallen since its previous high. This reduction suggests that the demand for buying isn’t as intense as it was a few days ago. If this trend persists and the MFI reading keeps falling, there’s a possibility that XRP’s price might dip to around $0.80.

If XRP’s trading volume surges back into the double-digits, there might be a shift in this trend. In such a case, the value of XRP could potentially reach $1.26.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-11-19 22:08