As a seasoned researcher with a keen interest in the evolving financial landscape, I find the recent surge in investments towards Bitcoin Exchange-Traded Funds (ETFs) particularly intriguing. The rapid influx of funds into BlackRock’s iShares Bitcoin Trust (IBIT), totaling over $3 billion in just five days, is a testament to the growing confidence in digital assets among institutional investors.

In the last five days, the Bitcoin exchange-traded fund (ETF) provided by the global leader in asset management, BlackRock, known as the iShares Bitcoin Trust (IBIT), has attracted more than $3 billion in investments.

Based on figures from Farside Investors, BlackRock’s fund received approximately $1.119 billion in investments on November 7, which increased to over $206 million the next day. At the beginning of this week, the fund experienced inflows of about $756.5 million, followed by an additional $778.3 million on November 12. On November 13, IBIT recorded inflows amounting to $230.8 million.

In summary, the fund experienced inflows exceeding $3 billion during a period when cryptocurrency values were significantly increasing. Over the last week, Bitcoin’s price climbed by 21.1%, reaching $90,700, slightly lower than its previous all-time high of approximately $93,000.

According to CryptoGlobe’s report, U.S.-based Bitcoin Spot ETFs have reached an asset value exceeding $90 billion following a daily increase of approximately $6 billion. This means they are currently about one-third short of surpassing the assets held by gold ETFs.

According to Eric Balchunas, senior analyst at Bloomberg ETF, he noted on the social media platform X (previously known as Twitter) that the surge of $6 billion in spot Bitcoin ETFs within a day was due to $1 billion in inflows and $5 billion in market appreciation, which coincided with a substantial increase in Bitcoin’s price.

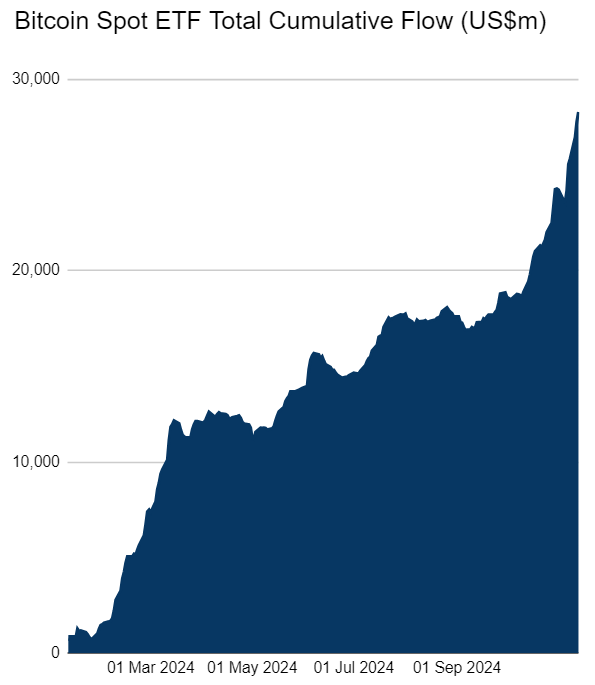

According to Farside Investors’ data, spot Bitcoin ETFs’ total cumulative flow is at $28.3 billion.

It’s worth noting that there has been a substantial increase in investments in cryptocurrency products, with a total of $1.98 billion flowing in during the week following Donald Trump’s victory in the U.S. Presidential elections.

Based on the latest report from CoinShare’s Digital Asset Fund Flows, a surge in inflows during the cryptocurrency market rally has boosted the total value of assets managed by crypto investment products to an all-time high of $116 billion.

Over the last seven days, investments in products centered around Bitcoin totaled approximately $1.79 billion, whereas those focusing on Ethereum recorded an inflow of about $157 million.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-14 18:39