As a seasoned analyst with over two decades of experience in tech and finance industries, I find Genius Group’s bold move to convert its treasury reserves into Bitcoin quite intriguing. Having witnessed the rise and fall of numerous companies, I must admit that this strategic pivot seems risky yet potentially rewarding.

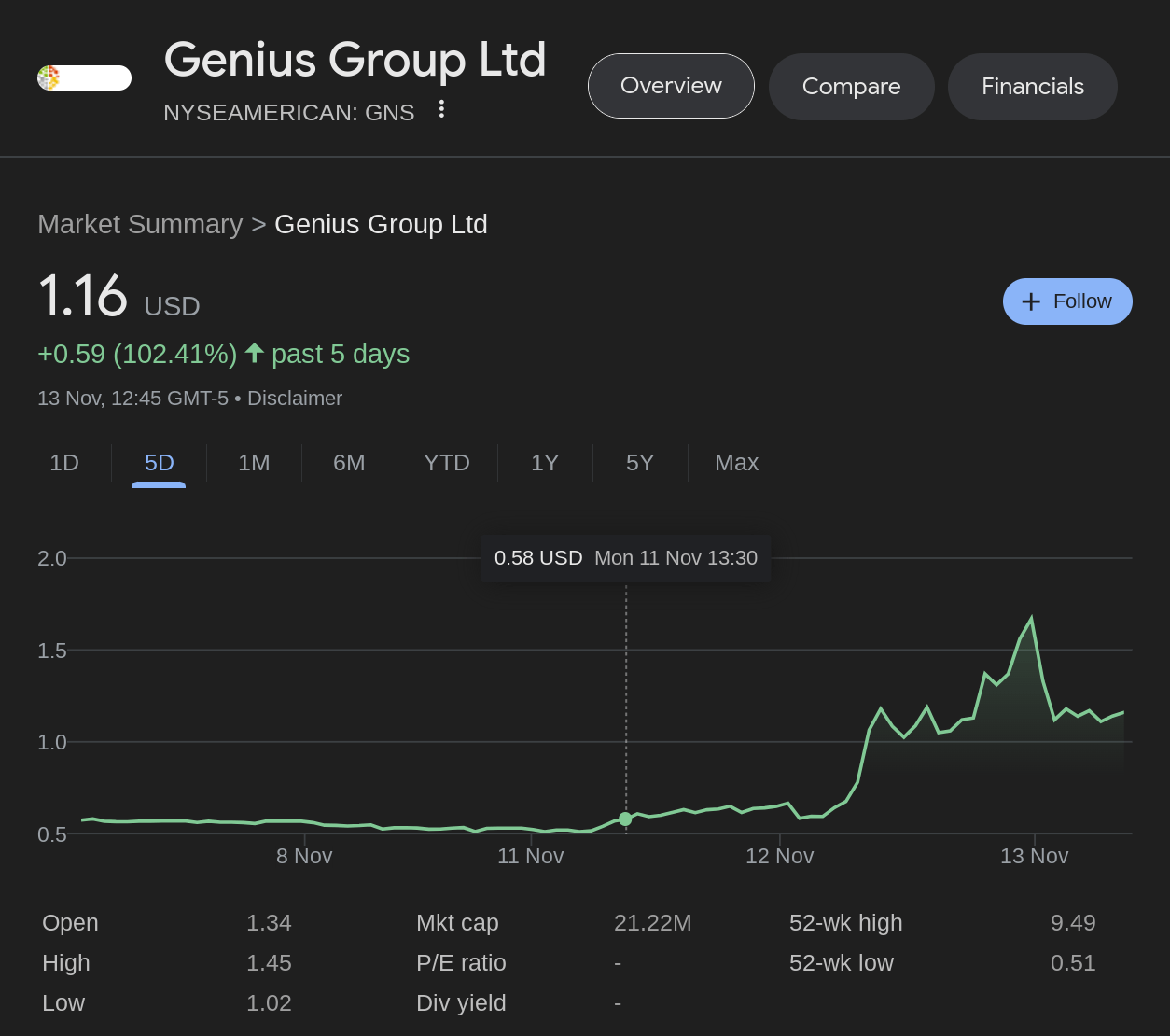

On Tuesday, the stock price for Genius Group, a company specializing in AI-driven education, skyrocketed by over 100% following their announcement to transform 90% of their cash holdings into Bitcoin. This struggling stock, which has plummeted by more than 98% since its initial trading, went from $0.58 to $1.16, increasing its total market value to a staggering $21.22 million.

The U.S.-listed company on the NYSE American wants to employ its $150 million at-the-market (ATM) program to potentially invest up to $120 million in Bitcoin as their main reserve asset. But this ambitious goal encounters a substantial regulatory obstacle: In order to fully utilize the facility, the company must first reach a market capitalization of $75 million, which is more than three times its current value.

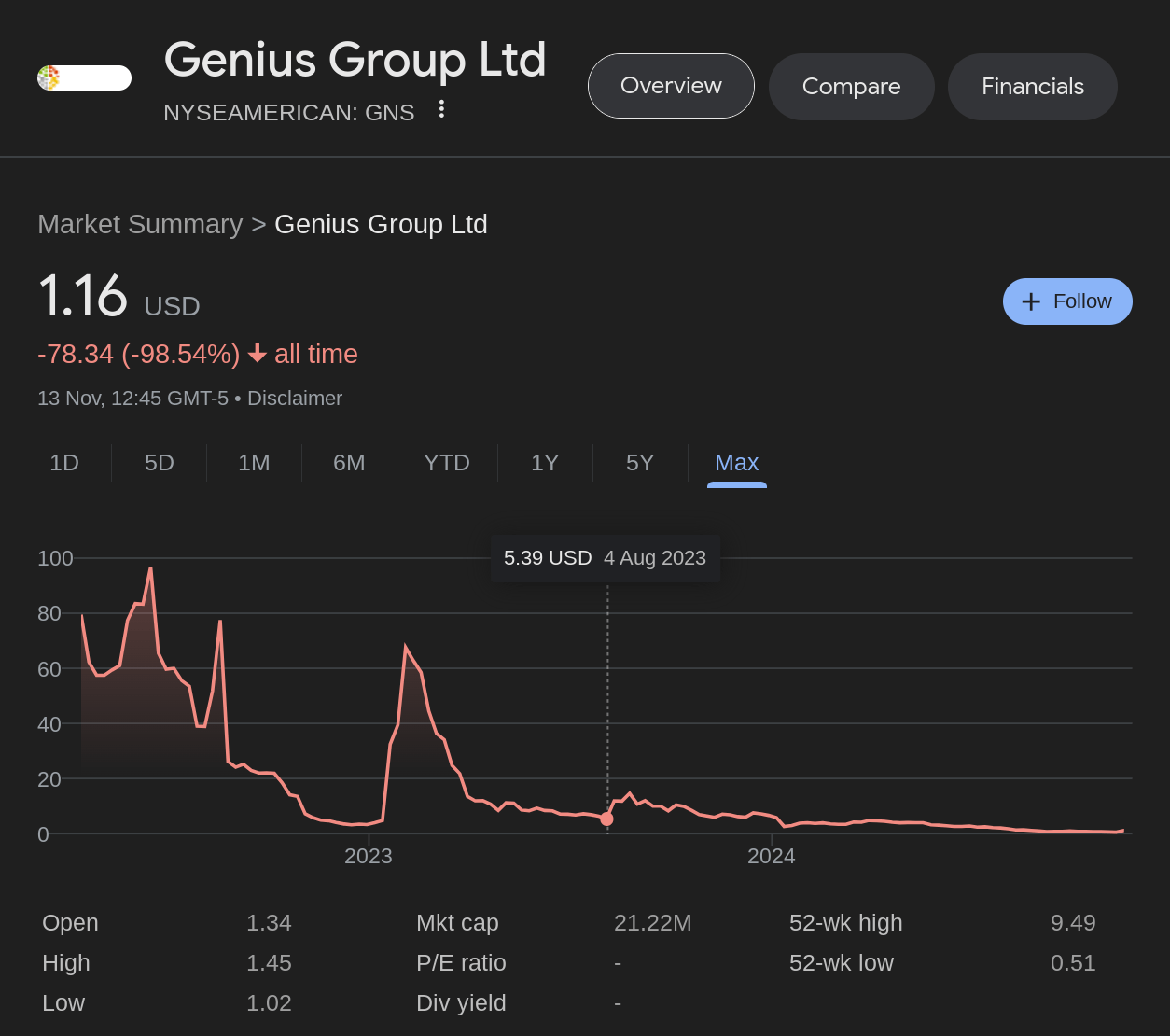

The announcement signifies a significant shift for Genius Group, whose shares have plummeted from initial prices close to $100 each, to a 52-week low of $0.51. While the company reported an audited revenue of $23 million in 2023 and holds total assets worth $43 million, its market value has found it challenging to rebound from its downturn.

To align with its fresh strategic focus, Genius Group has reshaped its board by adding seasoned professionals in blockchain technology. Thomas Power, a previous board member at Team Blockchain and the Blockchain Industry Compliance and Regulation Association, as well as Ian Putter, former head of the blockchain sector at Standard Bank and founder of the African Blockchain Research Institute, have been brought on to guide this transformation process.

The educational platform specialized in artificial intelligence is planning to accept Bitcoin as a global payment method for its EdTech platform. Moreover, they are set to introduce an educational series on Web3, Wealth Renaissance, using their AI-driven learning resources to instruct students about Bitcoin, cryptocurrency, and blockchain technology.

The business is presently involved in a lawsuit against individuals accused of manipulating the market, claiming losses totaling more than $250 million. This company operates using the Genius City model and an online digital marketplace, supplying AI education, resources, and workforce solutions. It provides tailored artificial intelligence entrepreneurial journeys for individuals, corporations, and even governments.

As a crypto investor, I’m excited about Genius Group’s decision to establish itself in Singapore, a location that offers a 0% capital gains tax policy. This strategic move could potentially benefit their Bitcoin strategy significantly. On November 19th, during the GeniusLIVE podcast, CEO Roger Hamilton and other board members will unveil more details about their cryptocurrency plans.

The stock experienced a significant increase after the Bitcoin news, marking its most substantial one-day increase in a while. However, despite this surge, the share price is currently over 98.5% lower compared to its peak of $96.80, which it reached on June 17, 2022.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2024-11-13 21:01