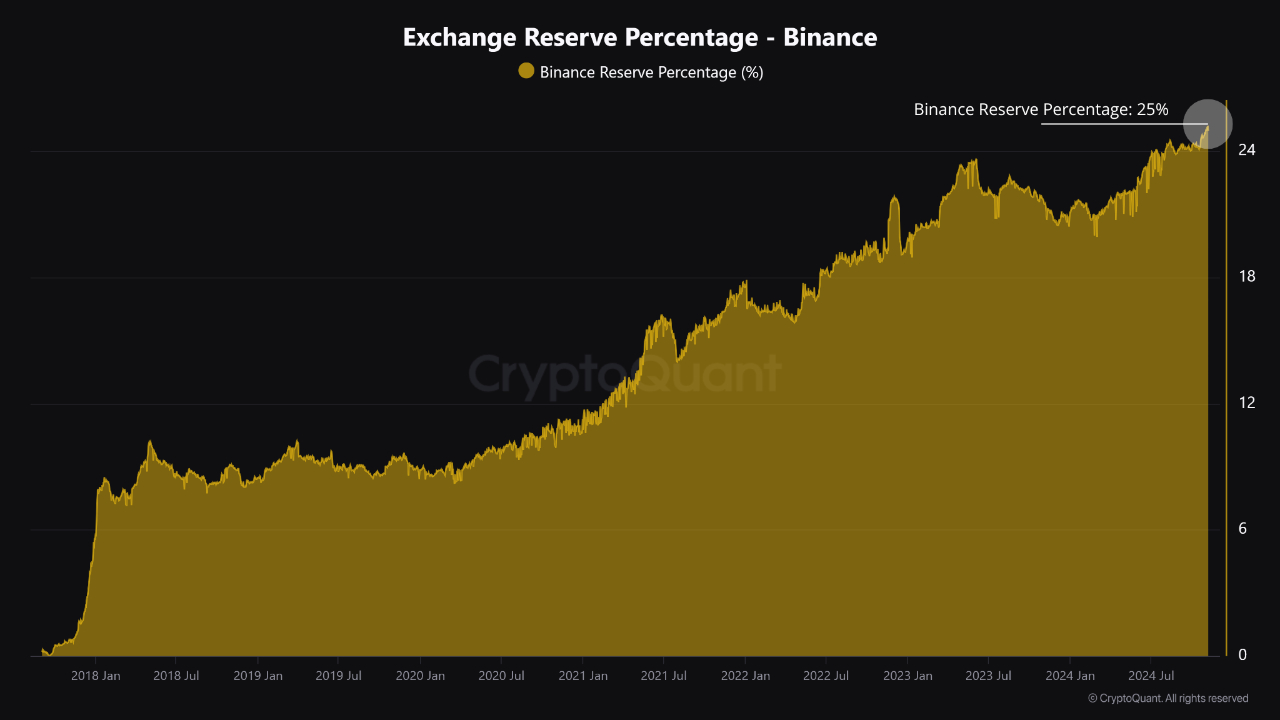

As a seasoned analyst with over two decades of experience in the financial markets, I find myself increasingly impressed by the meteoric rise of Binance in the cryptocurrency space. The latest data from CryptoQuant, which shows Binance’s reserves reaching an all-time high of 25%, underscores the exchange’s dominance within the sector.

Binance, a prominent cryptocurrency trading platform, has hit an unprecedented record with its reserves, now standing at 25% – the highest ever. This percentage, representing the portion of all cryptocurrencies stored on the exchange, emphasizes Binance’s unparalleled influence in the crypto sector.

Based on a study from CryptoQuant, it’s revealed that approximately 21% of the reserves were held by Binance in November 2023. Over the course of the last year, this percentage has increased by roughly 4%.

Among all the platforms under consideration, it’s just Conbase – a NASDAQ-listed crypto trading platform – that boasts an Exchange Reserve Percentage significantly higher than others, standing roughly at 33% of their total reserves.

According to CryptoGlobe’s report, there was an astounding $9.3 billion influx of stablecoins into these trading platforms on the Ethereum network following Donald Trump’s victory in the U.S. Presidential Election.

As a crypto investor, I’ve noticed that out of the staggering $9.3 billion in ERC-20 stablecoins deposited outside exchanges, an impressive $4.3 billion has been flowing into Binance, while another $3.4 billion has been moving towards the Nasdaq-listed exchange, Coinbase. According to CryptoQuant’s analysis, large-scale stablecoin inflows and subsequent upward trends have often aligned with bullish market rallies in the past.

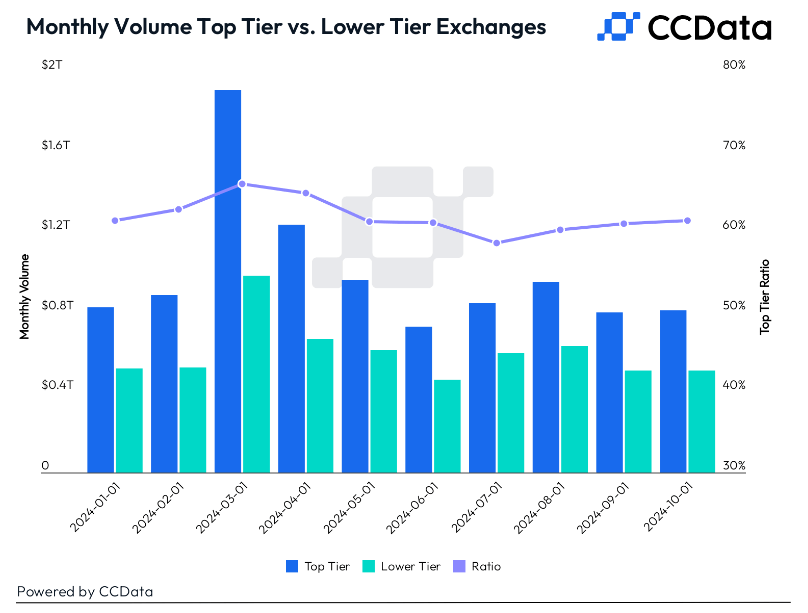

Remarkably, it’s been found in CCData’s recent Exchange Benchmark report that the leading cryptocurrency exchanges account for just around 20% of the 81 active exchanges out there, yet they handle over 60% of the entire trading activity.

Over the past few months, these trading platforms have been managing an average of around $850 billion each month as part of a total transaction value of $1.4 trillion. Binance takes the lead with approximately $472 billion in regular monthly transactions, while Bybit follows closely behind with about $127 billion. Coinbase, the highest-ranking U.S. exchange, holds fifth place with an average monthly volume of $66 billion.

In the world of cryptocurrencies, trading activity has been escalating due to an increase in stablecoin influxes. This surge has pushed prices up significantly, causing Bitcoin to reach a fresh record high of around $90,000.

As a crypto investor, I’ve noticed some strategic shifts in the market following Donald Trump’s victory in the U.S. presidential elections. The widespread anticipation was that his win would bolster Bitcoin’s value, given his vocal advocacy for the cryptocurrency sector. This could potentially mean a more favorable regulatory landscape, with less ambiguity and the appointment of pro-crypto officials to key positions, which in turn could foster improvement in the overall outlook.

Bitcoin’s price often surges following U.S. presidential elections. For instance, it experienced increases of 87%, 44%, and an impressive 145% after the elections in 2012, 2016, and 2020 over a 90-day period following each election.

Read More

- ALEO PREDICTION. ALEO cryptocurrency

- MUFASA: THE LION KING Trailer Tells the Tale of Mufasa and Scar as Brothers

- ATH PREDICTION. ATH cryptocurrency

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Solo Leveling Season 2: Check Out The Release Date, Streaming Details, Expected Plot And More

- How To Fix The First Berserker Khazan Controller Issues on PC

- Marvel Confirms ‘Avengers: Secret Wars’ as the End of the Multiverse Saga — Here’s What Could Be Next

- Blake Lively Starrer It Ends With Us Features Songs by Taylor Swift and Post Malone and More

- COMP PREDICTION. COMP cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

2024-11-13 19:12