As a seasoned investor with over three decades of navigating various market landscapes, I find Bernstein’s latest Black Book, “From Coin to Computing: The Bitcoin Investing Guide,” an intriguing read that offers valuable insights into the future of cryptocurrency and its role in modern portfolios.

The Bernstein Black Books represent an extensive collection of meticulously researched studies issued by Bernstein, a subsidiary of AllianceBernstein. In the realm of investments, these books are highly respected for their comprehensive examination of industries, markets, and investment tactics like asset allocation. The Black Books frequently delve into significant trends, providing valuable insights on how worldwide events impact investment approaches.

The “Black Books” are mainly designed for large-scale investors, providing them with forward-thinking insights about market trends and recommended strategies for asset distribution in intricate investment situations.

As an analyst, I’ve recently come across the latest publication by Bernstein titled “From Coin to Computing: The Bitcoin Investing Guide.” This comprehensive book delves into the dynamic landscape of Bitcoin, exploring its potential role in contemporary investment portfolios. Reflecting my perspective, Bitcoin is viewed as a dual entity – a digital equivalent of gold and a cutting-edge technological asset class. The scarcity of Bitcoin, similar to that of gold, positions it uniquely as a hedge against inflation and the devaluation of fiat currencies.

This article delves into the pros and cons, as well as future prospects, of the Bitcoin market, with a particular focus on security matters, regulatory issues, and advancements in infrastructure that have paved the way for institutional investment. It further examines different evaluation methods like Metcalfe’s Law and elucidates the role that Bitcoin’s computational power and network size play in its long-term growth potential.

In addition, Bernstein discusses the role of Bitcoin in broader investment strategies, focusing on its volatility and potential use as a hedge compared to assets like gold, despite being significantly more volatile. Investors are encouraged to adopt a venture capital approach when dealing with Bitcoin, which includes keeping investments minimal, diversifying holdings, and maintaining a long-term perspective to manage risks associated with its price fluctuations.

Key Insights:

Institutional Surge in Bitcoin ETFs

As an analyst, I’ve noticed a substantial surge in institutional participation, as global asset managers are projected to hold approximately $60 billion in Bitcoin and Ethereum ETFs by 2024. This represents a monumental increase from the $12 billion held in 2022. The launch of these ETFs has been unparalleled in exchange-traded fund history, amassing an impressive $18.5 billion in inflows since their debut in January this year. Notably, the report underscores that Bitcoin ETFs have emerged as the principal conduit for large-scale institutional investment.

Bitcoin’s Path to $200,000 by 2025

Bernstein remains highly optimistic about Bitcoin’s future, predicting it could hit $200,000 by the end of 2025, driven by institutional adoption, particularly through ETFs. Bitcoin has already surged 120% over the last year, bringing its market cap to $1.3 trillion. As demand continues to grow, miners are scaling their infrastructure to meet these needs, with Wall Street expected to take a more prominent role in the market.

Bitcoin as a Corporate Treasury Asset

As an analyst, I’m observing a trend where companies such as MicroStrategy are pioneering the use of Bitcoin as a corporate asset, with over 99% of their cash reserves now being stored in Bitcoin. MicroStrategy alone holds approximately 1.3% of the total Bitcoin supply. The report suggests that investing in equities like MicroStrategy, rather than holding Bitcoin directly or through ETFs, provides better returns. This strategy is termed as an “active leveraged Bitcoin equity approach.

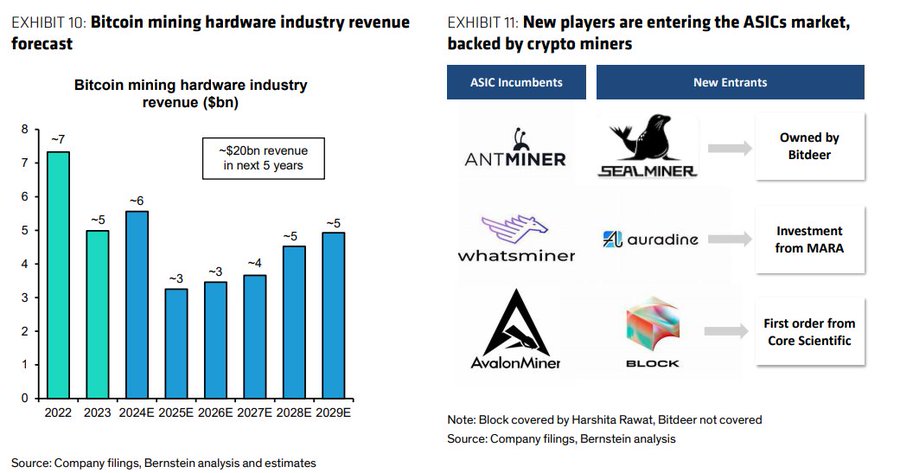

Consolidation in the Bitcoin Mining Industry

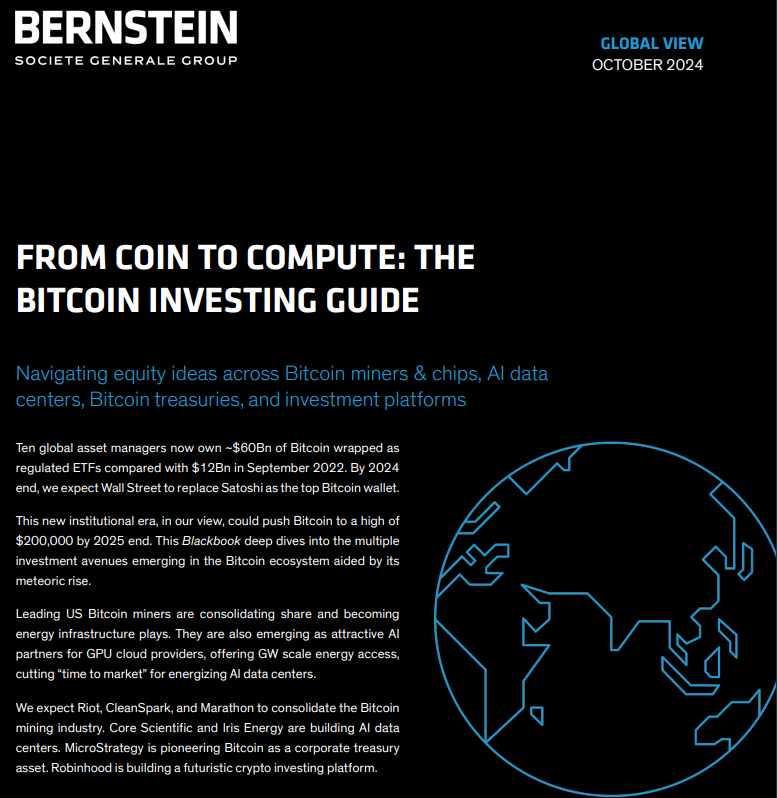

The Bitcoin mining sector is undergoing significant consolidation, with large players such as Riot Platforms and Marathon acquiring smaller operations. According to Bernstein, these major mining companies are on track to control at least 20 gigawatts of global power supply by 2025. The trend toward consolidation is expected to continue, with miners also moving into AI data centers to capitalize on excess energy.

Bitcoin Mining and AI

The study further delves into the growing link between Bitcoin mining and Artificial Intelligence facilities. As miners have easy access to extensive power resources, they are poised to play significant roles in AI server farms. By providing energy at significantly reduced rates compared to conventional data centers, Bitcoin miners are capitalizing on this situation, thereby creating a profitable “energy arbitrage” scenario.

Mainstream Adoption of Bitcoin ETFs

According to Bernstein’s prediction, the usage of Bitcoin ETFs among retail investors is expected to outpace traditional assets in the near future. This rapid growth is attributed to difficulties faced by individual investors in managing digital assets independently. By 2025, the total value of Bitcoin is estimated to exceed $3 trillion as wealth management platforms and institutional investors increasingly invest in cryptocurrency.

Bernstein’s guide outlines a definitive roadmap for the future of Bitcoin, given its growing adoption in conventional finance and advanced AI frameworks.

Read More

2024-11-09 02:14