As a researcher with years of experience studying Bitcoin’s intricate dynamics, I’ve witnessed firsthand the rollercoaster ride that is this revolutionary digital currency. The constant ebb and flow of the Bitcoin mining difficulty and hashrate have always fascinated me, not unlike the tides of the ocean I’ve sailed on for years.

Bitcoin mining difficulty measures how tough it is to find new blocks on the Bitcoin blockchain. The network recalibrates this figure every 2,016 blocks, roughly every two weeks, to ensure a consistent block discovery pace.

In 2024, the process has been adjusted 23 times in difficulty, and approximately 60% of those adjustments have made the process more challenging. This increasing difficulty significantly increases the strain on miners, impacting their profitability and long-term sustainability directly. Smaller, private mining companies tend to bear the brunt of these changes, as they often face capital limitations that hinder their ability to upgrade equipment or maintain operations during tough economic periods. Unlike larger, publicly traded corporations, smaller operators frequently encounter difficulties in upgrading their equipment or staying afloat during challenging times.

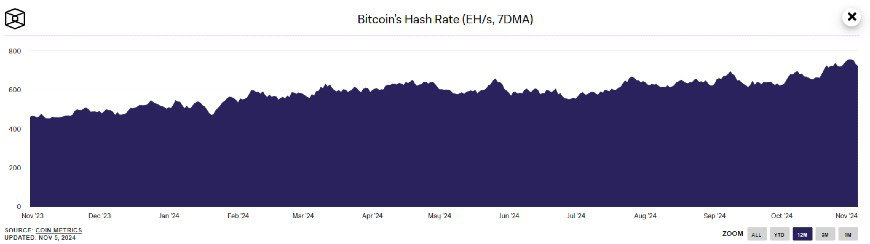

Bitcoin Hashrate Hits Record 755 EH/s

Just last week, the average seven-day computing power used in Bitcoin mining and transaction processing (known as hashrate) reached an unprecedented 755 quintillion hashes per second (EH/s). This significant milestone represents the first time the hashrate has exceeded 750 EH/s, according to The Block’s reporting. The increase suggests that miners are collectively striving to enhance their capabilities in order to maintain a competitive edge as mining difficulty escalates.

Hashrate holds great importance due to its direct link to network security and transaction speed. A higher hashrate signifies more computational power securing the blockchain, leading to faster and safer transactions. However, it also demands more advanced equipment and higher energy consumption, increasing challenges for smaller mining operations.

On October’s calendar, Bitcoin’s hashrate witnessed a significant 12% daily spike, marking one of the year’s most substantial leaps, as reported by Glassnode. This sudden upsurge underscores the intense rivalry among miners and their quick incorporation of advanced technology to boost efficiency and optimize profits.

Financial Strain on Small Miners

Mining Bitcoin demands intense competition and significant capital. Smaller mining companies often face financial challenges compared to their larger, publicly traded counterparts. Rising difficulty levels further strain their ability to keep operations running smoothly. Consequently, many smaller miners must sell Bitcoin to fund ongoing activities, potentially increasing market sell-side pressure.

At the moment, miners are using all of their newly mined Bitcoin. However, in October, they temporarily stored some of their Bitcoin, refilling reserves that were depleted in August and September. Right now, approximately 450 Bitcoins are mined each day. If all these mined coins are sold, it would create around $31.5 million in daily selling pressure, potentially affecting market trends.

Regardless of the obstacles faced, miners tend to maintain their footing. By keeping the mined Bitcoins instead of quickly selling them, they can lessen the demand for quick sales, thereby promoting a more even market. This strategy might help keep Bitcoin’s price steady by reducing the immediate supply increase.

Resilience Amidst Market Fluctuations

Even amidst difficulties, the Bitcoin network continues to demonstrate impressive robustness. Following the fourth halving on April 20, 2024, block rewards decreased from 6.25 BTC to 3.125 BTC, resulting in a substantial decline in revenue. Miners experienced a steep drop in earnings, with daily averages falling from $72.4 million on halving day to approximately $25-$35 million. This economic downturn forced less profitable mining operations out of the market.

The drop in revenue can also be seen in Bitcoin’s hash rate price, which reached an all-time low of $0.04 in September and then slightly increased to $0.045. The hash rate price, representing the daily earnings from one terahash per second (TH/s) of mining power, acts as a profitability indicator. This small recovery indicates that miners are slowly adjusting and optimizing their operations to match the decreased rewards.

After experiencing a seven-day average drop in hashrate to 550.3 EH/s in June, this metric has been steadily climbing. Survivor miners, particularly those based in the U.S., are growing their capacity, upgrading equipment, and strengthening their market positions. This increase in computational power demonstrates the industry’s adaptability to recent hurdles, as it gears up for continued growth and stability.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-06 13:00