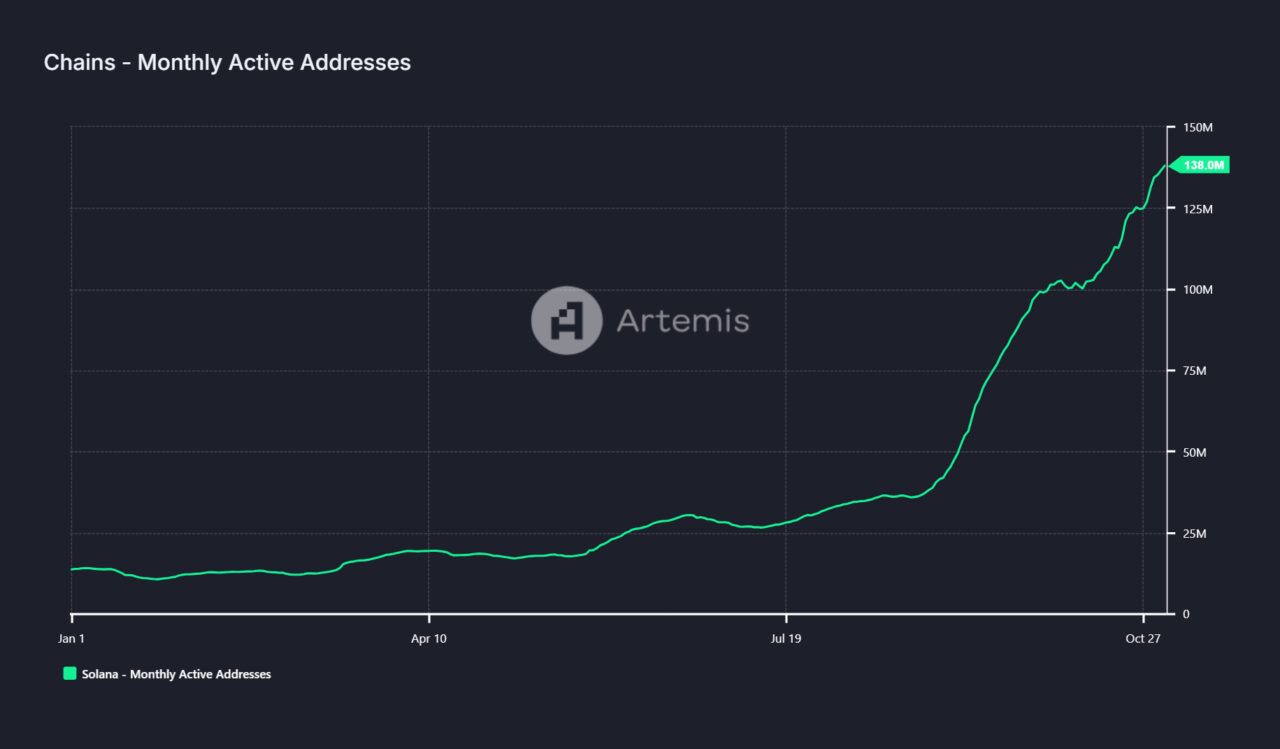

As a researcher who has been closely observing the cryptocurrency market for years now, I must admit that the growth of Solana (SOL) this year has left me quite impressed. The number of monthly active addresses on the network surpassing 138 million is nothing short of astonishing, especially considering it started at just 13.8 million in January. It’s a testament to the resilience and adaptability of the blockchain technology, and Solana seems to be leading the charge in this new era of digital assets.

This month, I’ve seen the number of monthly active addresses on the Solana (SOL) network soar to an impressive 138 million. Throughout the year, it’s been on an exponential upward trajectory, mirroring a broader revival in the cryptocurrency market.

As a researcher, I’ve been closely tracking the activity on the Solana network, and here’s what I’ve found: At the start of the year, based on data from Artemis, there were approximately 13.8 million monthly active addresses on the network. This number steadily increased until summer. However, things took a significant turn in August. The number of active addresses skyrocketed, going from around 40 million at the end of that month to surpassing 100 million by early October. In the past month alone, the figure has grown over 30%.

An increase in the number of monthly active addresses can be attributed to the significant growth in total value locked (TVL) within Solana’s decentralized finance environment. Data indicates that a substantial amount of these inflows has been observed this year. As per CryptoGlobe’s report, approximately $2.36 billion of those influxes originated from Ethereum; however, Ethereum experienced a return flow of around $1 billion.

It appears that just 2.7% of Ethereum’s Total Value Locked has moved over to Solana this year, and the second most valuable network in terms of market cap has experienced a total outflow of about $6 billion as of yet in 2021.

This year, Solana’s growth has been particularly striking. Its value has surpassed many other digital currencies so much that it’s almost challenging Binance‘s BNB for the fourth spot as the largest digital currency in terms of market cap.

In simple terms, the fall of FTX in November 2022 had a detrimental effect on the Solana network. FTX’s leaders were prominent supporters of Solana and held substantial amounts of SOL, the collapse causing a dramatic reduction in the price of Solana by nearly 70%. This significant drop occurred amidst widespread market turmoil.

The downfall of FTX has sparked worries regarding the long-term viability of the Solana network, as it’s been estimated that around one fifth of Solana-linked projects previously secured funding from either FTX or its related entity, Alameda Research.

Since then, investors have once again become involved in the Solana system, as evidenced by a surge in activity for initiatives such as Pump.fun and the decentralized crypto exchange Raydium. This resurgence was initially reported by The Block.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

- ‘He Knows He’s Got May…’: Gwyneth Paltrow Reveals Husband Brad Falchuk’s Reaction To Her Viral On-Set Kiss With Timothee Chalamet

- Drake Announces Collab Album With OVO Labelmate PartyNextDoor; Teases Fall Release

2024-11-05 02:22