As a researcher with a keen interest in blockchain technology and its evolving landscape, I find myself closely watching the developments surrounding Canary Capital’s proposed Solana ETF. Having followed the crypto market for several years now, I can attest to the increasing demand for easy, accessible investment options in digital assets. The potential creation of a Solana ETF would undoubtedly expand this scope and make it easier for both institutional and retail investors to tap into one of the most promising blockchain networks today.

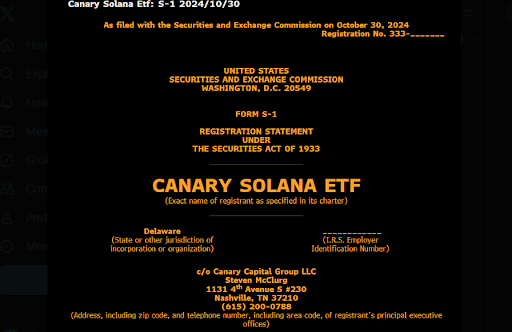

In response to growing interest in crypto ETFs, Canary Capital has submitted an application to the U.S. Securities and Exchange Commission (SEC) for the creation of a Solana ETF that tracks the price of Solana directly (a “spot” Solana ETF). Based in Nashville, the company intends to propose this ETF as a way to capitalize on the rapidly expanding Solana blockchain platform.

In simpler terms, the Solana ETF follows the fluctuations in the value of SOL. This means you can invest in Solana indirectly through a traditional brokerage account, making it an effortless and convenient option for investors.

Expanding the Scope of Crypto Investments

Canary Capital’s plan to establish a Solana ETF is not their first endeavor in creating crypto ETFs. Previously, they filed applications in October for spot ETFs based on both Ripple (XRP) and Litecoin. This move indicates their ambition to offer access to various digital assets. If authorized, these ETFs would enable investors to participate in the cryptocurrency market without the usual complications or risks involved in directly holding digital currencies. Instead, these ETFs would follow the price movements of the underlying cryptocurrencies using established indices like the CME CF Solana Index, which provides real-time pricing and a relatively low-risk investment option for investors.

Cryptocurrency-backed Exchange Traded Funds (ETFs) have been gaining more attention, particularly following the Securities and Exchange Commission’s recent approval of a Bitcoin and Ethereum ETF. This has created fresh opportunities for not only institutional but also individual investors as well.

Solana’s Position as a Leading Blockchain Network

Absolutely, Solana is undeniably gaining popularity as a leading blockchain platform for dApps and DeFi applications, alongside Ethereum. It stands out due to its remarkably low transaction fees and exceptionally quick transaction speeds, making it highly appealing. The resulting high level of transaction activity and vast number of active addresses demonstrate its popularity. Additionally, its technical proficiency has made it a preferred choice for numerous decentralized finance projects, meme coins, and NFTs.

According to Canary Capital, Canaccord Genuity considers Solana as a highly promising ETF because of its expansive DeFi ecosystem and cost-effective transaction environment. Canary emphasizes that consistent on-chain activity and a rapidly expanding user base create a strong foundation for institutional interest. Notably, Solana has surpassed both Ethereum and Binance Chain in terms of active address market share, despite Ethereum’s Layer 2 solutions being taken into account within the platform.

Regulatory Hurdles: Will the SEC Approve a Solana ETF?

Despite many bold plans, the Securities and Exchange Commission (SEC) has approached cryptocurrency ETFs with caution, particularly for assets other than Bitcoin and Ethereum. The regulatory body has classified Solana as a security in previous instances, such as its lawsuit against Binance in 2023, which creates extra hurdles for Solana-centric products. Analysts posit that while the SEC has demonstrated a readiness to endorse ETFs for Bitcoin and Ethereum, it might be less eager to sanction products focused on less decentralized networks like Solana due to its smaller number of validator nodes.

Canary is not the only firm vying for a Solana ETF. Asset managers VanEck and 21Shares submitted similar applications in June, with both firms also offering Bitcoin and Ethereum ETFs. Franklin Templeton has also shown interest in Solana, indicating that the demand for ETFs covering a broader range of digital assets is on the rise. However, these applications must contend with regulatory scrutiny, as the SEC remains stringent in assessing digital assets for potential network vulnerabilities and investor risks.

Potential Market Impact and Institutional Adoption

If given the green light, a Solana ETF could significantly broaden the reach and accessibility of SOL to both institutional and individual investors. An ETF would simplify the investment process by allowing investors to gain Solana exposure via their regular brokerage accounts, without needing to deal with the complexities involved in purchasing and safeguarding digital assets directly.

Currently, the market’s expectation of an upcoming ETF approval for Solana is shaping its sentiment. Some experts suggest that such an approval could significantly boost SOL’s value. This scenario might resemble what happened with Bitcoin and Ethereum, whose ETF approvals led to increased demand and market liquidity. If the ETF is successful, it could spur more adoption and heightened interest in the blockchain technology it supports. Furthermore, it would attract institutional investors seeking regulated avenues for investing in this asset.

The Influence of U.S. Elections on Crypto Regulation

As the U.S. Presidential election approaches, there’s a significant possibility of regulatory shifts impacting the crypto market. These changes might influence the Securities and Exchange Commission’s (SEC) approach towards cryptocurrency ETFs and crucially, their regulations on digital assets.

Recently, Eric Balchunas, Senior ETF Analyst at Bloomberg, stated that if Donald Trump wins, it could signal a favorable regulatory climate for cryptocurrency and possibly accelerate the approval process for new digital asset products. On the other hand, an administration led by Kamala Harris might preserve the SEC’s cautious approach under Chair Gary Gensler, potentially leading to delays in decisions regarding Solana and other crypto ETFs.

In the meantime, global markets are adopting a forward-thinking stance. To illustrate, Brazil has just greenlighted a Solana ETF, making it a potential test bed for crypto ETFs. On the other hand, U.S. investors might have to endure longer delays due to intricate regulatory hurdles.

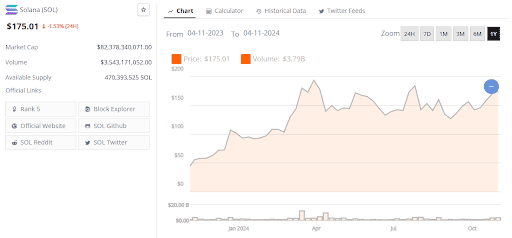

Canary Capital’s ETF Boosts Solana’s Price

Following Canary Capital’s submission of the Solana ETF, there was a temporary yet significant improvement in Solana’s market activity. The news ignited an immediate increase in Solana’s value, indicating a wave of investor interest. However, as market trends took effect, there was a correction in the price, returning it to a balanced state following the initial enthusiasm. Data from BeInCrypto shows a minor decrease of 3.32% post-correction, with Solana being traded around $175.01 at the time of reporting.

Currently, the focus is on whether Solana can break through the resistance at $180. This level has been difficult to surpass in the past, and people are eagerly waiting to find out if Solana’s current progress will carry it over this significant barrier. If it does, its next major goal lies slightly above, with a potential target being its 7-month high of $202.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- ‘Did Not Expect To See That Fiery Bully’: Hell’s Kitchen Alums Recall ‘sharp-tongued’ Gordon Ramsey’s Behavior On Set

- ‘He Knows He’s Got May…’: Gwyneth Paltrow Reveals Husband Brad Falchuk’s Reaction To Her Viral On-Set Kiss With Timothee Chalamet

- Gold Rate Forecast

2024-11-01 21:11