As an analyst with over two decades of experience in the tech industry, I must admit that MicroStrategy’s recent move to raise $42 billion for Bitcoin acquisition is nothing short of audacious. However, it’s this kind of boldness that has kept them at the forefront of innovation, much like Michael Saylor compared Bitcoin to Google or Facebook of money.

MicroStrategy Inc. (MSTR) disclosed its third-quarter 2024 earnings, detailing a strategy aimed at amassing $42 billion over a three-year period to bolster its Bitcoin holdings. This strategic move underscores the company’s strong commitment to Bitcoin as its primary treasury asset, solidifying its position as the world’s leading corporate Bitcoin owner.

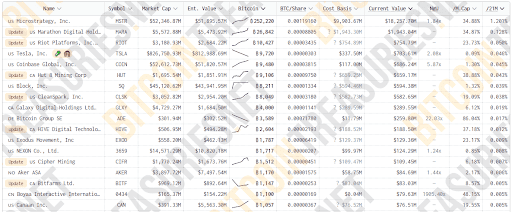

By the end of October 2024, as a researcher studying digital currencies, I found MicroStrategy proudly holding approximately 252,220 Bitcoins. The market value of this impressive collection surged to an astounding $18 billion, according to Bitcoin Treasuries. In the recent period since June 30, 2024, the company has shown aggressive growth in its Bitcoin reserves, investing in an additional 25,889 Bitcoins at an average price of around $60,839 per coin. This strategic move resulted in total purchases amounting to a substantial $1.6 billion.

MicroStrategy’s strategic Bitcoin accumulation mirrors the increase in Bitcoin value so far this year, largely due to the approval of Bitcoin exchange-traded products (ETPs), which have garnered significant attention from institutions. The launch and initial success of these ETPs suggest that Bitcoin is maturing into a high-quality asset class for institutions.

During the earnings call, a representative from MicroStrategy expressed their view that the launch and initial success of Bitcoin Exchange Traded Products (ETPs) indicates that Bitcoin is becoming more mature as an asset class accepted by institutions, with growing regulatory recognition and institutional adoption.

Strategic Capital Raising Enhances Bitcoin Treasury

In September, MicroStrategy strengthened its financial standing by raising a total of $1.1 billion through an equity offering and $1.01 billion via the issuance of convertible senior notes due in 2028. This capital allowed for the repayment of a $500 million debt on senior secured notes, thereby releasing its Bitcoin holdings from any debt obligations.

Andrew Kang, in his capacity as Senior Executive Vice President and Chief Financial Officer, underscored the crucial significance of recent funding initiatives. He pointed out that MicroStrategy’s expansion prospects and its Bitcoin-focused strategy are becoming more aligned. He elaborated on the financial methods sustaining this strategy, which encompass debt financing, stock offerings, and income from software sales.

MicroStrategy employs a strategy that uses both stock and bond investments along with operational cash flow to accumulate Bitcoin. This financial approach offers investors various economic opportunities in Bitcoin through equity and bond options. Furthermore, MicroStrategy also provides sophisticated analytics software powered by AI, balancing technological advancement with a dedication to digital assets.

Kang explained MicroStrategy’s strategy for acquiring Bitcoins using leverage, emphasizing three key components: borrowing money (debt financing), selling shares (equity issuance), and generating cash through software operations. By effectively utilizing these financial tactics, MicroStrategy aims to expand its Bitcoin holdings, ultimately boosting shareholder worth.

New 21-21 Plan Targets $42 Billion for Bitcoin Acquisition

As a crypto investor, I’m excited about MicroStrategy’s ambitious 21-21 strategic plan that aims to raise an impressive $42 billion by 2027. The goal is to divide this capital equally, with $21 billion coming from equity sales and another $21 billion through fixed income. This massive influx of funds will empower MicroStrategy to significantly increase its Bitcoin holdings. By launching the largest ATM equity program in history, MicroStrategy intends to establish a substantial Bitcoin reserve.

The plan aims for a $10 billion goal by 2025, with half allocated to stocks and the other half to bonds. This figure increases to $14 billion in 2026, and ultimately reaches $18 billion in 2027. A phased approach enables the company to manage interest costs efficiently, adjusting between equity and debt financing as required.

In addition to its Bitcoin strategy, MicroStrategy is also strengthening its software division, establishing itself as a top independent public company in the business intelligence sector. By Q3 2024, non-GAAP subscription revenues surged by 93% compared to the previous year, amounting to $32.4 million—marking the fourth straight quarter with robust growth, primarily due to cloud migrations and new client acquisitions.

As a crypto investor, I’m thrilled about the surge in cloud subscriptions, signaling a strategic shift from traditional on-premises solutions to cloud services. Although our software earnings decreased by 10% to $116 million year-on-year, the emphasis on cloud offerings is projected to bring in more predictable, recurring income. My aim continues to be boosting cloud revenue by facilitating customer migrations, all while maintaining profitability.

Financial Performance and Future Outlook

MicroStrategy’s Q3 2024 financial report demonstrates a strategic approach that combines the upkeep of substantial Bitcoin investments and the progression of its software business. Although the software business revenues dipped slightly, subscription services revenues significantly increased by 32% compared to the same period last year, accounting for roughly 24% of total revenues. This growth indicates MicroStrategy’s commitment to growing more robust and sustainable cloud recurring revenues over time.

In Q3 of this year, the cost of revenues jumped by 29% compared to the same period last year, mainly because of increased cloud hosting expenses linked to our expanding cloud infrastructure. Furthermore, operating expenses went up by 7%, largely due to a rise in stock-based compensation and custody fees associated with greater Bitcoin holdings. The company also recorded a $14 million expense for severance costs related to workforce optimization, anticipating a decrease of $30 million in salary costs next year.

Andrew Kang underlined the importance of a methodical cost management strategy and efficient organizational design within the company.

Our company’s strategic approach involves adjusting workforce numbers evenly across all departments, structuring our organization efficiently, and fostering a culture that emphasizes disciplined performance management.

CEO Michael Saylor Champions Bitcoin as Digital Capital

During the earnings call, Michael J. Saylor, serving as Chair, President, and CEO of MicroStrategy, vividly expressed the company’s vision. He likened Bitcoin to traditional assets such as crude oil, emphasizing its function as a valuable and energetic digital commodity.

“Bitcoin is like the Facebook of money or the Google of money. It is the dominant digital monetary network,” he stated.

Saylor explained MicroStrategy’s innovative financial solutions, particularly convertible bonds, which aim to shield investors from losses and foster Bitcoin’s growth. These types of investments have garnered significant returns, even outperforming Bitcoin itself. For example, an initial $1 million investment in these bonds could result in a 90% profit, while Bitcoin only provided a 47% return over the same timeframe.

MicroStrategy’s focus encompasses Bitcoin return on investment (ROI), a crucial metric that compares the total Bitcoin held to the estimated diluted shares. This ratio assesses the effectiveness of capital allocation strategies designed to increase Bitcoin reserves more rapidly than share issuance. In 2024, the company announced a BTC ROI of 17.8%, surpassing both the previous year’s rate and the revised goal of 6% to 10%.

Kang underscored that MicroStrategy is uniquely positioned due to its blend of robust operational abilities, a substantial Bitcoin holding, and unwavering focus on technology innovation. This harmonious mix places the company at the cutting edge of digital assets and business analytics.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-11-01 18:36