As a seasoned analyst with over two decades of experience under my belt, I find MicroStrategy Inc.’s Q3 2024 financial results to be a fascinating mix of bold ambition and challenging realities. The company’s Bitcoin acquisition strategy is undeniably audacious, aiming to raise $42 billion in three years – a move that, if successful, could redefine the landscape of digital currency holdings. However, the steep decline in its software segment revenue and operating loss, largely driven by an impairment on its digital assets, paints a more complex picture.

On October 30th, MicroStrategy Inc. (NASDAQ: MSTR) disclosed their Q3 2024 financial report, emphasizing their new Bitcoin purchasing approach and the hurdles encountered in their software sector.

The company, recognized for its large Bitcoin investments, unveiled a three-year strategy called the “21/21 Plan” with the goal of amassing $42 billion in total – $21 billion through equity sales and an additional $21 billion from fixed-income securities. This capital influx is intended to expand its Bitcoin reserves, with the aim of boosting returns derived from these assets, as stated by CEO Phong Le.

In the third quarter, MicroStrategy boosted its funds to the tune of $2.1 billion through both stock and bond sales. This move was explained as part of their long-term financial strategy. By the end of September, the company’s Bitcoin holdings grew by approximately 11%, amounting to roughly 252,220 bitcoins, with a market value of around $16.007 billion.

MicroStrategy’s year-to-date return on Bitcoin, a measure they use to evaluate their Bitcoin investment strategy, has hit 17.8%. However, they have adjusted their long-term yield expectation for the years 2025 to 2027, setting it between 6% and 10% annually.

Conversely, MicroStrategy’s software division saw a drop of 10.3% in annual revenue compared to the previous year, amounting to $116.1 million. This decline was partly due to decreases in product license and support revenues. However, this was somewhat balanced by a significant increase of 32.5% in subscription services.

1) In Q4 2023, the company’s gross profit margin decreased from 79.4% to 70.4%. Moreover, operating costs skyrocketed by more than triple, primarily due to a $412.1 million write-off on its digital assets, resulting in an operational loss of $432.6 million for the quarter. This is a significant contrast to the minimal loss of $25.2 million experienced during the same period in 2022.

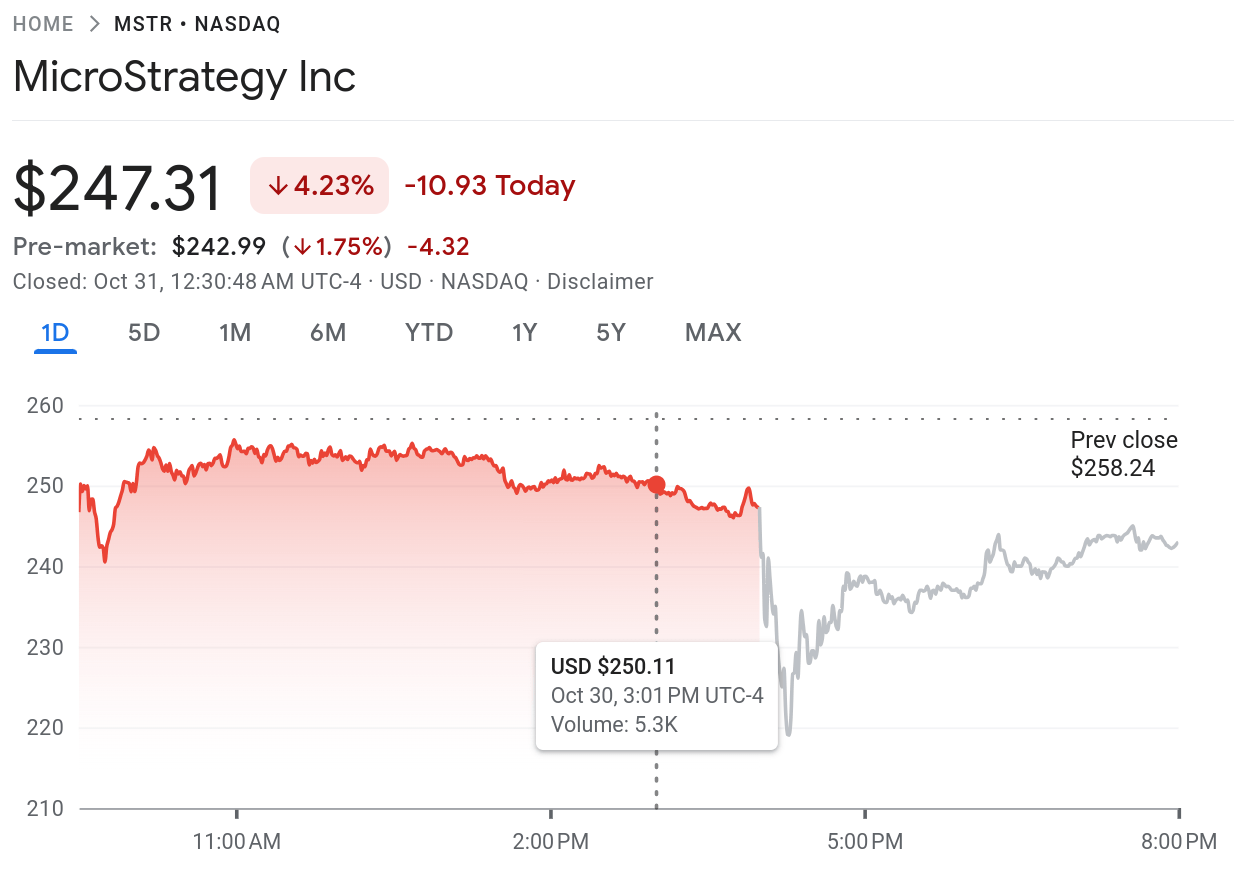

During normal trading hours, MicroStrategy’s stock decreased by 4.23%, ending the day at $247.31. Later in extended trading, the stock experienced a further decline of 1.75%, reaching $242.99.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2024-10-31 10:21