As a seasoned researcher who has closely watched the crypto market evolve over the past decade, I find myself intrigued by the current state of play among cryptocurrency mining firms post-Bitcoin halving. The strategic decisions these companies are making reflect the complexities and uncertainties inherent in this rapidly changing landscape.

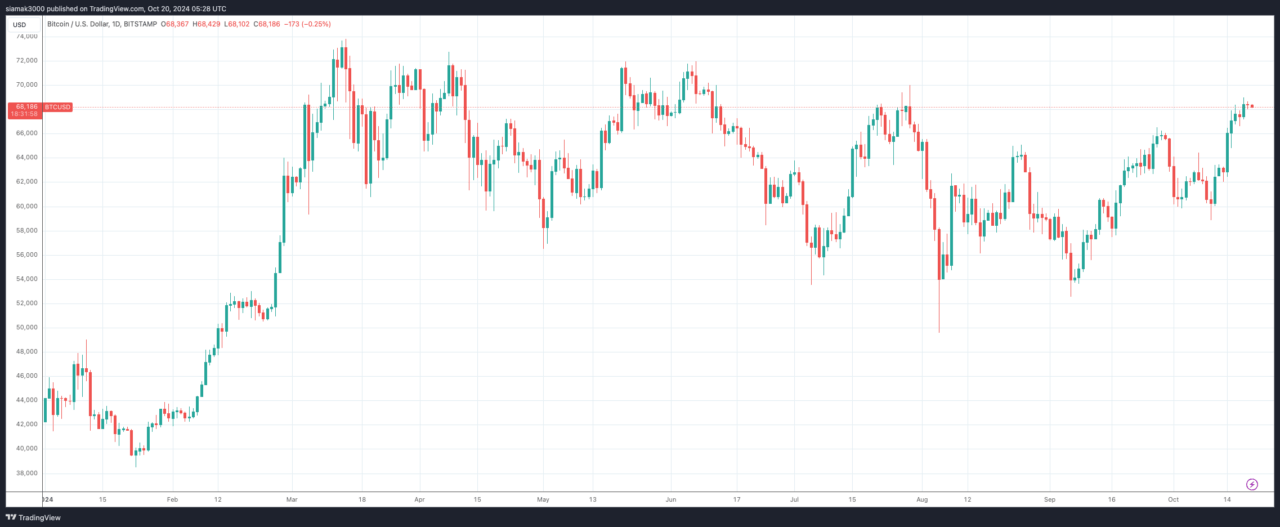

Approximately six months following the Bitcoin halving in April 2024, crypto mining companies are confronted with crucial choices due to a substantial decrease in their earnings, as suggested by a report from David Pan at Bloomberg News.

Every four years, a reduction happens that cuts in half the compensation miners get for validating transactions (known as “block rewards”). This decrease in supply is meant to combat inflation by limiting the amount of Bitcoin available. However, this adjustment has put significant strain on miners, as they now earn less profit per mined block.

Companies such as MARA Holdings (NASDAQ: MARA), Riot Platforms (NASDAQ: RIOT), and CleanSpark (NASDAQ: CLSK), which are listed on the stock market, are employing various tactics to adjust their operations. Some of these firms are choosing to keep the Bitcoin they mine, hoping that the asset’s value will increase in the future. This strategy, known as “HODL,” indicates a belief that long-term profits will compensate for short-term revenue declines. On the other hand, some miners are redirecting their resources towards creating data centers for artificial intelligence (AI) purposes, an action intended to broaden their income sources.

According to Wolfie Zhao, a specialist at TheMinerMag, the advantage of owning Bitcoin for miners is that they can avoid selling it at disadvantageous prices when funding their operations. Instead, they can seek financial support through options like borrowing or issuing shares, which could help them postpone losses and perhaps benefit from potential future price rises.

Despite Bitcoin’s more than 60% price increase this year, firms holding onto their mined Bitcoin have seen their stock prices drop. MARA and RIOT, two very popular Bitcoin mining stocks, have experienced declines of roughly 18% and 36%, respectively, in the year-to-date (YTD) period.

Instead of them, firms such as Core Scientific (NASDAQ: CORZ) and TeraWulf (NASDAQ: WULF), which have adopted AI technology, are experiencing substantial growth. The share price for Core Scientific has surged by an impressive 272% this year following the acquisition of large-scale contracts with AI firm CoreWeave. Meanwhile, the stock value for TeraWulf has more than doubled (128% increase this year) due to its shift towards developing AI data centers.

Miners who specialize in Bitcoin have become better at coordinating their activities following market declines in the past. Major players such as MARA and CleanSpark persistently retain healthy profit margins due to advancements in mining equipment technology and the possibility of future increases in Bitcoin’s price. As Bitcoin bounces back from its 2022 crash, miners are once again borrowing money and offering shares for sale. Companies like MARA are even adopting MicroStrategy’s strategy by using fresh funds to buy more Bitcoin, demonstrating their long-term faith in the asset.

Nevertheless, Ethan Vara, Chief Operating Officer at Luxor Technology, issues a cautionary note about this approach. If the value of Bitcoin drops, miners might encounter significant financial losses and potential shareholder dilution due to increasing operational expenses.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- DEXE PREDICTION. DEXE cryptocurrency

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- ‘Cracked Like A Potato Chip’: Keanu Reeves Reveals How He Injured His Kneecap While Filming For Good Fortune

2024-10-20 08:53