As a seasoned researcher with a keen eye for emerging trends in the cryptocurrency market, I must admit that the recent surge of Sui and its native token has piqued my interest. With a background in blockchain technology and financial markets, I’ve seen my fair share of projects promising scalability and high performance, but few have delivered as consistently as Sui seems to be doing.

Over the last week, many digital asset prices experienced a substantial drop. However, Sui, a high-performing Layer-1 cryptocurrency network with “infinite scalability,” has witnessed an increase in its native token’s price, reaching a record new peak of $2.16.

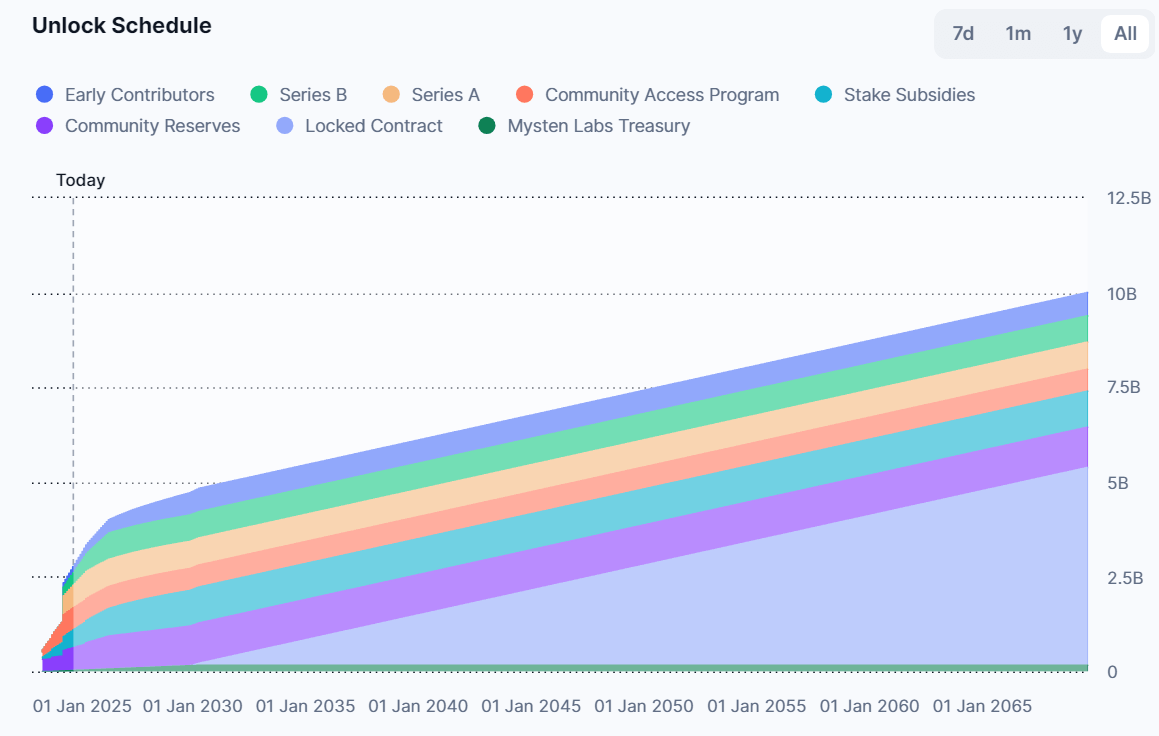

Based on current market information, the total value of SUI, including coins tied up in smart contracts or escrow, as well as tokens owned by team members and the protocol, now stands at approximately $19 billion. Notably, more than half (52%) of SUI’s total supply is secured within smart contracts, around 10% is set aside for community reserves, and early contributors hold about 6%.

Data also shows that Series A and Series B investors hold 7.14% and 6.95% of SUI’s tokens, while 1.64% are in the Mysten Labs Treasury. 7.24 billion SUI tokens are currently locked, with unlocking set to occur over time according to CoinMarketCap.

In the SUI system, daily transactions regularly surpass the six-billion-dollar mark, largely due to activity involving SUI and FDUSD, a stablecoin. The majority of FDUSD trades take place on the well-known cryptocurrency trading platform, Binance.

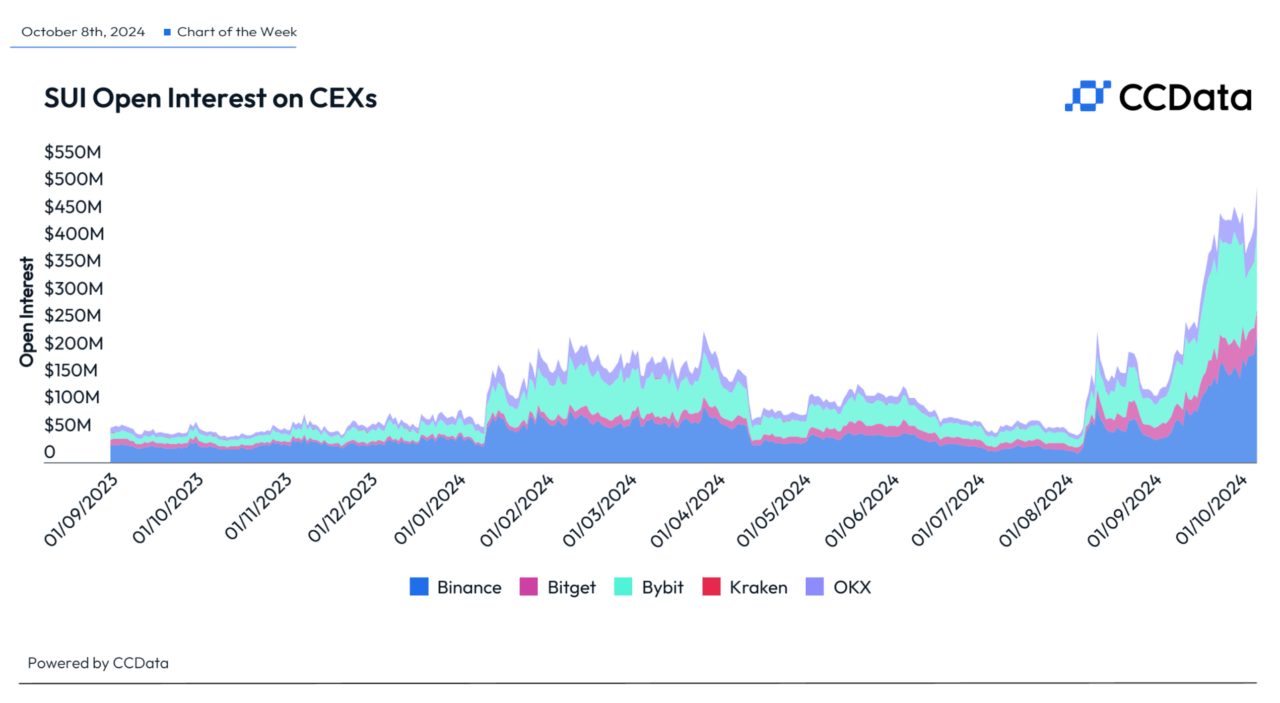

The ecosystem, aside from the main SUI token and FDUSD, is teeming with a variety of projects such as decentralized trading platforms (DEXs), humorous digital currencies (meme coins), and lending systems. It’s worth noting that the popularity of SUI has grown significantly on prominent centralized cryptocurrency exchanges like Binance, Bybit, Kraken, and OKX, suggesting heightened interest from investors. As of October 7, data reveals that these exchanges have collectively reported over $508 million in open interest for SUI.

As an analyst, I’ve noticed a significant increase in open interest within our market, which I attribute to the upcoming launch of Circle’s USDC stablecoin on the Sui network. This development appears to be strengthening investor confidence and encouraging broader participation. In fact, since the start of the year, SUI’s open interest has skyrocketed by a staggering 495%, surpassing the growth rates of major assets such as BNB and DOGE, according to CCData’s latest reports.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-10-09 19:20