Some investment firms gather blue-chip stocks. Some buy bonds. Metaplanet raids the metaphorical pastry shop of modern finance and comes out, arms full, with another slice of Bitcoin. And just in case anyone thought they’d run out of room on the digital mantelpiece, they’ve gone and bought another 1,111 BTC (oleaginous, satisfying, delightfully palindromic)—a cool $118 million, give or take a rounding error or two, or the cost of a small volcanic island.

The bean-counters say they paid $106,408 per “coin.” (Insert stunned gasps, several monocles hitting the marble floor.) Bitcoin, never one to miss a dramatic entrance or a spectacular pratfall, has wobbled its price down more than 5% this week, like a tipsy wizard distracted by butterflies.

Performance Metrics: Inflated, Yet Still Legal

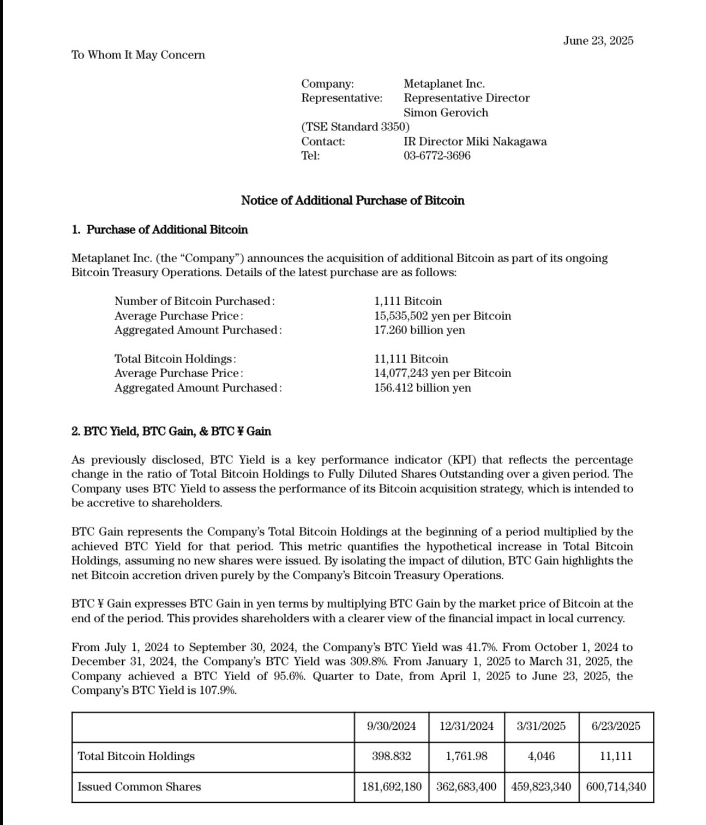

Metaplanet’s numbers are currently zooming around the board like a caffeinated squirrel: quarter-to-date Bitcoin yield of 108%. That’s up from 96% in Q1 and a fistful-of-lightning 310% in Q4 2024. The ‘BTC per fully diluted share’ number means that, theoretically, every investor owns a tiny, invisible crumb of a coin. If you squint, it’s almost worth bragging about at parties.

Reports claim Metaplanet managed to stack up 4,367 BTC during this period alone, hitting $451 million in universal immodest boasting rights (using prices from Bitflyer, the digital equivalent of “my cousin Vinny says so, so it must be true”).

*Metaplanet Acquires Additional 1,111 $BTC. Total Holdings Reach 11,111 BTC*

— Metaplanet Inc. (@Metaplanet_JP) June 23, 2025

Balance Sheet Now Weighs More Than An Elephant (Or 11,111 BTC)

With this purchase, the firm now sits atop 11,111 BTC, valued at more than $1.07 billion—you know, just enough to buy several nations or one Taylor Swift tour. Their cost per coin: $95,869. The shares fell 3.5% on the announcement, possibly because investors are starting to wonder if the company is laundering its coffee budget or selling naming rights to the office cutlery.

Financing: Bonds, Shares, and Goblins With Abacuses

Since January, Metaplanet has been raising cash via zero-coupon bonds—a sort of IOU that pays no interest and makes accountants reach for their dictionaries. It also issued over 210 million shares under the “210 Million Plan”, because “The Big Baffling Number Plan” didn’t fit on the forms.

Evo Fund has been gobbling up most of these bonds and rights. In two short months (May to June 2025), Metaplanet scooped up over $300 million, all marked for more Bitcoin, presumably so they can build a Bitcoin fort and charge everyone else for parking.

The Goal: Enough Bitcoin to Scare a Dragon (210,000 BTC)

Metaplanet’s master plan: by the end of 2027, snatch 210,000 BTC. That’s ten times their current hoard, enough to fill the digital equivalent of a vault so large that even the Luggage* would hesitate.

(*If you know, you know.)

They even invented a “Bitcoin Treasury Operations” arm in December 2024, which is a far cry from their previous incarnation as hotel moguls—proof that career changes can be both whimsical and borderline alarming.

Dilution: Now in Family-Sized Portions 🤲

Metaplanet’s diluted share count now teeters near 760 million as of June 23. Each 1,000 shares entitles its brave holder to a whopping 0.0146 BTC—enough for a triumphantly indecipherable cocktail napkin calculation. Of course, with every new bond and share comes more dilution for old investors, who may soon need microscopes to locate their returns. If Bitcoin staggers and falls, raising more cash will feel like picking pockets in a nudist colony—awkward, risky, and likely to end in tears.

This is a bold move, and it’s not unlike betting the house, the farm, and the family fortune at the Ankh-Morpork Thieves’ Guild roulette night. If Bitcoin soars, Metaplanet can gloat freely. If not, well, at least the long-term shareholders will have the satisfaction of saying “I told you so”, which, let’s be honest, is what capitalism is truly about. 🪙😅

And so Metaplanet marches on, armed with nothing but spreadsheets and a maverick sense of fiscal bravado. Can this keep going? Will someone eventually turn the lights off? Watch this space (but not with money you actually need).

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-06-23 19:56