I’m so encouraged by what’s happening in Hollywood right now. It’s amazing to see leading actresses not just asking for diversity in front of the camera, but demanding real change behind it too. They’re using their power to push for things like inclusion riders, and actively working to avoid harmful tropes like the ‘white savior.’ They want to have a say in how stories are told, and they’re fighting for diverse crews so that stories about all communities are authentic and empowering. It feels like they’re really trying to break down old, unfair systems and prioritize telling genuine, meaningful stories instead of just sticking to the same old formulas.

Viola Davis

As a critic, I’ve been really impressed with Viola Davis’s commitment to on-screen representation. She’s openly admitted she has some regrets about ‘The Help,’ feeling the story wasn’t truly centered on the experiences of the Black characters. Now, through her production company, JuVee Productions, she’s making sure that BIPOC characters are the heroes of their own stories, not just supporting players. She’s a powerful advocate for giving Black characters complete control over their narratives, letting them drive the plot instead of simply existing to help white characters develop. This dedication to authentic storytelling is really making a difference, and she’s become a leading voice in demanding fairer contracts and more equitable representation in Hollywood.

Frances McDormand

During her 2018 Oscar acceptance speech, Frances McDormand brought attention to the idea of ‘inclusion riders.’ These are clauses added to actors’ contracts that require a film to have a certain level of diversity among its cast and crew. The goal of these riders is to fight against unfair biases, like the ‘white savior’ trope, and make sure that people from all backgrounds have a voice both in front of and behind the camera. McDormand’s support for inclusion riders has inspired other well-known actors to ask for similar requirements in their contracts.

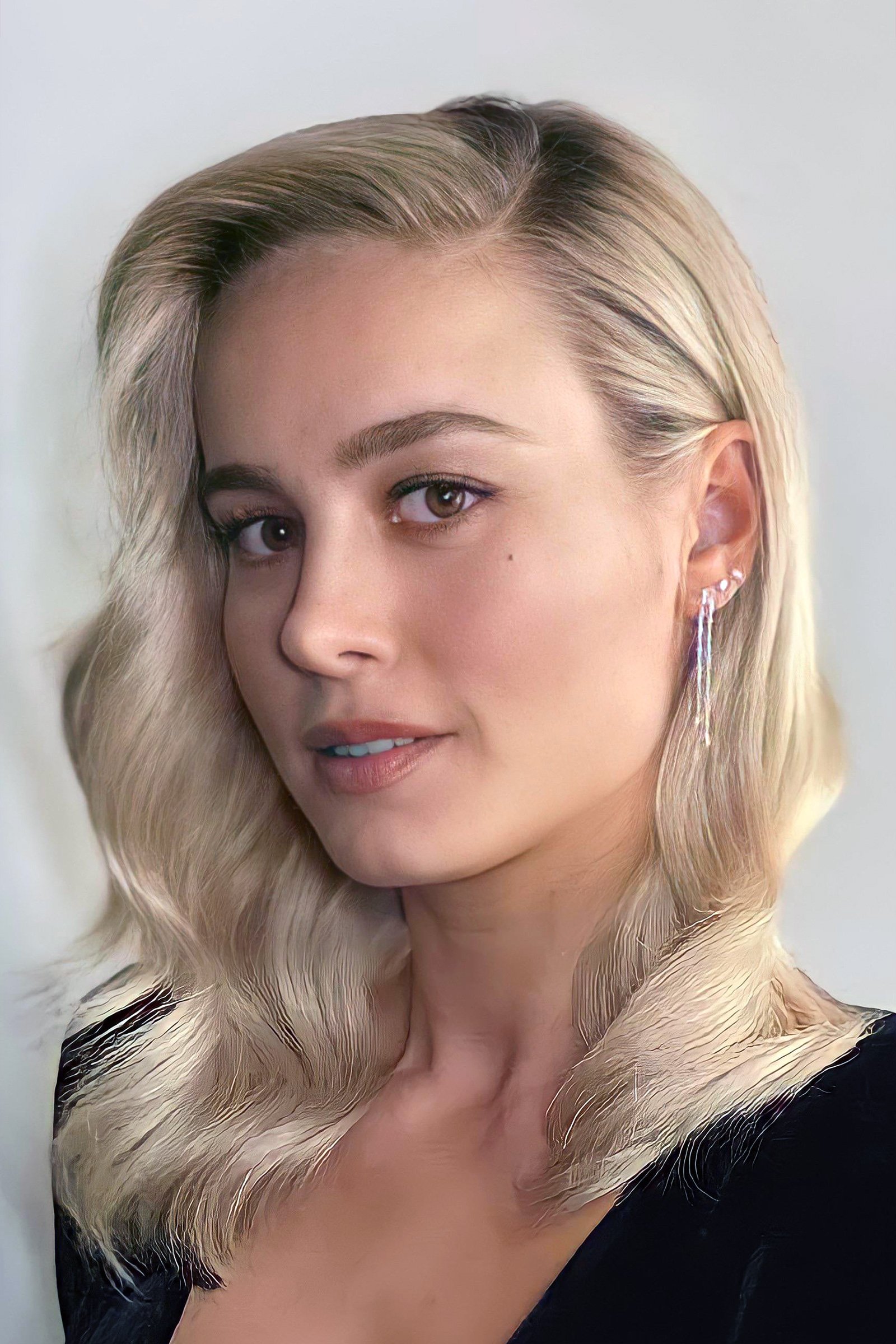

Brie Larson

Brie Larson, known for her role in ‘Captain Marvel,’ consistently uses her influence to advocate for greater diversity in filmmaking. She’s actively worked to include more people from different backgrounds in both the teams making movies and the journalists who cover them. This pushes back against the usual power structures that often result in stories focused primarily on white perspectives. Larson also makes sure the projects she’s involved in avoid using tired and damaging stereotypes about race.

Zendaya

Zendaya actively works to create more realistic and nuanced portrayals of Black women in media, challenging tired stereotypes. She carefully selects projects, asking for characters who are complex and self-sufficient. As an executive producer on ‘Euphoria,’ she helps shape her character’s story, ensuring it isn’t simply used to support the development of white characters. She prioritizes having creative control to avoid falling into predictable tropes.

Regina King

The Academy Award-winning actress and director has made a commitment to ensure that half of the people working on her film and television projects are women. She often includes this requirement in her contracts to create a more inclusive and diverse workplace. This commitment is important because it changes how stories are told, preventing them from focusing solely on white experiences, especially when telling stories about communities of color. For example, her film ‘One Night in Miami…’ highlights Black voices and celebrates Black intellectual thought and camaraderie.

Octavia Spencer

After working on ‘The Help’, Octavia Spencer has become a strong advocate for fair pay and creative control for Black actresses. She famously teamed up with Jessica Chastain to successfully negotiate a salary five times higher than her original offer, proving the effectiveness of working together. Spencer now prioritizes roles that give her characters rich, complex backgrounds and motivations that aren’t tied to white characters. Through her production company, she aims to tell historically accurate stories that avoid the trope of a white character saving the day.

Jessica Chastain

Jessica Chastain is a passionate supporter of equal representation for all genders and races. She consistently prioritizes diversity in her work, often requiring it as a condition for her participation. She uses her influence to guarantee fair pay and equal recognition for her colleagues from underrepresented groups. By championing inclusion riders, she actively works against stereotypical narratives, like the ‘white savior’ trope, and helps foster more balanced and inclusive storytelling in the projects she’s involved with.

Tracee Ellis Ross

I’ve always been so impressed by Tracee Ellis Ross’s dedication to telling Black stories authentically. She consistently fights to ensure Black women are seen on screen with depth and complexity, not just as characters meant to educate others. It’s amazing how she uses her power as an actress and producer – even negotiating her contracts – to make sure these nuanced portrayals happen and that Black culture is always honored. She really prioritizes stories that reflect our experiences, on our own terms, and I admire that so much.

America Ferrera

America Ferrera has been a strong advocate for improved Latinx representation, particularly through her work with Harness. She consistently uses her platform as an actress and producer to make sure Latinx stories are told authentically, from the perspective of people within the community. She champions diverse teams of writers and actors, helping to avoid stereotypes where Latinx characters are only supporting roles or depend on non-Latinx heroes. When negotiating contracts, she focuses on making lasting, systemic changes that prioritize genuine and culturally accurate storytelling.

Thandiwe Newton

Following the 2018 Oscars, ‘Westworld’ actress Thandie Newton publicly committed to using inclusion riders – contracts that require a certain level of diversity – for all her future projects. She’s made it clear she won’t work on films or shows that don’t prioritize diversity and inclusion. Newton actively uses her platform to champion stories that represent a wider range of perspectives, moving beyond narratives focused solely on white experiences. This ensures fairness and representation are built into projects from the very beginning.

Kerry Washington

Through her company, Simpson Street, Regina King focuses on producing stories about women of color. She uses her influence to make sure these stories are authentic and avoid relying on predictable, often harmful, stereotypes. For example, her work on ‘Little Fires Everywhere’ tackled difficult issues of race and motherhood without providing simple answers for white characters. King champions a creative process where people from marginalized groups have the ultimate decision-making power.

Mindy Kaling

Mindy Kaling has consistently worked to increase South Asian representation in television and film, both in front of and behind the camera. Through shows like ‘The Mindy Project’ and ‘Never Have I Ever,’ she features stories centered around strong, independent Indian-American characters. She also makes sure her productions prioritize diversity by requiring diverse writers’ rooms, avoiding stereotypical storylines. Because of her success, she’s able to set a high bar for inclusivity in all her projects.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Best TV Shows Featuring All-White Casts You Should See

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- Umamusume: Gold Ship build guide

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Actors Who Refused Autographs After Becoming “Too Famous”

- The Most Famous Foreign Actresses of All Time

2026-03-13 12:15