As a seasoned researcher with a keen interest in the dynamic world of cryptocurrencies, I find the recent trends in Bitcoin ownership particularly intriguing. The shift in dynamics, as revealed by CryptoQuant, suggests a potential market stabilization, which is music to my ears after the turbulent ride we’ve seen this year.

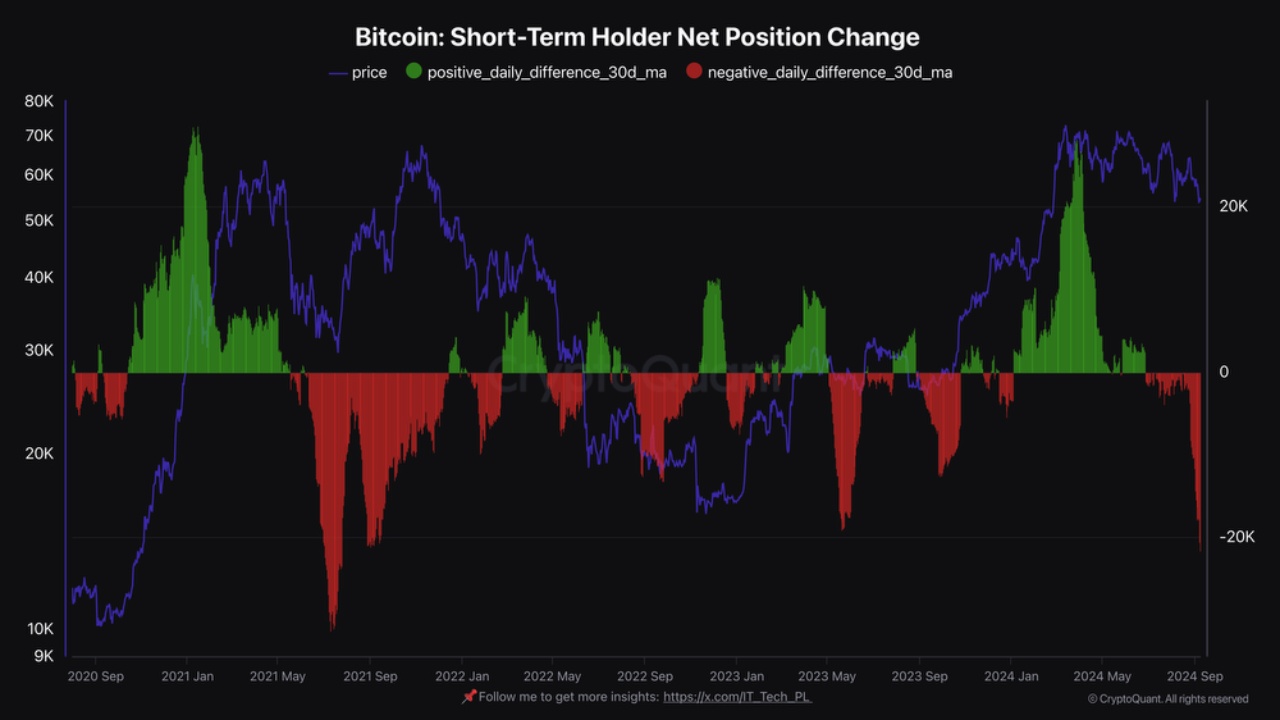

A crypto analytics firm named CryptoQuant has found in a recent study that there’s been a noticeable change in Bitcoin ownership patterns. It appears that individuals who own Bitcoin for 155 days or fewer (referred to as short-term holders) have been gradually decreasing their holdings since late May. This reduction suggests a possible decline in the desire for Bitcoin among these investors.

As a researcher examining Bitcoin’s dynamics, I’ve observed an interesting pattern emerging. While short-term investors seem to be offloading their BTC, long-term holders appear to be steadily increasing their positions. Data from CryptoQuant reveals this trend quite clearly over the last few months, with a substantial decrease in short-term holder positions, particularly noticeable in July and August.

The rapid selling by short-term investors might cause an increase in medium-term prices and market stabilization, as suggested by CryptoQuant contributor IT Tech. This is based on the data that shows a definite movement of funds from less experienced investors to more experienced ones, indicating a stable market scenario.

Over the last fortnight, short-term investors have been leaving the market, either cashing out profits or taking losses. This trend follows closely after the cryptocurrency market’s sentiment plummeted to “extreme fear,” with Bitcoin’s price falling to around $53,500 in a significant downturn. Consequently, the overall market capitalization of the crypto space has dropped below the $2 trillion threshold.

The Crypto Fear & Greed Index, a measure that reflects overall investor sentiment and interest towards the crypto market, dipped to 22. However, it has since begun to rebound. The index reached its lowest point, 6, when Bitcoin fell below $18,000 in 2022 following the demise of the well-known cryptocurrency exchange FTX.

Bitcoin has bounced back and is currently valued at approximately $56,700. Interestingly, certain analysts are optimistic about the digital currency, with MetaShackle, a cryptocurrency analyst on TradingView, recently presenting analysis suggesting that Bitcoin’s chart appears to be forming a “huge” cup and handle pattern, which might potentially result in a significant price surge.

Read More

- SOL PREDICTION. SOL cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- SKL PREDICTION. SKL cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- ‘Miraculous: Tales of Ladybug & Cat Noir’ Gets Anime Twist

- Chainsaw Man Chapter 183: Flashback To See Aki And Power Return; Release Date, Where To Read, Expected Plot And More

- USD MYR PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- PEOPLE PREDICTION. PEOPLE cryptocurrency

- CHR PREDICTION. CHR cryptocurrency

2024-09-12 07:20