We often hear about the biggest names in acting, but many incredibly talented performers consistently deliver outstanding work without getting the same level of attention. These actors are often the heart of critically acclaimed movies and TV shows, fully embodying their characters and elevating every project they’re a part of, no matter how big or small the role. This is a look at some of those hardworking and exceptionally skilled individuals who have quietly built impressive careers.

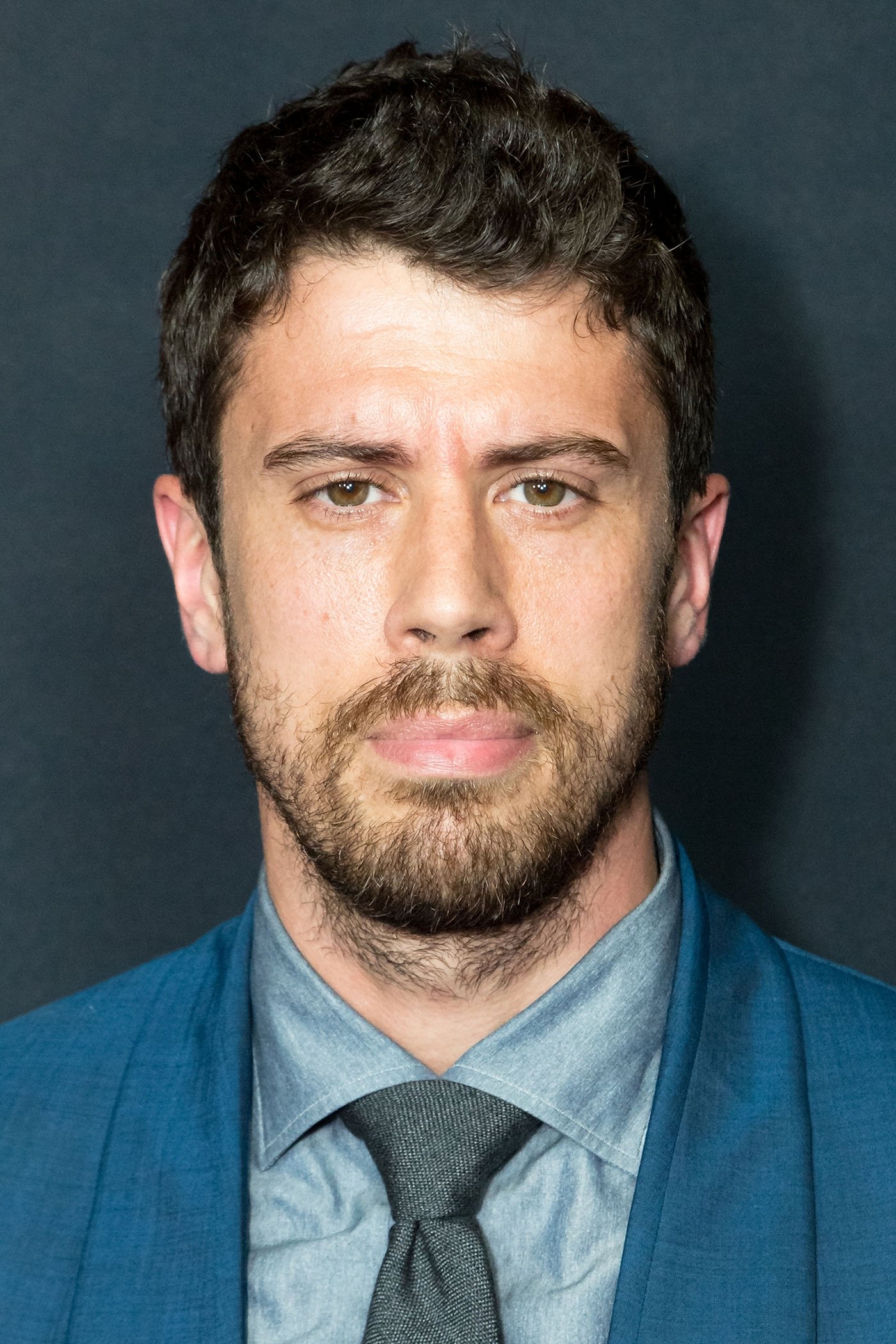

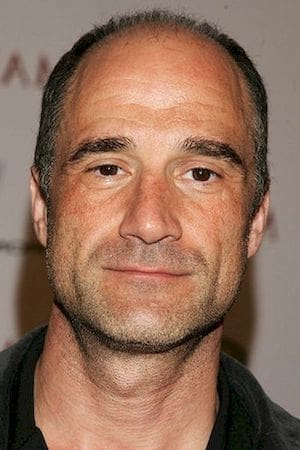

Ben Foster

Ben Foster is a remarkably talented actor known for completely transforming himself for his roles in a variety of films. He gained widespread praise for his performance as a troubled bank robber in the modern Western, ‘Hell or High Water,’ and has consistently proven his range, playing characters like soldiers and outlaws in films such as ‘The Messenger’ and ‘Hostiles.’ Foster is dedicated to authenticity, often undergoing significant physical changes or in-depth research for each role. Despite consistently strong reviews, he remains a surprisingly underappreciated actor in Hollywood.

Shea Whigham

Shea Whigham is a consistently excellent character actor known for his strong performances in both movies and TV shows. He became widely recognized for his role as Elias Thompson on ‘Boardwalk Empire’ and has since appeared in well-known films like ‘Take Shelter’ and ‘The Wolf of Wall Street,’ as well as many independent projects. Even in smaller roles, Whigham brings a remarkable depth and subtlety to his characters. Over the years, he’s proven his versatility by convincingly portraying a wide variety of roles across different time periods and locations.

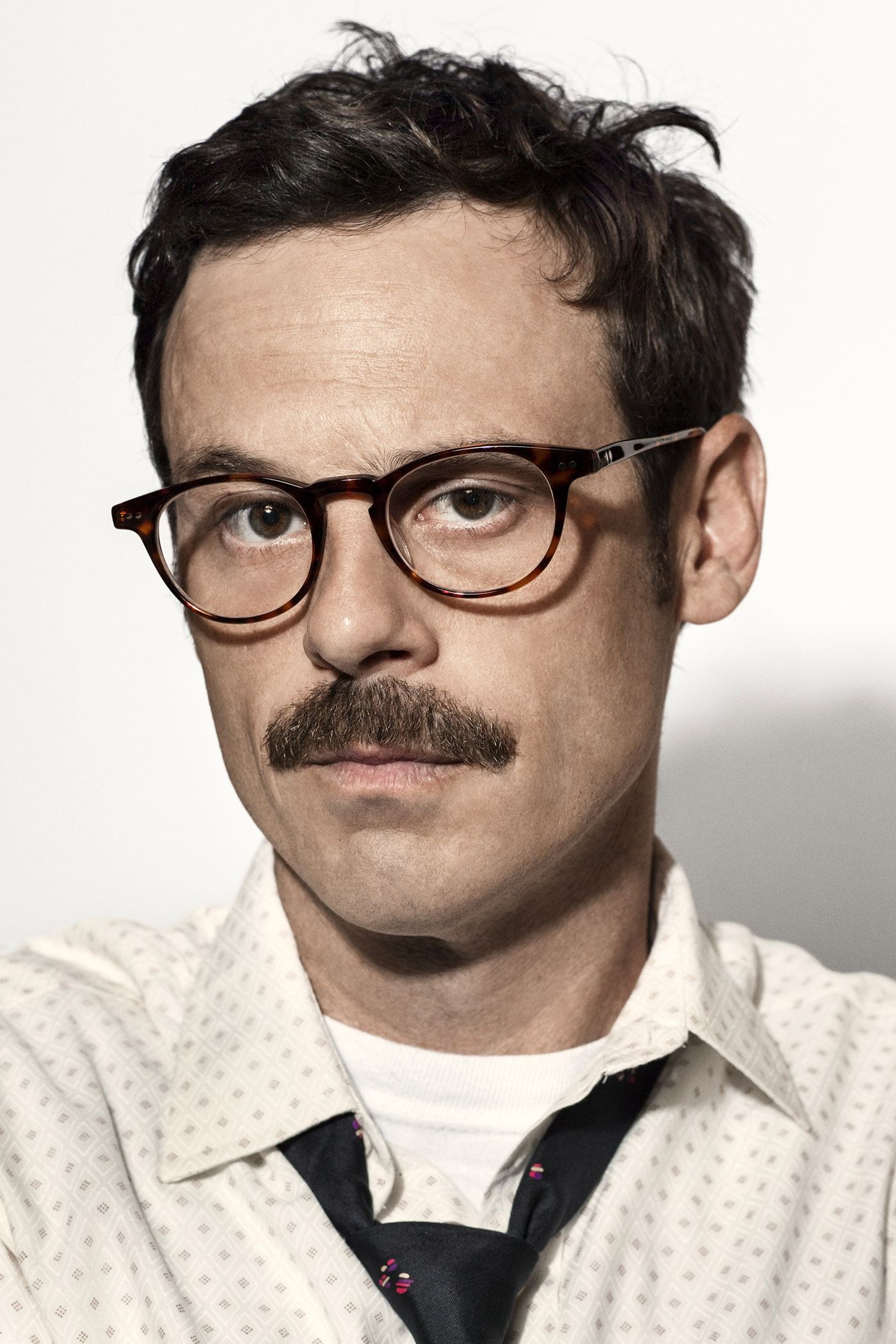

Scoot McNairy

As a movie fan, I’ve really come to appreciate Scoot McNairy. He’s one of those actors who just disappears into his roles. I first noticed him in ‘Argo’ – he was totally believable as one of the hostages. But then I watched ‘Halt and Catch Fire,’ and wow, he really showed what he could do with a long-running character, changing and growing over the whole series. What I love about him is how real he feels in everything he does; it’s no wonder directors keep working with him. He’s great in both smaller indie films and big blockbuster movies, which is pretty impressive.

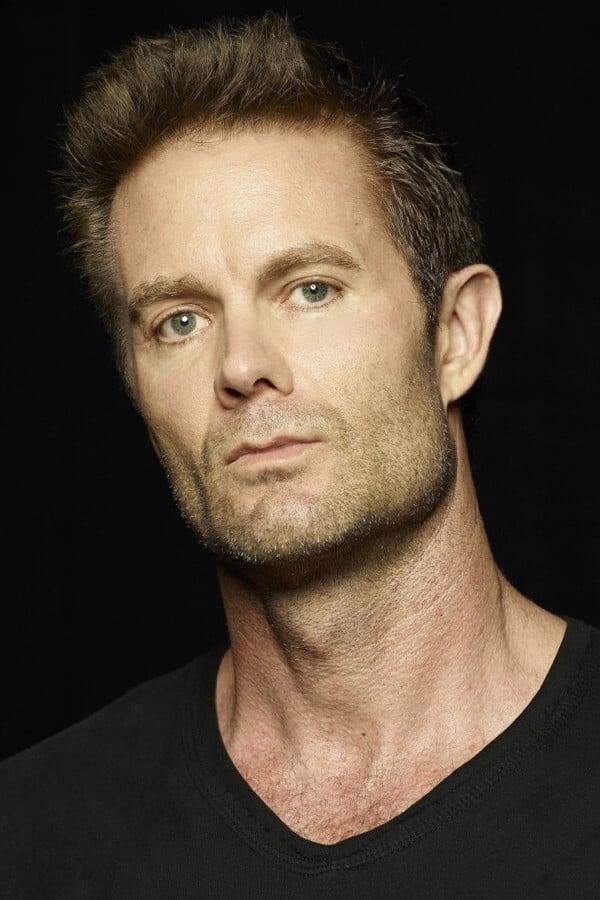

Garret Dillahunt

Garret Dillahunt is known for his versatility as an actor, often portraying very different characters, even within the same show. He first gained attention for playing two separate roles in the series ‘Deadwood,’ showcasing his impressive range. He’s also delivered memorable supporting performances in films like ‘No Country for Old Men’ and ‘Widows,’ and proven his comedic timing in shows like ‘Raising Hope.’ Dillahunt continues to be a consistently excellent and hardworking actor in a variety of genres.

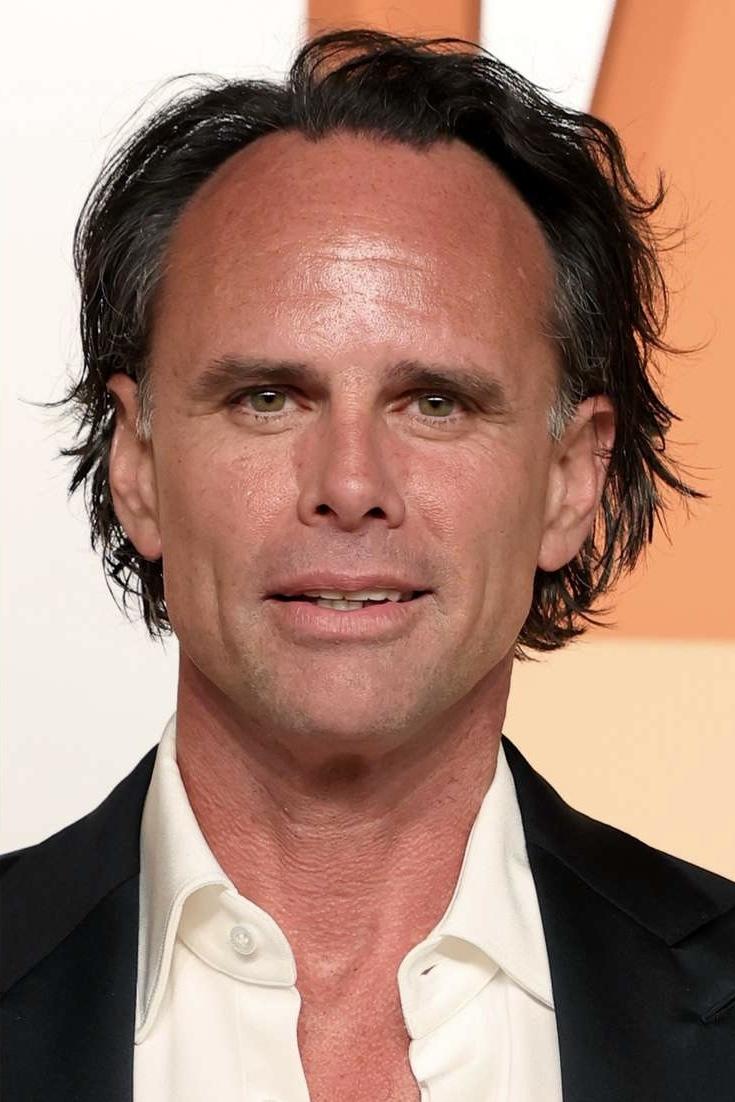

Walton Goggins

Walton Goggins is a captivating actor, especially known for playing complex, often questionable, characters. He first gained widespread recognition for his role as Shane Vendrell in the acclaimed series ‘The Shield’. He continued to prove his talent as Boyd Crowder in ‘Justified’, establishing himself as one of the best actors in the industry. Goggins has also impressed audiences in films like ‘The Hateful Eight’ and ‘Django Unchained’, both directed by Quentin Tarantino. He brings a special energy and charm to every role, making each character truly unforgettable.

Jesse Plemons

Jesse Plemons has become a highly respected actor, moving from a promising newcomer to a leading talent in Hollywood. He first caught attention as Landry Clarke on ‘Friday Night Lights,’ where his realistic acting stood out. He then impressed audiences with intense roles in ‘Breaking Bad’ and ‘Fargo,’ demonstrating his skill with complex and dark characters. Plemons has continued to star in critically acclaimed films like ‘The Power of the Dog’ and ‘Killers of the Flower Moon,’ consistently delivering strong performances alongside well-known actors. He’s known for his subtle and natural acting style, which allows him to create characters that feel authentic and relatable.

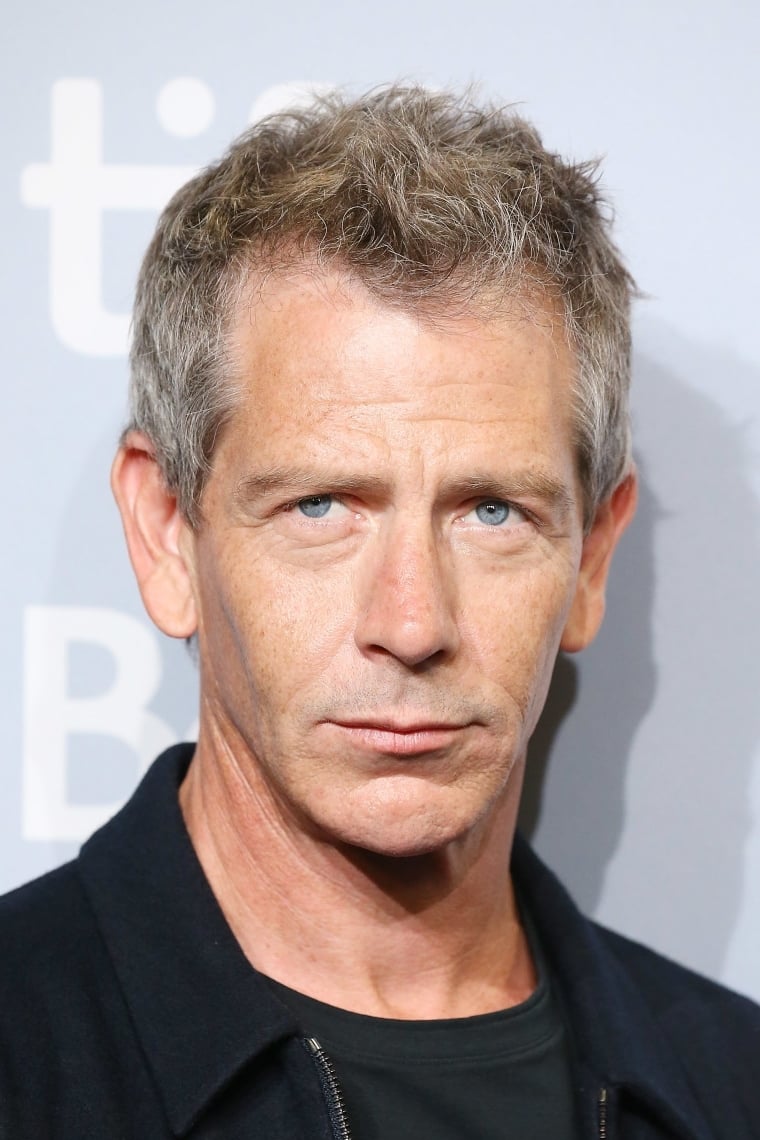

Ben Mendelsohn

Ben Mendelsohn is an Australian actor who has become a familiar face in Hollywood, known for playing complicated and often troubled characters. He first gained widespread recognition for his role in the crime drama ‘Animal Kingdom,’ which opened doors to many prominent projects. He won an Emmy Award for his performance in the series ‘Bloodline,’ where he brilliantly portrayed both weakness and danger. While appearing in blockbuster franchises like ‘Star Wars’ and ‘Marvel,’ he continues to work on independent films. His unique voice and expressive acting make him a compelling performer to watch.

Paddy Considine

As a movie lover, I’ve always been impressed by Paddy Considine. He’s one of those British actors who just completely throws himself into every role, whether it’s in a smaller independent film or a big blockbuster. I first noticed him in films like ‘A Room for Romeo Brass’ and ‘In America’ – he’s just so raw and honest in his performances. But honestly, his work as Viserys Targaryen in ‘House of the Dragon’ was something else entirely – he gave that character so much complexity and depth. And it’s not just acting, either! He’s a really talented director too, often exploring really tough, human stories about finding your way and battling inner demons. It’s clear he’s incredibly dedicated, and that’s why he’s so respected by everyone in the industry.

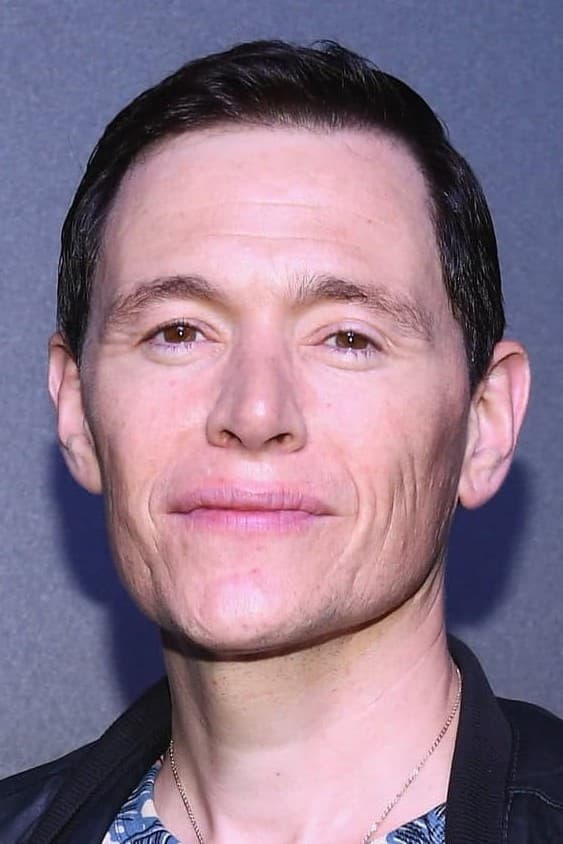

David Dastmalchian

David Dastmalchian is a successful actor known for playing distinctive and often quirky characters. He started his film career with a notable role in ‘The Dark Knight’ and has worked often with director Denis Villeneuve. He’s been in big movies like ‘Ant-Man’ and ‘The Suicide Squad,’ consistently delivering memorable supporting performances. Beyond acting, Dastmalchian is a writer and producer, even creating and starring in the highly praised horror film ‘Late Night with the Devil.’ He’s become a beloved figure among genre fans thanks to his ability to make even unusual characters feel relatable and human.

Caleb Landry Jones

Caleb Landry Jones is an actor celebrated for taking on unique roles and completely transforming himself to become his characters. He first gained recognition in films like ‘The Last Exorcism’ and ‘X-Men First Class’ with his powerful performances. He then captivated audiences with a chilling role in ‘Get Out’ and later won the Best Actor award at Cannes for his performance in ‘Nitram,’ solidifying his reputation as a talented actor. Jones is known for physically changing for roles and fearlessly exploring complex and often disturbing characters. He remains a daring and unpredictable figure in contemporary film.

Toby Kebbell

Toby Kebbell is a remarkably adaptable actor, skilled in both standard acting and performance capture. He first became known for his roles in films like ‘RocknRolla’ and ‘Dead Mans Shoes,’ where he quickly established himself as a compelling presence on screen. Kebbell is also celebrated for his work bringing the character Koba to life in ‘Dawn of the Planet of the Apes’ through motion capture and voice acting, giving the character impressive depth. He’s appeared in blockbuster films such as ‘Kong: Skull Island’ and ‘Warcraft,’ while consistently choosing demanding roles in smaller, independent projects. This combination of skills – conveying emotion through both traditional acting and advanced technology – makes him a truly exceptional performer.

Bill Camp

Bill Camp is a seasoned character actor with a long and successful career in film and television. He’s gained praise for his subtle but impactful performances in shows like ‘The Night Of’ and ‘The Queen’s Gambit’. Camp consistently brings a sense of weight and authority to his roles, and he’s delivered memorable performances in films such as ‘Lincoln’ and ‘Joker’. He’s well-respected by his peers for his reliable work ethic and professionalism.

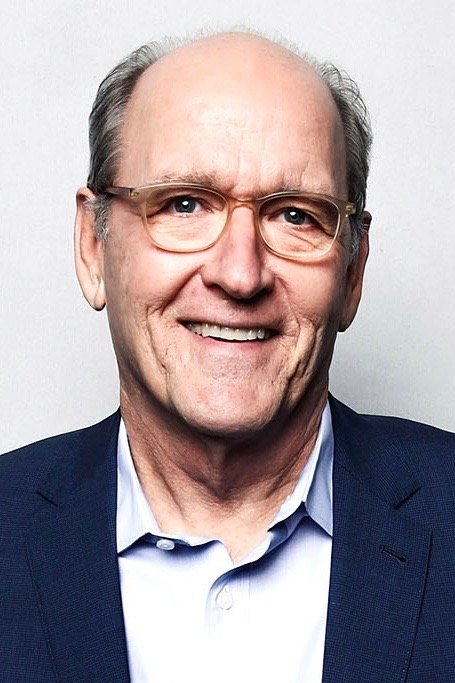

Richard Jenkins

Richard Jenkins is a highly respected actor who became widely known later in his career thanks to consistently strong performances. He gained critical acclaim and an Academy Award nomination for his leading role in ‘The Visitor’, playing a solitary professor. Many recognize him for his portrayal of Nathaniel Fisher, the family head in the acclaimed TV series ‘Six Feet Under’. Jenkins also won an Emmy for his work in the miniseries ‘Olive Kitteridge’ and has appeared in popular and successful films such as ‘The Shape of Water’ and ‘Step Brothers’, showcasing his talent for both drama and comedy. His versatility and ability to convey deep emotion have established him as a consistently dependable actor.

John Carroll Lynch

John Carroll Lynch is a highly skilled character actor known for fitting effortlessly into any movie or TV show. Many people first noticed him in ‘Fargo,’ where his calm performance stood out against the film’s intense energy. He’s played real people, like Arthur Leigh Allen in ‘Zodiac,’ and delivered memorable, unsettling roles, such as Twisty the Clown in ‘American Horror Story.’ With over a hundred credits including films like ‘The Trial of the Chicago 7’ and ‘The Founder,’ Lynch consistently enhances every story he’s a part of. He’s known for his realistic acting and ability to deeply understand the characters he plays.

James Badge Dale

James Badge Dale is a well-respected actor known for his powerful performances in intense dramas and action movies. He first became widely recognized for his leading roles in the miniseries ‘The Pacific’ and the TV show ‘Rubicon’, proving he could carry a story. While he often appears in supporting roles in big films like ‘The Departed’ and ‘World War Z’, he consistently delivers memorable performances, even with limited screen time. Dale is known for his tough, authentic presence and his ability to show the inner struggles of his characters, making him a highly regarded actor in both television and film.

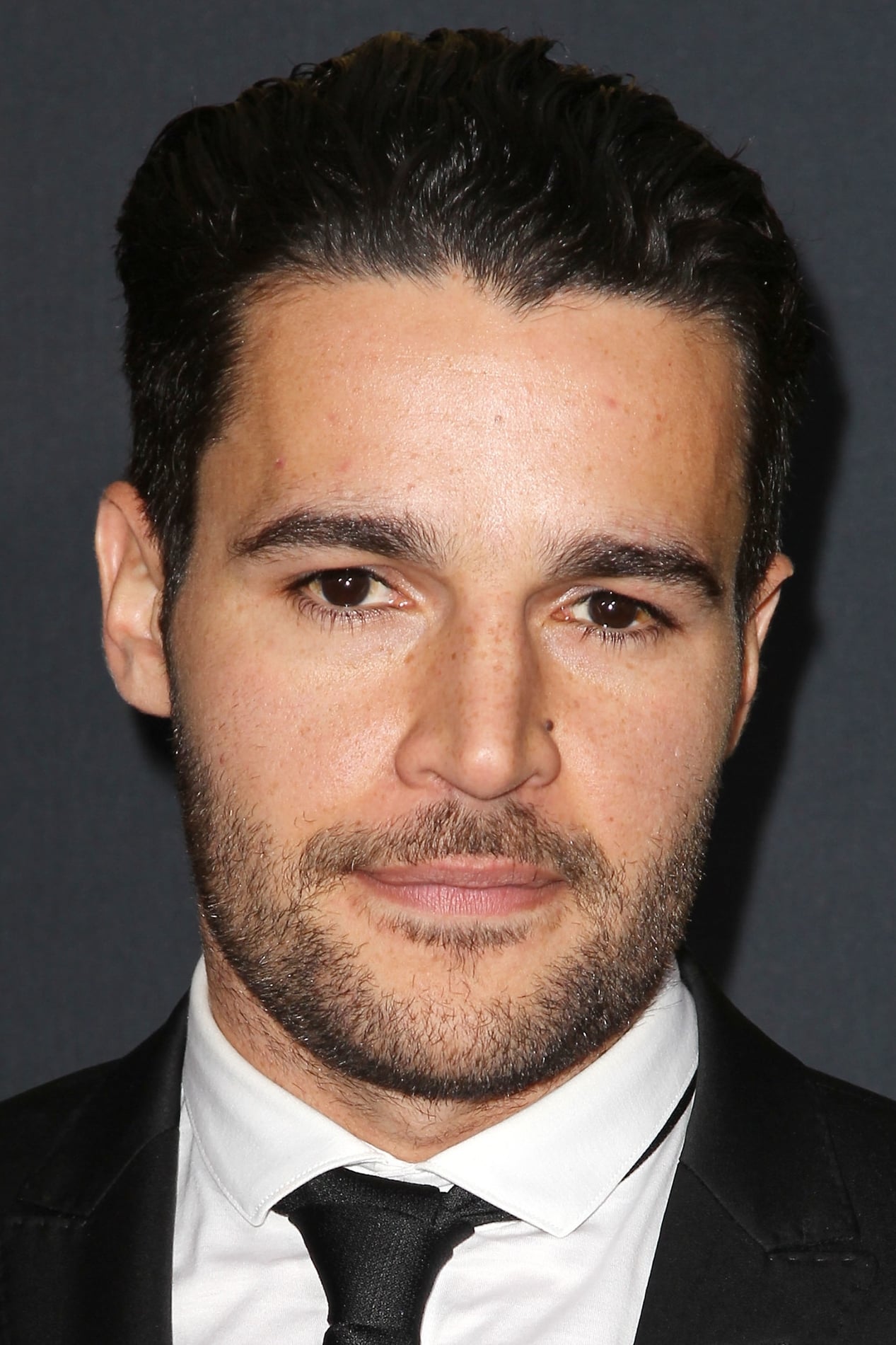

Corey Stoll

Corey Stoll is a remarkably skilled actor who’s become a prominent figure in film and television over the last ten years. He first gained widespread recognition and a Golden Globe nomination for his role as Peter Russo in the hit series ‘House of Cards.’ Since then, he’s appeared in blockbuster films like ‘Ant-Man’ and ‘First Man,’ alongside continuing to work in theater and independent projects. Stoll’s talent lies in his ability to convincingly portray both likeable and menacing characters, showcasing his impressive acting range. He remains a consistently strong and adaptable performer in the entertainment industry.

Alessandro Nivola

Alessandro Nivola is a skilled actor celebrated for his subtlety and ability to transform himself for different roles. While he initially gained recognition in films like ‘Face Off’ and ‘Jurassic Park III’ as a strong supporting actor, he’s earned widespread acclaim for roles in ‘American Hustle’ and, more recently, as Dickie Moltisanti in ‘The Many Saints of Newark,’ a prequel to ‘The Sopranos.’ Nivola is known for his careful preparation and deep understanding of the characters he portrays. He’s a consistently impressive and versatile performer.

Guy Pearce

Guy Pearce is a highly respected Australian actor known for taking on a wide range of demanding roles. He first became famous in the film ‘The Adventures of Priscilla, Queen of the Desert’ and then starred in critically acclaimed movies like ‘L.A. Confidential’ and ‘Memento’. Throughout his career, Pearce has demonstrated an impressive ability to transform himself physically and vocally for each character, as seen in films like ‘The Proposition’ and ‘Prometheus’. He’s also achieved success on television, receiving praise for his performances in shows like ‘Mildred Pierce’ and ‘Mare of Easttown’. His long and successful career highlights his talent and commitment to acting.

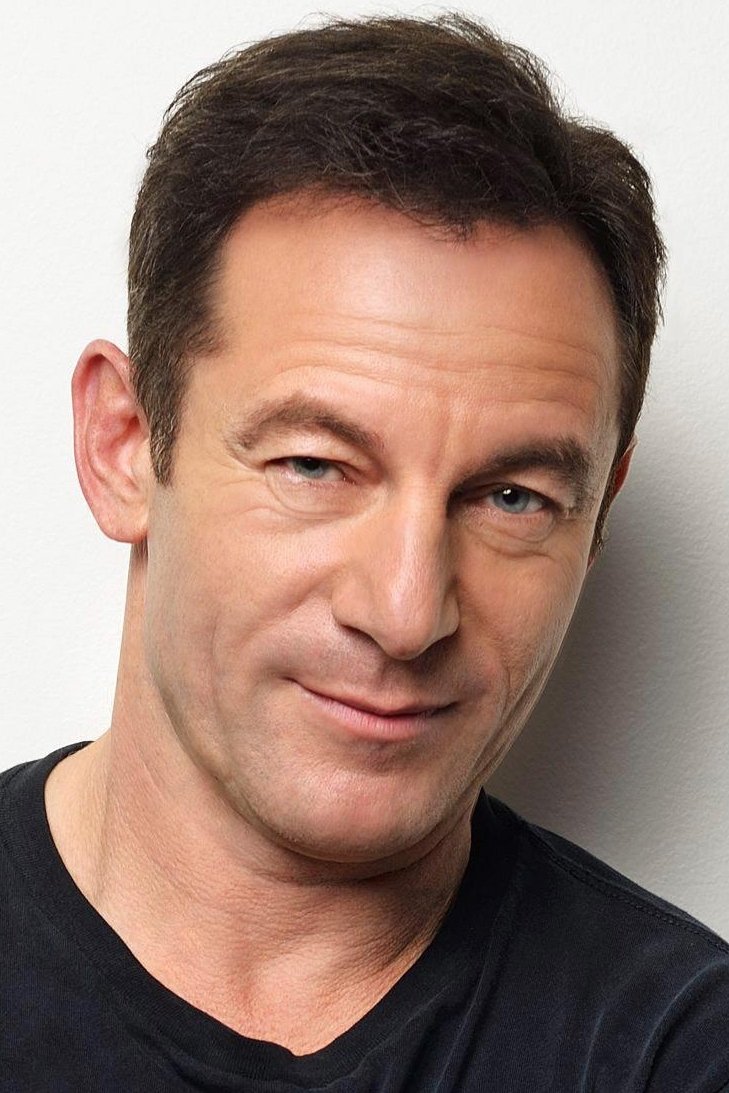

Jason Isaacs

Jason Isaacs is a British actor known for playing compelling villains and figures of authority. He’s widely recognized as Lucius Malfoy in the ‘Harry Potter’ films, where he brought a cool, sophisticated air to the role. Isaacs has also impressed audiences in films like ‘The Patriot’ and ‘Black Hawk Down’, proving he can excel in various types of movies. More recently, he’s shown his strong leadership skills and depth as an actor in television series such as ‘Star Trek Discovery’ and ‘The OA’. He continues to be a popular and respected actor who consistently improves any project he’s a part of.

Elias Koteas

Elias Koteas is a Canadian actor who has consistently worked in film and television for many years. He first became well-known for playing Casey Jones in the original ‘Teenage Mutant Ninja Turtles’ movie, and has since become respected for his serious acting skills. He’s appeared in critically acclaimed films like ‘The Thin Red Line’ and ‘Zodiac,’ delivering subtle and impactful performances. More recently, he gained a strong television fanbase for his role as Alvin Olinsky in the drama ‘Chicago P.D.’ Koteas is a remarkable performer known for his ability to portray quiet strength and deep emotion.

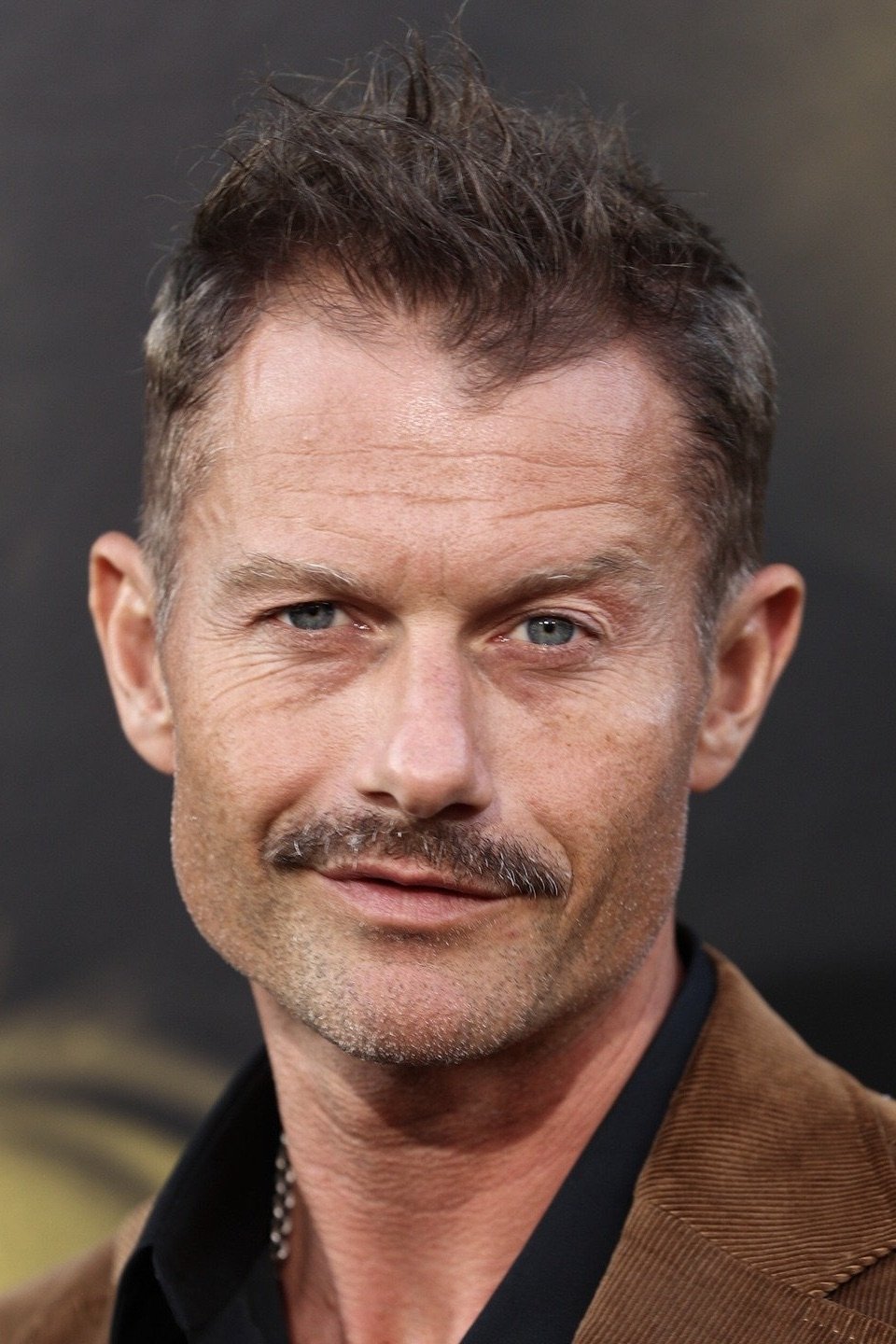

Frank Grillo

Frank Grillo is an actor known for his intense roles and appearances in action-packed movies. Many recognize him as Brock Rumlow from the Marvel Cinematic Universe and for his work in ‘The Purge’ films. He’s often cast in physically demanding roles that require fight training, and he excels in these parts. However, Grillo isn’t limited to action; he’s also demonstrated his acting depth in dramas like ‘Warrior’ and ‘Grey’. He continues to work steadily and is now a prominent figure in the action movie world.

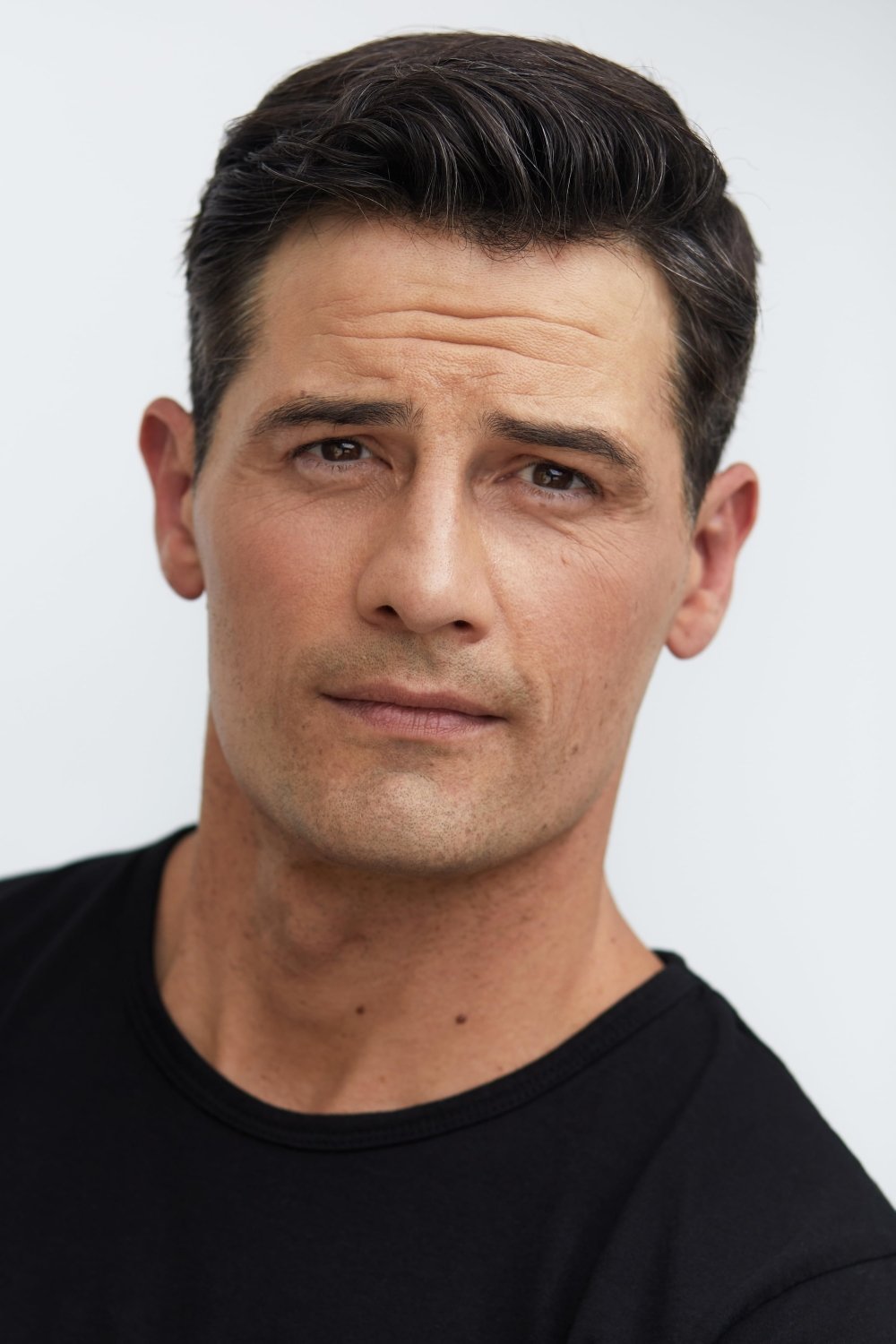

Logan Marshall-Green

Logan Marshall-Green is a talented actor and filmmaker known for his powerful and dedicated performances. He started gaining recognition with roles in popular TV shows like ‘The O.C.’ and ‘24’, and then transitioned to more challenging parts in movies. He received significant praise for his physically and emotionally demanding performance in the sci-fi thriller ‘Upgrade’. In addition to appearing in large-scale films such as ‘Prometheus’ and ‘Spider-Man: Homecoming’, he continues to work on independent projects. Recently, he expanded his creative work by directing his first film, ‘Adopt a Highway’.

Jack O’Connell

Jack O’Connell is a British actor celebrated for his powerful and realistic performances, often playing tough, determined characters. He first gained attention in the TV show ‘Skins’ and then impressed audiences in films like ‘Starred Up’ and ’71,’ showcasing his intense and captivating acting style. A significant break came when Angelina Jolie chose him to play real-life hero Louis Zamperini in the film ‘Unbroken.’ Since then, he’s collaborated with many respected directors on projects such as ‘Godless’ and ‘The North Water,’ solidifying his status as a highly talented and compelling actor.

Dan Stevens

Dan Stevens is a highly adaptable actor who first became well-known for his role as Matthew Crawley on the hit show ‘Downton Abbey’. He then surprised viewers with a chilling and captivating performance in the thriller ‘The Guest’, proving he could excel in roles beyond historical dramas. Stevens went on to star in the unique series ‘Legion’ and played the Beast in the hugely successful live-action ‘Beauty and the Beast’. He consistently chooses interesting and unconventional projects, showing his commitment to creative challenges. Stevens is a remarkably talented actor who seamlessly moves between comedy, drama, and horror.

Joel Edgerton

I’m a huge fan of Joel Edgerton! He’s an incredibly talented Australian actor who’s really made a name for himself worldwide. I first noticed him in ‘Star Wars’, but he’s consistently delivered amazing performances, especially in roles like the ones he had in ‘Warrior’ and ‘The Great Gatsby’ – he’s so good at playing complex characters. But he doesn’t just act! He’s a fantastic writer and director too – I thought ‘The Gift’ and ‘Boy Erased’ were both brilliant. What I really appreciate about his work is how he explores complicated family dynamics and moral issues with such a realistic and subtle touch. He’s just a really solid, respected figure in the industry, both on screen and behind it.

Matthias Schoenaerts

Matthias Schoenaerts is a highly acclaimed Belgian actor known for his strong screen presence and ability to portray deep emotions. He first became well-known for his role in the film ‘Bullhead,’ which was nominated for an Academy Award. He followed this with a standout performance in ‘Rust and Bone’ and has since appeared in several English-language films, including ‘The Drop’ and ‘Far from the Madding Crowd,’ demonstrating his range as an actor. Directors appreciate his skill at communicating complex feelings without a lot of dialogue. He remains a significant presence in both European and American filmmaking.

Mark Strong

Mark Strong is a well-known British actor who consistently delivers powerful performances. He’s incredibly versatile, convincingly playing both villains and heroes in a variety of films. You’ve likely seen him in popular movies like ‘Sherlock Holmes,’ ‘The Imitation Game,’ and the ‘Kingsman’ series, as well as the blockbuster ‘Green Lantern.’ Beyond acting, Strong is also a talented voice artist, lending his voice to numerous projects. He’s a consistently impressive and dependable actor who continues to be a prominent figure in the film industry.

Eddie Marsan

Eddie Marsan is a well-regarded actor known for his consistently strong performances in both film and television. He’s particularly skilled at portraying ordinary or troubled characters, completely immersing himself in each role. Many critics praised his work as Terry Donovan in the series ‘Ray Donovan,’ highlighting his ability to convey a wide range of emotions. He’s worked with acclaimed directors like Mike Leigh and Martin Scorsese on films such as ‘Happy-Go-Lucky’ and ‘Gangs of New York,’ consistently delivering memorable supporting performances. Marsan remains a reliable and important figure in the acting industry.

Toby Stephens

Toby Stephens is a British actor who has enjoyed a successful career in theater, film, and television. He became widely known for playing the villain Gustav Graves in the James Bond movie ‘Die Another Day’ and later starred as Captain Flint in the popular series ‘Black Sails,’ which ran for four seasons. Stephens is also a respected stage actor, having played many leading roles with the Royal Shakespeare Company. More recently, he appeared as John Robinson in the series ‘Lost in Space,’ introducing him to a new audience. He’s a versatile actor, capable of convincingly portraying both heroes and villains with charm and complexity.

Jimmi Simpson

Jimmi Simpson is a talented actor who’s known for bringing a special, often quirky energy to his roles. He became more widely known for playing William in the popular sci-fi series ‘Westworld,’ where he showed off his ability to handle complex characters. Simpson has appeared in many different TV shows, like ‘It’s Always Sunny in Philadelphia’ and ‘House of Cards,’ proving he can excel in both comedy and drama. He’s also been in films such as ‘Zodiac’ and ‘Under the Silver Lake,’ highlighting his range as an actor. He remains a popular and distinctive performer, consistently bringing something unique to every project.

Billy Magnussen

Billy Magnussen is a successful actor known for his work in movies, television, and theater. He first became popular for his funny performances in films like ‘Into the Woods’ and ‘Game Night,’ where his excellent comedic timing and charm were on full display. He’s also proven himself as a dramatic actor in projects like ‘The Many Saints of Newark’ and ‘No Time to Die,’ where he played important supporting roles. On stage, he’s earned a Tony Award nomination and continues to impress audiences with his range. Whether playing likable or conceited characters, Magnussen consistently stands out.

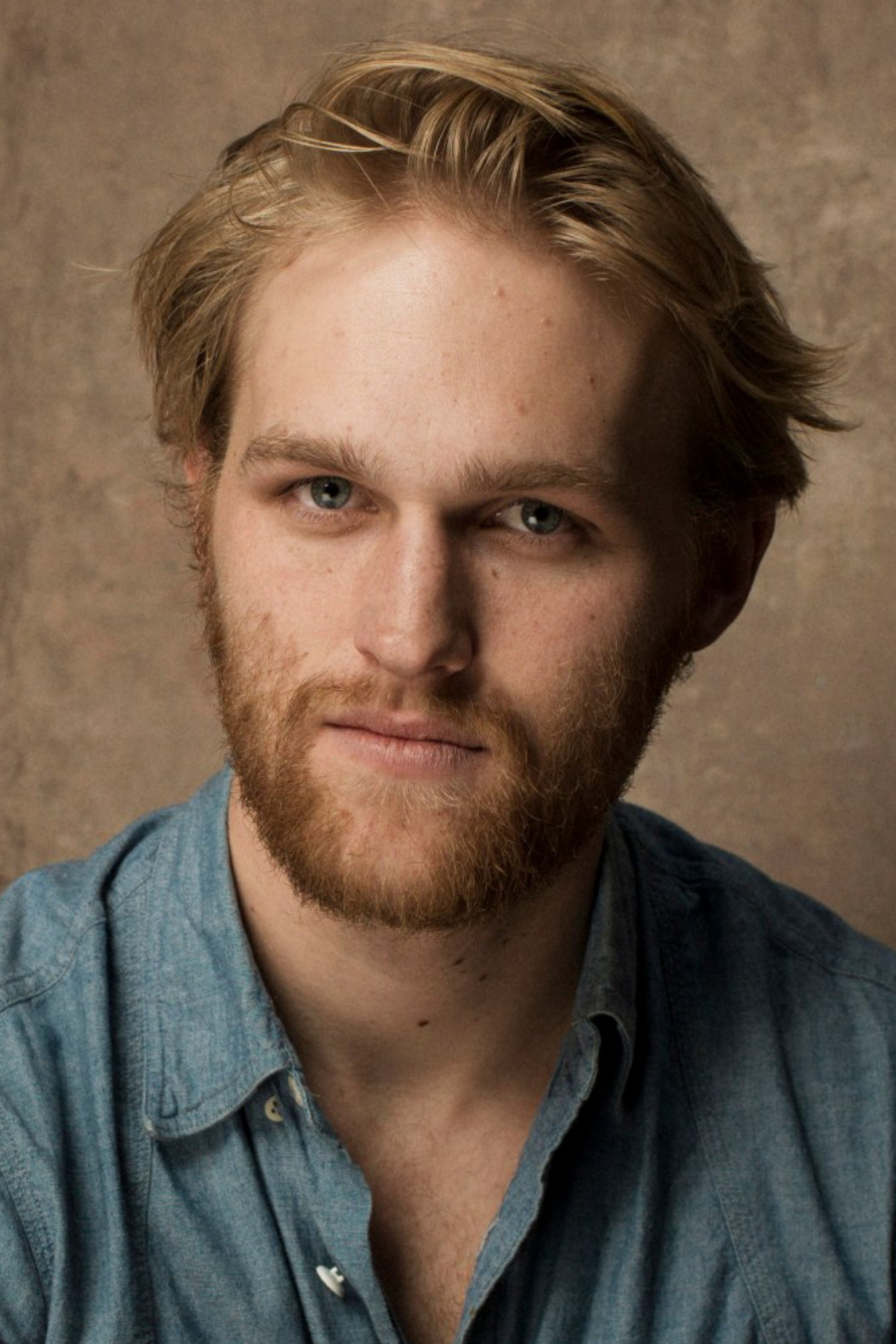

Wyatt Russell

Wyatt Russell is a talented actor who also had a career as a professional hockey player. He first became known for his comedic role in ’22 Jump Street’ and later proved his acting range in the horror film ‘Overlord’. Many viewers recognize him as John Walker from the Marvel series ‘The Falcon and the Winter Soldier’, where he gave a particularly compelling performance. He’s also starred in the series ‘Lodge 49’ and appeared in ‘Everybody Wants Some’, showcasing his ability to act naturally and convincingly. Russell continues to take on diverse roles, proving his skill and adaptability as an actor.

Alden Ehrenreich

Alden Ehrenreich is an actor first spotted by Steven Spielberg, and he’s since collaborated with many top directors. He initially earned praise for his memorable performance in the Coen brothers’ film ‘Hail Caesar,’ and then became internationally known for playing Han Solo in ‘Solo: A Star Wars Story.’ Beyond those roles, Ehrenreich has appeared in films like ‘Beautiful Creatures’ and ‘Blue Jasmine,’ and led the cast of the series ‘Brave New World,’ proving his ability to carry a show. His recent work in ‘Oppenheimer’ further demonstrated his talent, and he consistently chooses complex and demanding roles. This commitment has earned him the respect of those he works with.

Jack Lowden

As a real cinema fan, I’ve been consistently impressed with Jack Lowden. He’s a Scottish actor who’s really made a name for himself quickly. I first noticed him in ‘Dunkirk’ – that role really put him on the map! Since then, he’s given fantastic performances in films like ‘Mary Queen of Scots’ and ‘Fighting with My Family’, proving he can handle a lot of different types of characters. Right now, I’m loving his work as River Cartwright in ‘Slow Horses’ – he’s just brilliant in it. And it’s not just screen work; he’s a celebrated stage actor too, having even won an Olivier Award! He just brings such a genuine quality to everything he does, and I genuinely think he’s one of the most exciting actors working today.

George MacKay

George MacKay is a British actor celebrated for his powerful and physically committed performances. He gained widespread recognition for his leading role in ‘1917,’ a visually stunning war film made to appear as one continuous shot, demanding incredible concentration. He’s also appeared in highly praised movies like ‘Captain Fantastic’ and ‘Pride,’ proving his versatility as an actor. His dedication to complex and challenging characters was further highlighted in ‘True History of the Kelly Gang.’ MacKay remains a striking and gifted actor who consistently delivers exceptional work in contemporary cinema.

Joe Cole

Joe Cole is a British actor best known for his roles in hit TV shows like ‘Peaky Blinders’ where he played John Shelby, and ‘Gangs of London’ as Sean Wallace. He’s proven he can lead intense, action-packed series. Cole has also appeared in ‘Black Mirror’ and gave a compelling performance in the film ‘A Prayer Before Dawn’, portraying a real prisoner training in Thai boxing. He’s known for bringing a realistic and powerful energy to his characters. Cole continues to choose varied and demanding roles, showcasing his talent and versatility.

Cosmo Jarvis

Cosmo Jarvis is a highly acclaimed actor and musician known for his intense and realistic performances. He first gained recognition in the film ‘Lady Macbeth’ and further impressed audiences with his emotionally nuanced role in ‘Calm with Horses’. More recently, he achieved international fame as John Blackthorne in the series ‘Shogun’, bringing a powerful and raw energy to the character. Jarvis frequently portrays complex, often troubled, characters with remarkable sensitivity, establishing himself as a distinctive and captivating talent.

Christopher Abbott

As a film buff, I’ve been consistently impressed by Christopher Abbott. He really gravitated towards independent films early on, and he’s fantastic at portraying characters who are deeply complex and keep a lot hidden inside. Most people probably first noticed him as Charlie in ‘Girls,’ but for me, he truly came into his own with leading roles in films like ‘James White’ and ‘It Comes at Night’ – those performances were incredible. He also nailed the role of John Yossarian in ‘Catch-22.’ And he’s continued to take on interesting and challenging parts in films like ‘Possessor’ and, more recently, ‘Poor Things,’ proving just how versatile he is. What I really appreciate about his acting is how subtle and realistic it feels – he lets you really connect with what his characters are going through. He’s definitely one of the most respected actors working in independent cinema today.

Michael Stuhlbarg

Michael Stuhlbarg is a remarkably talented actor celebrated for his complete dedication to each role. He first gained widespread recognition with a Golden Globe nomination for his performance in ‘A Serious Man’ and has consistently appeared in prominent films and television shows ever since. In a single year, he was part of three films nominated for Best Picture – ‘The Shape of Water,’ ‘Call Me by Your Name,’ and ‘The Post’ – demonstrating both his talent and work ethic. He’s also delivered memorable supporting roles in series like ‘Boardwalk Empire’ and ‘Dopesick.’ Stuhlbarg’s ability to embody diverse characters has earned him a reputation as one of the most respected character actors working today.

Tracy Letts

Tracy Letts is a highly accomplished actor, playwright, and screenwriter. He’s best known for winning a Pulitzer Prize for his play, ‘August Osage County,’ and for memorable roles in films like ‘Lady Bird’ and ‘Ford v Ferrari,’ where he consistently delivers strong performances. He’s also recognizable from his work on the TV series ‘Homeland’ and the film ‘The Post,’ often playing characters with a sense of power and control. Letts’ skill in crafting stories and developing characters clearly enhances his acting, making each performance feel authentic and complete. He continues to be a significant and respected figure in theater and film.

Michael Chernus

Michael Chernus is a talented and hardworking actor who’s appeared in many movies, TV shows, and plays. He’s widely recognized for playing Cal Chapman on ‘Orange Is the New Black,’ bringing both humor and heart to the role. He’s also been in films like ‘Captain Phillips’ and ‘Spider-Man: Homecoming,’ consistently delivering strong performances even in smaller roles. Chernus is a critically acclaimed stage actor, having won several awards for his work. He has a special talent for making his characters feel genuine and relatable, no matter what kind of story he’s in.

Dallas Roberts

Dallas Roberts is a skilled actor known for bringing depth and nuance to his roles, often portraying thoughtful or conflicted characters. He became more widely known for playing Milton Mamet on ‘The Walking Dead’ and for his work on ‘The Good Wife’, where he showed his versatility. While appearing in films like ‘Walk the Line’ and ‘3:10 to Yuma’, he also demonstrated his comedic side in the series ‘Insatiable’. Early in his career, he received critical acclaim for his work in independent films such as ‘A Home at the End of the World’. Roberts remains a consistently strong and talented actor in the industry.

Enver Gjokaj

Enver Gjokaj is an actor known for his impressive ability to convincingly change his appearance and voice to fit different characters. He first became well-known for playing multiple roles on the show ‘Dollhouse’, showcasing remarkable skill in each one. He then joined the Marvel universe as Agent Daniel Sousa in ‘Agent Carter’ and ‘Agents of S.H.I.E.L.D.’, quickly becoming popular with fans. Throughout his work in various TV shows and films, Gjokaj consistently proves his range and depth as an actor, earning praise from both his peers and viewers for his commitment to bringing characters to life.

Burn Gorman

Burn Gorman is a British actor recognized for his striking look and talent for playing compelling, often villainous, characters. He first became well-known for his role as Owen Harper in the sci-fi show ‘Torchwood’ and has since appeared in numerous popular films and TV series. Notable performances include roles in ‘Pacific Rim’ and ‘The Dark Knight Rises,’ as well as recurring parts in shows like ‘Game of Thrones’ and ‘The Expanse.’ Gorman is known for his energetic acting style and dedication to creating memorable, unique characters. He continues to be a popular and impactful actor in every project he takes on.

David Wenham

David Wenham is a celebrated Australian actor who’s gained international recognition for his work in popular film series like ‘The Lord of the Rings’ – where he played Faramir – and ‘300’, where he famously narrated the story as Dilios. He’s also appeared in acclaimed TV shows such as ‘Top of the Lake’ and ‘Iron Fist’, demonstrating his skill as a dramatic actor. Wenham has a strong background in Australian film, earning many awards for his performances there. He’s known for his ability to convincingly play both strong, heroic roles and more sensitive characters, making him a highly versatile and respected actor.

Paul Sparks

Paul Sparks is a highly respected actor known for his subtle yet captivating performances on television and in film. He gained recognition for his roles as Mickey Doyle in ‘Boardwalk Empire’ and Thomas Yates in ‘House of Cards,’ the latter of which received critical acclaim. He’s also appeared in films like ‘Midnight Special’ and ‘The Greatest Showman,’ consistently delivering strong supporting performances. Sparks excels at portraying characters who are quietly complex and compelling, and he remains a consistently impressive actor in a variety of projects, from independent films to big-budget productions.

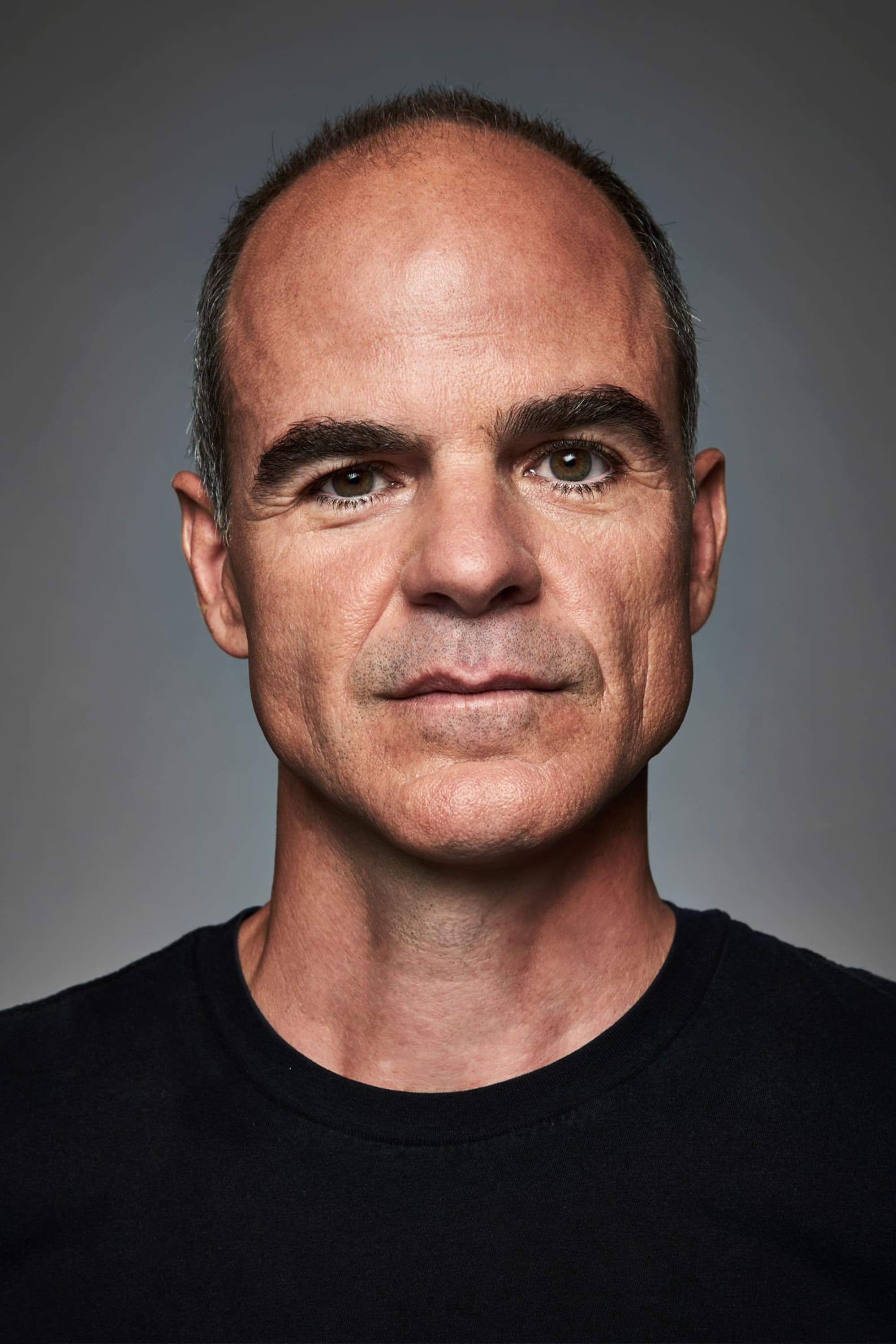

Michael Kelly

Michael Kelly is a well-established actor best known for his compelling performance as Doug Stamper in the hit series ‘House of Cards’. He’s also appeared in popular films like ‘Dawn of the Dead’ and ‘Man of Steel’, consistently bringing a sense of authenticity to his roles. Kelly has led series such as ‘The Long Road Home’ and been a key part of ‘Jack Ryan’, solidifying his status as a top television actor. He’s particularly skilled at portraying characters with both unwavering loyalty and a ruthless edge, making him a memorable performer. Kelly is a consistently reliable and highly regarded talent who enhances any project he’s involved in.

Toby Jones

Toby Jones is a highly respected British actor known for his incredible ability to portray diverse characters, both from history and fiction. He’s earned praise for roles like Truman Capote in ‘Infamous’ and his lead performance in the horror film ‘Berberian Sound Studio’. Beyond independent films, Jones is recognizable from major franchises – he played Arnim Zola in ‘Marvel’ films and famously voiced Dobby in the ‘Harry Potter’ series, proving his range as an actor. He’s also delivered award-winning performances on television in shows like ‘The Girl’ and ‘Detectorists’, showcasing his talent for both drama and comedy. Many consider him one of the best character actors working today.

Stephen Graham

Stephen Graham is a highly acclaimed British actor known for his realistic and powerful performances. He first gained widespread attention for playing Combo in ‘This Is England’ and its follow-up series, demonstrating his impressive range. Graham has also starred in popular shows like ‘Boardwalk Empire’ and the film ‘The Irishman,’ convincingly portraying complex and often intimidating characters. He’s respected throughout the industry for his ability to bring depth and intensity to every role, and consistently seeks out demanding parts that allow him to showcase his skills.

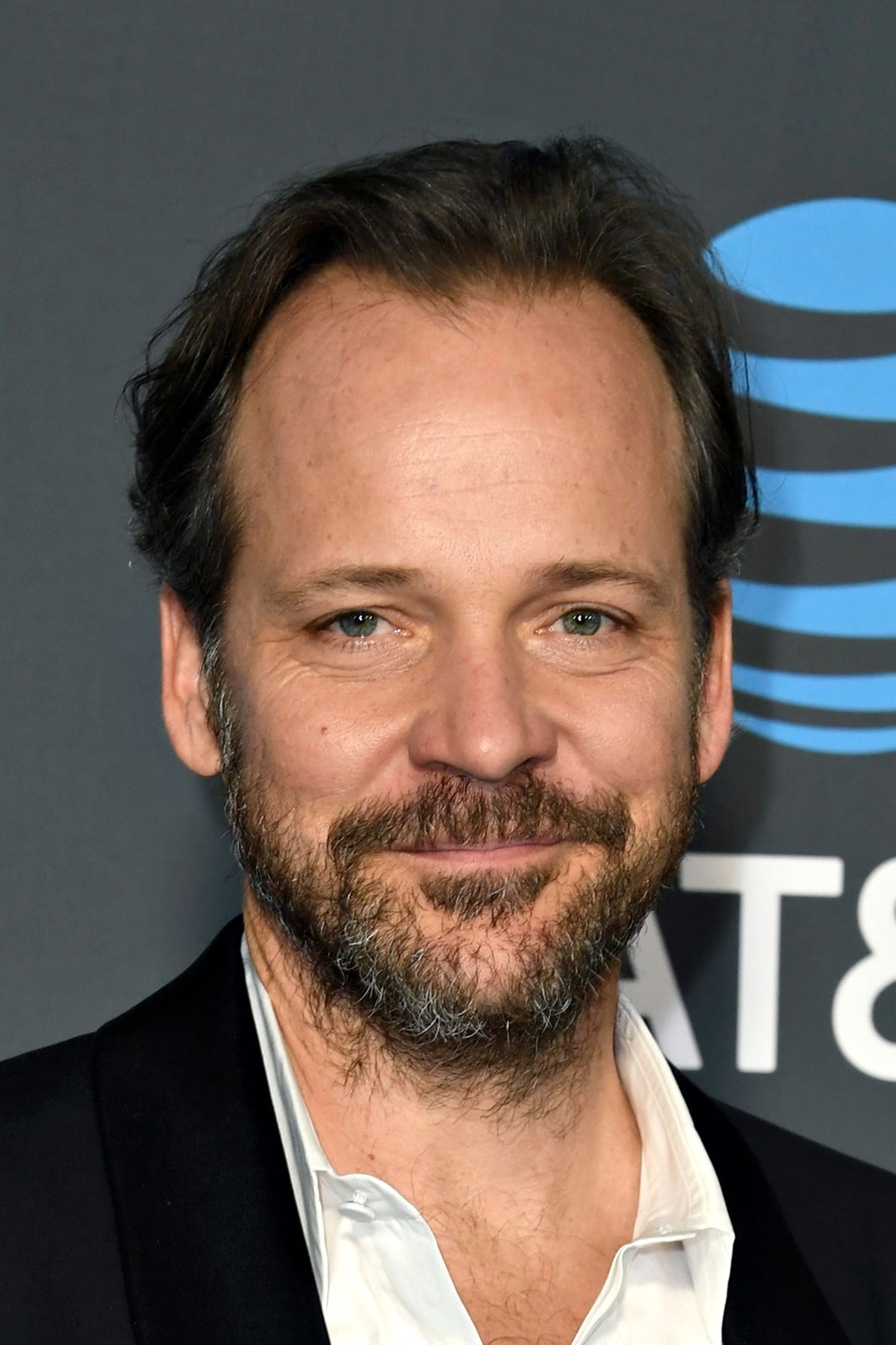

Peter Sarsgaard

Peter Sarsgaard is an actor known for his thoughtful and nuanced performances, often taking on complicated characters with shades of gray. He first gained widespread recognition for his role in ‘Shattered Glass’ as a doubting editor, and has consistently appeared in highly praised films ever since. From the quirky ‘Garden State’ to the coming-of-age story ‘An Education,’ Sarsgaard demonstrates his range and ability to portray deep emotions. He’s skilled at delving into the inner lives of his characters, bringing a subtle but compelling intensity to his work. He remains a reliable and well-regarded actor in both independent and mainstream films.

Tell us which other talented actors you believe deserve more attention in the comments.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Best TV Shows Featuring All-White Casts You Should See

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- Umamusume: Gold Ship build guide

- Gold Rate Forecast

- Most Famous Richards in the World

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 39th Developer Notes: 2.5th Anniversary Update

2026-03-11 15:22