Hassie Harrison, known for playing Laramie on Yellowstone, is joining the cast of the upcoming Baywatch reboot. The show is currently being developed by Fox and Fremantle, and Harrison will play a new character named Nat.

Nat is an accomplished athlete who grew up in foster care and competed in the Olympics. Now, she works as a professional lifeguard and is a trusted, key assistant to the main character, Hobie Buchannon, according to Deadline.

This new version of Baywatch stars Stephen Amell as Hobie, the son of the original series’ Mitch Buchannon. The story follows Hobie as a Baywatch captain whose life is turned upside down when his long-lost daughter, Charlie, shows up wanting to become a lifeguard.

View this post on InstagramA post shared by ✨hassie harrison✨ (@hassieharrison)

Jessica Belkin will play Charlie Vale, and Thaddeus LaGrone will be Brad in the show. Adding to the nostalgia, David Chokachi, who was in the original series, will return as Cody Madison, now the owner of a beachside restaurant and bar called The Shoreline.

Production on the first season, which will have 12 episodes, is set to begin in Los Angeles this spring. The network intends to premiere the show as part of its 2026–2027 season, updating the classic series for today’s viewers with the return of the famous red swimsuits.

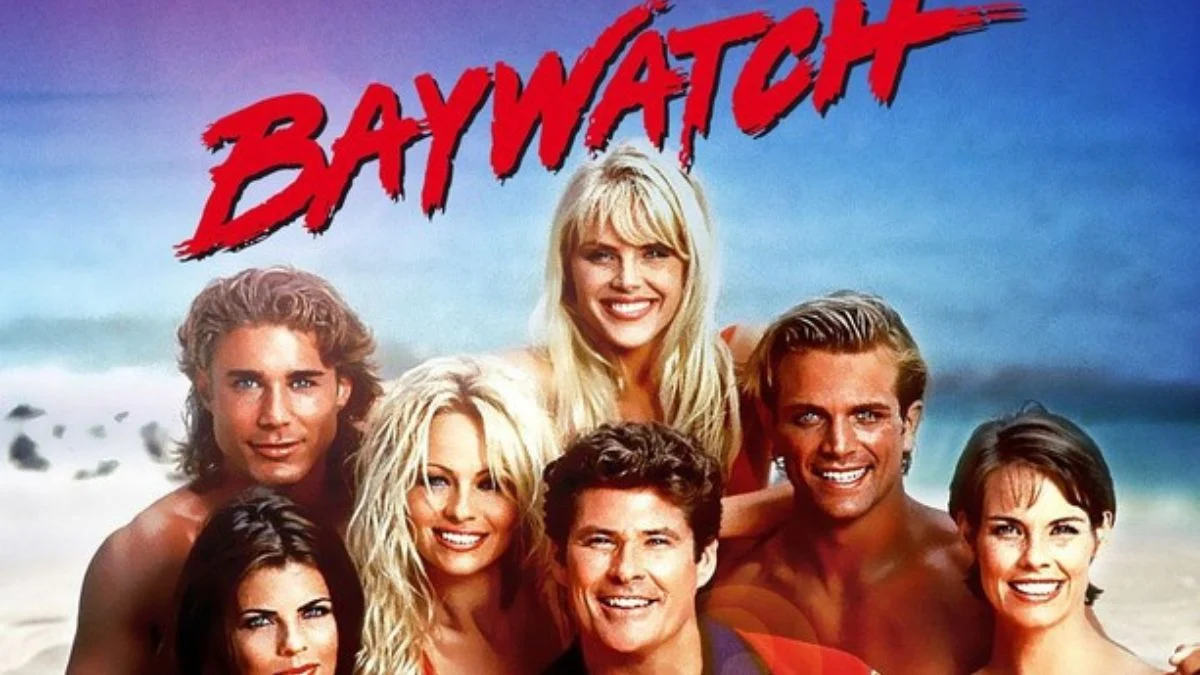

As a lifelong movie and TV fan, I was really excited to hear about the Baywatch reboot! Last year, Fox’s Michael Thorn talked about how the original series basically defined beach culture and turned lifeguards into total icons. Now, they’re teaming up with Fremantle to bring it back for a new generation. The goal? To give us fresh stories, introduce some new faces, and recapture all the fun and excitement that made Baywatch a worldwide phenomenon. Honestly, it sounds like they’re really trying to bring that classic California vibe to a whole new audience, and I’m here for it!

Since leaving Yellowstone after three seasons, Harrison has remained very busy. She starred in the thriller Dangerous Animals in 2025 and just finished filming Deep Eddy, a movie filmed in Austin about a writer looking for his lost partner.

She’s currently filming The Rescue, a modern Western thriller with Paramount, and will be acting alongside Brandon Sklenar. After that, she’ll be in the action-thriller Raven, which also stars Anthony Mackie and Pablo Schreiber.

Fans have also been following her life off-screen, especially her recent marriage to Ryan Bingham, who stars with her on Yellowstone. They tied the knot last year in a Western-style wedding at her family’s ranch in Texas, where they first met while working on the show.

Harrison is taking her acting career to new heights, moving from filming in Montana to sunny Southern California. Viewers who loved the original Baywatch are excited to see how her character, Nat, will contribute to the show’s famous history as a lifeguard team.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-03-09 12:44