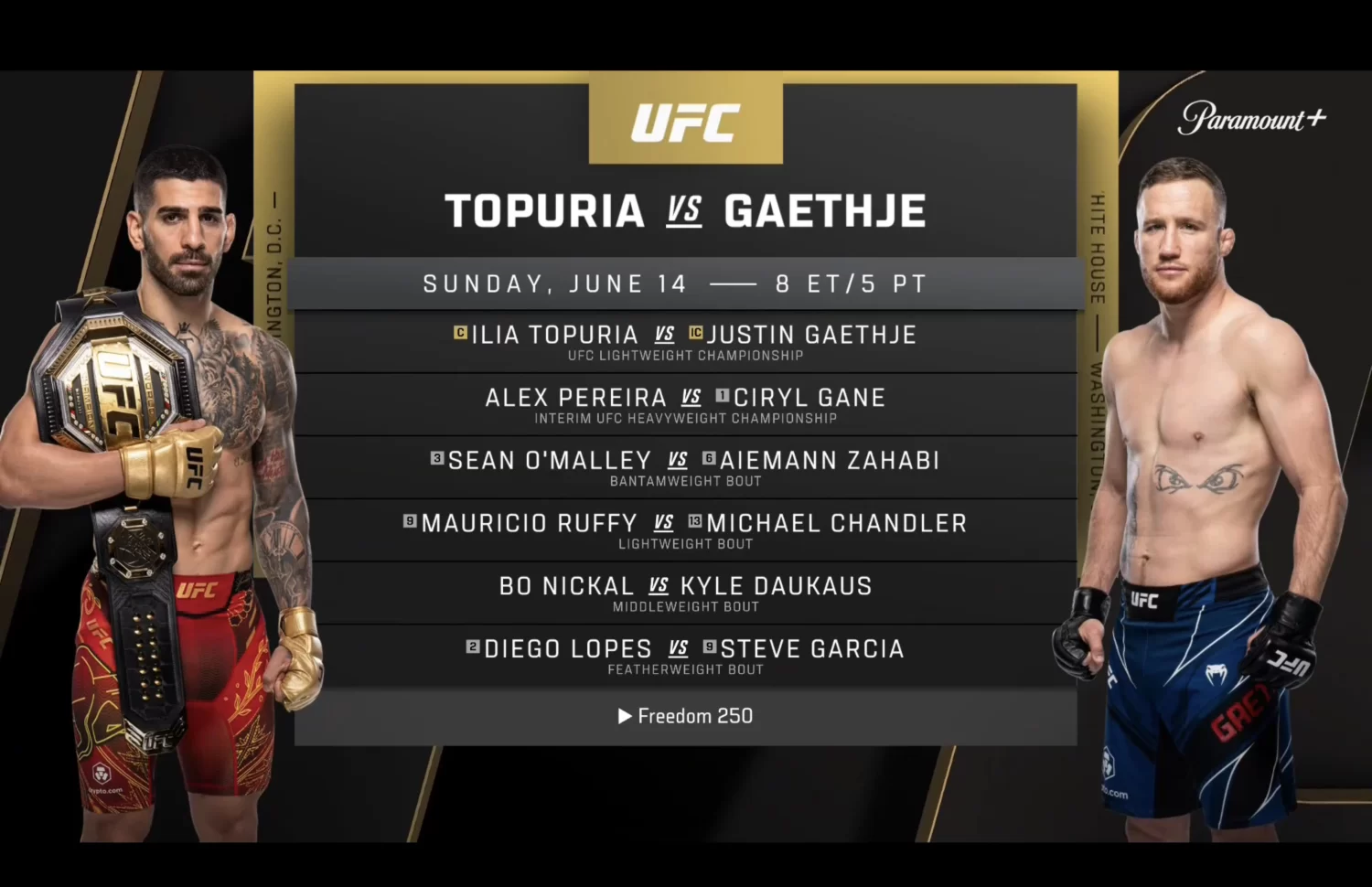

UFC has officially revealed the complete fight card for its June 14th event, headlined by a title match between Ilia Topuria and Justin Gaethje. Dana White has put together a strong lineup of six additional fights for the event, which is being called UFC Freedom 250.

The event will take place on the White House South Lawn in Washington, D.C., as a part of the America 250 festivities.

— UFC (@ufc) March 8, 2026

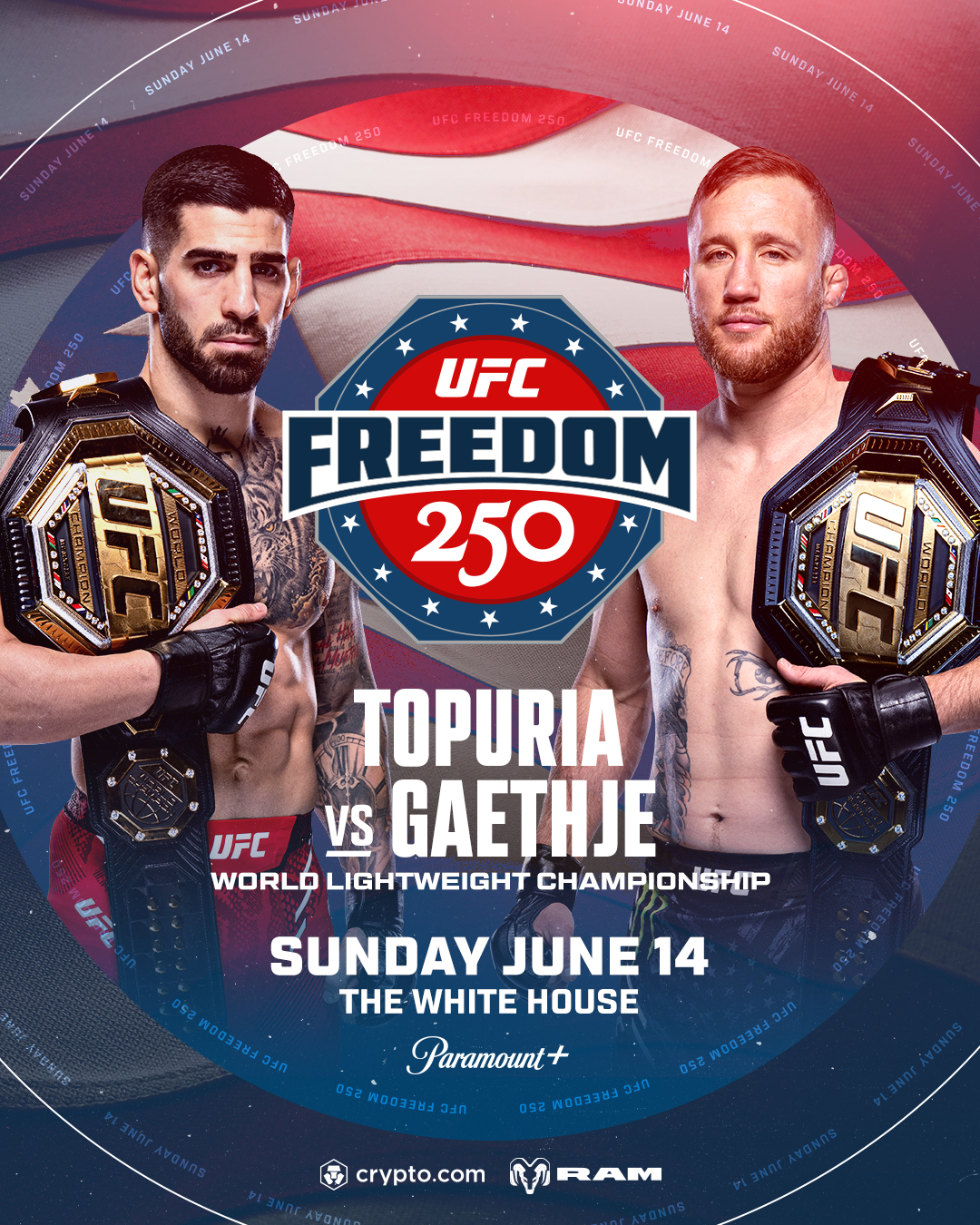

Topuria vs. Gaethje set for the main event

The biggest fight of the night will be between Ilia Topuria, the current lightweight champion, and Justin Gaethje, the interim champion, as they compete to become the undisputed champion.

ESPN announced the fight during Saturday’s UFC 326 broadcast. Topuria is returning to the ring after dealing with personal matters, and Gaethje previously won the interim championship by beating Paddy Pimblett earlier in the year.

This matchup instantly makes the event a major draw. Topuria is still undefeated and quickly becoming a huge name in UFC, and Gaethje is known for his exciting, aggressive fighting style and broad appeal, making him a great fit for this card.

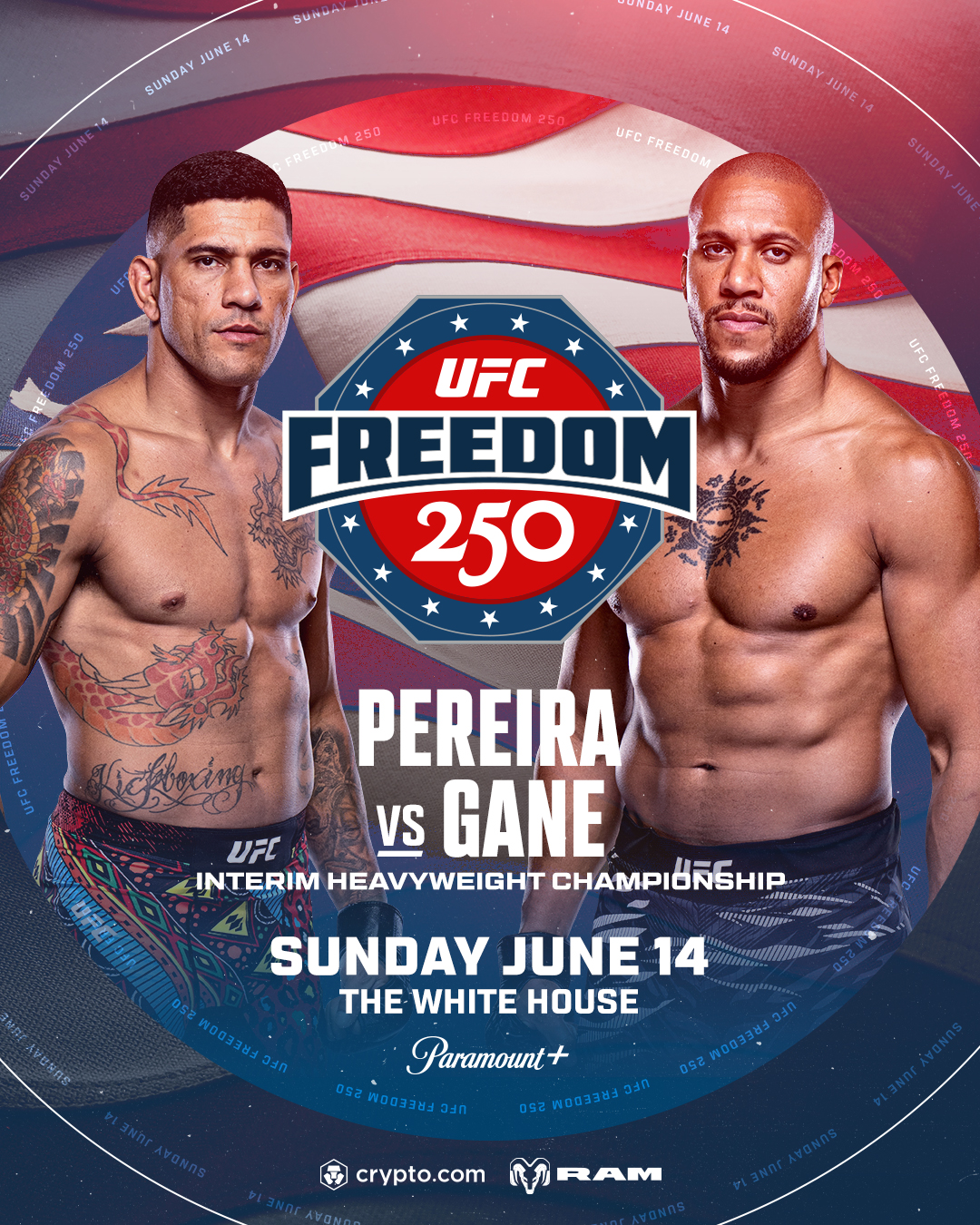

Pereira vs. Gane adds even more star power

The second main event is a huge matchup, with Alex Pereira expected to fight Ciryl Gane for the temporary heavyweight title. This is happening because the current heavyweight champion, Tom Aspinall, is recovering from surgery, so they’ve created an interim belt to keep the division moving.

A win for Pereira would further cement his status as a legend, bringing him closer to a title shot in a new division. The UFC aimed to showcase major stars at this event, and the fight between Pereira and Gane certainly delivers that star power.

Full UFC White House card

The announced card includes:

Ilia Topuria vs. Justin Gaethje

Okay, so we’ve got a title fight here – it’s for the UFC lightweight championship. Ilia Topuria currently is the champion, but Justin Gaethje holds the interim title, meaning this fight will unify the belts and crown one undisputed king. It’s a big one!

Alex Pereira vs. Ciryl Gane

This fight is for the interim UFC heavyweight championship.

Sean O’Malley vs. Aiemann Zahabi

A bantamweight bout that adds another major name to the card.

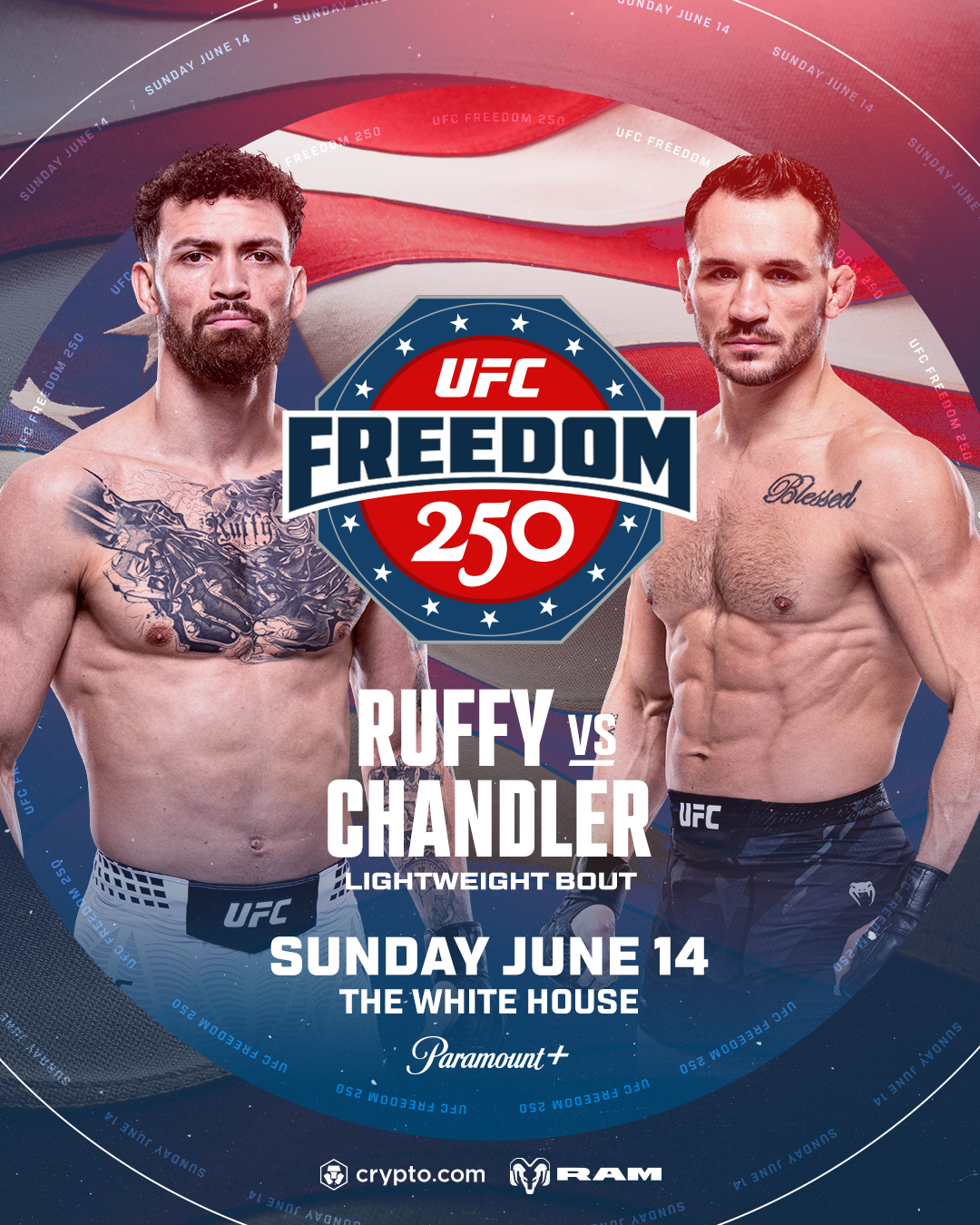

Mauricio Ruffy vs. Michael Chandler

A lightweight fight that could easily steal the show.

Bo Nickal vs. Kyle Daukaus

A middleweight bout featuring one of the UFC’s heavily watched rising names.

Diego Lopes vs. Steve Garcia

A featherweight matchup rounding out the announced lineup.

Why this event is such a big deal

This UFC event is different from most. ESPN reported that the UFC has been planning this event with the White House for months, focusing on the details. TKO CEO Ari Emanuel mentioned they anticipated a small card with around six or seven fights, which now seems accurate as the official lineup includes just six bouts.

The event will likely be held on the South Lawn, and the official weigh-ins will take place at the Lincoln Memorial. ESPN says about 5,000 people are expected to attend, but tickets for the South Lawn won’t be available for public purchase; instead, they’ll be given free to military personnel.

This event is proving incredibly expensive to produce. Dana White, the head of ESPN, has stated the costs are even higher than those for their Sphere show, with estimates reaching tens of millions of dollars.

UFC finally delivers on the White House hype

For months, people had been speculating about who would be on the card, with fighters like Jon Jones and Conor McGregor frequently mentioned as possibilities.

The UFC opted for a solid and exciting card featuring established champions, top challengers, and fighters known to attract viewers.

The fight between Topuria and Gaethje is a major draw, and the Pereira versus Gane matchup also promises to be exciting. Fighters like O’Malley, Chandler, Nickal, and Lopes are all adding to the event’s overall appeal.

Although some fans hoped for even more outlandish names, the official UFC card announced by the White House remains remarkably unique and features a very prominent lineup of fighters.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Best TV Shows Featuring All-White Casts You Should See

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- Umamusume: Gold Ship build guide

- Gold Rate Forecast

- 39th Developer Notes: 2.5th Anniversary Update

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- The Most Famous Foreign Actresses of All Time

2026-03-08 07:02