The market’s been twitching. A nervous tick in a heavyweight. Everyone’s got a worry, a shadow clinging to their portfolio. AI valuations are looking stretched, like a gambler’s last chip. The economy’s humming a tune nobody recognizes. And a distant rumble from Iran adds a little static to the air. The S&P? It’s been doing the jitterbug, up one day, down the next. A predictable mess, really.

But a downturn, see, that’s when the real money moves. Not the frantic scrambling of the amateurs, but the cool, deliberate steps of someone who knows the game. Long-term investing isn’t about catching the peak; it’s about surviving the valley. Five years isn’t a lifetime, but it’s long enough to let a good company breathe, to let it grow, to see if the promise was real or just smoke and mirrors. And when the panic sellers are throwing shares out the window? That’s when you start looking for bargains.

Cathie Wood understands this. She’s not chasing rainbows; she’s building positions. She buys when others are running, betting on the future, even when the present looks like a busted flush. She likes innovation, the long shots, the companies that might actually change things. And she’s been doing some quiet hunting lately. Two names caught my eye.

CoreWeave

March 3rd. Wood added to her stake in CoreWeave. Not a splashy move, but a calculated one. It’s a relatively small position in the Ark Innovation fund – 1.8% – but it’s telling. The stock had taken a hit in February, down 14%. A little bruised, but not broken.

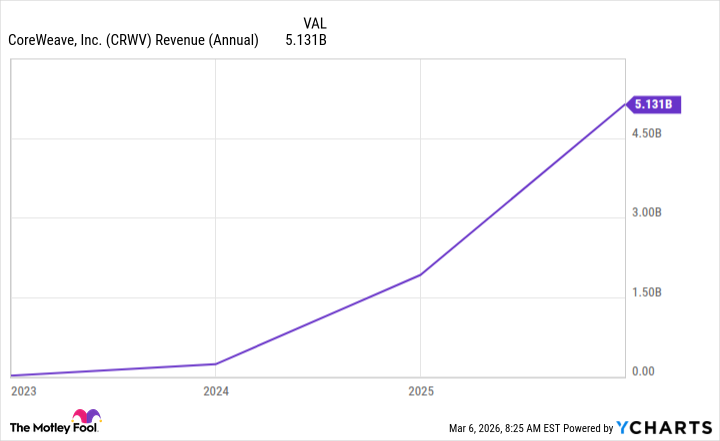

CoreWeave deals in the currency of the future: computing power. Specifically, Nvidia GPUs. They rent out the hardware that fuels the AI boom. Companies are clamoring for access, desperate to get a piece of the action. Building your own infrastructure? Too slow, too expensive, too much hassle. CoreWeave provides the muscle, and revenue is exploding. It’s a simple equation, really.

This isn’t a flash in the pan. We’re still in the early stages of AI actually doing something useful, moving beyond the hype. And as it permeates more and more aspects of life, the demand for computing power will only increase. CoreWeave is positioned to profit. It’s not a guarantee, of course. Nothing is. But it’s a smart play.

Amazon

Wood also added to her Amazon position on March 3rd and 4th, spreading the buy across several of her funds. A 1.9% weighting in Ark Innovation. Again, not a dramatic move, but a deliberate one. Amazon isn’t just riding the AI wave; it’s building the surfboard.

They’re using AI to streamline their e-commerce operations, optimize delivery routes, and enhance the customer experience. It’s about efficiency, about squeezing every last drop of value out of the system. And Amazon Web Services? That’s where the real money is being made. They’re a leading provider of AI products and services, generating an annual revenue run rate of $142 billion. They’re opening capacity and monetizing it immediately. That’s the sound of a well-oiled machine.

AWS dominates the cloud market, and that existing customer base gives them a significant advantage in the AI space. They’re not solely reliant on AI, either. They’ve got a diversified business, a solid foundation. Amazon shares were trading at 28x forward earnings after the recent dip. A reasonable price for a company with this much potential. Wood saw it. I see it. It’s not about getting rich quick; it’s about building a portfolio that can withstand the storms.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- Top 20 Educational Video Games

2026-03-08 02:12