Throughout cinema history, many African-American actors have become iconic for their powerful on-screen presence. From the early stars of blaxploitation films to today’s action heroes, they’ve consistently played strong, memorable characters – from soldiers and martial arts experts to detectives and complex, morally gray figures. This selection celebrates the actors who have built lasting careers portraying physically imposing, intense, and undeniably tough characters.

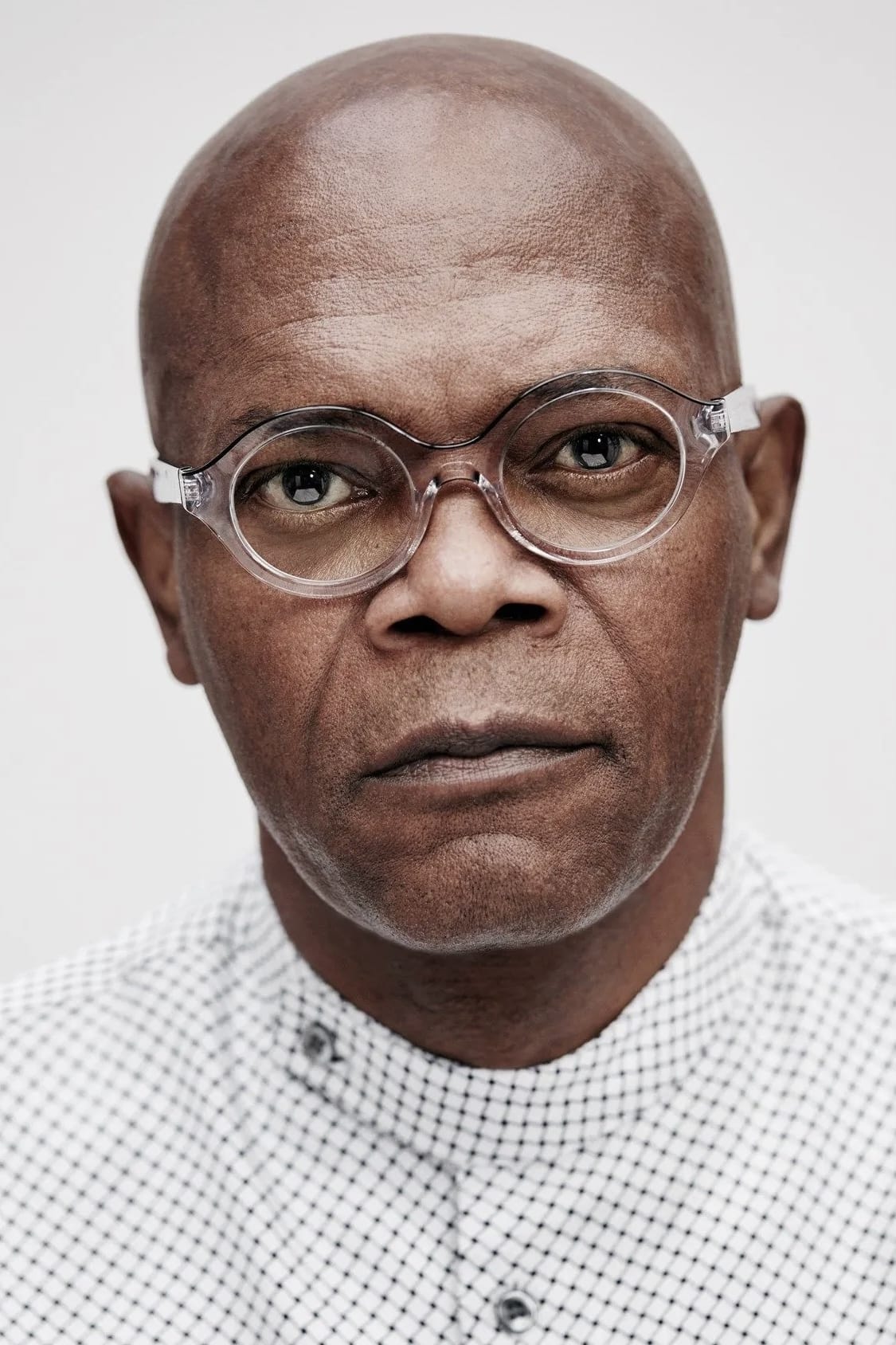

Samuel L. Jackson

Samuel L. Jackson is known for playing strong, commanding characters throughout his long career. He became a global star with his role as Jules Winnfield in ‘Pulp Fiction’ (1994). Since then, he’s played many important characters, like Mace Windu in the ‘Star Wars’ prequels and Nick Fury in the Marvel movies. Jackson is often cast as someone who takes charge, using both powerful words and a strong presence. His characters usually face tough situations, handling them with a combination of cleverness and a threatening attitude.

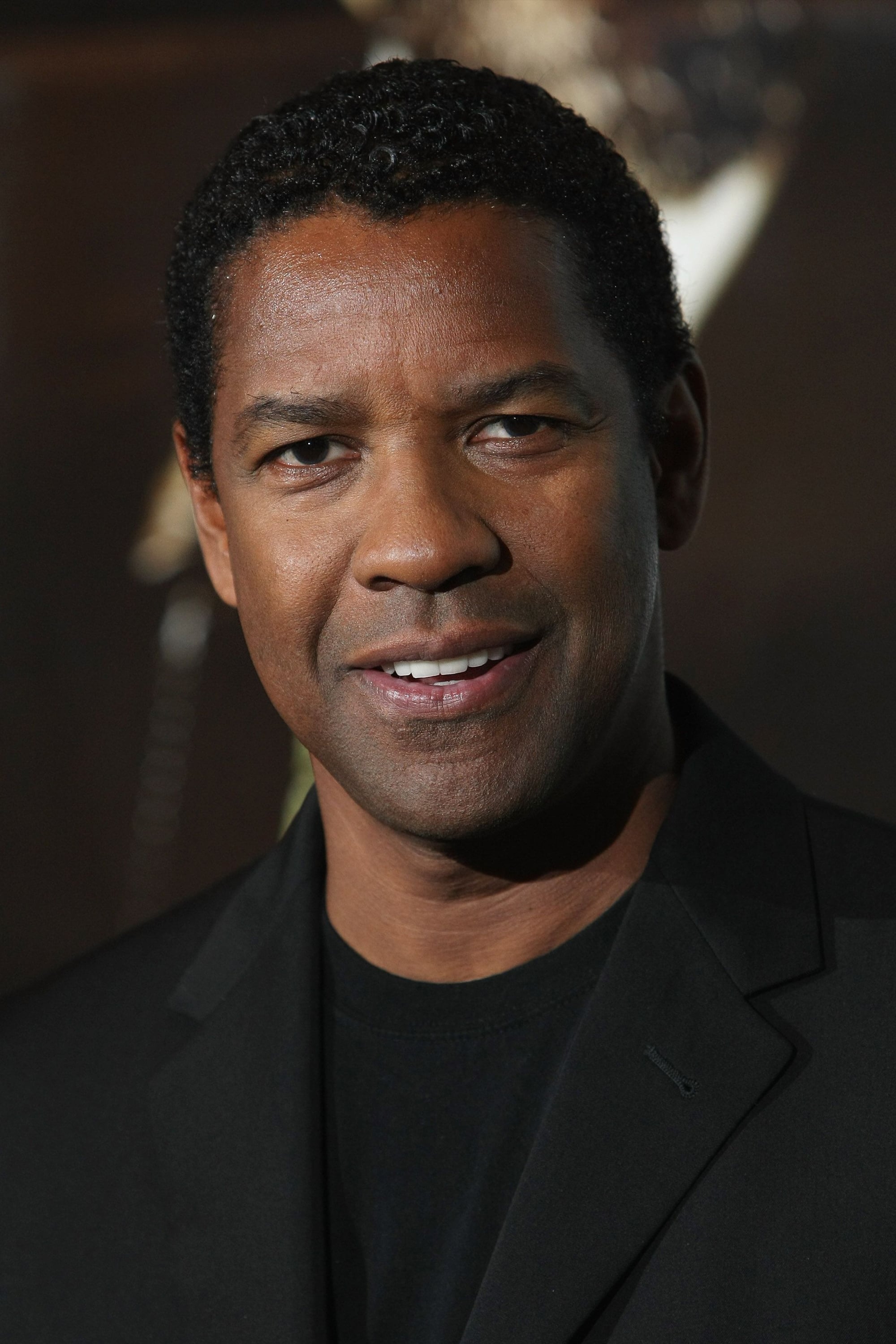

Denzel Washington

Denzel Washington is celebrated for bringing strong, complicated characters to life on screen. He won an Oscar for his portrayal of a crooked cop in the 2001 film ‘Training Day’ and has also starred in popular action series like ‘The Equalizer,’ where he plays a skilled and dangerous former spy. Washington is known for playing characters who are quietly tough and capable of intense action. He’s highly respected in Hollywood for consistently delivering realistic and powerful performances.

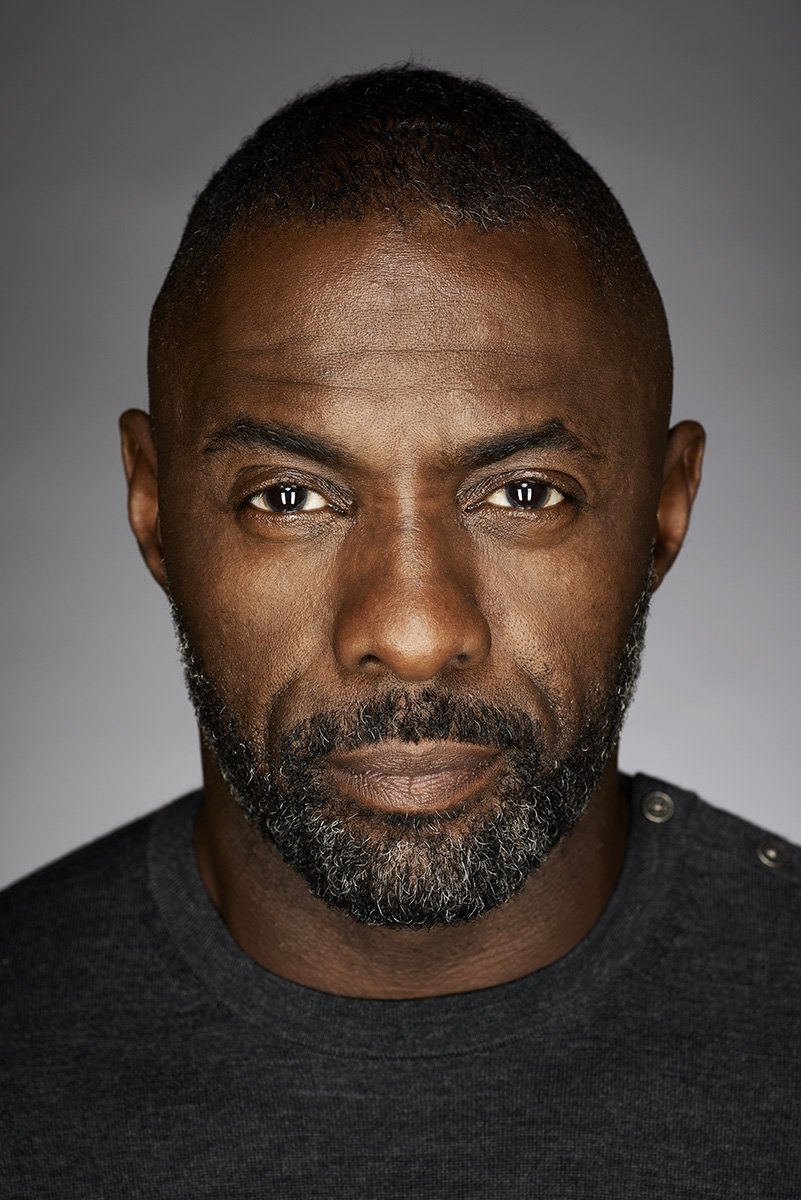

Idris Elba

Idris Elba first earned praise for his role as the shrewd drug dealer Stringer Bell on the HBO show ‘The Wire’. He became even more known for playing the lead in ‘Luther’, a detective who isn’t afraid to use tough, and sometimes extreme, tactics to solve cases. Elba has also been in several popular action movies like ‘Pacific Rim’ and ‘Hobbs & Shaw’, often playing powerful villains. Because of his impressive build and strong voice, he frequently takes on roles as characters in charge or as intimidating opponents.

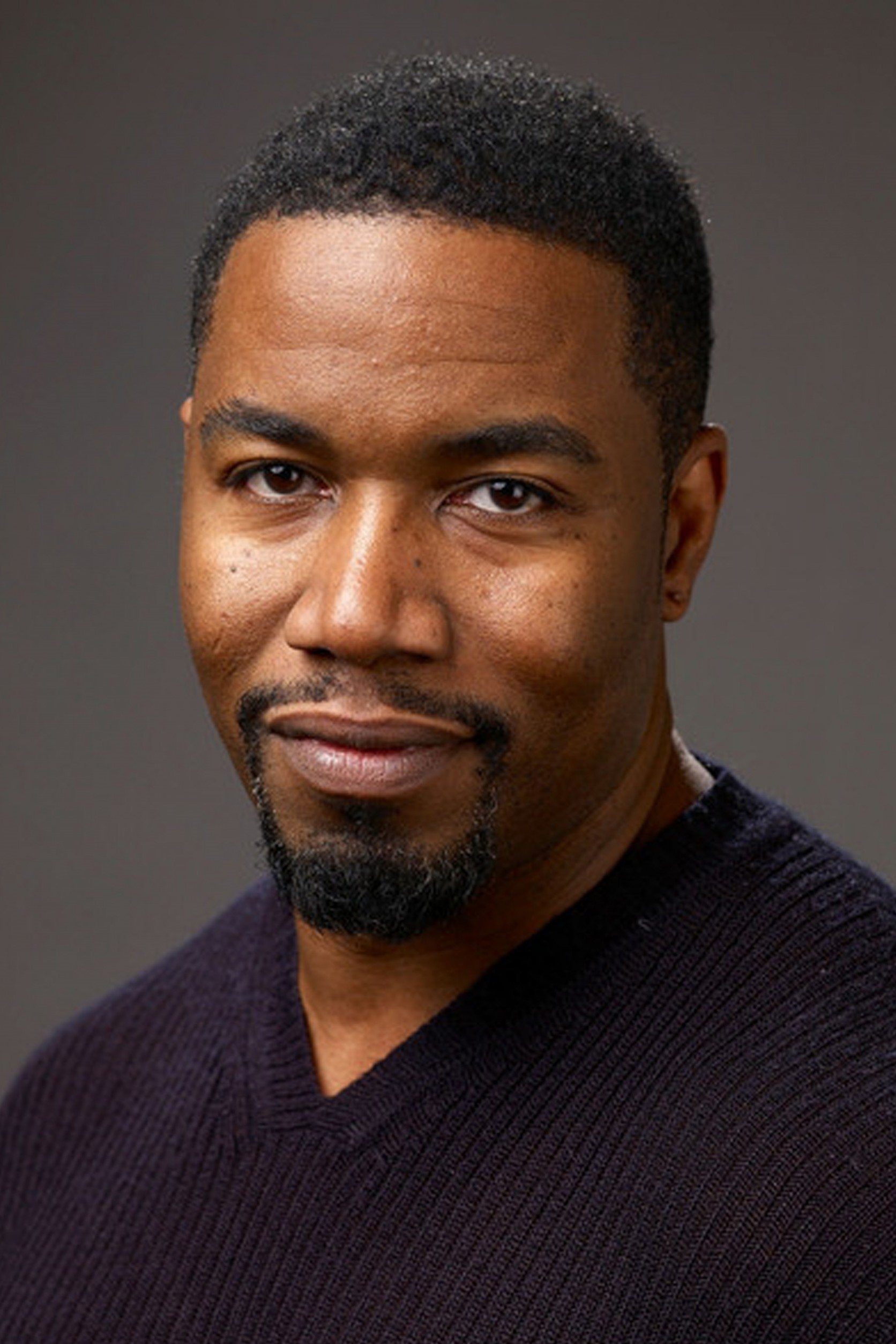

Michael Jai White

Michael Jai White is a talented martial artist who seamlessly blends his fighting skills with his acting. He’s known for groundbreaking roles like the lead in the ‘Spawn’ movie, a very early big-screen adaptation of a comic book with a Black protagonist. He also starred in ‘Black Dynamite,’ a hilarious send-up of 1970s blaxploitation films where he could really show off his fighting abilities. Throughout his career, including films like ‘Never Back Down 2: The Beatdown’ and ‘Falcon Rising,’ White has become known for his athleticism and impressive fight scenes.

Wesley Snipes

Wesley Snipes was a major action star of the 1990s, largely thanks to his role as the vampire hunter Blade. He was already skilled in martial arts like Shotokan Karate and Hapkido, which allowed him to do many of his own stunts and fight scenes. Snipes has played tough characters in films like ‘Passenger 57’ and ‘New Jack City’, and he’s known for combining exciting action with a strong, captivating presence. Even when he plays more serious roles, he often seems physically imposing and capable.

Laurence Fishburne

Laurence Fishburne is well-known for his iconic role as Morpheus in ‘The Matrix’ films, where he played a wise teacher and powerful fighter. He first gained attention for his performance as a strict but caring father in ‘Boyz n the Hood,’ showcasing his ability to play strong, internal characters. Fishburne has also appeared in many action movies, like ‘John Wick: Chapter 2’ and ‘John Wick: Chapter 3 – Parabellum’. He frequently portrays characters who are both intelligent and capable of intense action. His distinctive, deep voice and serious attitude make him a truly imposing figure on screen.

Ving Rhames

Ving Rhames is famous for playing the powerful Marsellus Wallace in ‘Pulp Fiction’. He’s also been a regular in the ‘Mission: Impossible’ films, where he plays the tech-savvy and dependable Luther Stickell. Rhames often appears in roles that showcase his strong build and distinctive deep voice, like his portrayal of Don King in ‘Don King: Only in America’. He also showed his survival skills in the remake of ‘Dawn of the Dead’. Throughout his long career, he’s consistently played characters who are both physically strong and incredibly loyal.

Jim Brown

Jim Brown was a football legend who successfully moved into acting, becoming one of the first prominent Black action stars. He gained recognition for his role in ‘The Dirty Dozen’, playing a soldier in a dangerous World War II mission. Brown’s tough, athletic build and unwillingness to avoid a fight became his trademark on screen. He went on to star in many popular blaxploitation and action movies like ‘Slaughter’ and ‘Three the Hard Way’, and his work in the 60s and 70s opened doors for future African-American actors in the action genre.

Fred Williamson

Fred Williamson, nicknamed “The Hammer,” was a leading man in the popular blaxploitation films of the 1970s. Before becoming an actor, he had a successful career playing professional football. He often played strong, uncompromising characters who weren’t afraid to break the rules, and became well-known for films like ‘Black Caesar’ and ‘Hell Up in Harlem’. He also had a memorable role in the cult film ‘From Dusk Till Dawn’ as a seasoned war veteran. Williamson is celebrated for bringing a charismatic and powerful energy to his performances, and frequently did his own stunts.

Richard Roundtree

Richard Roundtree became a legend for playing Shaft, a character who changed how Black heroes were seen in movies. As the cool and clever private detective John Shaft, he was just as good at fighting as he was at solving mysteries. The original ‘Shaft’ movie was so popular it led to several follow-up films and a TV show, making Roundtree a significant figure in popular culture. He continued acting for many years, often playing roles that acknowledged his status as a groundbreaking action star. His performance essentially created the blueprint for today’s action heroes in city settings.

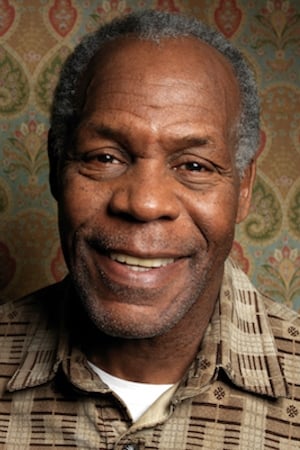

Danny Glover

Danny Glover is best known for playing Sergeant Roger Murtaugh in the ‘Lethal Weapon’ movies. Working with Mel Gibson, he played a seasoned detective who constantly risked his life while staying dedicated to his family and job. Glover has also starred in action-packed films like ‘Predator 2’, where he pursued an alien hunter in a futuristic setting. However, he’s also shown his range in dramas like ‘The Color Purple’, portraying characters with strong values and inner strength. Throughout his career, Glover has successfully combined thrilling, intense roles with emotionally resonant performances.

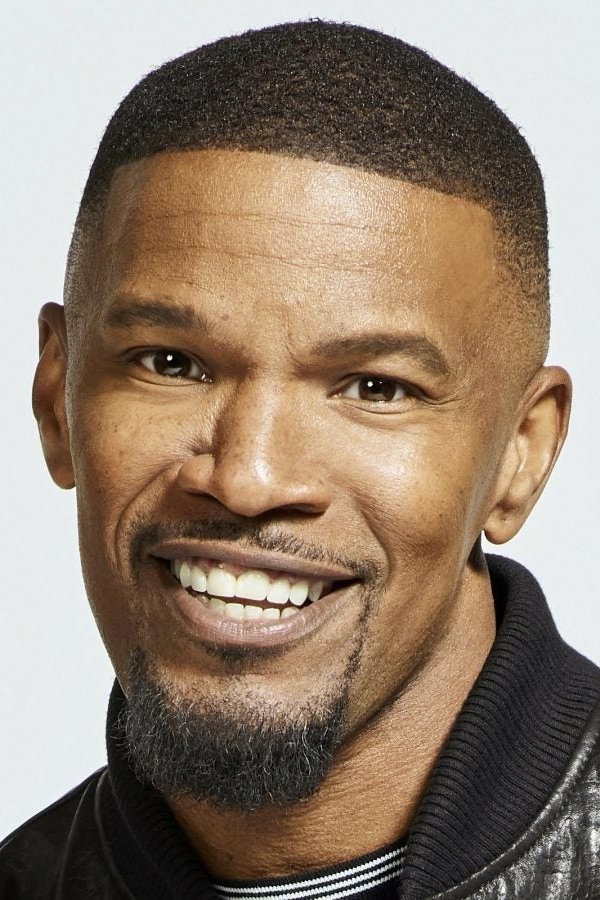

Jamie Foxx

Jamie Foxx is known for his versatility, especially in action roles. He powerfully portrayed a slave seeking revenge in ‘Django Unchained’ and prepared physically for demanding parts like a soldier in ‘Jarhead’ and an undercover agent in ‘Sleepless’. Even as the villain Electro in ‘The Amazing Spider-Man 2’, he excelled in large action sequences. Foxx consistently brings both physical skill and intense focus to his tougher characters, and he continues to choose roles that push his limits as an actor.

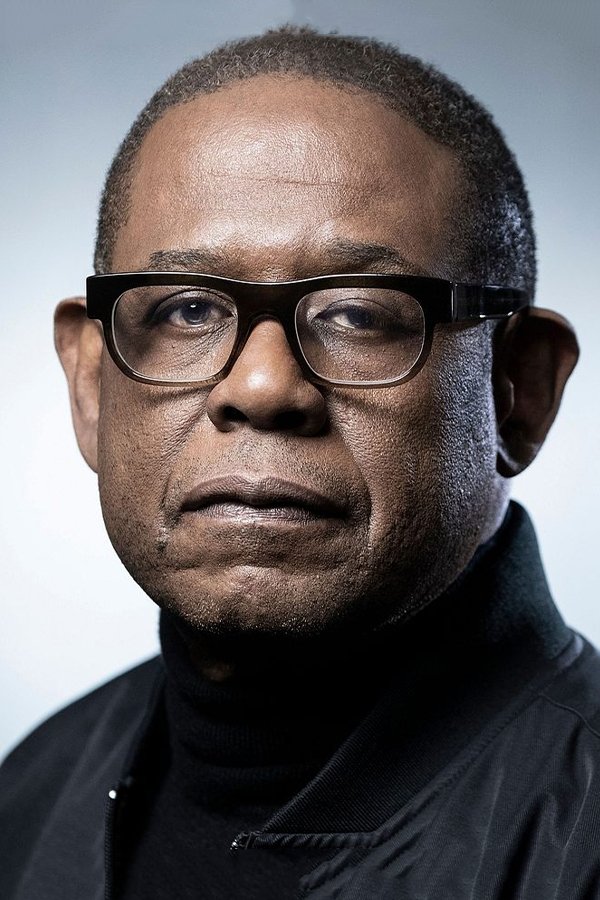

Forest Whitaker

Forest Whitaker is celebrated for his deeply immersive acting, especially his portrayal of the ruthless Idi Amin in ‘The Last King of Scotland.’ He’s also known for roles like the samurai-following hitman in ‘Ghost Dog.’ Whitaker often plays characters with a subtle but frightening power, relying on psychological tactics as much as physical strength. He’s appeared in action movies too, such as ‘Black Panther,’ where he played a powerful Wakandan leader and fighter. His ability to project dignity and concealed power makes him a frequent and welcome presence in both dramatic and suspenseful films.

Michael B. Jordan

Michael B. Jordan became a major star playing boxer Adonis Creed in the ‘Creed’ movies. He proved his ability to handle action roles as the villain Erik Killmonger in ‘Black Panther,’ and continued that trend as a Navy SEAL in ‘Without Remorse.’ His roles consistently demand he be in top physical shape and perform convincing fight scenes. Because of this, he’s become one of the leading young actors in today’s action and sports films.

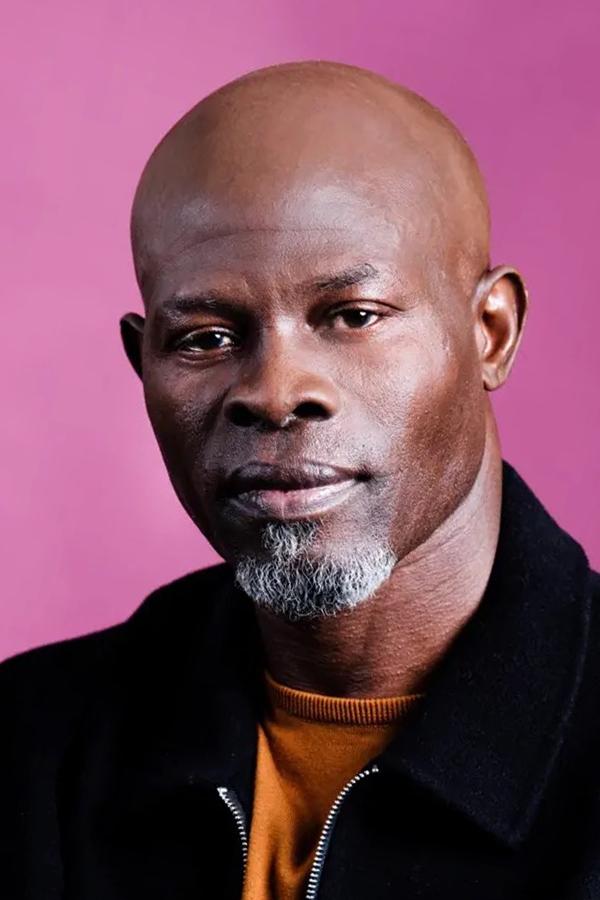

Djimon Hounsou

Djimon Hounsou became well-known for his strong performances in films like ‘Amistad’ and ‘Gladiator’, where he played a powerful warrior. He’s been in many big-budget action movies, including ‘Blood Diamond’, where he played a father desperately searching for his son during a war. More recently, he joined the Marvel universe as Korath in ‘Guardians of the Galaxy’. Hounsou is a popular actor because of his commanding presence and his ability to show deep emotion even while performing action. He frequently plays characters who are strong, dependable, and physically impressive.

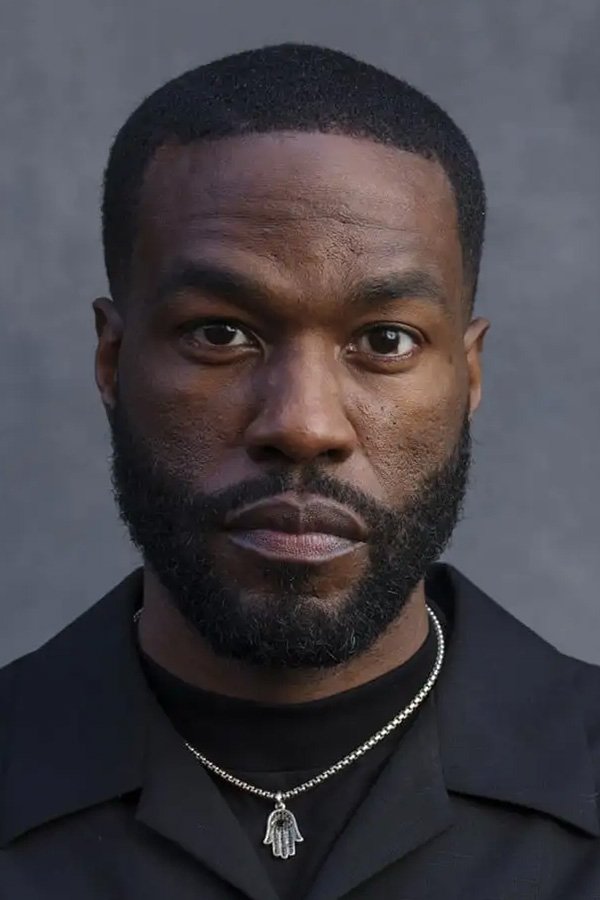

Yahya Abdul-Mateen II

Yahya Abdul-Mateen II has quickly become a major action star, known for roles like Black Manta in ‘Aquaman’ and a fresh take on Morpheus in ‘The Matrix Resurrections’. He also impressed audiences with a complex, powerful character in the series ‘Watchmen’ and as a desperate veteran in the thriller ‘Ambulance’. Throughout his career, he’s consistently shown a commanding presence and a talent for intense, high-pressure stories.

Winston Duke

Winston Duke is known for his powerful performances, especially as M’Baku, the leader of the Jabari Tribe, in ‘Black Panther’. He brings both incredible physical strength and a commanding voice to the role. He’s also proven himself in action films like ‘Spenser Confidential’, where he plays a strong and reliable fighter. In Jordan Peele’s ‘Us’, he showed his versatility while still portraying a powerfully protective father figure. Often, directors cast Duke in roles that make the most of his impressive height and physique to create a sense of strength and authority.

Chiwetel Ejiofor

Chiwetel Ejiofor is known for playing strong, capable characters. He’s proven this in films like ‘Serenity,’ where he played a skilled operative, and ‘Doctor Strange,’ as a mystic arts expert who embraces a darker side. In the action film ‘The Old Guard,’ he starred as a CIA agent working with immortals. While he’s celebrated for his dramatic work in movies like ’12 Years a Slave,’ Ejiofor often takes roles that demand both smarts and fighting skills, and his performances consistently show a cool, determined strength.

Keith David

Keith David is a well-established actor celebrated for his distinctive, deep voice and memorable roles in several beloved action and horror films. He’s known for playing strong, enduring characters like Childs in John Carpenter’s ‘The Thing’ and for an impressively long fight scene in ‘They Live’. He also portrayed the formidable Imam in ‘Pitch Black’ and its sequel, ‘The Chronicles of Riddick’. Throughout his long career, David has often played characters who are leaders, figures of authority, or tough survivors. He continues to be a highly regarded performer in the action and horror genres, consistently delivering powerful and impactful performances.

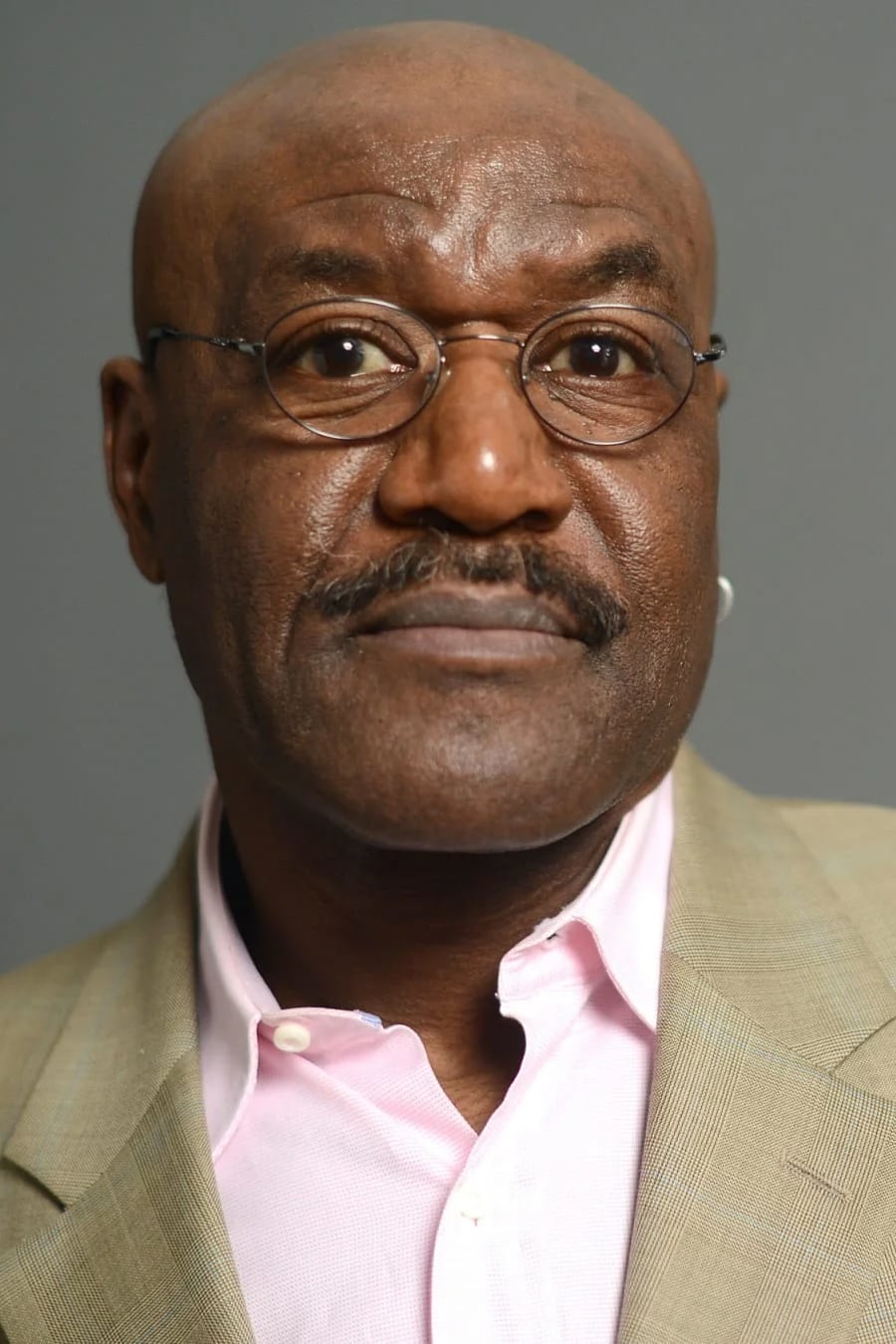

Delroy Lindo

Delroy Lindo is a powerful actor known for bringing a strong, often intimidating presence to his roles. He truly shone in ‘Da 5 Bloods’ as a complex veteran, convincingly portraying both inner turmoil and physical strength. While he’s appeared in popular action and crime films like ‘Get Shorty’ and ‘Gone in 60 Seconds’, Lindo consistently brings a captivating, unpredictable energy to all his characters. He’s particularly well-known for his commanding voice and ability to take complete control of any scene.

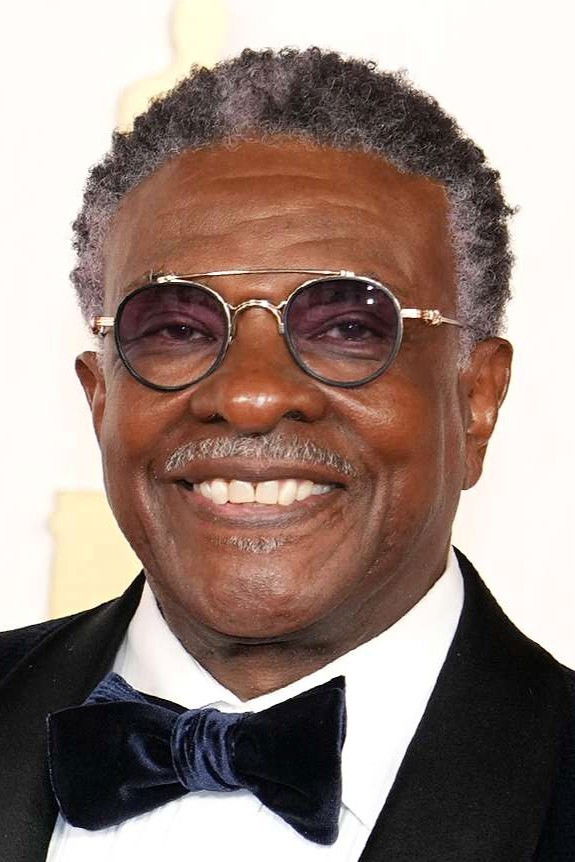

Carl Weathers

Carl Weathers was a popular actor best known for playing Apollo Creed, a skilled boxer, in the ‘Rocky’ movies. He also appeared in ‘Predator’ alongside Arnold Schwarzenegger, portraying a strong and clever CIA agent. Weathers solidified his reputation as an action star in the 1980s with the film ‘Action Jackson’. In more recent years, he gained a new generation of fans as Greef Karga in ‘The Mandalorian’, where he played a leader and fighter in the ‘Star Wars’ world. Throughout his career, his athletic ability and tough-guy persona made him a lasting icon.

Tommy Lister Jr.

As a movie fan, I always remember Tiny Lister – or Tommy Lister Jr., as some knew him – for just being larger than life. He had this incredible presence, and of course, everyone remembers him as Deebo from ‘Friday’! That character is iconic. But he was so much more than just that one role. I mean, he was the Galactic President in ‘The Fifth Element’ and a genuinely good guy playing a prisoner in ‘The Dark Knight’. He was often the muscle, the big intimidating presence in action movies, which makes sense, but honestly, the guy was a working actor with over 200 credits to his name. It’s easy to get stuck on Deebo, but he had a really impressive career.

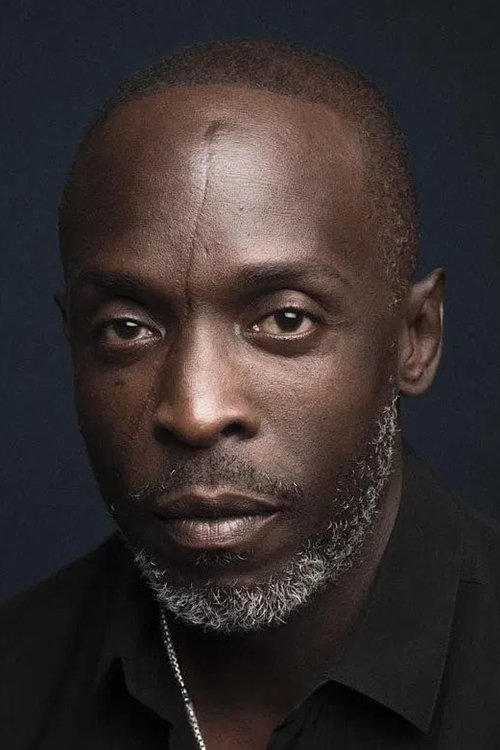

Michael Kenneth Williams

Michael K. Williams became a celebrated actor, largely thanks to his iconic role as Omar Little in ‘The Wire’ – a character who, despite being a robber, had a strong personal code of ethics. He brought the same raw energy and realism to his part as Albert “Chalky” White in ‘Boardwalk Empire’. Williams had a gift for making even intimidating characters feel human and understandable. While also taking on action roles in films like ‘Assassin’s Creed’ and ‘The Purge: Anarchy’, he remained instantly recognizable thanks to his distinctive scar and powerful performances, cementing his place as a truly memorable actor.

Mahershala Ali

Mahershala Ali is known for playing strong, controlled characters in both movies and TV shows. He’s impressed audiences as the strategic Remy Danton in ‘House of Cards’ and the dangerous Cornell “Cottonmouth” Stokes in ‘Luke Cage.’ He also starred as a detective haunted by a cold case in the third season of ‘True Detective.’ Currently, he’s preparing to play the lead role of Blade in the upcoming Marvel reboot. Ali’s performances are consistently marked by a calm, intense focus and a clever, thoughtful approach.

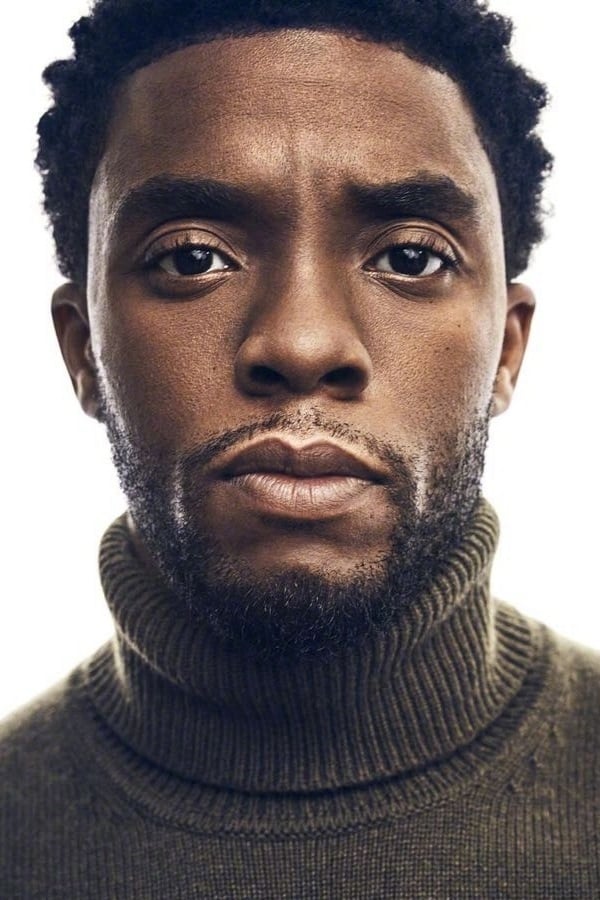

Chadwick Boseman

Chadwick Boseman achieved worldwide fame for playing King T’Challa in ‘Black Panther’, a role that showcased his strength and regal presence. Before becoming a Marvel superhero, he powerfully portrayed real-life figures like Jackie Robinson in ‘42’ and James Brown in ‘Get on Up’. He also demonstrated his action chops in the thriller ‘21 Bridges’, playing a determined detective. Boseman consistently brought a sense of strength and integrity to his characters. Remarkably, he continued acting in challenging roles even while facing serious health issues, solidifying his reputation as a dedicated and enduring performer.

Ernie Hudson

Ernie Hudson is famous for playing Winston Zeddemore in the ‘Ghostbusters’ movies, where he was the practical and steady member of the team. He often portrays strong characters in roles involving law enforcement or the military, like in ‘The Crow’ and ‘Miss Congeniality’. Hudson also starred in the HBO drama ‘Oz’ as Warden Leo Glynn, a character responsible for keeping order in a tough prison. Throughout his career, he’s consistently played dependable, resilient characters who can handle difficult circumstances, making him a popular figure in action and science fiction.

Billy Brown

Billy Brown is an actor well-known for playing strong, capable characters in crime and legal dramas. He’s best recognized for his roles as Detective Nate Lahey in ‘How to Get Away with Murder’ and August Marks in ‘Sons of Anarchy’. He also played a hitman connected to organized crime in the film ‘Proud Mary’. Brown frequently portrays physically fit characters who are serious, determined, and often work within—or against—the law.

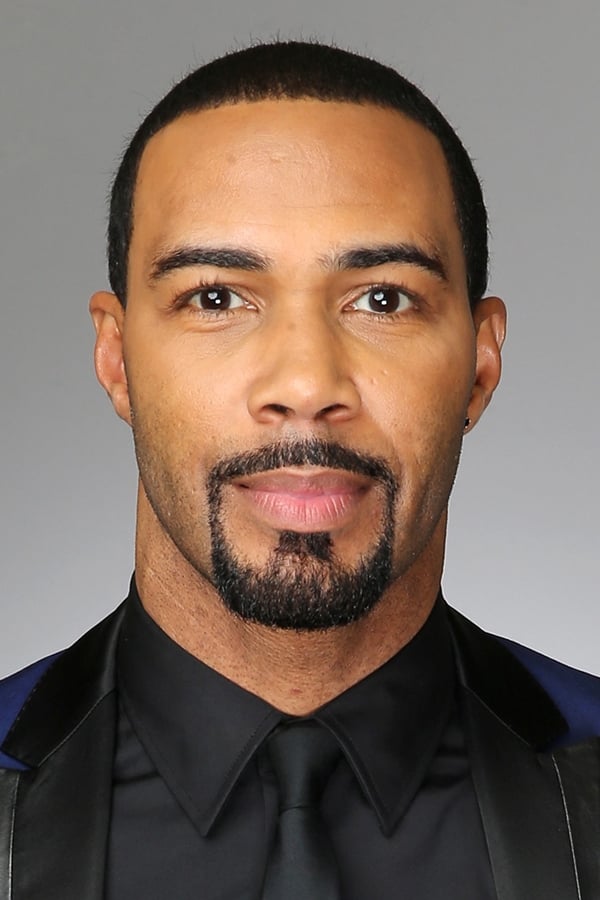

Omari Hardwick

Omari Hardwick is famous for playing James “Ghost” St. Patrick in the popular show ‘Power’. He played a character with a dangerous double life – a successful nightclub owner who was also a powerful drug dealer. Hardwick has also demonstrated his ability to handle action roles, notably in ‘Army of the Dead’ where he fought zombies in Las Vegas. He’s appeared in other action-packed films like ‘Kick-Ass’ and ‘The A-Team’, and is known for portraying characters who are both physically strong and intelligent.

Sterling K. Brown

Sterling K. Brown has proven he can handle action roles, as seen in ‘The Predator’ where he played a government agent tracking alien dangers. He also had a significant role in ‘Black Panther’ as N’Jobu, a character whose past actions drove the entire story. Though best known for the emotional drama of ‘This Is Us’, Brown frequently takes on characters who are powerful and in control. He showcased this in ‘Hotel Artemis’, playing a professional criminal in a futuristic hospital for criminals. He seamlessly moves between heartfelt dramatic performances and intense action sequences, demonstrating his range as an actor.

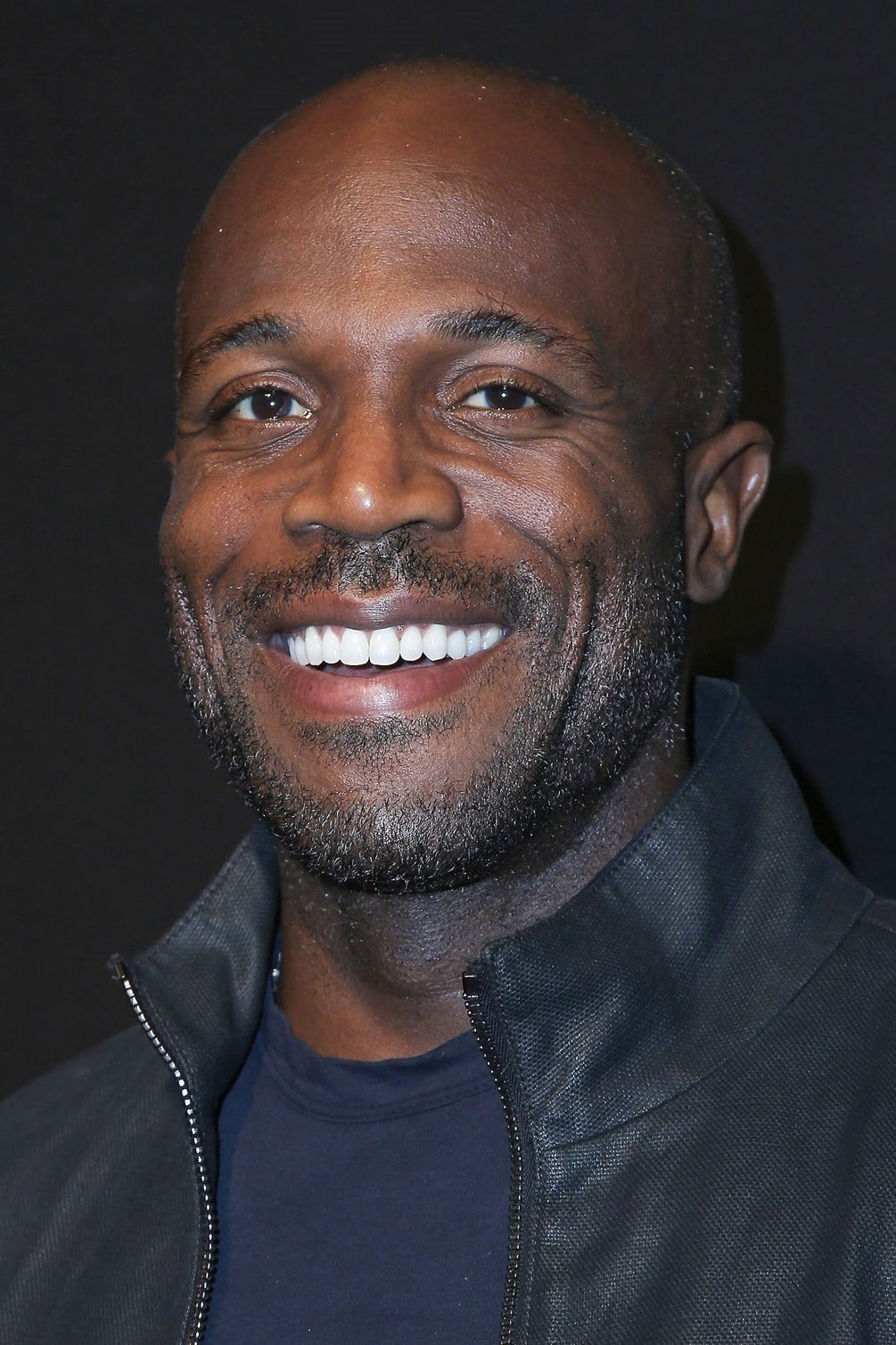

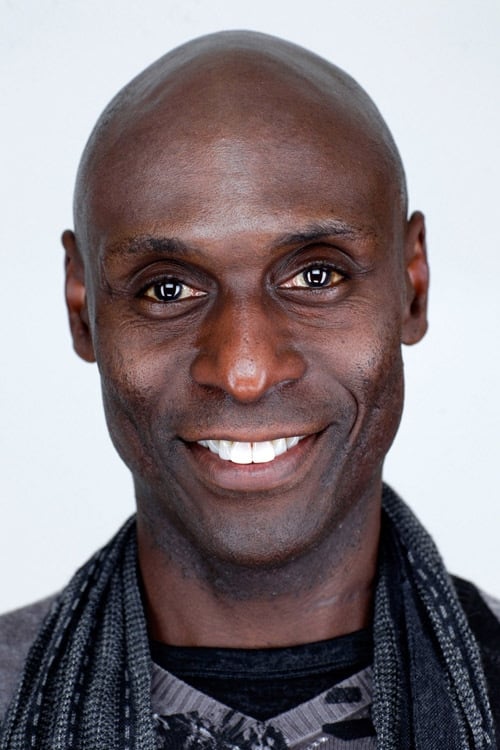

Lance Reddick

Lance Reddick was a powerful and recognizable actor, famous for playing strong, commanding characters. Many will remember him as Cedric Daniels from ‘The Wire,’ or as Charon, the cool and efficient concierge in the ‘John Wick’ movies. He also had a significant role as Phillip Broyles on ‘Fringe,’ leading an FBI division. Reddick’s height and deliberate way of speaking made him ideal for portraying figures of authority and security. He was a constant presence on television in action and crime dramas, and his disciplined acting will be greatly missed.

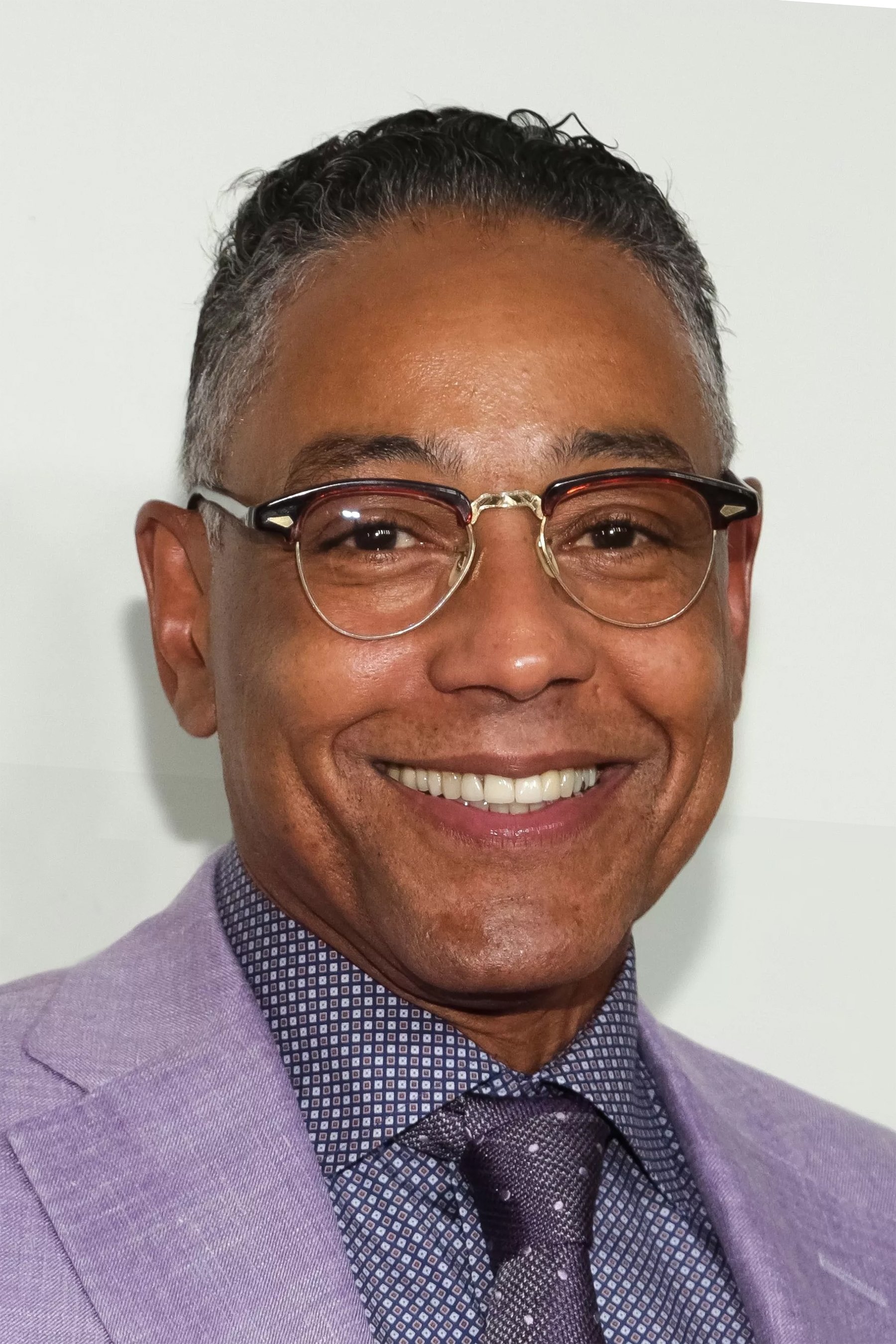

Giancarlo Esposito

Giancarlo Esposito is well-known for playing compelling villains, most notably the calm and ruthless Gus Fring in ‘Breaking Bad’ and ‘Better Call Saul’. He also brought a unique intensity to the role of Moff Gideon in ‘The Mandalorian’, a villain famous for his skill with the Darksaber. Throughout his career, Esposito has been in many action movies, like ‘The Usual Suspects’ and ‘King of New York’. His characters are often marked by careful planning and a surprising ability to become extremely violent. Many consider him one of the most powerful and frightening actors working today.

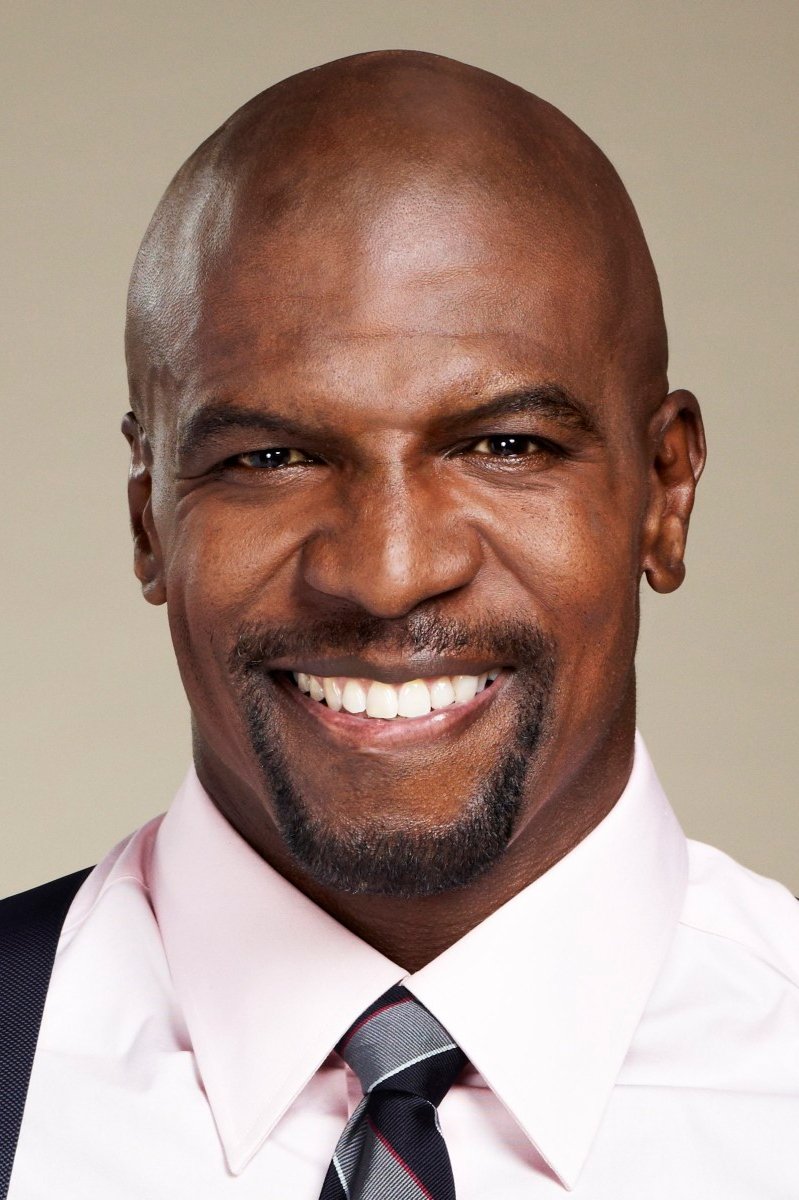

Terry Crews

I’ve always been amazed by Terry Crews’ career! He went from being an NFL player to a huge star in both action and comedy. I first noticed him in ‘The Expendables’ as Hale Caesar – he was perfect as the muscle! Then, ‘Brooklyn Nine-Nine’ showed a totally different side of him; Terry Jeffords was strong, but also really sweet and vulnerable. And let’s not forget his action roles like in ‘Gamer’ – the guy is incredibly fit and brings so much energy to everything he does. What I really love is how he effortlessly switches between being a tough guy and making us laugh – he’s truly one of a kind in Hollywood.

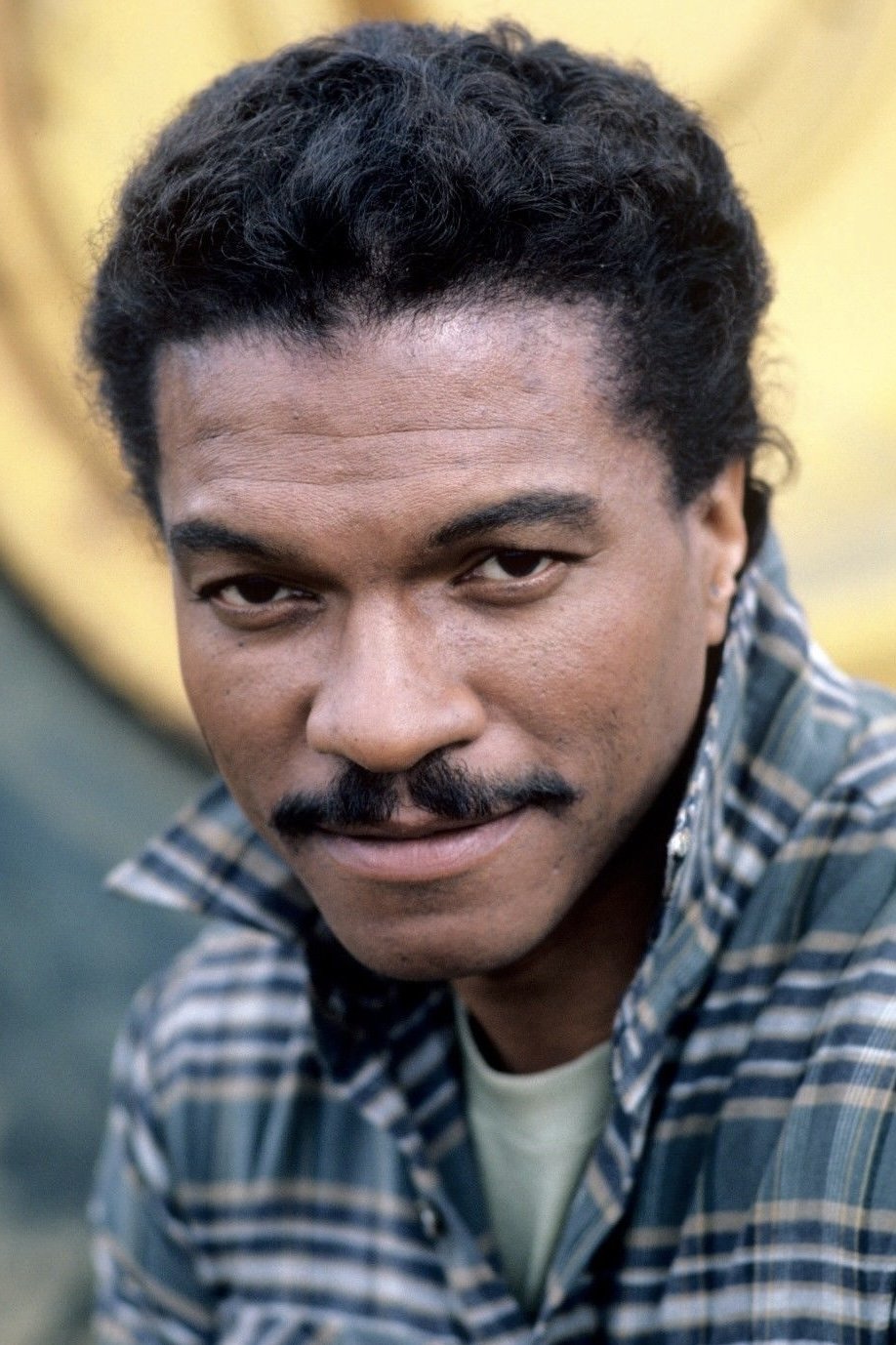

Billy Dee Williams

Billy Dee Williams is best known for playing Lando Calrissian in the ‘Star Wars’ films, a character who evolves from a charming scoundrel to a key leader in the fight against the Empire. He also showed his range as Harvey Dent in ‘Batman,’ portraying a strong and intelligent district attorney. Throughout the 70s and 80s, Williams appeared in many action movies, including ‘Nighthawks’ with Sylvester Stallone. He often brought a smooth, sophisticated style to his roles, hinting at hidden strength and a knack for strategy. He continues to be remembered as one of the most captivating and memorable actors of his generation.

Mike Colter

Mike Colter is famous for playing Luke Cage, the powerful hero in the Marvel series of the same name. He brought both strength and a realistic sense of morality to the character, appearing in multiple shows like ‘The Defenders’. More recently, he starred in the action movie ‘Plane’ as a strong and enigmatic prisoner. Throughout his career, Colter has often played physically imposing characters with calm, serious personalities, and he continues to choose roles where his characters protect others.

Adewale Akinnuoye-Agbaje

Adewale Akinnuoye-Agbaje is best known for playing the powerful and frightening Simon Adebisi on the HBO series ‘Oz’. He’s also impressed audiences with his physically demanding roles as the villain Kurse in ‘Thor: The Dark World’ and Killer Croc in ‘Suicide Squad’. Akinnuoye-Agbaje frequently chooses roles that call for a strong physique and a threatening presence, and he’s appeared in action films like ‘The Bourne Identity’ and ‘G.I. Joe: The Rise of Cobra’. His experience as a model and his law degree likely contribute to his dedicated and thoughtful approach to playing challenging, tough characters.

Tell us which of these legendary actors played your favorite tough-guy role in the comments.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- Top 20 Educational Video Games

- Most Famous Richards in the World

2026-03-07 17:49