HBO Max has a wide variety of movies, from big action films to smaller, more personal dramas. This week, they’re featuring both new releases and popular classics, covering genres like horror, comedy, and action. You’ll find everything from historical movies and spooky thrillers to documentaries about what the future might hold. It’s a great selection to check out if you’re looking for something to watch this weekend.

‘Chris Fleming: Live at The Palace’ (2026)

“Chris Fleming: Live at The Palace” is the first stand-up comedy special from Chris Fleming. The show features his energetic and unusual mix of physical comedy and music. Fleming shares funny and strange thoughts on everyday life and what’s considered normal. It feels like being in a live theater with him, and really shows off his one-of-a-kind comedic style. You can stream it now with a subscription.

‘Fackham Hall’ (2025)

“Fackham Hall” is a funny movie that playfully mocks classic British period dramas. It’s set on a grand English estate and focuses on the complicated relationships between the wealthy family and their servants. The film uses humor to poke fun at common themes and clichés often seen in historical TV shows and movies. You can start watching it this Friday, March 6th.

‘The Smashing Machine’ (2025)

‘The Smashing Machine’ is a true story about Mark Kerr, a groundbreaking fighter in the world of mixed martial arts. The film follows his incredible success in the late 1990s, but also honestly portrays the personal challenges and struggles he faced outside of fighting. It highlights the intense physical and emotional impact of the early days of MMA. You can now watch the film on the streaming service.

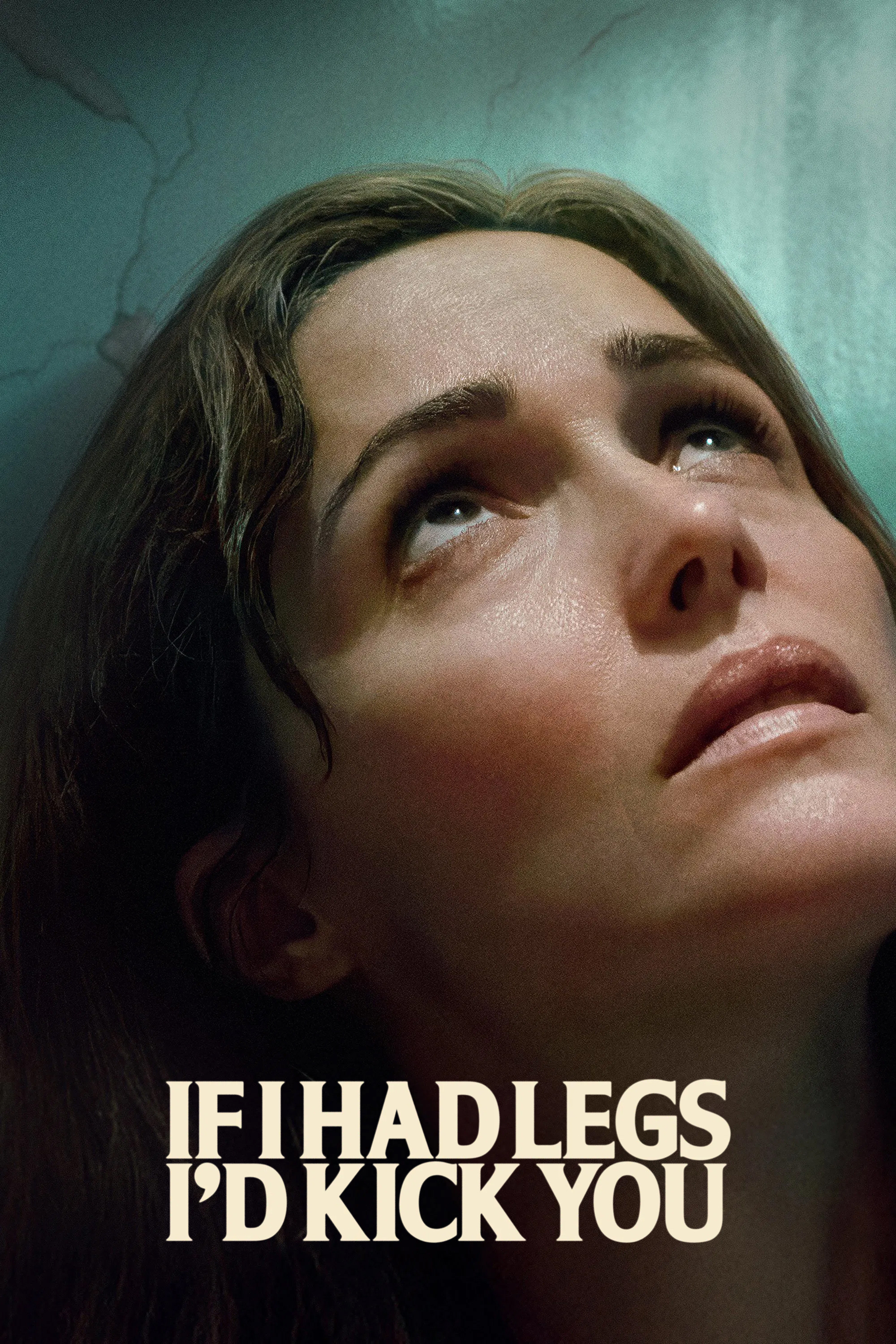

‘If I Had Legs I’d Kick You’ (2025)

‘If I Had Legs I’d Kick You’ is a powerful and emotional film about a psychotherapist struggling to care for her seriously ill daughter. Living in a struggling motel, she faces enormous physical and emotional challenges. The movie explores the sacrifices mothers make and the heavy toll of psychological stress. It’s currently available to stream now.

‘Dead of Winter’ (2025)

In ‘Dead of Winter,’ a woman mourning her husband embarks on a road trip to scatter his ashes. Her journey takes a dangerous turn when a blizzard hits and she uncovers a kidnapping. She quickly becomes the only chance to save a young girl trapped in the storm. This thrilling movie explores how far people will go to survive and protect others when facing impossible odds. You can now watch it on HBO Max.

‘Godzilla x Kong: The New Empire’ (2024)

As a huge monster movie fan, I just finished watching ‘Godzilla x Kong: The New Empire,’ and it was a blast! It’s a direct sequel that brings back these two legendary creatures, Godzilla and Kong. The story throws them together – they have to team up to save the world from a massive, brand-new threat that comes from deep within the Hollow Earth. It really digs into the history and backstory of these Titans, which I loved. If you’re looking for some big, action-packed fun, you can stream it now!

‘2073’ (2024)

‘2073’ is a dark and thought-provoking film set in the ruins of New San Francisco, where a single person struggles to survive. The movie combines a fictional story with actual historical footage, presented in a realistic, documentary style. It offers a bleak look at a potential future shaped by today’s problems, like environmental damage and global issues, and also reflects on where our society is headed. You can watch ‘2073’ as part of the films showing this weekend.

‘The Pope’s Exorcist’ (2023)

‘The Pope’s Exorcist’ tells the story of Father Gabriele Amorth, the Vatican’s leading exorcist, as he travels to Spain to investigate a disturbing case of possession affecting a young boy at an ancient abbey. His investigation leads him to uncover a long-hidden conspiracy within the Catholic Church. The movie is a supernatural horror film inspired by the real-life memoirs of Father Amorth and is now available to stream.

‘Masterminds’ (2016)

‘Masterminds’ is a funny movie based on the real story of the 1997 Loomis Fargo robbery. It’s about a frustrated armored car driver who gets talked into stealing a lot of money from the vault by a coworker. Even though he’s not a skilled criminal, he manages to steal over $17 million in a series of clumsy attempts. The movie shows just how ridiculous and inept the people involved in the actual robbery were. It’s available to watch right now for all subscribers this weekend.

‘Robin Hood’ (2010)

This movie, ‘Robin Hood’, tells the story of how the famous outlaw came to be, starting after the death of King Richard. It follows a skilled archer who comes home to England to find it plagued by corruption and facing a potential invasion from France. He then builds a band of rebels to fight against the local sheriff and the king’s unjust taxes. Unlike some versions of the tale, this film offers a realistic and historically inspired take on the classic Robin Hood legend. You can currently watch this action-packed drama on HBO Max.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-03-06 23:23