For years, Hollywood has depended on talented character actors to bring realism and depth to its most famous movies and shows. These actors frequently appear in many projects, becoming recognizable faces even if they aren’t the biggest stars. Latino male character actors, with their skill and consistency, have been particularly influential in a wide range of genres, from intense crime stories to huge action films. They often excel in supporting roles, bringing a compelling presence that can truly captivate audiences.

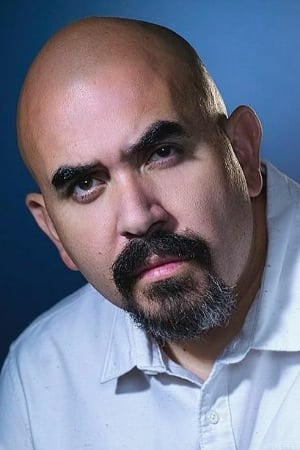

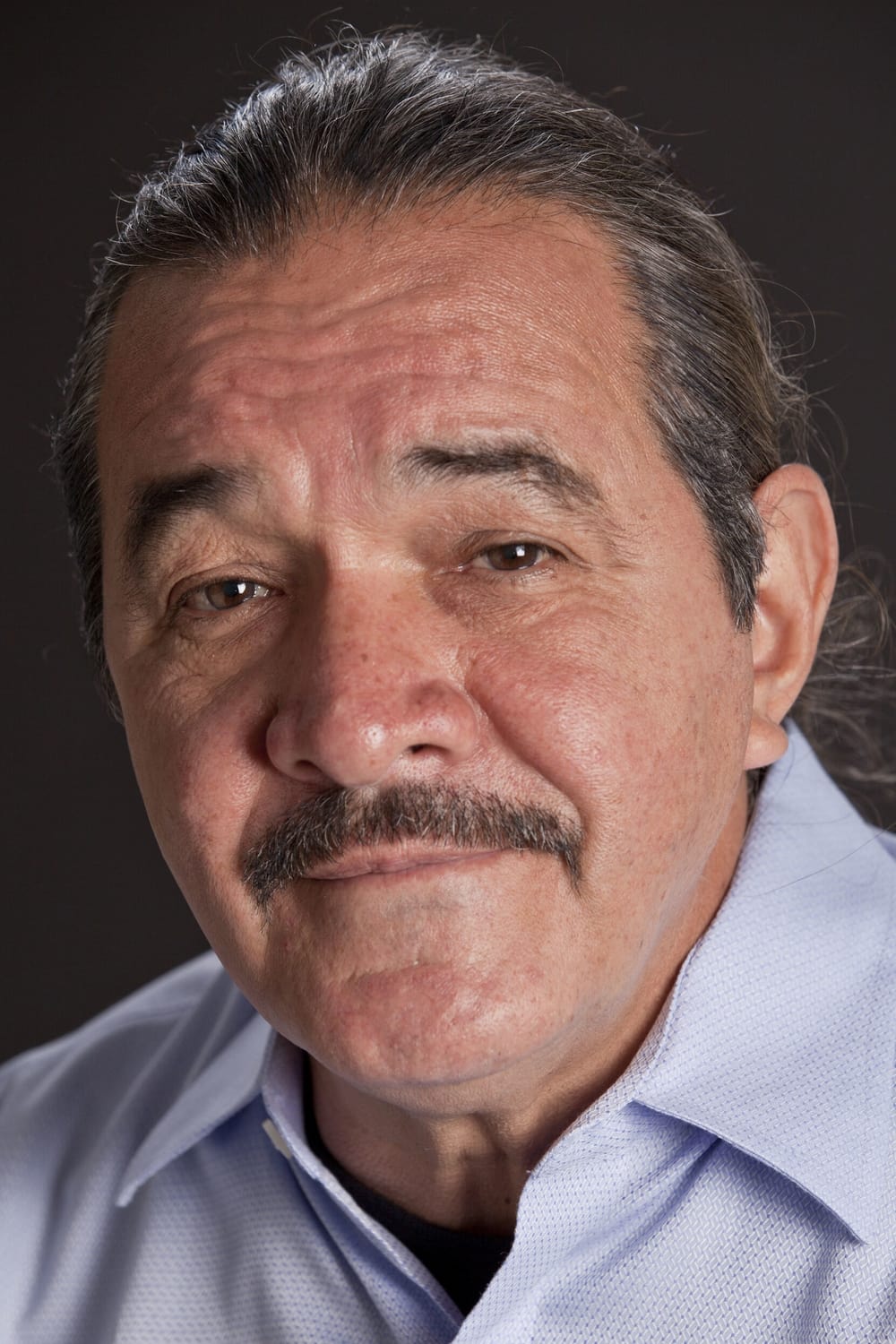

Luis Guzmán

Luis Guzmán is a highly accomplished character actor who has been working in film for over four decades. He’s known for frequently collaborating with director Steven Soderbergh, appearing in popular movies like ‘Out of Sight’, ‘The Limey’, and ‘Traffic’. He’s also worked closely with Paul Thomas Anderson on films such as ‘Boogie Nights’ and ‘Magnolia’. On television, Guzmán gave a memorable performance as Raoul Hernandez in the HBO series ‘Oz’.

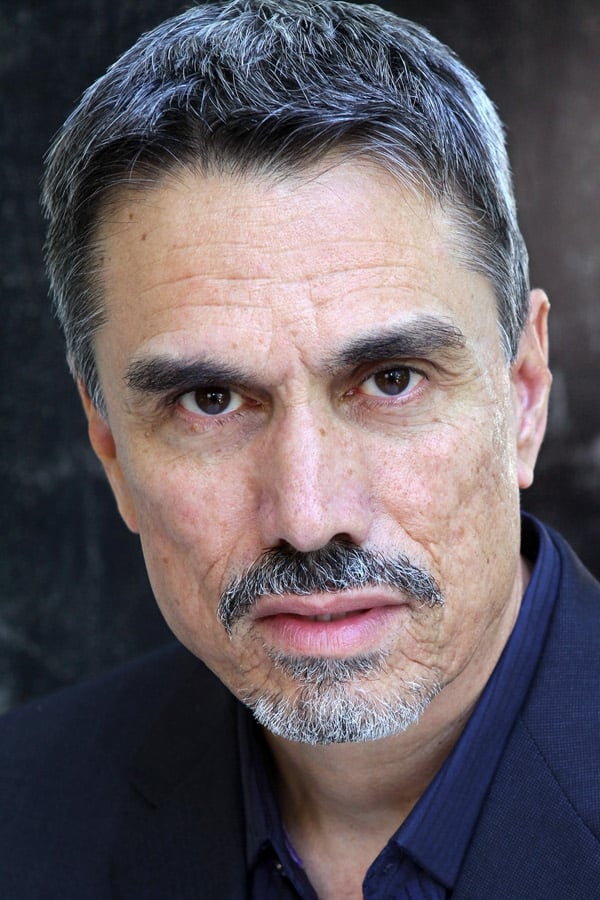

Noel Gugliemi

As a film critic, I’ve definitely noticed Noel Gugliemi. He’s become something of a reliable presence in action and crime films, and it’s funny – he’s played a character named Hector in several different movies, including a couple of the ‘Fast & Furious’ films! But it’s more than just a running gag. He consistently delivers a really believable, tough-guy performance, and you’ve likely seen him in big productions like ‘Training Day’ and ‘The Dark Knight Rises’. With over 100 credits to his name, he’s that instantly recognizable character actor – you know, ‘that guy’ casting directors call when they need someone to authentically portray a streetwise persona.

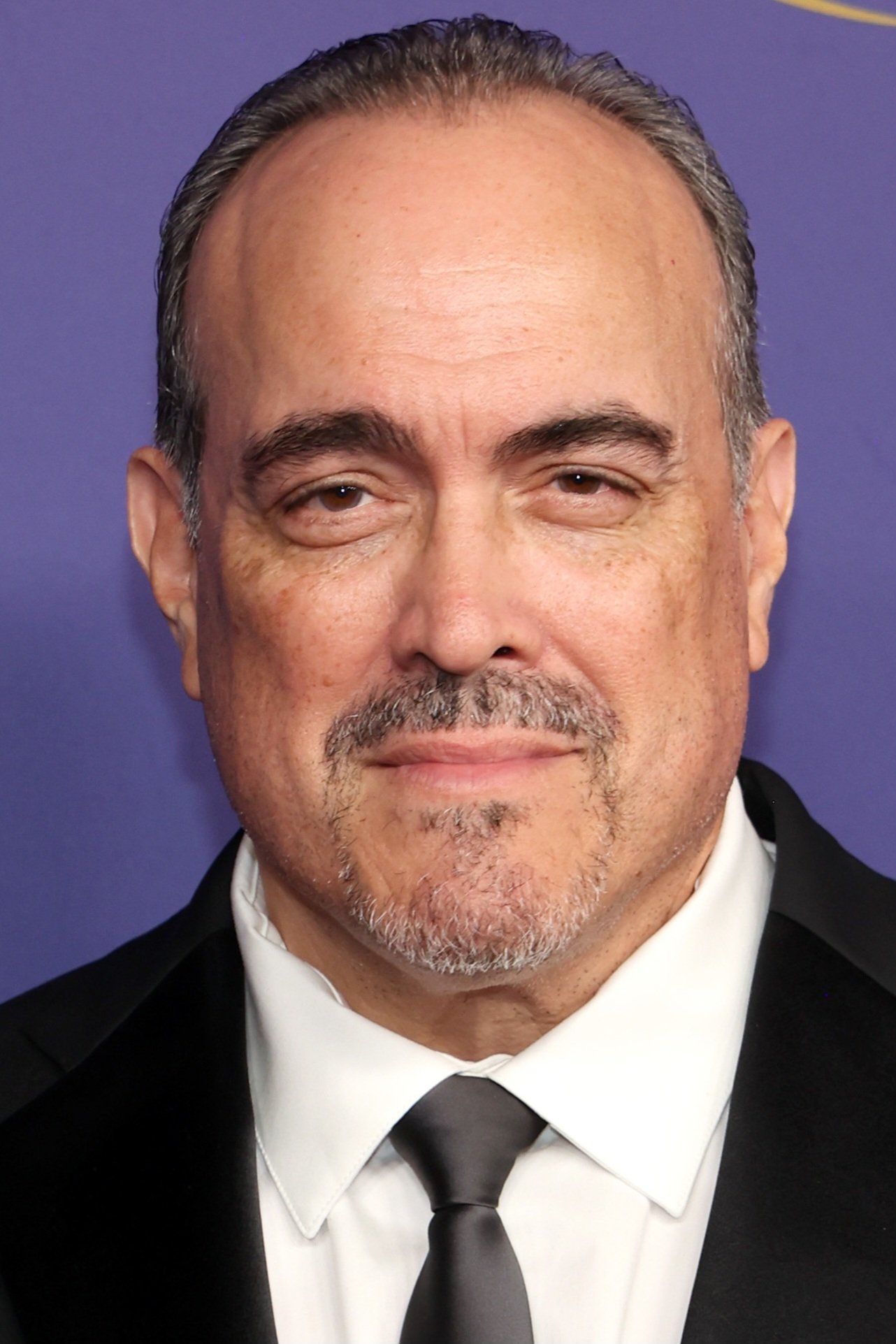

David Zayas

David Zayas had a fascinating career change, moving from being a police officer in New York City to a successful actor. He’s best known for playing Angel Batista on the popular Showtime series ‘Dexter’ and its follow-up shows. He also impressed audiences with his role as Enrique Morales in the intense drama ‘Oz’. Beyond television, Zayas has appeared in several well-known films, including ‘The Expendables’, ’16 Blocks’, and ‘Michael Clayton’.

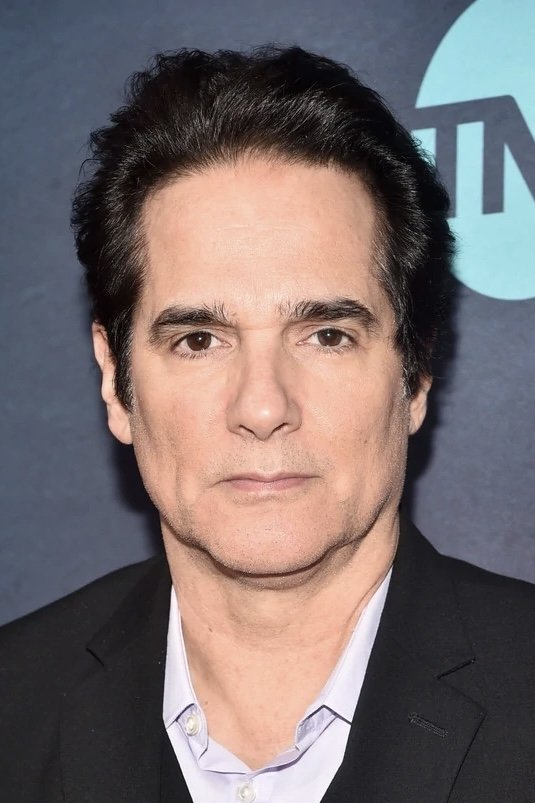

Yul Vazquez

Yul Vazquez is a Cuban-American actor who’s proven himself in both funny and serious roles. Many viewers first noticed him as the memorable, and somewhat intimidating, armoire thief on ‘Seinfeld’. He’s continued to impress in recent shows like ‘Severance’, ‘Russian Doll’, and ‘The Outsider’, and has a substantial film career with appearances in movies such as ‘American Gangster’, ‘Captain Phillips’, and Steven Soderbergh’s ‘Che’.

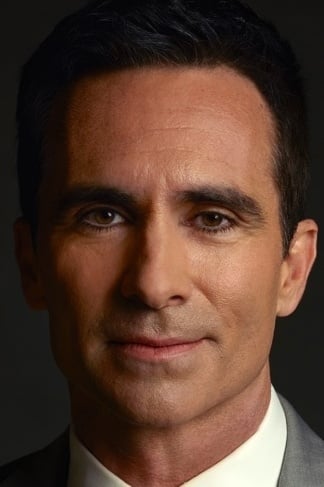

Nestor Carbonell

Nestor Carbonell is well-known for his roles in several popular projects. He first gained widespread recognition playing the mysterious Richard Alpert on the TV show ‘Lost’. He continued to build his career with appearances in Christopher Nolan’s ‘The Dark Knight’ and ‘The Dark Knight Rises’ as Mayor Anthony Garcia, and later as Sheriff Alex Romero in the series ‘Bates Motel’. Most recently, in 2024, he earned an Emmy Award and critical praise for his performance as Rodney in the FX series ‘Shōgun’.

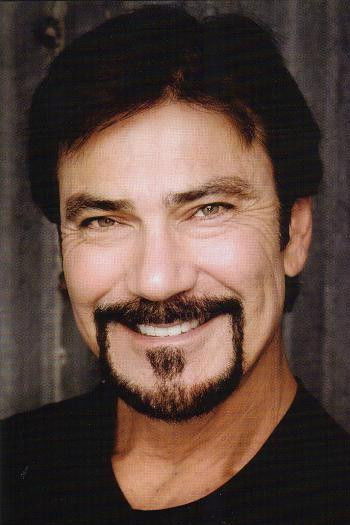

Emilio Rivera

Emilio Rivera is widely recognized for playing Marcus Alvarez, the leader of the Mayans Motorcycle Club, in the popular series ‘Sons of Anarchy.’ He continued in this iconic role as a main character in the spin-off show, ‘Mayans M.C.’, which lasted five seasons. Throughout his career, Rivera often plays powerful or intimidating characters in films like ‘Con Air’ and ‘Traffic.’ He’s also appeared in many TV shows, with notable recurring roles in ‘The Shield’ and guest spots on ‘The X-Files’ and ‘NYPD Blue’.

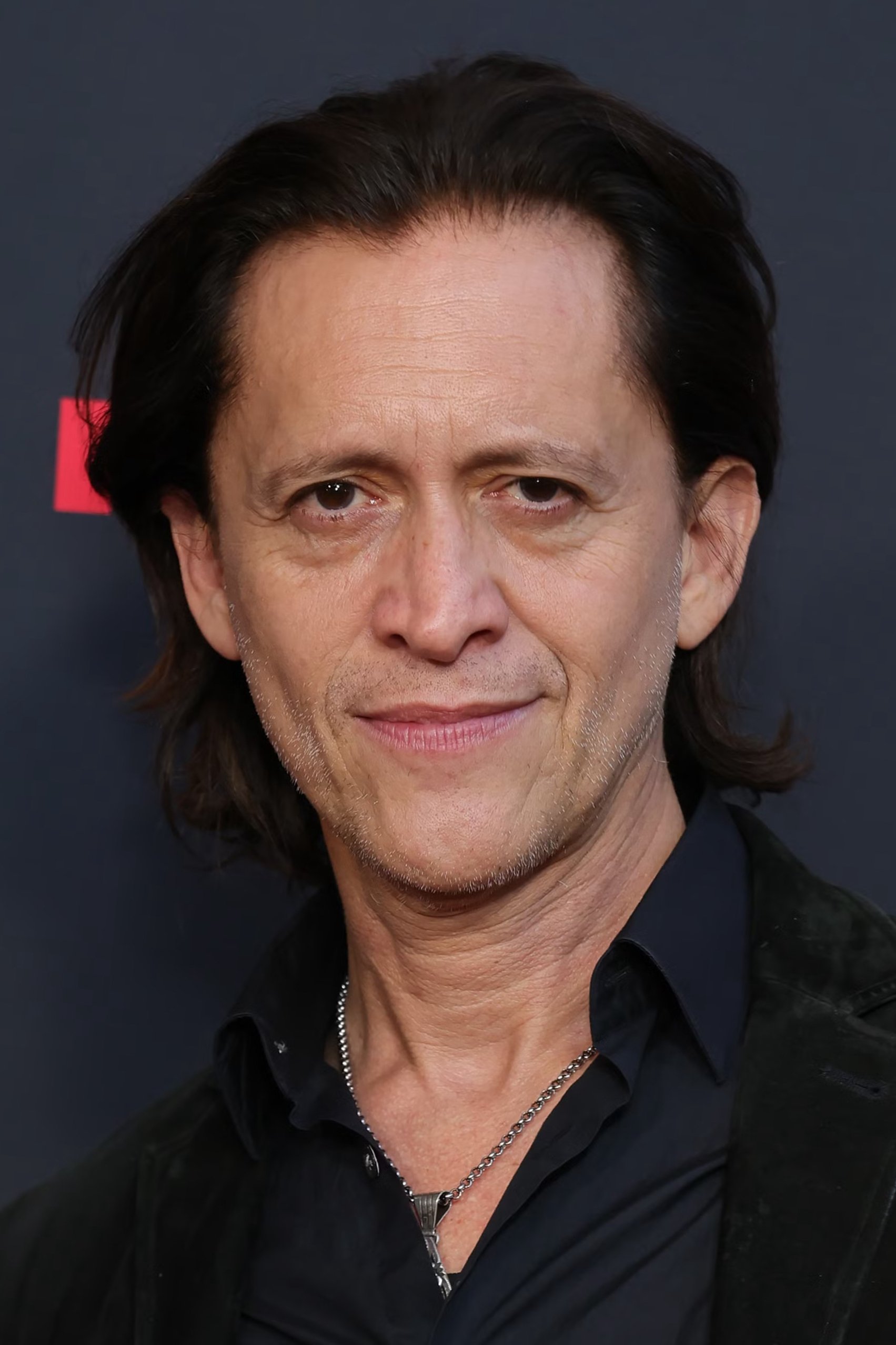

Clifton Collins Jr.

Clifton Collins Jr. is a talented and adaptable actor known for dramatically changing his appearance to fit his roles. He earned an Emmy nomination and critical acclaim for his work in the miniseries ‘Thief,’ and delivered a memorable performance as Perry Smith in ‘Capote.’ You might also recognize him from popular films like ‘Traffic,’ ‘Star Trek,’ and ‘Once Upon a Time in Hollywood,’ as well as his recurring role on the HBO series ‘Westworld.’

Julio Oscar Mechoso

Julio Oscar Mechoso was a talented Cuban-American actor who worked on more than 120 movies and TV shows. He often worked with director Robert Rodriguez, appearing in films like ‘Once Upon a Time in Mexico’ and ‘Grindhouse’. Many viewers will remember him as Detective Ruiz in the movie ‘Bad Boys’ or from his role in ‘Little Miss Sunshine’. Over his extensive career, he also made appearances in popular TV series including ‘Miami Vice’, ‘Seinfeld’, and ‘Grey’s Anatomy’.

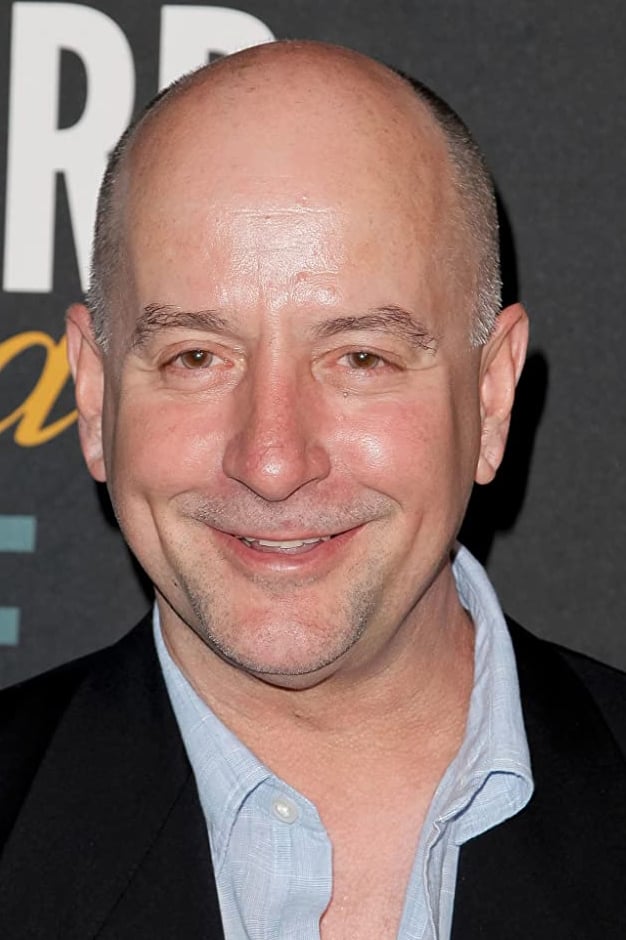

Benito Martinez

Benito Martinez is best known for playing the determined David Aceveda on the FX show ‘The Shield’. He’s consistently appeared in popular and well-respected TV series, with notable roles in ‘Sons of Anarchy’ and ‘House of Cards’. He received critical praise for his portrayal of an undocumented immigrant on the anthology series ‘American Crime’. Martinez has also worked in film, appearing in the iconic horror movie ‘Saw’ and Clint Eastwood’s Academy Award-winning ‘Million Dollar Baby’.

John Ortiz

John Ortiz is a highly respected actor known for his work in both theater and film, frequently taking on roles with morally ambiguous characters. He began his film career with a part in ‘Carlito’s Way,’ appearing alongside Al Pacino, and later became known for playing the villain Arturo Braga in several ‘Fast & Furious’ movies. Other notable films he’s appeared in include ‘American Gangster,’ ‘Silver Linings Playbook,’ and the 2023 release ‘American Fiction.’ In addition to his on-screen work, Ortiz is a co-founder of the LAByrinth Theater Company based in New York City.

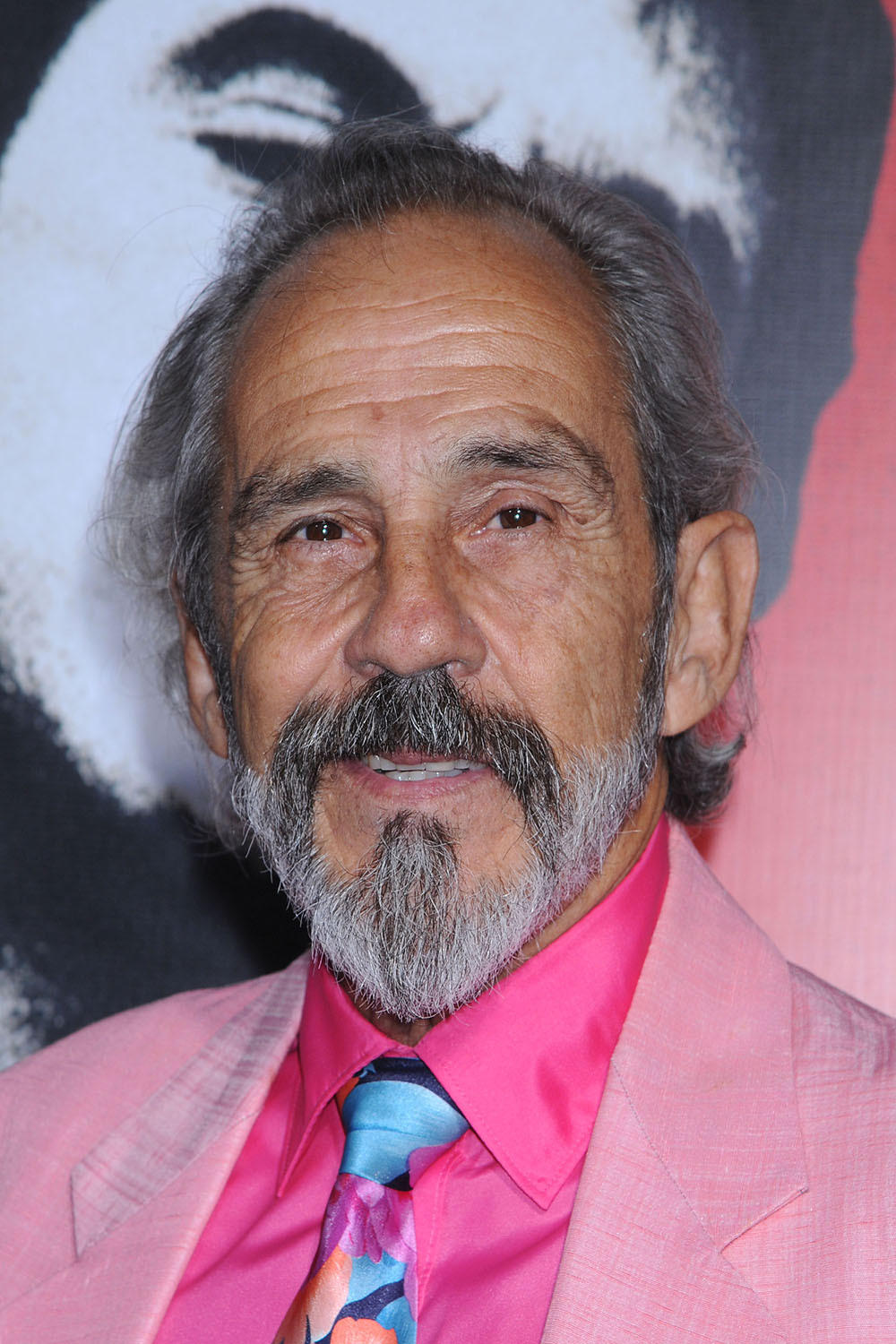

Pepe Serna

Pepe Serna is a well-known actor in Latino films, with over 100 credits dating back to the 1970s. He’s particularly remembered for playing Angel Fernandez, the friend of Tony Montana in the iconic movie ‘Scarface.’ Serna has also demonstrated his talent for comedy in films like ‘The Jerk’ and had an important role in the Western ‘Silverado.’ Throughout his career, he’s consistently portrayed diverse experiences of Mexican-Americans in both popular and independent films.

Jacob Vargas

Jacob Vargas started his career as a breakdancer and later became a well-known actor. He’s appeared in films like ‘American Me’ and ‘My Family’, and played A.B. Quintanilla in the movie ‘Selena’. He also provided the voice for the main character in the animated series ‘Max Steel’. More recently, he’s been recognized for roles like Joker in ‘Next Friday’, as Benicio del Toro’s partner in ‘Traffic’, and in television shows such as ‘Sons of Anarchy’, ‘Luke Cage’, and ‘Mayans M.C.’.

Jesse Borrego

Jesse Borrego is best known for playing Cruz Candelaria in the popular film ‘Blood In Blood Out’. He first became well-known in the 1980s as a dancer and actor on the TV show ‘Fame’. Since then, he’s appeared in many successful movies and shows, including ‘Con Air’, ‘Lone Star’, and ‘The Mission’. On television, he had memorable roles in ’24’ as Gael Ortega and as part of the Freebo team in ‘Dexter’.

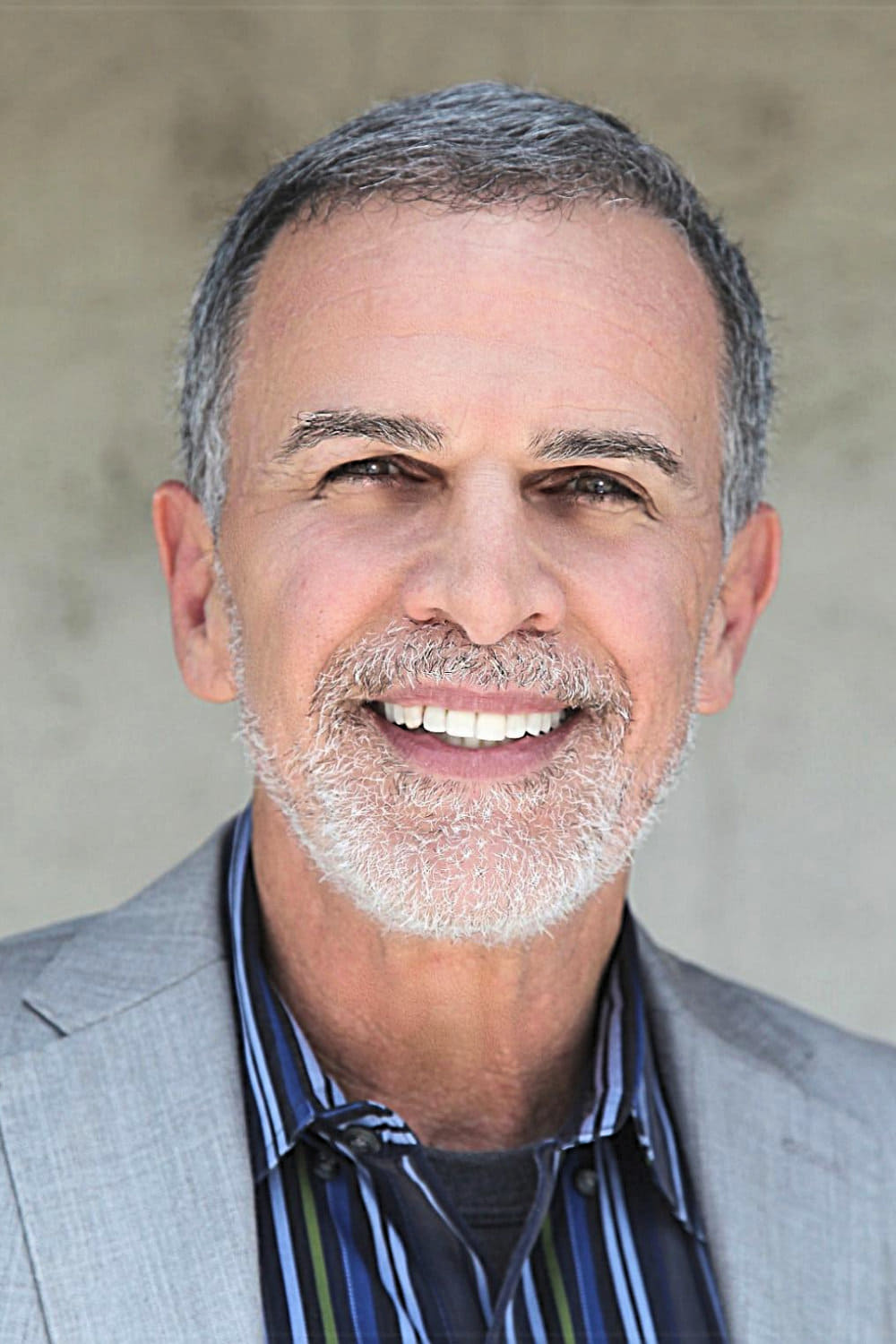

Miguel Sandoval

Miguel Sandoval is a veteran actor who consistently delivers strong performances in supporting roles. He frequently plays characters who are in positions of power, like doctors, judges, or government officials. Many viewers recognize him as D.A. Manuel Devalos from the TV series ‘Medium’. He’s also appeared in notable films, including the very beginning of ‘Jurassic Park’ and a key part in ‘Clear and Present Danger’, and has worked with director Spike Lee on films like ‘Do the Right Thing’ and ‘Jungle Fever’.

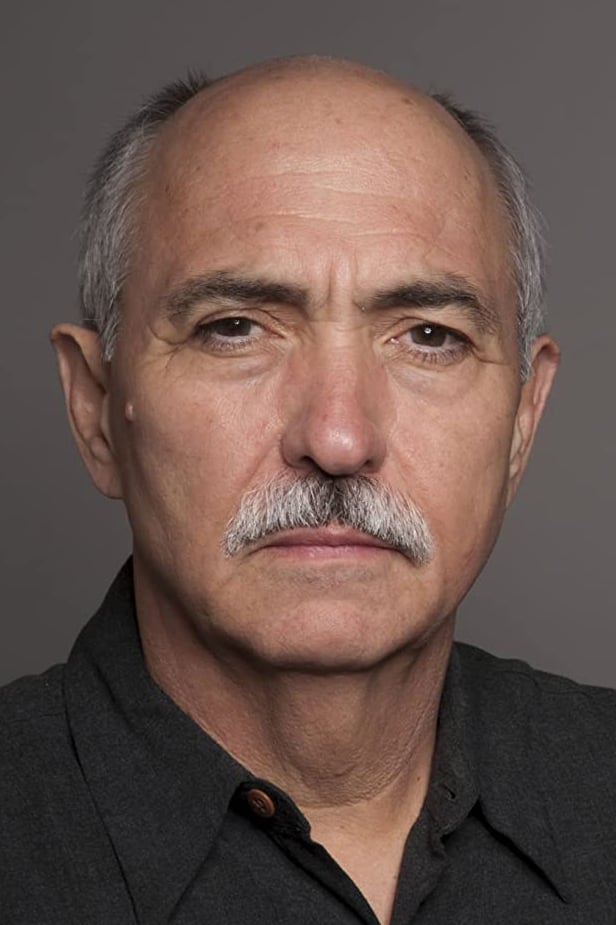

Julio Cesar Cedillo

Julio Cesar Cedillo is an internationally recognized actor, best known for his starring role in ‘The Three Burials of Melquiades Estrada,’ directed by Tommy Lee Jones. He also gained prominence playing Comandante Calderoni in the Netflix series ‘Narcos: Mexico.’ Cedillo has been in a variety of films, including ‘Sicario,’ ‘Cowboys & Aliens,’ and ‘The Harder They Fall,’ and is often seen in Westerns and crime thrillers, where his powerful on-screen presence shines.

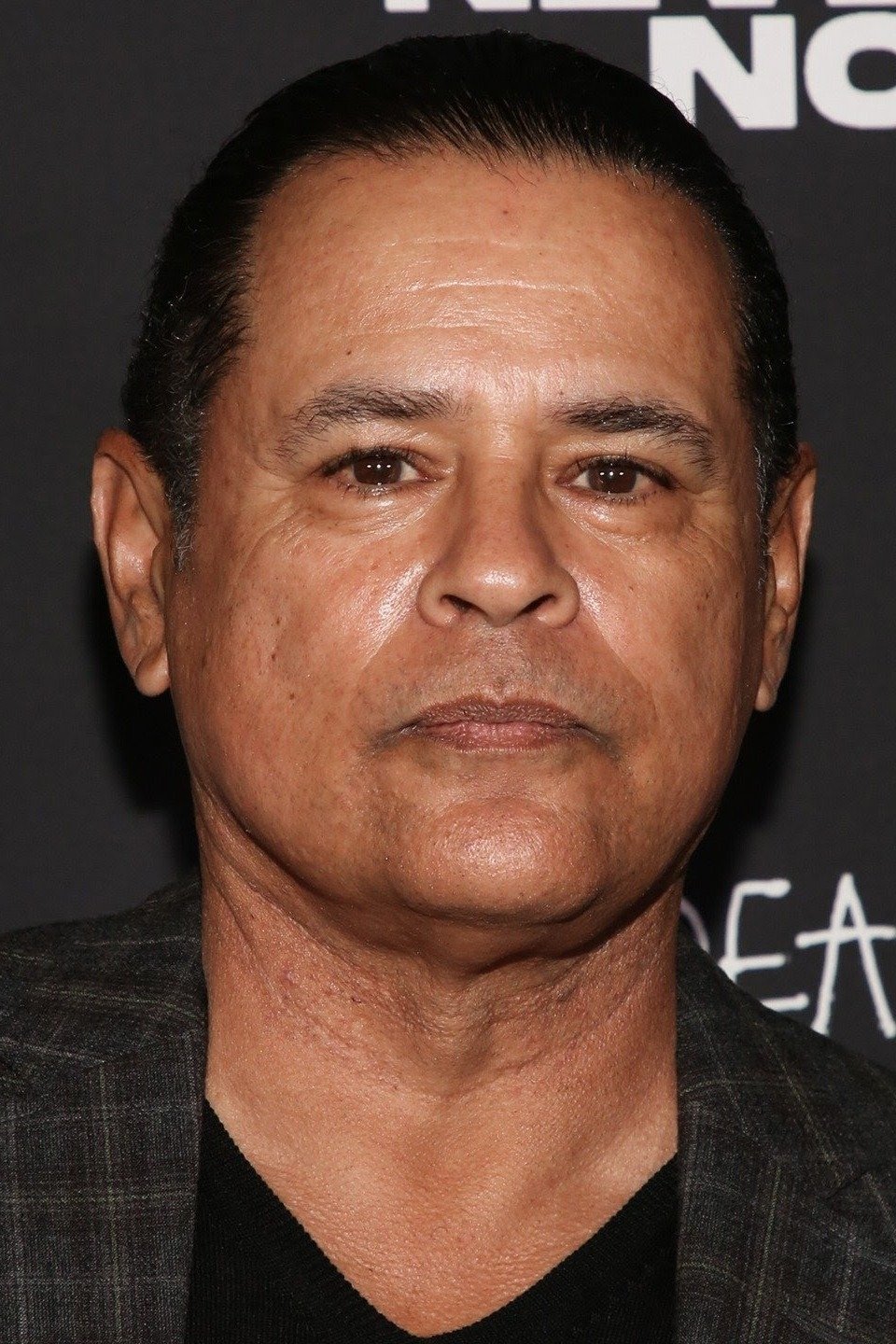

Raymond Cruz

Raymond Cruz is well-known for his memorable and often intimidating roles in popular TV shows and films. He gained widespread recognition as the ruthless drug lord Tuco Salamanca in both ‘Breaking Bad’ and ‘Better Call Saul’. He also starred as Detective Julio Sanchez for seven seasons across ‘The Closer’ and ‘Major Crimes’. Beyond television, Cruz has a strong background in action movies, appearing in films like ‘Clear and Present Danger’, ‘The Rock’, and ‘Alien: Resurrection’. His upbringing in East Los Angeles frequently adds a layer of realism to his portrayals of tough characters.

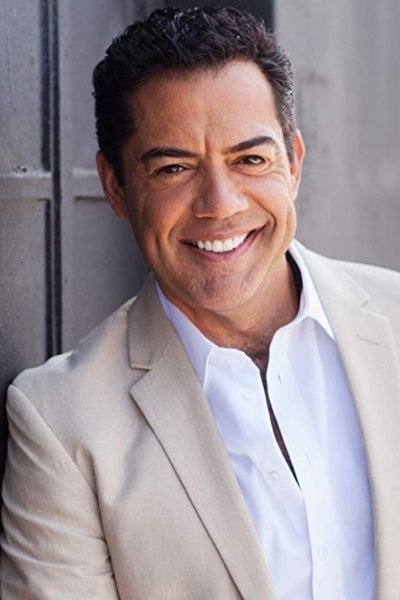

Carlos Gómez

I’ve been watching Carlos Gomez pop up on screen for decades now, and he’s consistently solid. Most viewers probably remember him as Raul Melendez, the openly gay paramedic on ‘ER’ – a really groundbreaking role for network television at the time. But he’s so much more than that one part. He’s a fantastic character actor; I particularly enjoyed him as Bucho’s right-hand man in ‘Desperado’ – he brought a real menace to that role. More recently, I’ve seen him in shows like ‘The Glades’ and ‘Madam Secretary’, and even ‘Law & Order True Crime’. He’s a reliable presence who always elevates whatever he’s in.

Hemky Madera

Hemky Madera is well-known for his role as Pote Galvez, the dedicated and dangerous right-hand man in the series ‘Queen of the South’. Before that, he appeared in the popular Showtime comedy ‘Weeds’ as Ignacio. Madera has also been in several films, including ‘Spider-Man: Homecoming’ where he played Mr. Delmar, and the Academy Award-winning film ‘La La Land’. He started his acting career in the Dominican Republic and has since become a familiar face on American TV and in movies.

Tony Plana

Tony Plana is a well-established actor and director, best known for his heartwarming role as Ignacio Suarez in ‘Ugly Betty’. Throughout his career, he’s been in more than 60 movies, including popular titles like ‘An Officer and a Gentleman’, ‘Three Amigos’, and ‘JFK’. He’s also a talented voice actor, famously providing the voice of Manuel “Manny” Calavera in the acclaimed video game ‘Grim Fandango’. Beyond film, Plana has a long list of television appearances, with memorable roles in shows like ‘Resurrection Blvd.’, ’24’, and ‘The West Wing’.

Esai Morales

Esai Morales first gained recognition in the 1980s playing Bob Morales in the movie ‘La Bamba’. He continued to build his career with roles in popular shows like ‘NYPD Blue’ (as Lieutenant Tony Rodriguez) and ‘Ozark’, where he was the main villain in the first season. More recently, he’s reached a new generation of fans as the villain Gabriel in ‘Mission: Impossible – Dead Reckoning Part One’. Throughout his career, he’s also appeared in notable projects like ‘Titans’, ‘Caprica’, and the film ‘Bad Boys’ with Sean Penn.

Michael Irby

I’ve been a fan of Michael Irby for years! He’s just so good at playing those tough, believable characters – you probably recognize him from shows like ‘The Unit’ or ‘Mayans M.C.’, where he played Bishop. He really stood out in ‘Barry’ too. He’s been in some big movies like ‘Fast Five’ and ‘Flightplan’, and he always brings a real sense of authority or street smarts to his roles. It’s cool to learn he actually started out doing theater in New York before making it big in L.A. – a really versatile actor!

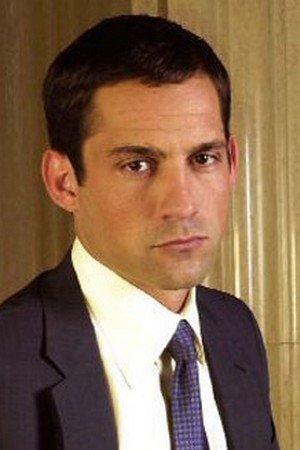

Enrique Murciano

Enrique Murciano is widely recognized for his role as Danny Taylor in the CBS series ‘Without a Trace’. He’s also appeared in notable films like Ridley Scott’s ‘Black Hawk Down’ and ‘Miss Congeniality 2: Armed and Fabulous’. On television, he’s had recurring roles in popular shows including ‘Bloodline’, ‘Power’, and ‘The Blacklist’. Murciano is known for convincingly portraying characters who are both likable and compelling, making him a strong fit for extended television dramas.

Nicholas Gonzalez

Nicholas Gonzalez is well-known from his television work, especially for playing Dr. Neil Melendez on ‘The Good Doctor’. He began his career as a main cast member on ‘Resurrection Blvd.’ and has since been in popular shows like ‘How to Get Away with Murder’, ‘Pretty Little Liars’, and ‘The Flash’. More recently, he starred as Levi Delgado in the NBC sci-fi series ‘La Brea’. Throughout his career, Gonzalez has taken on diverse roles, drawing on his experience in theater and literature.

Kamar de los Reyes

Kamar de los Reyes, a Puerto Rican actor, was well-known for playing Antonio Vega on the soap opera ‘One Life to Live’. He became famous worldwide for voicing and performing the movements of the villain Raul Menendez in the video game ‘Call of Duty: Black Ops II’. He also appeared in the film ‘Nixon’ and had regular roles on the TV shows ‘Sleepy Hollow’ and ‘The Rookie’. He was often cast as a compelling villain due to his powerful and captivating presence on screen.

Rick Gomez

Rick Gomez is a recognizable actor, best known for playing George Luz in the popular HBO miniseries ‘Band of Brothers’ and for his recurring role as Assistant U.S. Attorney David Vasquez on ‘Justified’. He’s also appeared in films like ‘Sin City’, ‘Ray’, and ‘Transformers’, often delivering believable and down-to-earth performances in supporting roles. He’s the brother of actor Carlos Gomez and has consistently worked on high-quality television shows.

Tony Dalton

Tony Dalton gained worldwide recognition for his captivating and frightening performance as Lalo Salamanca in ‘Better Call Saul’. He was already a well-known actor in Mexico, starring in the series ‘Sr. Ávila’, before becoming popular in the United States. He also played Jack Duquesne in the Marvel series ‘Hawkeye’. Dalton is celebrated for his skill in portraying characters who are both charming and intimidating, making him one of today’s most memorable television villains.

J. J. Soria

Joseph Julian Soria is an actor best known for playing Private First Class Hector Cruz on ‘Army Wives’. He’s also appeared in several popular crime dramas, including ‘The Shield’, ‘Southland’, and ‘Animal Kingdom’. Soria demonstrated his versatility with his role as Erik Morales in the Netflix series ‘Gentefied’, and he’s had supporting roles in films like ‘The Purge: Election Year’ and movies from the ‘Fast & Furious’ franchise.

Richard Cabral

Richard Cabral transformed his life from being a gang member to a successful actor, bringing a powerful sense of realism to his performances. He gained recognition for his role in ‘American Crime’, earning an Emmy nomination, and later appeared as Coco in ‘Mayans M.C.’. He’s also been in films like ‘End of Watch’ and ‘The Counselor’, frequently playing characters who are facing difficult situations. Beyond acting, Cabral is a poet and works with at-risk young people, drawing on his own experiences to enrich his work.

Jose Pablo Cantillo

Jose Pablo Cantillo is a talented actor known for his work in action and horror. He’s recognizable for roles like Ricky Verona in ‘Crank’ and Caesar Martinez, a key character in ‘The Walking Dead’. He’s also appeared in shows like ‘Sons of Anarchy’ and films by director Neill Blomkamp, including ‘Elysium’ and ‘Chappie’. Because he’s athletic, he often plays characters in physically challenging thrillers and crime dramas.

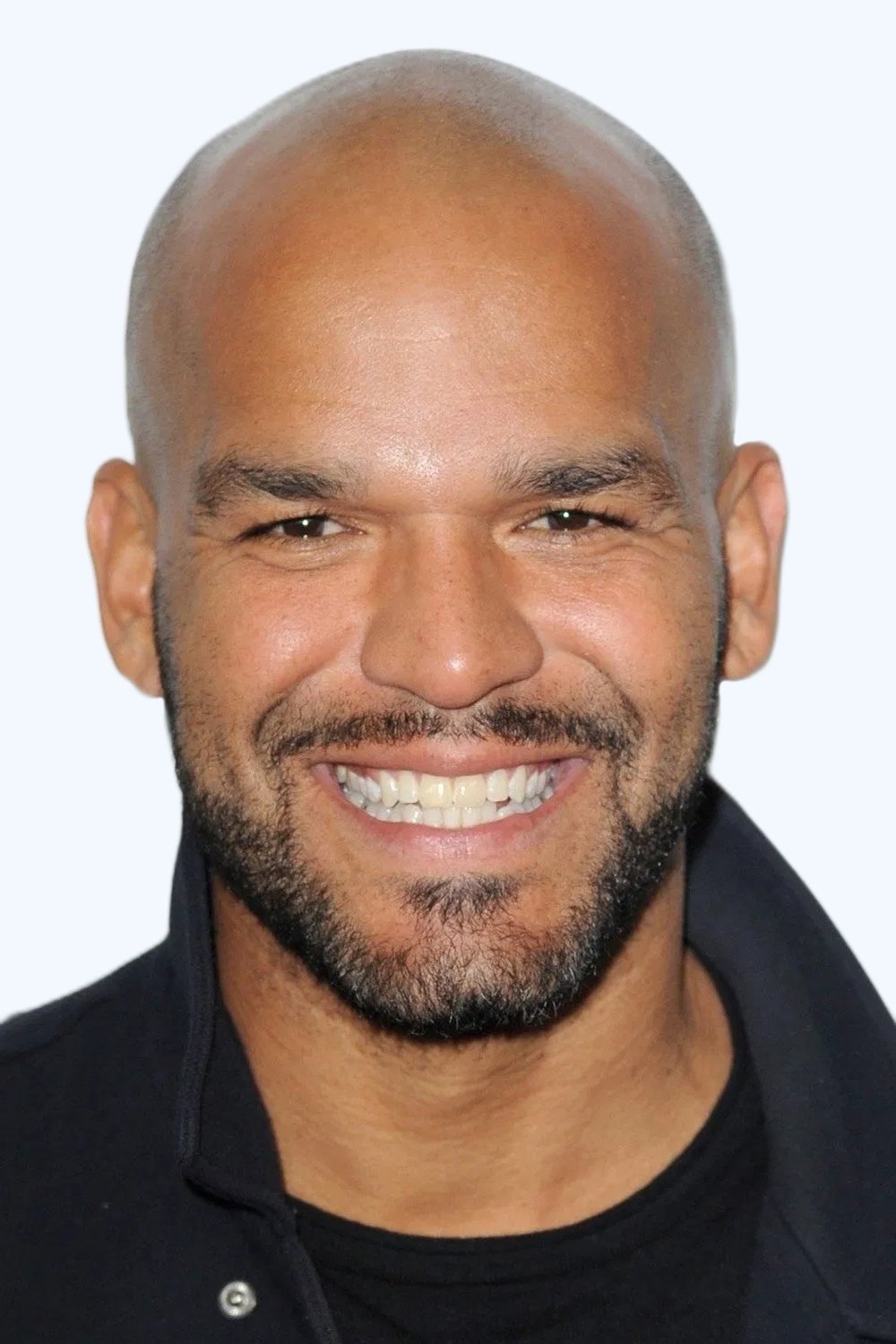

Amaury Nolasco

Amaury Nolasco is best known for playing Fernando Sucre in the popular series ‘Prison Break’, where he was the steadfast cellmate of Michael Scofield. He’s also appeared in major projects like the first ‘Transformers’ movie and the series ‘Telenovela’ with Eva Longoria. Throughout his career, Nolasco has been in films such as ‘2 Fast 2 Furious’ and ‘Max Payne’, often playing memorable and strong supporting characters. He frequently makes guest appearances on TV crime shows, always bringing a lot of energy to his performances.

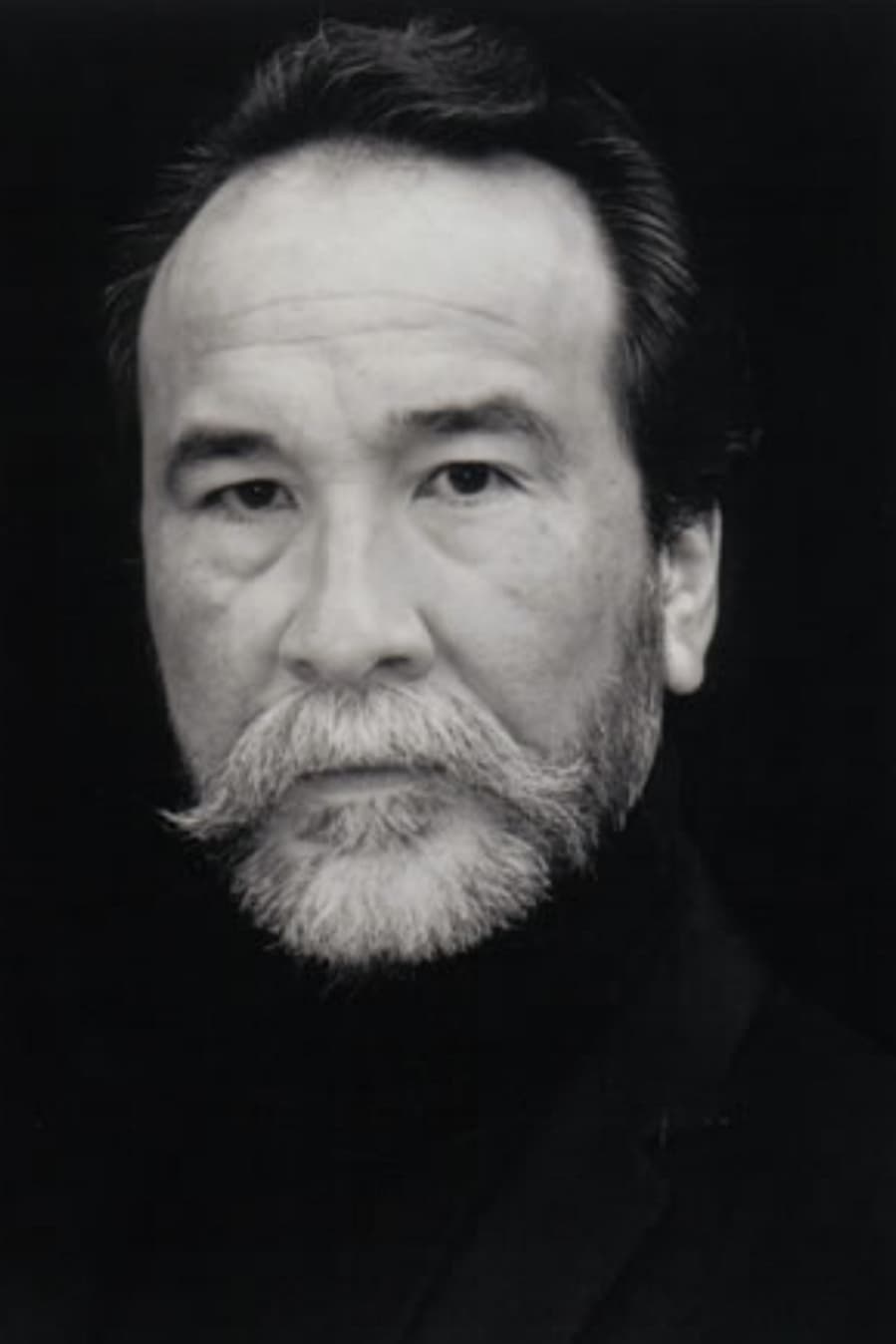

Geno Silva

Geno Silva is best remembered for his chilling, wordless performance as The Skull in the final scenes of ‘Scarface’. A working actor for over three decades, he collaborated with acclaimed directors like Steven Spielberg, appearing in films such as ‘The Lost World: Jurassic Park’ and ‘Amistad’. He also had a notable role as Cookie in David Lynch’s ‘Mulholland Drive’. Throughout his long career, Silva consistently portrayed powerful and unforgettable characters on both stage and screen.

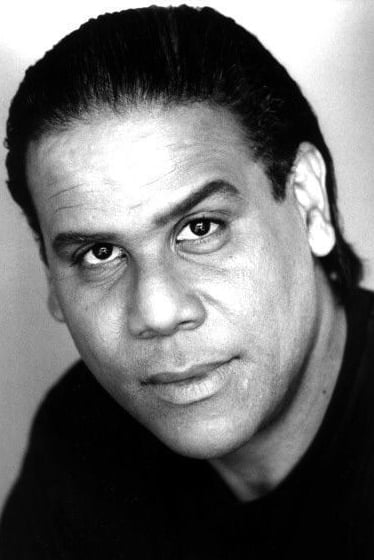

Victor Rivers

Victor Rivers is an actor and former NFL player of Cuban-American descent, widely recognized for his portrayal of Magic in ‘Blood In Blood Out’. He’s also appeared in popular films like ‘The Mask of Zorro’ and ‘Hulk’ (2003), and has made guest appearances on TV shows including ‘Star Trek: Deep Space Nine’, ‘Miami Vice’, and ‘CSI: Miami’. Because of his athletic build and experience as a professional athlete, Rivers often plays strong, commanding characters.

Carlos Carrasco

Carlos Carrasco is best known for playing Ortiz, the construction worker on the bus in the hit movie ‘Speed.’ He’s also remembered for his role as Popeye in the popular film ‘Blood In Blood Out.’ Throughout his career, Carrasco has frequently appeared in ‘Star Trek’ shows like ‘Deep Space Nine’ and ‘Voyager.’ In addition to acting, he’s a director and producer, and he created the Panamanian International Film Festival in Los Angeles.

Thomas Rosales Jr.

Thomas Rosales Jr. is a highly experienced stuntman and character actor who has appeared in over 150 movies. You’ve likely seen him in action films like ‘Speed’, ‘Heat’, and ‘The Lost World: Jurassic Park’ – often playing a henchman, driver, or other tough background character. Though his roles are usually small, he’s a familiar face in action movies from the 1980s to the 2000s. Rosales has had a remarkably long career by consistently performing dangerous and physically challenging stunts and scenes.

Mike Gomez

Mike Gomez is a well-known character actor who first gained attention for his work in ‘The Milagro Beanfield War’. Many viewers remember him as the auto shop owner in ‘The Big Lebowski’ who finds the wrecked car. He also made history as the first Latino actor to play a captain in ‘Star Trek’, appearing as Captain Lense in ‘Star Trek: The Next Generation’. Throughout his long career, he’s appeared in numerous popular shows, including ‘Hunter’, ‘The Shield’, and ‘Bones’, often in supporting roles.

Alejandro Edda

Alejandro Edda has received praise for his performance as Joaquín “El Chapo” Guzmán in the Netflix series ‘Narcos: Mexico’. He’s also been in popular films and shows like ‘The Purge Forever’ and ‘Fear the Walking Dead’. In addition, Edda voiced and provided the motion capture for the character Manny in the highly-regarded video game ‘The Last of Us Part II’. He’s becoming known as a talented character actor, able to convincingly portray both real people and fictional characters with nuance and depth.

Marco Rodríguez

I’ve noticed Marco Rodriguez in so many things over the years! He always seems to play someone in charge, like a cop or a local leader. As a ‘Seinfeld’ fan, I definitely remember him as the officer dealing with Kramer’s whole serial killer misunderstanding – that was hilarious! He was also in ‘Cobra’ and had a really important part in ‘The Crow’ as a detective. Honestly, it feels like he’s been a guest star on pretty much every crime show on TV for the last three decades. He’s a really consistent, reliable actor!

Tell us which of these prolific performers is your favorite “that guy” in the comments.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-03-06 06:49