Hollywood is known for creating acting families, where success often passes down through generations. While it can be challenging for children of famous actors to make their own mark, some actresses have not only achieved fame but have actually become more successful than their parents. They’ve moved beyond being known as someone’s daughter to become celebrated stars in their own right, earning both critical acclaim and widespread popularity. Through smart choices and exceptional talent, they’ve created new, modern legacies for their families.

Angelina Jolie

Though Angelina Jolie is the daughter of acclaimed actor Jon Voight, she ultimately became a much more globally recognized figure. She won an Oscar early in her career for ‘Girl, Interrupted’ and then became famous for action roles, most notably as Lara Croft in ‘Tomb Raider’. Jolie later expanded her work into directing, with films like ‘Unbroken’, and dedicated herself to humanitarian efforts with the United Nations. While Jon Voight has had a long and successful career, Jolie’s impact on popular culture and her success at the box office have surpassed his. Her role as Maleficent proved she could lead major film franchises.

Jennifer Aniston

I’ve always been a huge Jennifer Aniston fan! Her dad, John Aniston, was a soap opera legend – he was on ‘Days of Our Lives’ forever. But Jennifer really blew up when she played Rachel on ‘Friends’. Seriously, that role made her a global star, she even won an Emmy and became one of the highest-paid actresses ever! And she didn’t stop there – she’s had amazing roles in movies like ‘The Break-Up’ and ‘Marley & Me’. Now, she’s still killing it with ‘The Morning Show,’ where she’s both in front of and behind the camera. It’s incredible to see how successful she’s become!

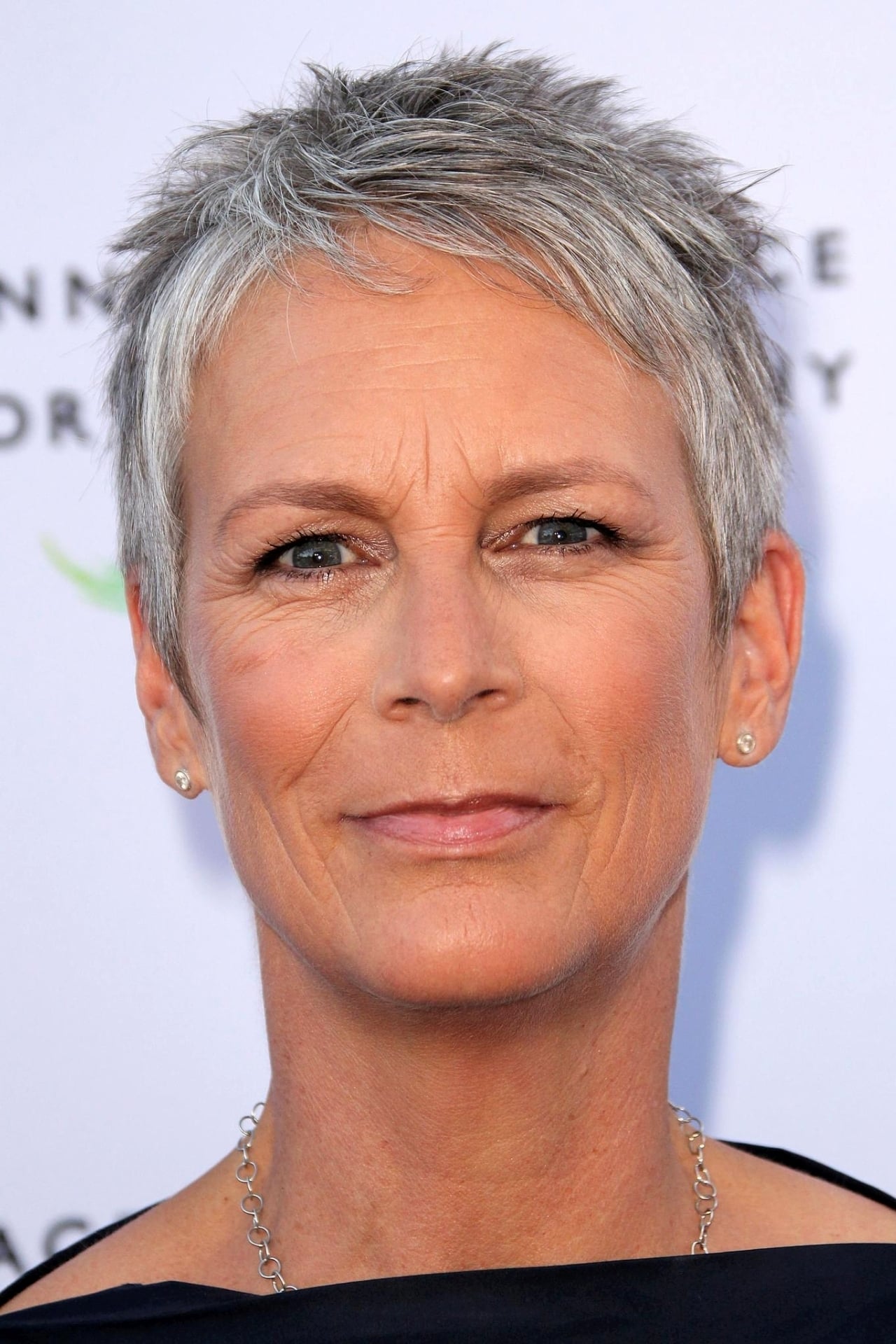

Jamie Lee Curtis

Jamie Lee Curtis entered the film industry with a lot of pressure, being the daughter of famous actors Tony Curtis and Janet Leigh. She first became well-known for her roles in horror films, especially ‘Halloween’, earning her the nickname “scream queen.” Over the years, she proved her versatility by successfully starring in comedies like ‘A Fish Called Wanda’ and ‘Freaky Friday’. Her career hit a high point with an Academy Award win for ‘Everything Everywhere All at Once’. Many believe her long and varied career has ultimately created a more diverse and memorable impact than that of her celebrated parents.

Gwyneth Paltrow

Gwyneth Paltrow comes from a show business family – her mother is actress Blythe Danner and her father was producer Bruce Paltrow. While her mother has had a long and respected career, Gwyneth quickly became famous and critically acclaimed, even winning an Oscar for her role in ‘Shakespeare in Love’. She gained even more recognition playing Pepper Potts in the ‘Iron Man’ and ‘Avengers’ movies. In addition to acting, Paltrow has created a very successful lifestyle brand, making her a well-known figure in the world of business and wellness.

Drew Barrymore

Drew Barrymore is part of a famous acting family, following in the footsteps of her father, John Drew Barrymore, and grandfather, John Barrymore. She first became well-known as a child in the movie ‘E.T. the Extra-Terrestrial’ and successfully continued her career as an adult. She also created her own production company, Flower Films, which produced popular films like ‘Never Been Kissed’ and ‘Charlie’s Angels’. More recently, she launched ‘The Drew Barrymore Show,’ a widely watched talk show. Through her long-lasting career and successful businesses, Drew Barrymore has become the most recognizable member of the Barrymore family today.

Laura Dern

Laura Dern comes from a Hollywood acting family – her parents are Bruce Dern and Diane Ladd. She started her career in smaller, independent films, including ‘Blue Velvet,’ and then became internationally known with the huge success of ‘Jurassic Park.’ Throughout her career, she’s skillfully moved between large-scale blockbusters and highly praised television roles, such as in ‘Big Little Lies.’ She’s received numerous awards for her work, including an Academy Award for ‘Marriage Story’ and multiple Emmy and Golden Globe Awards. Her long and successful career has made her a more consistently working and recognizable star than either of her parents.

Dakota Johnson

Dakota Johnson, the daughter of actors Don Johnson and Melanie Griffith, became a global star thanks to her role as Anastasia Steele in the ‘Fifty Shades of Grey’ movies. After that success, she deliberately chose a variety of roles in films like the thrillers ‘Suspiria’ and the drama ‘The Lost Daughter’. She’s successfully balanced big-budget studio films with smaller independent projects, broadening her appeal. Now, Dakota is considered one of the most prominent actresses of her generation, and her career has even surpassed the level of fame her parents achieved.

Mariska Hargitay

Growing up, my mom, Jayne Mansfield, was a huge star in movies, and my dad was Mr. Universe, so I always knew show business was in my blood. But I’ve built my own path, and I’m incredibly proud of it. For over twenty-five years, I’ve played Olivia Benson on ‘Law & Order: Special Victims Unit,’ and it’s become a defining part of my life. It’s amazing to be one of the longest-running and most-awarded actresses on TV. But honestly, I’m just as proud of the work I do through my Joyful Heart Foundation. I’m building a legacy that’s all my own, and it feels good to know I’m making a difference, separate from my mom’s amazing, but shorter, film career.

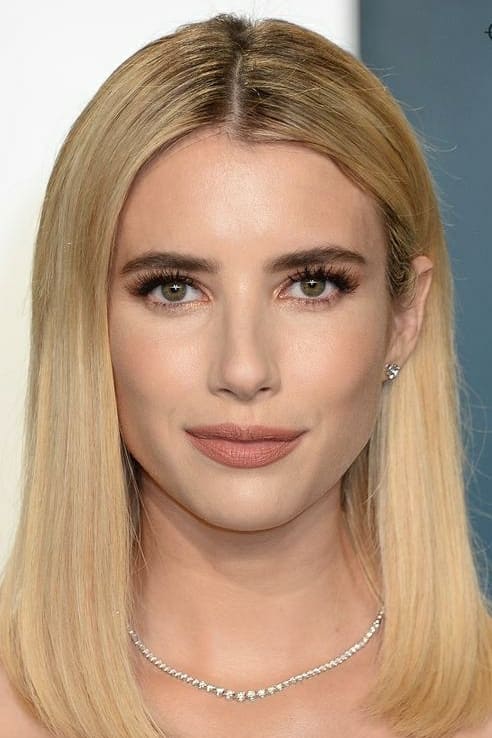

Emma Roberts

Emma Roberts, whose parents include actor Eric Roberts and aunt Julia Roberts, began acting as a teen on the TV show ‘Unfabulous’. She soon transitioned to movies like ‘Aquamarine’ and ‘Wild Child’ and eventually became well-known for her work in horror films. Her frequent partnerships with producer Ryan Murphy on shows like ‘American Horror Story’ and ‘Scream Queens’ made her a popular TV star for a new audience. Though her father was successful in the 1980s, Emma has achieved even greater fame today thanks to consistent leading roles and a large following on social media. She continues to work as both an actress and producer, remaining a regular presence in Hollywood.

Kate Hudson

Kate Hudson, the daughter of Goldie Hawn and Bill Hudson, became famous for her Oscar-nominated role in ‘Almost Famous’. That performance made her a popular star in romantic comedies, with films like ‘How to Lose a Guy in 10 Days’ becoming big hits. Beyond acting, she’s also built a thriving activewear brand, which has boosted her fame and wealth. While her mother, Goldie Hawn, is a celebrated icon, Kate Hudson has created her own successful career as both a movie star and a businesswoman.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

2026-03-05 08:45