For decades, Hollywood has featured actors known for their impressive physiques. Many Black actors have committed to intense training to prepare for physically demanding roles in action movies and superhero films. They not only deliver powerful performances but also motivate viewers with their dedication to fitness and a healthy lifestyle. Here’s a look at some of the most muscular Black men currently starring in major movies and TV shows.

Michael B. Jordan

As a movie fan, one thing that always strikes me about Michael B. Jordan is his dedication to physical transformation for his roles. I mean, the guy really commits! He bulked up massively for ‘Creed’ and stayed in incredible shape for the follow-up films. Then, for ‘Black Panther’, he went through another intense training process to become the imposing Erik Killmonger. It’s clear that staying physically fit isn’t just about the roles for him; it’s become a huge part of how he presents himself as an actor in Hollywood.

Jonathan Majors

Jonathan Majors got incredibly fit for his role in ‘Creed III,’ achieving a physique that looked like a professional boxer. He continued to prioritize his muscular build and athleticism for ‘Ant-Man and the Wasp: Quantumania,’ and believes that getting physically prepared is key to understanding and portraying his characters convincingly.

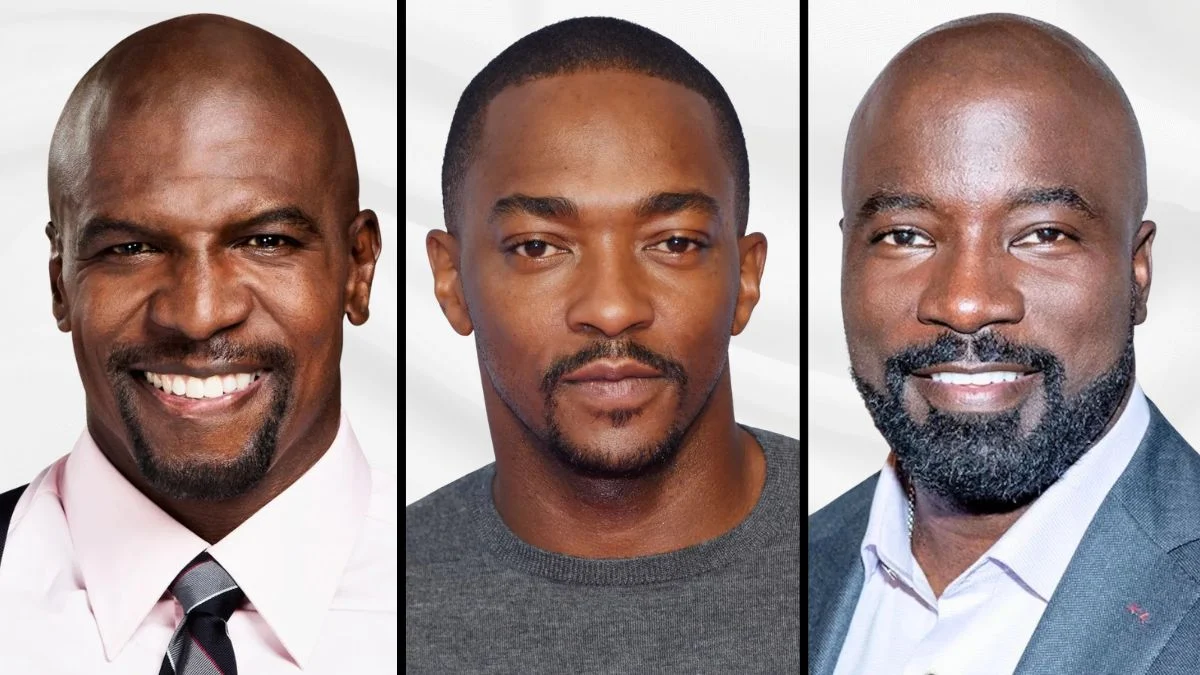

Anthony Mackie

Throughout his time in the Marvel Cinematic Universe, Anthony Mackie has consistently stayed in excellent physical condition, building a lean and muscular body. To prepare for his role as Captain America in ‘The Falcon and the Winter Soldier’, he focused on strength training. This high level of fitness allows him to do many of his own stunts and manage the physically challenging aspects of his action roles. Mackie regularly uses functional training and cardio to stay in peak condition for all his acting work.

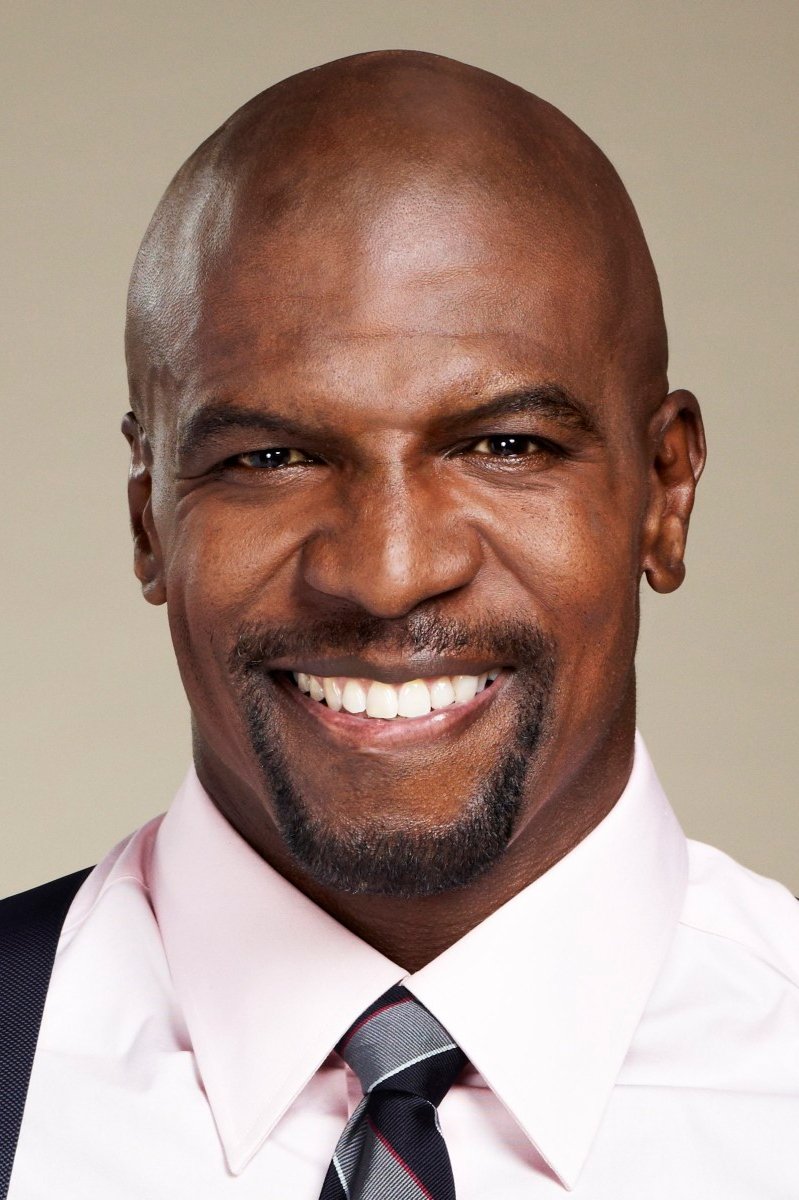

Terry Crews

Terry Crews started as a professional football player before becoming a popular actor, and he’s always been known for his impressive physique. He’s famous for roles in shows like ‘Brooklyn Nine-Nine’ and movies like ‘The Expendables,’ where his strength is often showcased. Crews continues to inspire people in the fitness world, often sharing his workouts and how he practices intermittent fasting. His combination of incredible muscle and comedic talent makes him stand out in film and television.

Mike Colter

Mike Colter is famous for playing the super-strong Luke Cage, a role he prepared for by building a powerfully muscular physique. He’s continued to take on physically demanding roles, like in the series ‘Evil’, and consistently chooses projects that showcase his athleticism and dedication to fitness.

Winston Duke

I was absolutely blown away by Winston Duke in ‘Black Panther’ – his portrayal of M’Baku was incredible! He’s a huge guy, naturally, well over six feet tall, but he clearly works hard to stay in amazing shape for his roles. You could really see that in movies like ‘Us’ and ‘Spenser Confidential’ where he had a lot of physical scenes. He’s definitely become a major star in Hollywood, and he really embodies this strong, powerful type of character – it’s awesome to watch!

Laz Alonso

Laz Alonso is well-known for his impressive physique, especially in the show ‘The Boys’ where he plays Mother’s Milk. This character is both smart and physically powerful, and Alonso has consistently prepared for demanding roles – like those in ‘Fast & Furious’ and ‘Avatar’ – by staying in top shape. His commitment to fitness allows him to consistently look the part and perform challenging action scenes.

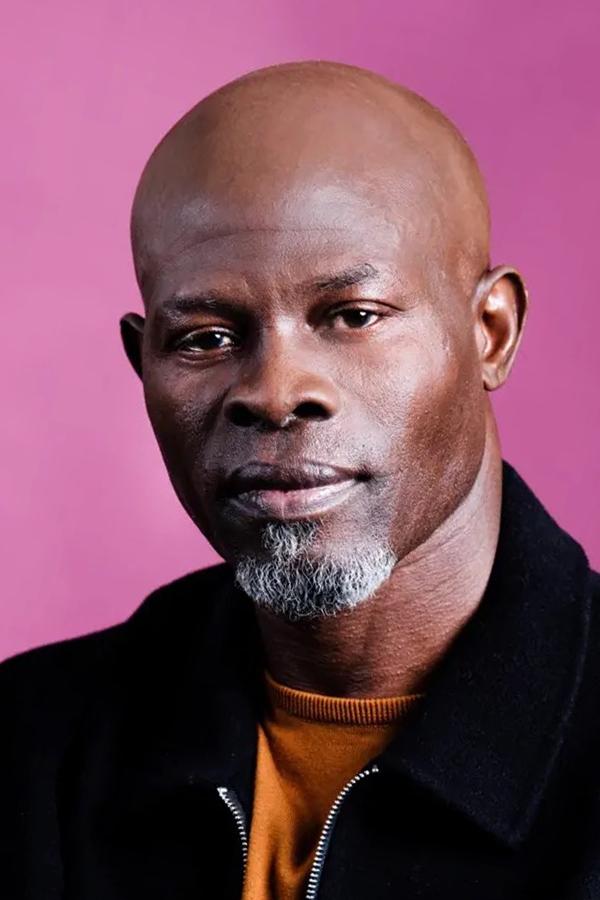

Djimon Hounsou

Djimon Hounsou started his career as a model and went on to become a highly respected actor, known for his strong and athletic build. He’s starred in popular films like ‘Gladiator’ and ‘Blood Diamond’. Hounsou has a classic look that makes him believable as both warriors and leaders in a variety of movies, and he continues to be one of the most physically fit actors working today.

Henry Simmons

Henry Simmons is known for his tall stature and strong physique, which have been prominent in his television roles. He’s particularly remembered for playing Alphonso Mackenzie in ‘Agents of S.H.I.E.L.D.’, a character often engaged in fight scenes. Throughout his career, including roles in shows like ‘NYPD Blue’ and ‘Manhunt’, Simmons has consistently stayed in excellent shape. This commanding physical presence remains a key part of what makes him a memorable actor.

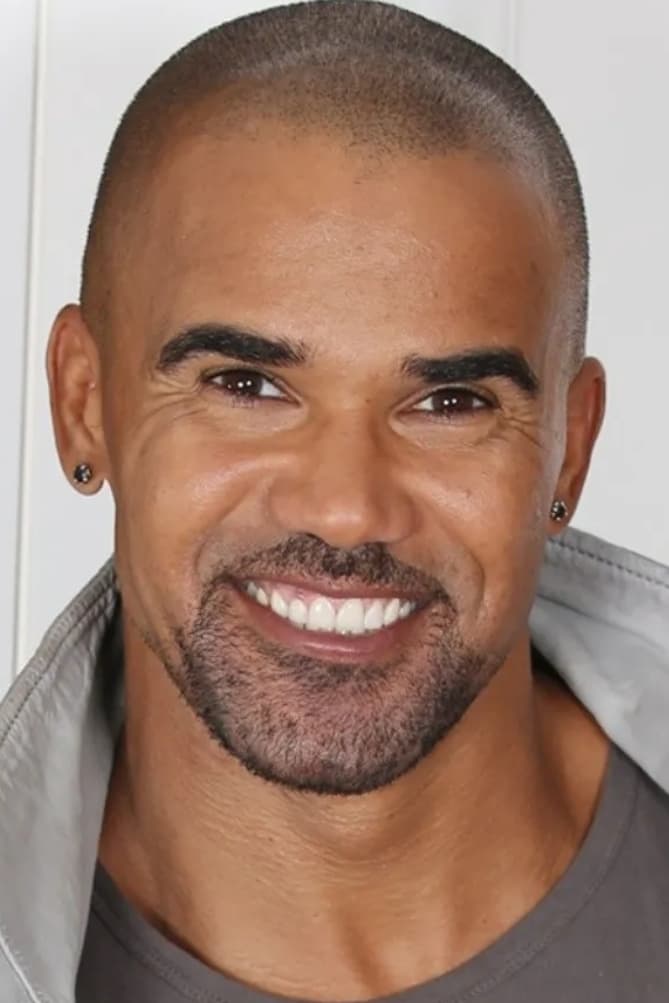

Shemar Moore

Shemar Moore is known for being incredibly fit, and he often shows off his impressive physique in his TV roles. Throughout his time on ‘Criminal Minds’ as an FBI agent, he stayed in top shape. When he became the lead in ‘S.W.A.T.’, maintaining peak physical condition was essential for the show’s challenging action scenes. Moore frequently shares his workouts with fans to inspire them to live healthier lives and commit to regular training.

Morris Chestnut

For decades, Morris Chestnut has been a Hollywood icon of health and fitness, famous for roles in films like ‘The Best Man’ and the TV show ‘Rosewood’. He shared his own wellness journey by writing a book to help others reach their fitness goals, and he continues to stay in great shape through dedicated workouts and a healthy diet.

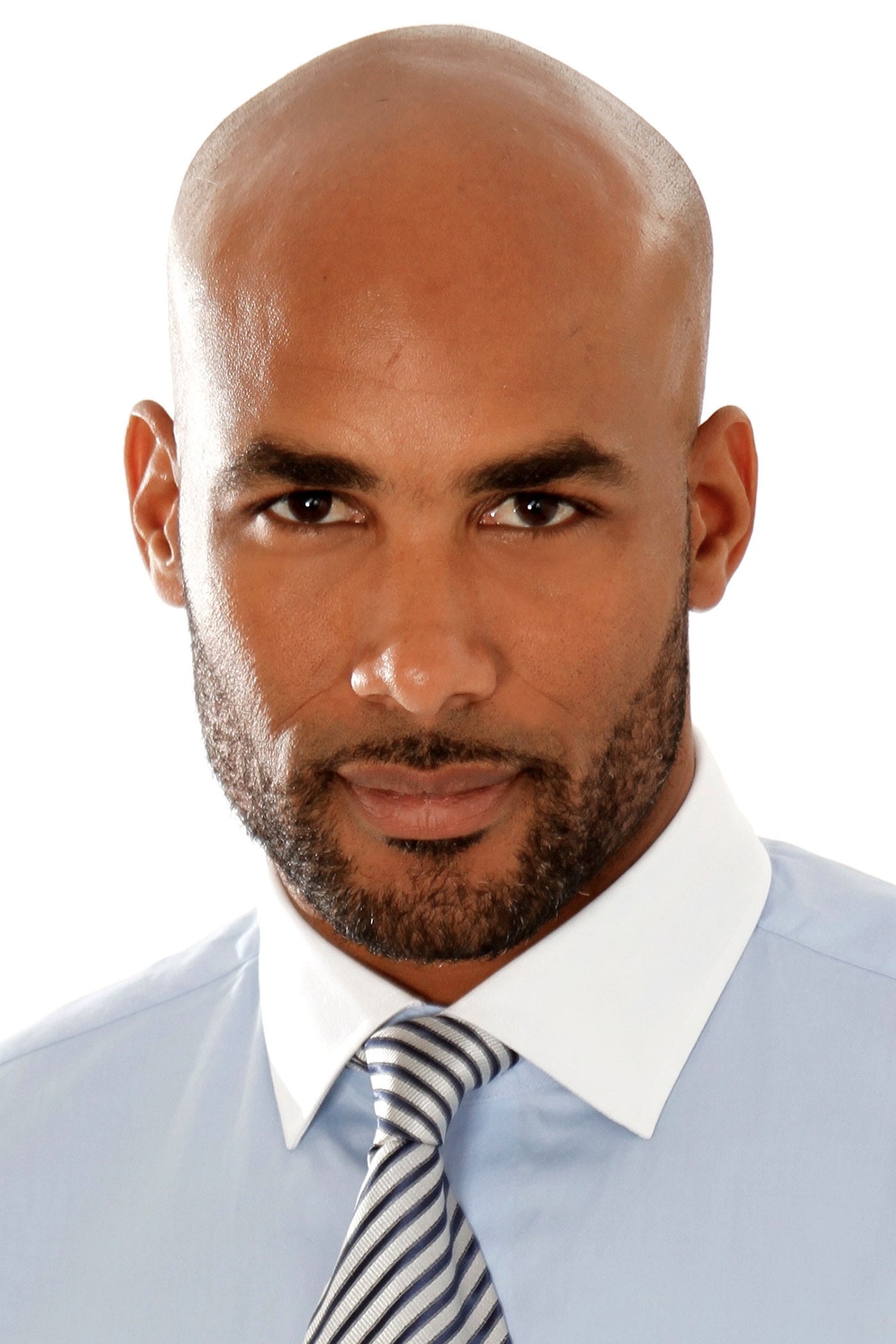

Boris Kodjoe

Boris Kodjoe was once a competitive tennis player, and he’s now a successful actor. He’s become popular for his work on shows like ‘Station 19’ and in the ‘Resident Evil’ movies. Kodjoe’s fit and athletic build allows him to play both romantic and action-packed characters. Staying in shape and living a healthy lifestyle are important parts of his everyday life.

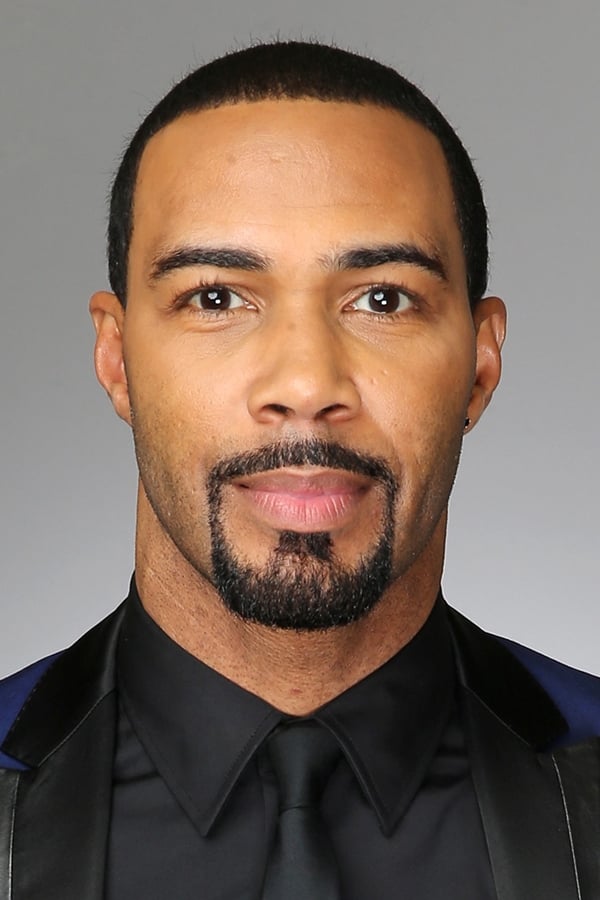

Omari Hardwick

Omari Hardwick became known for his impressive physique while starring in ‘Power’. His character, Ghost, needed to appear strong and commanding, which Hardwick achieved through his physical presence. He further displayed his athleticism in ‘Army of the Dead’, playing a tough and experienced fighter. Hardwick continues to prioritize a strict fitness routine to maintain his shape and keep up with the demands of his acting career.

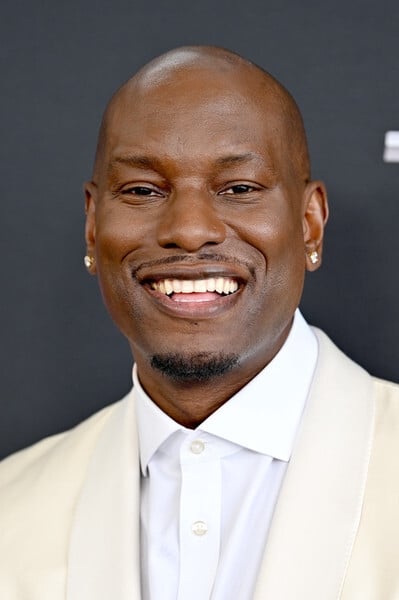

Tyrese Gibson

Tyrese Gibson is known for his consistently fit physique, something he’s maintained throughout his many years working on the ‘Fast & Furious’ movies. Because he often stars in action films, staying in excellent shape is essential for performing challenging stunts. Before becoming a Hollywood star, Gibson started out as a model and singer. Even with a packed schedule of filming and making music, he continues to make his health and fitness a priority.

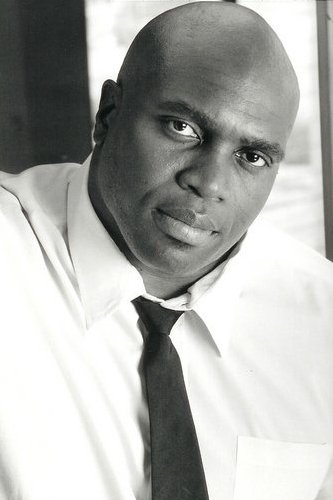

Lester Speight

Lester Speight is a former football player and wrestler famous for his incredibly large and muscular build. He first became well-known for his funny commercials as ‘Terry Tate: Office Linebacker’ and then moved on to acting in films and TV. He’s been in big projects like ‘Transformers: Dark of the Moon’ and the ‘Gears of War’ video games. Because of his impressive size and strength, he’s considered one of the most physically powerful actors currently working.

Aldis Hodge

Aldis Hodge completely changed his physique to play Hawkman in ‘Black Adam,’ spending months building muscle through intense weight training. While he’s known for being lean and fit in shows like ‘Leverage’ and ‘City on a Hill,’ preparing for this superhero role demanded an even greater level of physical and mental dedication – something he often discusses.

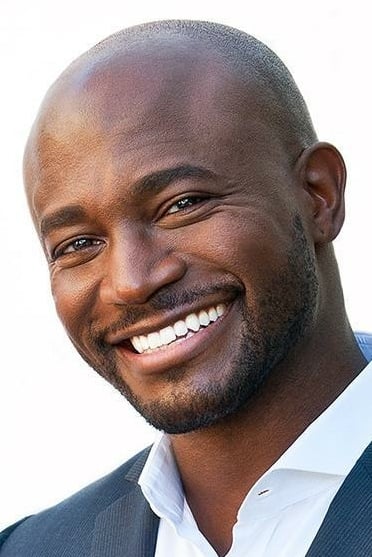

Taye Diggs

Taye Diggs has been admired for his impressive physique since he first gained recognition in ‘How Stella Got Her Groove Back’. He’s consistently stayed in great shape through roles in shows like ‘All American’ and ‘Private Practice’. Diggs keeps lean and flexible by including dance and practical exercises in his workouts, and remains one of the most fit actors in Hollywood.

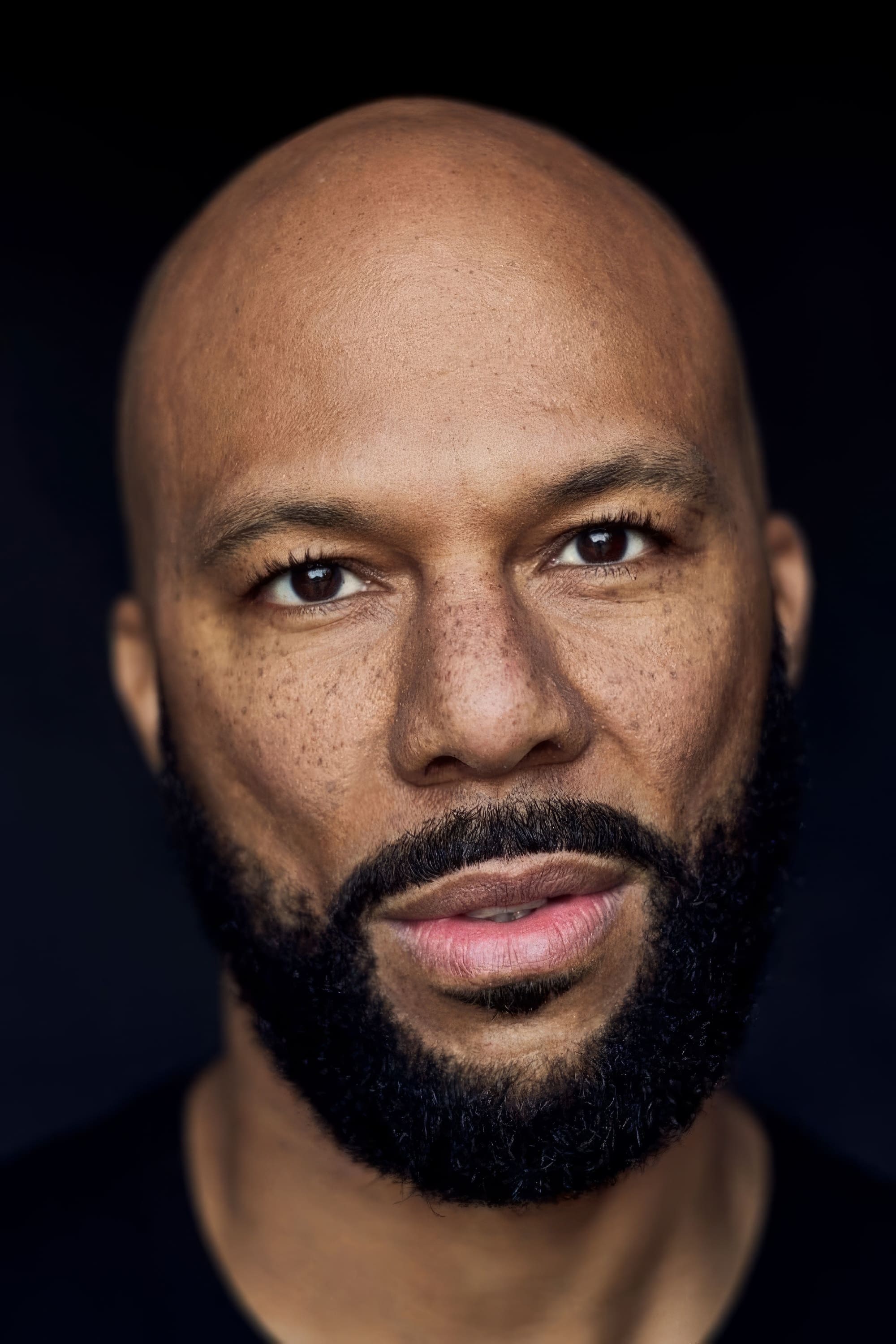

Common

Common is an Oscar-winning actor and musician known for his fit, muscular physique. He’s starred in action-packed movies like ‘John Wick: Chapter 2’ and ‘Suicide Squad’. To stay in top shape, Common eats a strict vegan diet and exercises regularly. This dedication to fitness helps him handle the physically challenging roles that require both strength and flexibility.

Sterling K. Brown

Sterling K. Brown is a celebrated actor known for his versatility and commitment to staying fit. Viewers often see his impressive physique in shows like ‘This Is Us’ and the movie ‘Black Panther’. He maintains his shape through a mix of activities, including playing basketball and lifting weights, proving that a successful career and personal health can go hand-in-hand.

Sinqua Walls

As a movie fan, I’ve noticed Sinqua Walls really brings a physicality to his roles, and it makes sense when you learn he used to play college basketball! He’s known for projects like ‘Teen Wolf’ and the remake of ‘White Men Can’t Jump’, where he’s often playing characters who need to be strong and athletic. It’s clear he takes his fitness seriously – he’s always in great shape, and I know he focuses on weightlifting and staying active to be ready for those demanding roles.

Lance Gross

Lance Gross is an actor and photographer known for staying in great shape. He first became famous for his role on ‘House of Payne’ and has since acted in many action and drama films and shows. He frequently posts about his workouts and shares fitness advice with his fans online. His commitment to staying fit and athletic has helped him land leading roles throughout his career.

Jesse Williams

Jesse Williams is famous for playing a doctor on ‘Grey’s Anatomy,’ and he’s always been in great shape. He’s continued to stay fit as he’s taken on different acting roles in theater and movies. Staying healthy and exercising regularly is a priority for Williams, helping him meet the physical challenges of his work. He’s known throughout the entertainment industry for consistently being in excellent physical condition.

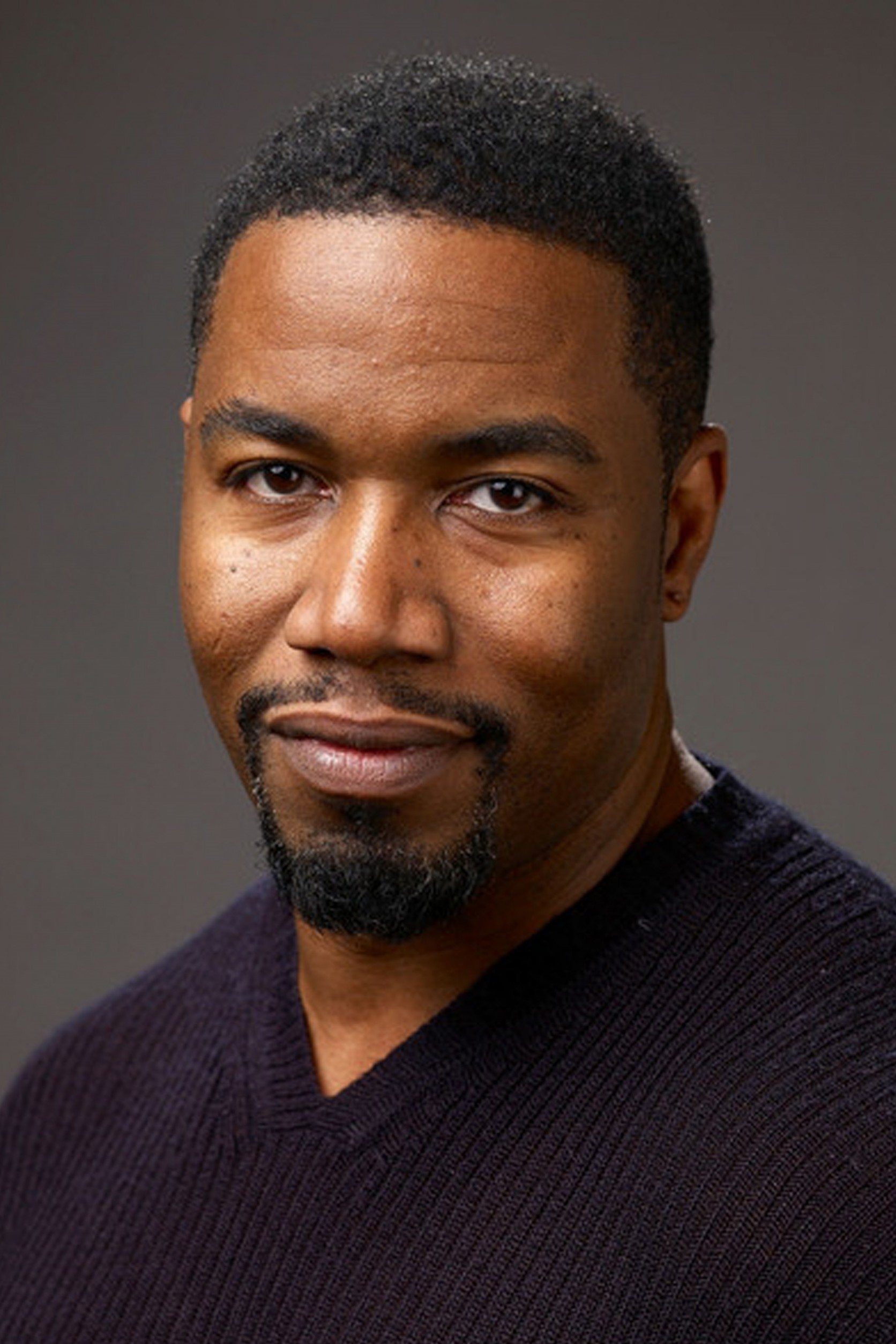

Michael Jai White

Michael Jai White is a highly skilled martial artist and actor known for his impressive physique and strength. He’s appeared in many action movies, like ‘Spawn’ and ‘Black Dynamite’, and is a black belt in several disciplines. He consistently uses his martial arts training to stay in top shape, and is widely regarded as one of Hollywood’s most physically gifted and naturally strong actors.

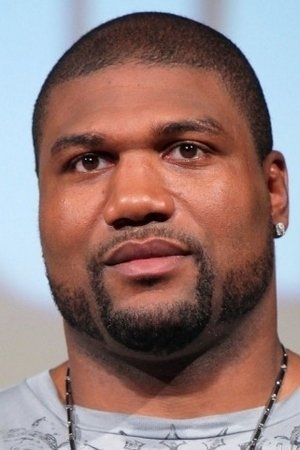

Quinton Rampage Jackson

Quinton Jackson first became famous as a mixed martial arts champion, but he’s also had a thriving career as an actor. Many people recognize him as B.A. Baracus from ‘The A-Team,’ a role where he really showed off his incredible strength. Jackson’s naturally large and muscular build comes from his years as a professional fighter, and he often takes roles that allow him to use his powerful physique and imposing presence.

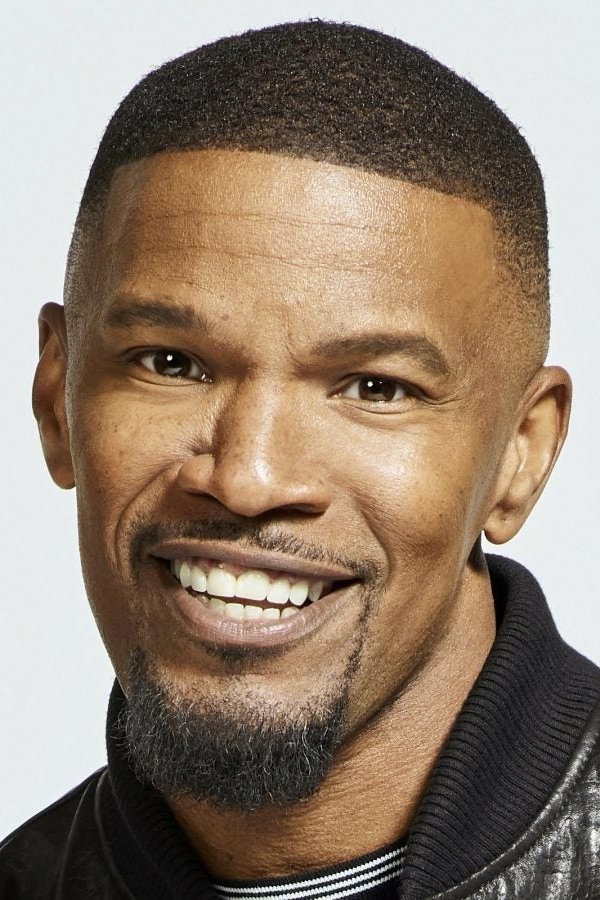

Jamie Foxx

Jamie Foxx, an Academy Award winner, is known for dramatically changing his physique for different movie roles. He got into incredible shape for ‘Django Unchained’ and has continued to prioritize fitness ever since. He frequently posts videos of his tough workouts, which include both strength training and cardio. Staying physically fit is a major reason he’s had such a long and successful career in Hollywood.

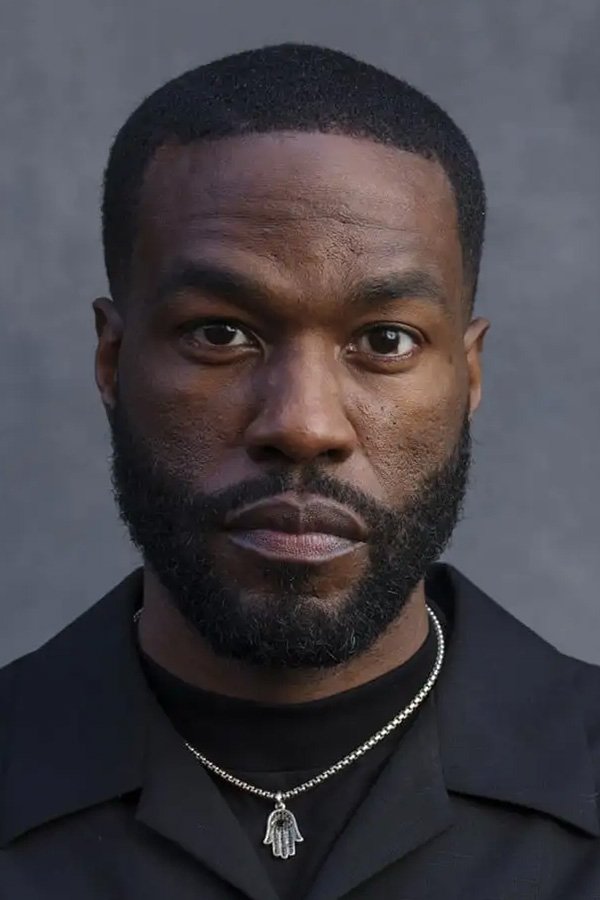

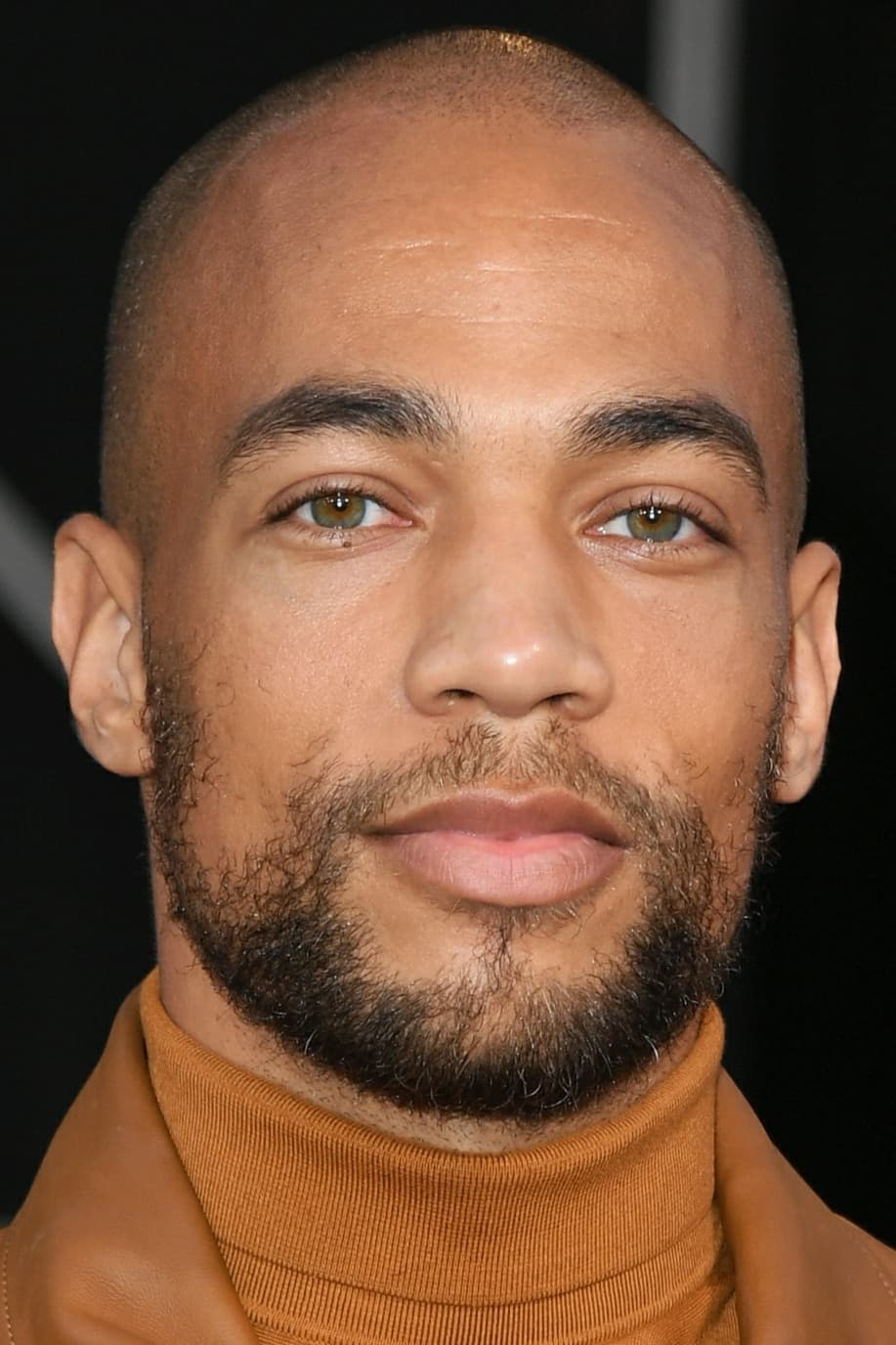

Yahya Abdul-Mateen II

Yahya Abdul-Mateen II has become known for his strong and muscular physique, which he developed for roles in films like ‘Aquaman’, ‘Watchmen’, and ‘The Matrix Resurrections’. He notably played the physically imposing villain Black Manta and consistently takes on demanding roles that showcase his impressive strength and build.

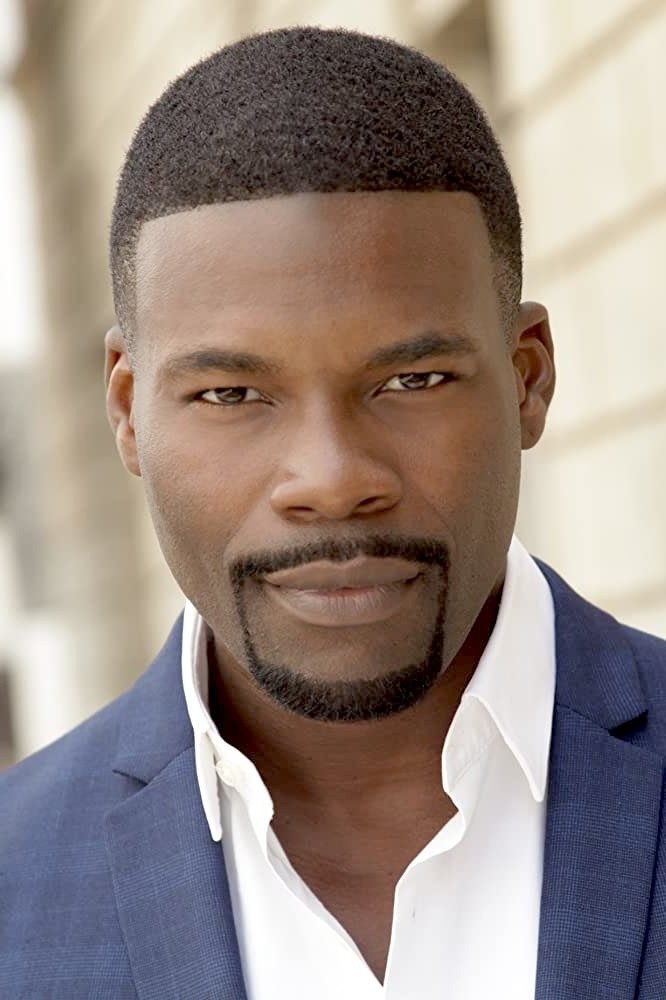

Cress Williams

Cress Williams brought a strong, heroic physique to his role as the lead in ‘Black Lightning’. He trained specifically to get in shape for the part of a seasoned superhero. Williams has often played characters that showcase his impressive build and muscular physique throughout his career. He remains a busy actor in Hollywood and continues to stay in excellent physical condition.

Tory Kittles

Tory Kittles is recognized for his fit and muscular build, prominently featured in the show ‘The Equalizer’. He frequently portrays characters with expertise in tactical skills and fighting. Kittles stays in shape by combining traditional strength training with functional exercises, and his athletic physique is a defining aspect of his performances in action and dramatic roles.

Isaiah Mustafa

Isaiah Mustafa first gained widespread recognition as the face of Old Spice, becoming known for his impressive physique. He’s since moved into acting, appearing in projects like ‘It Chapter Two’ and ‘Shadowhunters’. Before his entertainment career, Mustafa was a professional football player, and he continues to prioritize his fitness. He regularly shares his dedication to health and exercise with his followers.

Mehcad Brooks

Mehcad Brooks is well-known for his impressive physique, which he showcased in shows like ‘Supergirl’ and the movie ‘Mortal Kombat’. In ‘Mortal Kombat’, he played Jax, a role that highlighted his strength. Before becoming a successful actor, Brooks started his career as a model. He continues to be one of the most physically fit actors in Hollywood.

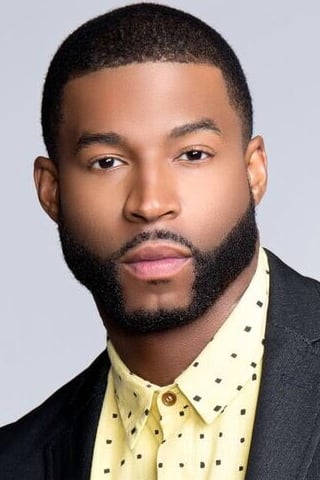

Pooch Hall

As a movie fan, I’ve always been impressed with Pooch Hall. He’s not just an actor, but a former boxer, and he’s clearly kept in amazing shape! Most people probably recognize him from ‘The Game,’ where he totally nailed the role of a football player. What’s cool is he uses his boxing skills to stay fit and even do some of his own stunts! He consistently chooses roles that let him show off his athleticism and dedication to training, which is awesome to see.

Mahershala Ali

As a movie fan, I’ve always been impressed with Mahershala Ali – he’s incredibly talented and has won two Oscars! Something I’ve also noticed is how physically fit he is. He’s taken on roles, like in ‘Luke Cage’ and ‘Alita: Battle Angel’, where he really needed to be strong and capable. I actually learned he used to play college basketball, and he still makes fitness a big part of his life. Right now, he’s getting into amazing shape for his upcoming role as Blade, and I’ve heard the training is intense!

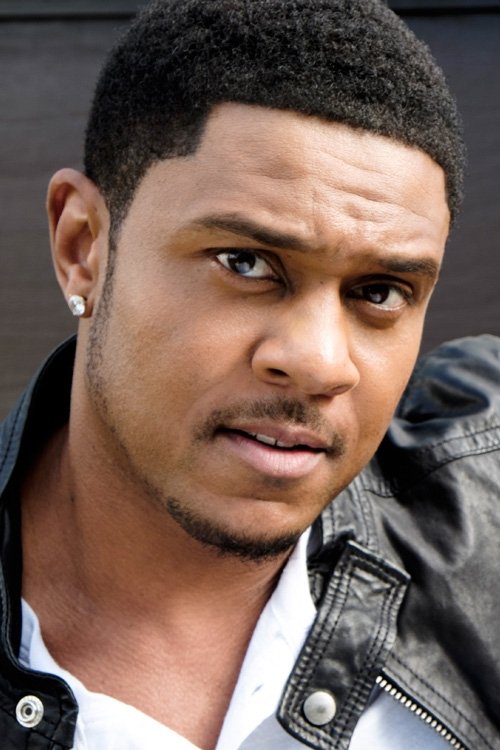

Cory Hardrict

Cory Hardrict is known for staying in excellent physical shape throughout his acting career. He’s appeared in projects like ‘Battle: Los Angeles’ and ‘All American: Homecoming’, often playing roles that call for him to be physically fit, such as soldiers or athletes. He consistently works out to maintain his condition and prepare for a variety of roles.

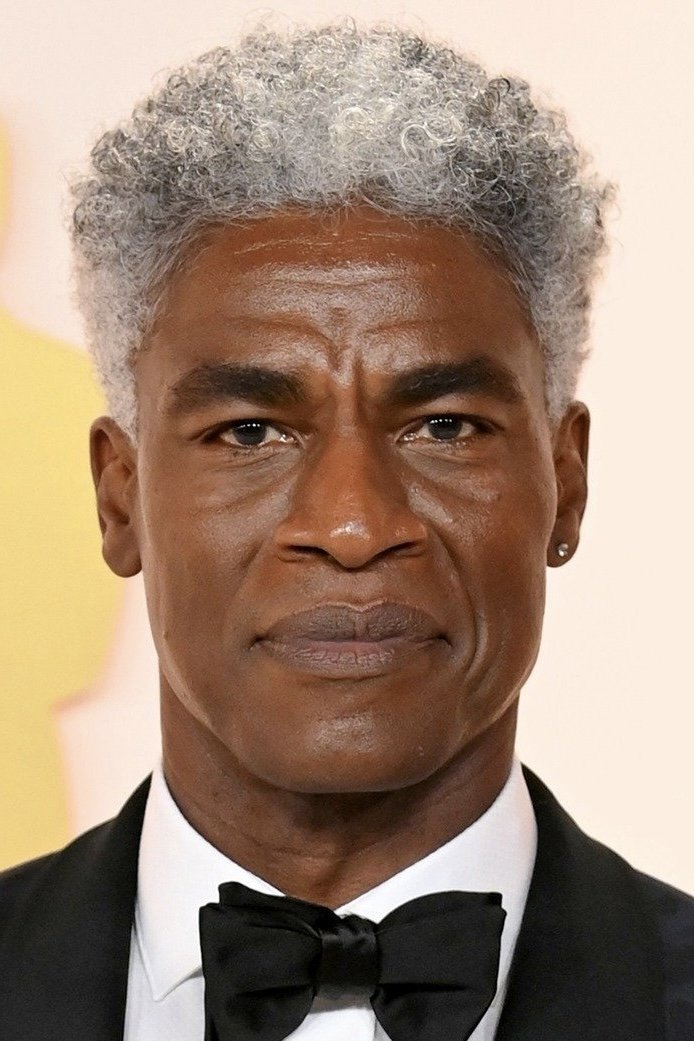

Charles Parnell

Charles Parnell is recognizable for his impressive physique in the hit movie ‘Top Gun: Maverick’. He often plays powerful military characters who project strength and confidence. Parnell stays in excellent shape, which allows him to take on demanding roles in big action films. He’s a well-regarded actor in Hollywood, known for his dedication to health and fitness.

Wood Harris

Wood Harris is best known for his work on ‘The Wire’ and has consistently stayed in great shape throughout his acting career. He showed off his impressive physique in the ‘Creed’ movies, where he played a boxing coach. Harris makes exercise a priority to maintain his fit appearance for his roles, and his strong physical presence has become a key part of how he’s known as an actor.

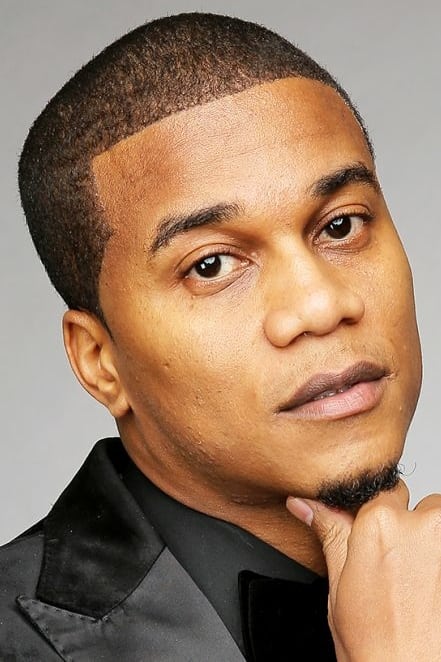

Robert Christopher Riley

Robert Christopher Riley is famous for his impressively fit body, seen in shows like ‘Dynasty’ and ‘Hit the Floor’. He frequently plays athletes, which means he dedicates a lot of effort to staying in shape. Riley uses social media to share his fitness progress and motivate others to live active lifestyles. He consistently chooses roles that highlight his strength and commitment to health.

Jay Ellis

Jay Ellis is an actor recognized for his athletic physique, showcased in shows like ‘Insecure’ and the movie ‘Top Gun: Maverick’. He stays in great shape, allowing him to play both romantic and action-oriented characters. Ellis focuses on a healthy lifestyle, regularly engaging in sports and outdoor activities, and is a well-known advocate for overall wellness in Hollywood.

Sarunas J. Jackson

Sarunas J. Jackson started as a professional basketball player before becoming a successful actor. He’s recognizable for his height and athletic build, especially in shows like ‘Insecure’ and ‘Games People Play’. He stays in great shape for his roles by drawing on his experience as an athlete, and is often cast as physically strong or imposing characters.

Kendrick Sampson

Kendrick Sampson is recognized for his impressive physique, seen in shows like ‘Insecure’ and ‘The Vampire Diaries’. He believes that mental and physical health are closely linked and essential for overall well-being. To stay in shape for his roles, Sampson consistently works out and is a leading advocate for a well-rounded approach to fitness, using his public profile to spread this message.

Kofi Siriboe

Kofi Siriboe first became well-known for his fit physique while starring in the show ‘Queen Sugar’. He started out as a model and has since become a prominent actor. Siriboe stays in shape through a healthy lifestyle and consistent workouts, and often chooses roles that showcase his athletic build and captivating presence on screen.

Amin Joseph

Amin Joseph is recognized for his impressively fit physique, especially in the show ‘Snowfall’. He plays Jerome Saint, a character known for his strength and imposing presence. Joseph consistently maintains peak physical condition for his roles, and remains a highly regarded actor known for his dedication to fitness.

Thomas Q. Jones

Thomas Q. Jones was a professional football player who has become a successful actor. He’s known for his impressive physique, which he displays in shows like ‘Luke Cage’ and ‘P-Valley.’ Jones uses his athletic background to stay in top shape for his acting roles, proving that athletes can thrive in the entertainment industry.

Gaius Charles

Gaius Charles is recognized for his impressive physique, first seen in shows like ‘Friday Night Lights’ and ‘Grey’s Anatomy’. Throughout his acting career, especially in action-oriented roles, he’s consistently stayed in great shape. Charles achieves this through regular exercise and a healthy lifestyle, allowing him to remain physically and mentally prepared for any role. He’s now a well-respected actor known for his dedication and discipline.

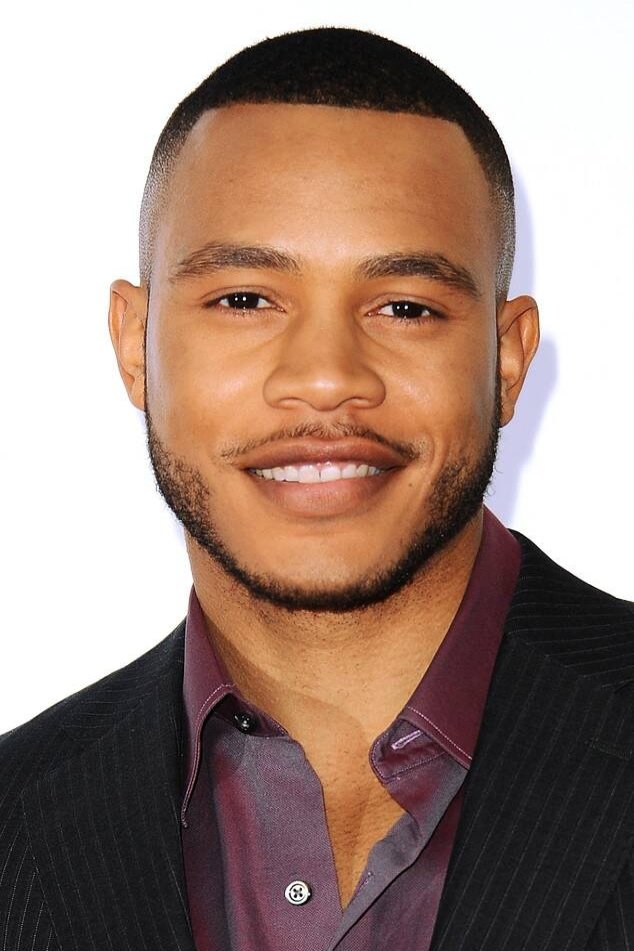

Trai Byers

Trai Byers is well-known for his impressive physique, especially from his role as Andre Lyon in the TV show ‘Empire,’ where he often needed to look strong and fit. He’s continued to prioritize his health and fitness with his other acting work in film and theater. Byers believes that success in both acting and staying in shape requires consistent effort and commitment.

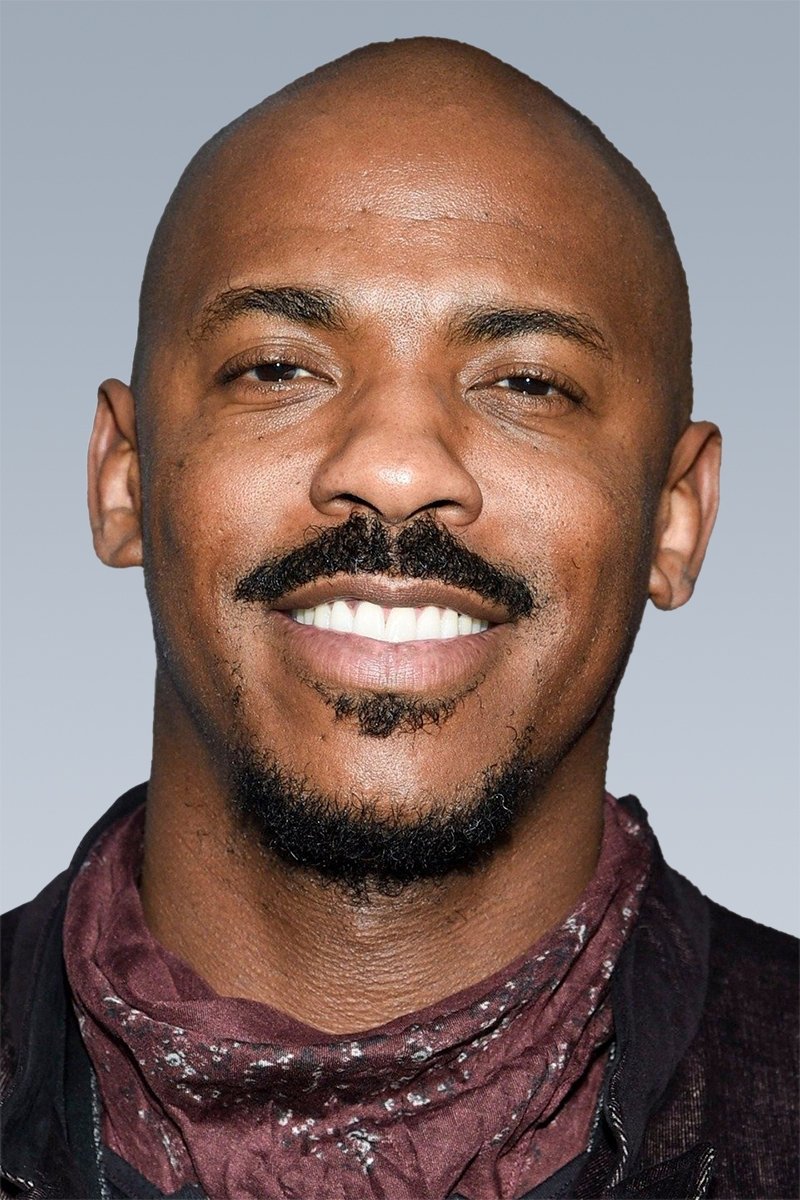

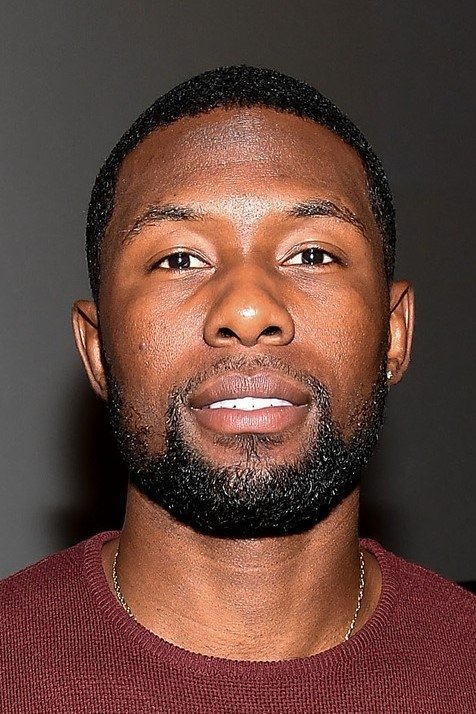

Rotimi

Rotimi is a singer and actor known for his roles in shows like ‘Power’, where he often plays characters who need to look athletic and fit. He stays in shape through a healthy lifestyle and consistent exercise, understanding that physical conditioning is important for his performances and career in Hollywood. He’s a versatile performer who takes his physical fitness seriously.

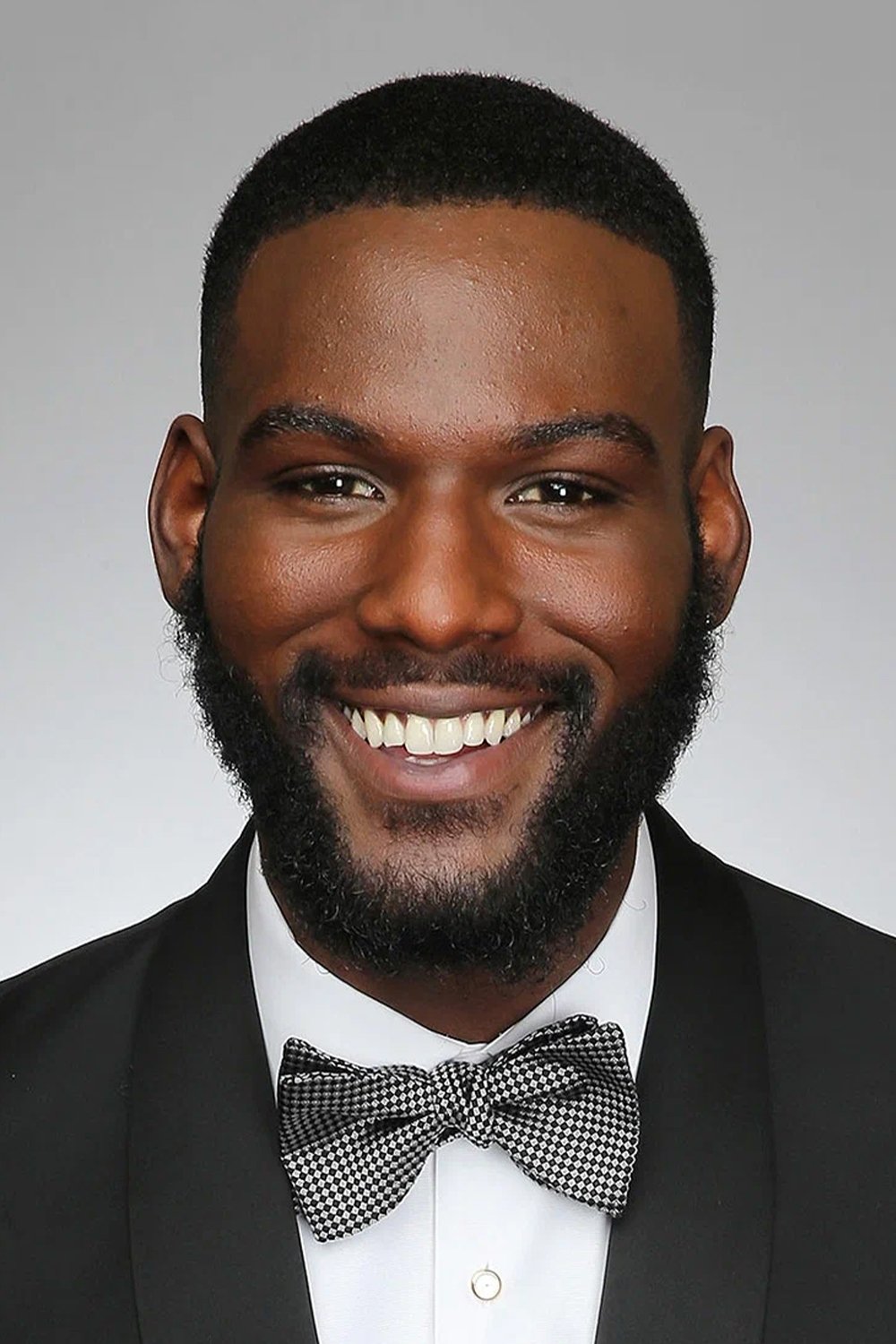

Ser’Darius Blain

Ser’Darius Blain is recognized for his strong and athletic build, especially in the ‘Jumanji’ movies. His character’s physical power is important to the story, and Blain stays in shape by lifting weights and playing sports. He often chooses roles that allow him to showcase his impressive physique and athletic skills.

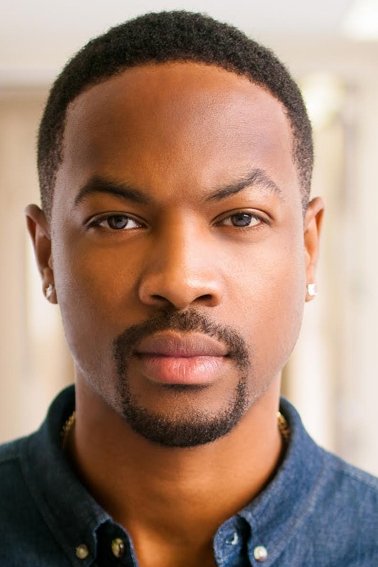

Charles Michael Davis

Charles Michael Davis is an actor and former model recognized for his impressive physique. He’s appeared in hit shows like ‘The Originals’ and ‘Younger’. Davis stays in shape through regular exercise and a healthy lifestyle to maintain his lean, muscular build, making him a sought-after actor for roles that call for both charisma and physical strength.

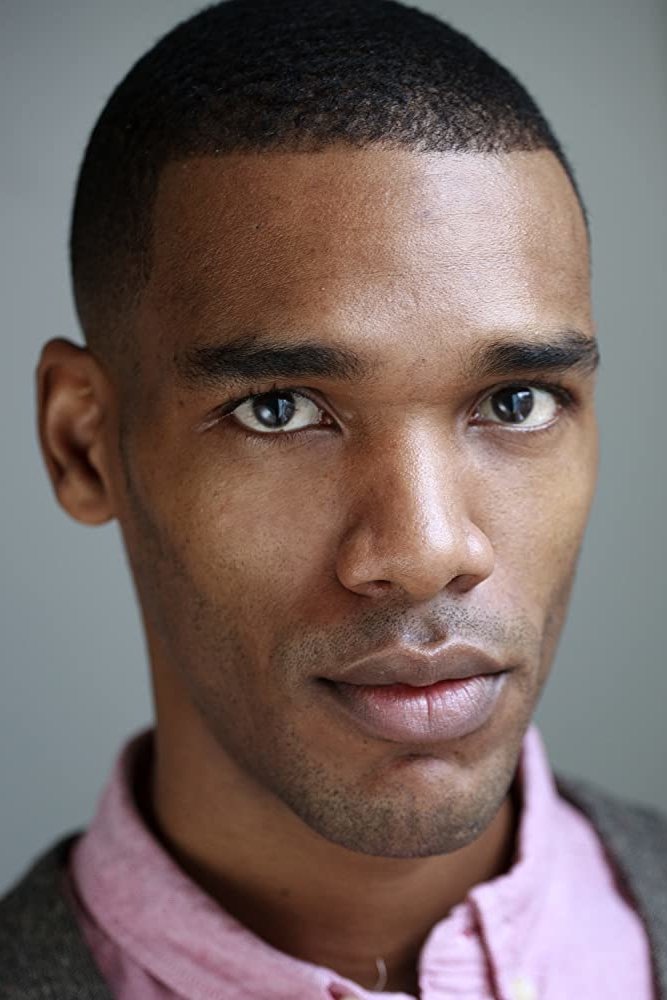

Parker Sawyers

Parker Sawyers is an actor recognized for his athletic build, showcased in films like ‘Southside with You’. He stays in great shape by regularly exercising and maintaining a muscular physique, which allows him to take on diverse roles. He’s steadily building a successful acting career in both the United States and abroad.

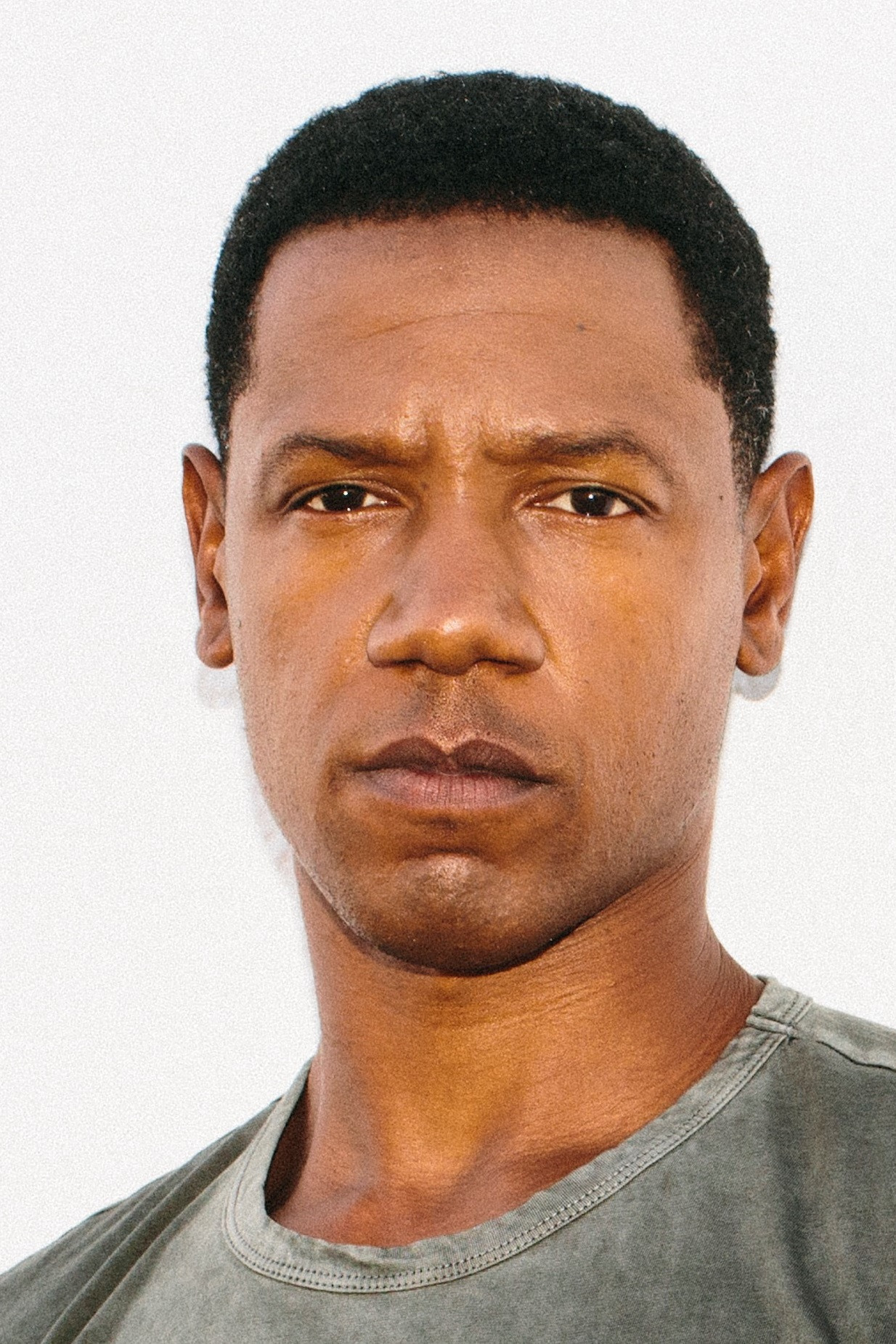

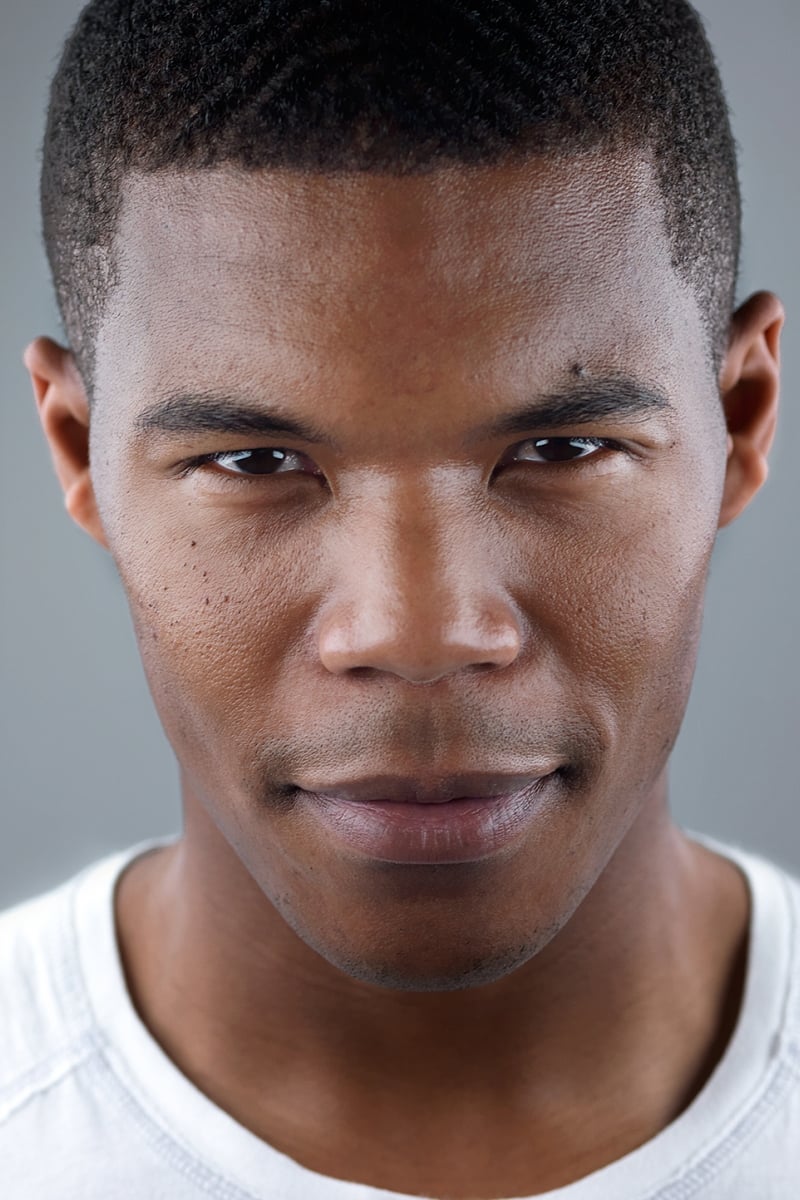

Trevante Rhodes

Trevante Rhodes first gained attention as a track and field athlete, but he became famous for his role in the movie ‘Moonlight’. Known for his incredibly fit and muscular build, Rhodes recently underwent rigorous training to physically transform into Mike Tyson for a biographical series. He continues to be one of Hollywood’s most physically imposing actors.

Share your favorite picks for the most muscular actors in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-03-04 21:20